Unlocking the potential of Battery Energy Storage Systems

Battery Energy Storage Systems (BESS) are quickly becoming a key part of Southeast Asia''s energy future. With costs dropping and real-world projects already in place,

Get a quote

Enel brings five new batteries storage systems online

Enel North America has more than tripled its operational utility-scale storage capacity this summer by bringing five new battery energy

Get a quote

Unlocking the potential of Battery Energy Storage Systems (BESS

Battery Energy Storage Systems (BESS) are quickly becoming a key part of Southeast Asia''s energy future. With costs dropping and real-world projects already in place,

Get a quote

Rept Battero opens N America office, launches

At the show, considered North America''s biggest event of its type with more than 50,000 visitors at the 2024 edition, Rept Battero showcased a

Get a quote

Blue Whale and UNIGRID to deploy rooftop BESS in Southeast Asia

Blue Whale Energy has announced a new partnership with UNIGRID to deliver battery energy storage system (BESS) installations in space-limited Southeast Asian cities.

Get a quote

Battery energy storage systems: South-east Asia''s key to

ENGIE''s collaboration with Luik Natie in Antwerp''s port (above) showcases the tangible impact of BESS deployment, with significant energy savings achieved through

Get a quote

Commercial & Industrial Liquid Cooling Energy Storage System | GSL ENERGY

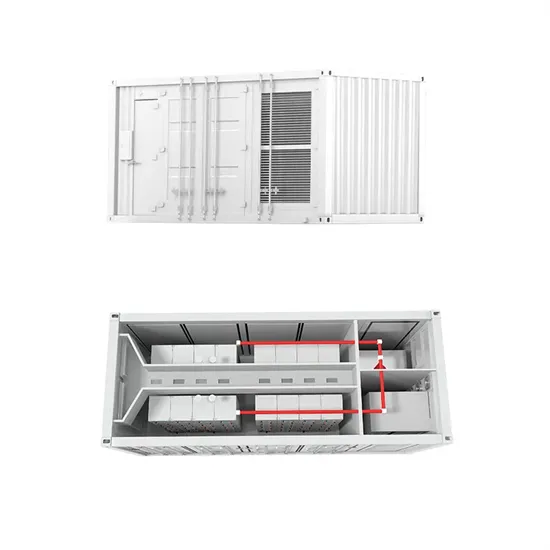

The system supports up to 10 units in parallel and meets European and Southeast Asian grid connection certifications, making it an efficient and reliable commercial and industrial energy

Get a quote

BESS the Linchpin for Asia''s Renewable Energy Targets

Battery Energy Storage Systems (BESS) and related solutions are critical for Asian countries to reach stated renewable energy targets. Many

Get a quote

Southeast Asia''s biggest BESS officially opened in

Singapore has surpassed its 2025 energy storage deployment target three years early, with the official opening of the biggest battery storage

Get a quote

Battery Energy Storage Systems Development

As a result of the project, Singapore has reached its BESS goal of over 200 MWh of energy storage capacity three years ahead of schedule. Singapore''s new BESS will help

Get a quote

Blue Whale and UNIGRID to deploy rooftop BESS in Southeast Asia

Urban BESS installations face new solution in Southeast Asia Blue Whale Energy has announced a new partnership with UNIGRID to deliver battery energy storage system

Get a quote

ABB supplies Southeast Asia''s largest battery energy storage

The building block designs include an integrated combination of Energy Storage Modules and power distribution equipment, that can be increased or reduced in capacity to

Get a quote

Battery energy storage systems: Southeast Asia''s key to

By providing flexible, reliable, and scalable power, BESS enables Southeast Asia to overcome traditional infrastructure limitations and embrace a sustainable future.

Get a quote

Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get a quote

Commercial Energy Storage Outlook 2025–2030 -pknergypower

Discover how commercial energy storage systems work and explore cost, ROI, and market growth forecasts for 2025 and 2030. Battery storage is the future.

