Best Energy Storage Inverter Manufacturer and Supplier, Factory

Introducing the latest Energy Storage Inverter from Fujian Nebula Electronics Co., Ltd., a leading manufacturer, supplier, and factory of innovative energy solutions. This state-of-the-art inverter

Get a quote

Amber Enterprises expands into solar and battery energy storage

Amber Enterprises acquires Power-One to scale into India''s solar inverter and BESS market. Find out what this strategic move means for energy-tech growth.

Get a quote

10 Energy Storage Companies to Know in 2025

These technologies underpin the transition to a low-carbon future by ensuring grid reliability, maximizing renewable energy use, and enhancing energy security. Below, we

Get a quote

EK Solar Energy-Photovoltaic energy storage inverter

Founded in May 2015, EK Solar Energy is a global leading technology innovation company in the field of energy storage systems. It is committed to providing

Get a quote

Battery Storage Inverter Companies

The battery storage inverter market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios,

Get a quote

Analysis of Key Enterprises in China''s Energy Storage Inverter

Deye shares a comprehensive coverage of energy storage, strings, and micro-inverter product matrices, and is a rare inverter company in the industry that has achieved coordinated growth

Get a quote

Utility Scale Energy Storage Inverters Market 2026

The Regional Analysis of the Utility Scale Energy Storage Inverters Market provides a detailed examination of market performance, trends, and growth potential across key

Get a quote

Leading enterprise of energy storage photovoltaic inverter

GoodWesolar inverters have been largely used in residential rooftops,commercial systems and energy storage systems. GoodWe is ranked as World Top 10 solar inverter

Get a quote

Global Battery Energy Storage Inverter Market Sector

The Battery Energy Storage Inverter market is projected to grow at a CAGR of 11.7% from 2025 to 2032, reaching USD 10.89 billion by the end of the forecast period. This

Get a quote

US Energy Storage Market Size & Industry Trends 2030

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand at a 28.5% CAGR through 2030.

Get a quote

Explore the differences between energy storage

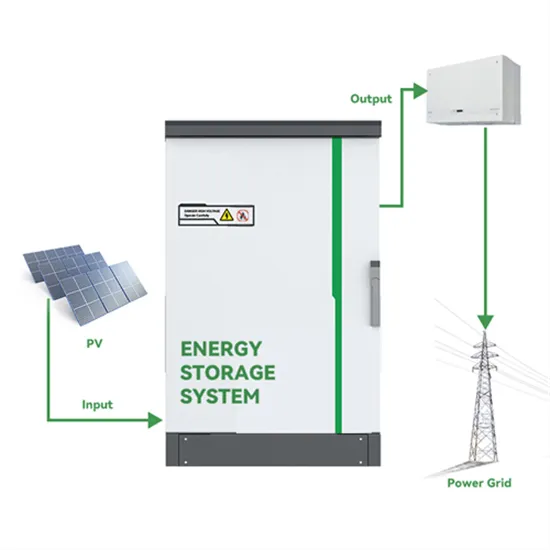

Industry data reveals significant efficiency improvements when comparing systems with and without energy storage. Traditional PV-only

Get a quote

What are the energy storage inverter manufacturers? | NenPower

Such developments have paved the way for energy storage inverter manufacturers to emerge as critical players driving the energy transition. These manufacturers

Get a quote

Battery Storage Inverter Companies

The battery storage inverter market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach

Get a quote

Top 10: Energy Storage Companies | Energy Magazine

In this week''s Top 10, Energy Digital takes a deep dive into energy storage and profile the world''s leading companies in this space who are

Get a quote

Top 21 Energy Storage Companies

Firms in this sector range from battery manufacturers to innovative technology creators, offering solutions like lithium-ion batteries, flow batteries, and even novel alternatives like liquid metal

Get a quote

Photovoltaic and energy storage industry

solar power inverters in the new energy industry are mainly used in photovoltaic and energy storage fields. Among them, the photovoltaic solar power inverter is one of the main

Get a quote

Analysis of Key Enterprises in China''s Energy Storage Inverter Industry

Deye shares a comprehensive coverage of energy storage, strings, and micro-inverter product matrices, and is a rare inverter company in the industry that has achieved coordinated growth

Get a quote

Top 10: Energy Storage Companies | Energy Magazine

In this week''s Top 10, Energy Digital takes a deep dive into energy storage and profile the world''s leading companies in this space who are leading the charge towards a more

Get a quote

shutters-alkazar

Shipments of energy storage inverters more than doubled in 2020 to reach over 11 GW. As the world''s major economies increasingly unite in moving faster toward an energy transition, and

Get a quote

Top Global Energy Storage Inverter Companies in 2024-2025:

The Heavyweight Champions: 2024-2025 Company Rankings Drumroll please! Here''s the current lineup of industry leaders based on market share and technological innovation:

Get a quote

China TOP 10 energy storage system integrator

Sungrow Power Supply Co., Ltd. is a national key high-tech enterprise focusing on the R&D of the top 10 energy storage system integrator, production, sales

Get a quote

Energy storage inverter industry chain

Inverter manufacturers such as Sungrow are increasingly targeting the United States market because of the significant pipeline of solar-plus-storage projects,which play into the experience

Get a quote

Energy Storage Inverters Market Companies

This Analysis is based on comprehensive primary and secondary research on the corporate strategies, financial and operational performance, product portfolio, market share and brand

Get a quote

Global Trends Analysis of Residential Energy Storage Industry

With the rapid development of residential energy storage in Europe, it has emerged as a key player in the realm of energy transformation. On one hand, the imperative of

Get a quote

Collection! List of 50 energy storage inverter PCS enterprises!

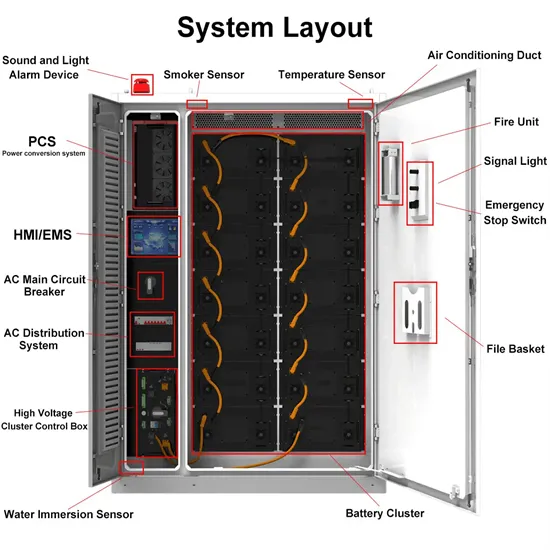

Energy storage converter (PCS), also known as energy storage inverter, is the key device between the energy storage device and the power grid. It is used to control the charging and

Get a quote

PV Energy Storage Inverter Market''s Strategic Roadmap: Insights

The PV energy storage inverter market is experiencing robust growth, driven by the increasing adoption of renewable energy sources and the need for reliable energy storage

Get a quote

5 FAQs about [Key enterprises in the energy storage inverter industry]

What are the key innovations in energy storage?

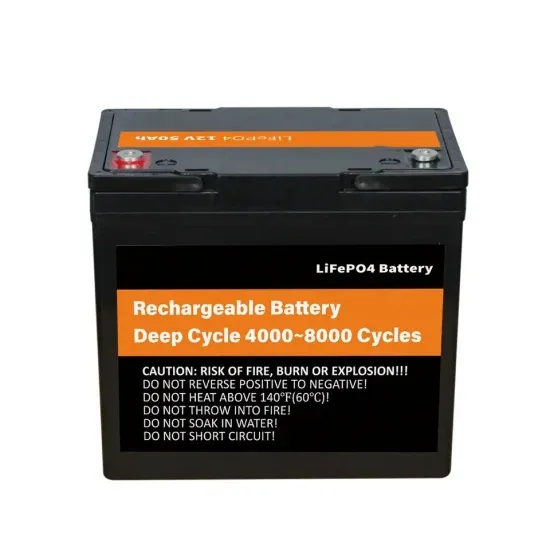

Key Innovation: Advanced lithium-ion batteries for consumer and grid applications. Panasonic’s battery storage solutions provide reliable backup power and enhance renewable energy use, particularly in collaboration with electric vehicle manufacturers. 5. Nostromo Energy Key Innovation: IceBrick thermal energy storage for commercial buildings.

What are energy storage companies?

It encompasses various companies that offer a range of products and services to meet the increasing demand for energy storage solutions. These companies specialize in providing batteries, chargers, and energy storage systems for numerous applications, including telecommunications, renewable energy, and industrial sectors.

What is the market share of energy storage in 2024?

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand at a 28.5% CAGR through 2030.

What are the key innovations in thermal energy?

Key Innovation: IceBrick thermal energy storage for commercial buildings. With support from a $305.5 million DOE loan guarantee, Nostromo scales its thermal energy systems, enhancing building energy efficiency and reducing peak electricity demand. 6. Abengoa Key Innovation: Solar thermal power plants with integrated storage.

What is the future of energy storage?

The United States energy storage market share of assets exceeding 100 MWh is poised to rise fastest at a projected 36% CAGR. Falling cell prices and enhanced revenue stacking make gigawatt-hour-scale parks such as Moss Landing economically attractive. Capital-light software optimizes charge cycles to shield warranties.

Guess what you want to know

-

Energy storage inverter industry

Energy storage inverter industry

-

Energy Storage Industry Inverter

Energy Storage Industry Inverter

-

Lithium battery energy storage industry concentration area

Lithium battery energy storage industry concentration area

-

Energy storage inverter price trend

Energy storage inverter price trend

-

Energy Storage Inverter Intelligent Universal Dual Voltage

Energy Storage Inverter Intelligent Universal Dual Voltage

-

Bhutan mobile energy storage site inverter connected to the grid 3 44MWh

Bhutan mobile energy storage site inverter connected to the grid 3 44MWh

-

Electric Power Industry Statistics New Energy Storage

Electric Power Industry Statistics New Energy Storage

-

Key points in energy storage product design

Key points in energy storage product design

-

Sao Tome and Principe Heavy Industry Energy Storage Cabinet Supplier

Sao Tome and Principe Heavy Industry Energy Storage Cabinet Supplier

-

US version off-grid energy storage inverter

US version off-grid energy storage inverter

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.