Get a quote

Southeast Asia: Emerging energy storage opportunities

The Philippines'' first large-scale solar-plus-storage hybrid (pictured), was commissioned this year. Image: ACEN. There has been an

Get a quote

Commercial & Industrial Liquid Cooling Energy Storage System

The system supports up to 10 units in parallel and meets European and Southeast Asian grid connection certifications, making it an efficient and reliable commercial and industrial energy

Get a quote

Largest Energy Storage System in South-East Asia to Enhance

EMA appointed Sembcorp Industries to build, own and operate Energy Storage Systems (ESS) to enhance the resilience of our energy supply and power grid in June this

Get a quote

BESS the Linchpin for Asia''s Renewable Energy Targets

Battery Energy Storage Systems (BESS) and related solutions are critical for Asian countries to reach stated renewable energy targets. Many governments have already identified

Get a quote

Sabah to have largest battery energy storage system

Breaking News: Sabah to Build Southeast Asia''s Largest Battery Energy Storage System (BESS) in Lahad Datu! In a groundbreaking initiative,

Get a quote

Market attractiveness analysis of battery energy storage systems

By assessing BESS market attractiveness in five key Southeast Asian countries (Indonesia, Malaysia, the Philippines, Thailand, and Vietnam), this study investigates the

Get a quote

Battery energy storage systems: South-east Asia''s

ENGIE''s collaboration with Luik Natie in Antwerp''s port (above) showcases the tangible impact of BESS deployment, with significant energy

Get a quote

Market attractiveness analysis of battery energy

By assessing BESS market attractiveness in five key Southeast Asian countries (Indonesia, Malaysia, the Philippines, Thailand, and Vietnam),

Get a quote

Trina Storage Drives Energy Storage Expansion In Asia Pacific

Trina Storage, the energy storage division of global solar leader Trinasolar, has reached a major milestone with its installed capacity of large-scale energy storage systems

Get a quote

Southeast Asia''s biggest BESS officially opened in Singapore

Singapore has surpassed its 2025 energy storage deployment target three years early, with the official opening of the biggest battery storage project in Southeast Asia.

Get a quote

Battery energy storage systems: Southeast Asia''s key to

In an article featured on The Business Times, Rodrigo Hernandezvara, Head of Solar C&I at ENGIE highlights how Battery Energy Storage Systems (BESS), combined with renewable

Get a quote

6 FAQs about [BESS energy storage equipment for Southeast Asian office buildings]

What is Bess & how does it work in ASEAN?

Typical BESS components include battery modules, a storage enclosure with thermal management, a power conversion system (PCS), a battery management system (BMS) and an energy management system (EMS). A few other ASEAN countries are also starting to wake up to the advantages of BESS in their respective energy sectors. But, it’s a slow start.

How will Bess help Southeast Asia reshape the energy landscape?

By providing flexible, reliable, and scalable power, BESS enables Southeast Asia to overcome traditional infrastructure limitations and embrace a sustainable future. What role will BESS play in reshaping Southeast Asia’s energy landscape? Explore the insights here.

How does Bess work?

BESS is able to complement renewable energy sources such as solar power, ensuring a reliable and flexible power supply. During the day, when solar energy production is at its peak, excess energy generated is stored in batteries for later use. Once the battery is full, the excess energy is sold back to the power grid.

What is a battery energy storage system (BESS)?

He is the Chief Marketing Officer (CMO) for US-based lithium-sulfur EV battery start-up Bemp Research Corp. A battery energy storage system (BESS) is a power station that uses batteries to store excess energy. It is necessary for power supply.

Is Bess facilitating the energy transition in Southeast Asia?

Despite the crucial role that BESS play in facilitating the energy transition, Southeast Asia’s BESS market remains in its early stages, marked by a lack of significant BESS policies. Implementing policies to foster a competitive market environment for BESS can attract investors and lead to widespread adoption of the BESS.

What is a Bess battery & how does it work?

Since a BESS is a backup power source, like any energy source that feeds the grid, it has to be managed and controlled. The lead-acid battery market in Southeast Asia is rapidly evolving, driven by the increasing demand for reliable energy storage solutions across various industries.

Guess what you want to know

-

Industrial Energy Storage Equipment BESS

Industrial Energy Storage Equipment BESS

-

Southeast Asian large-capacity energy storage battery manufacturers

Southeast Asian large-capacity energy storage battery manufacturers

-

Zimbabwe Energy Storage Equipment Company BESS

Zimbabwe Energy Storage Equipment Company BESS

-

What energy storage devices are there in Egyptian office buildings

What energy storage devices are there in Egyptian office buildings

-

Southeast Asian outdoor energy storage battery exports

Southeast Asian outdoor energy storage battery exports

-

The cost of energy storage equipment for the BESS industry

The cost of energy storage equipment for the BESS industry

-

A Southeast Asian company that makes energy storage batteries

A Southeast Asian company that makes energy storage batteries

-

Southeast Asian power grid energy storage companies

Southeast Asian power grid energy storage companies

-

Kazakhstan energy storage equipment BESS

Kazakhstan energy storage equipment BESS

-

BESS price calculation for energy storage equipment

BESS price calculation for energy storage equipment

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.