Vanadium flow batteries at variable flow rates

The growing demand for renewable energy has increased the need to develop large-scale energy storage systems that can be deployed remotely in decentralised and

Get a quote

Flow Batteries: Technology Synergies Will Provide

Flow batteries are considered excellent choice for large-scale energy storage projects for a number of reasons, but primarily because they

Get a quote

The Future of Clean Energy in the U.S. | Vanadium Redox Flow

The U.S. clean energy transition is accelerating, and energy storage is at its core. With corporate commitments, technological advancements, and government support, now is

Get a quote

Flow batteries for grid-scale energy storage

This white paper provides an overview of the state of the global flow battery market, including market trends around deployments, supply chain issues, and partnerships for VRFB

Get a quote

Flow Batteries Market Report 2024

According to the Energy Storage Report 2024, G7 countries have set a target of 1,500 GW of new global energy storage by 2030, a six-fold increase from current levels.

Get a quote

Flow batteries for energy storage | Enel Green Power

New energy storage technologies include innovative solutions such as flow batteries. This is a growing market, thanks in part to EGP''s innovation.

Get a quote

Emerging Markets for Vanadium Redox Flow Battery Energy Storage

The vanadium redox flow battery (VRFB) energy storage system market is experiencing robust growth, driven by the increasing demand for reliable and long-duration

Get a quote

Rising flow battery demand ''will drive global

Vanadium industry trade group Vanitec has commissioned Guidehouse Insights to undertake independent analysis of the VRFB energy storage sector. These have been

Get a quote

Vanadium Flow Batteries Market Outlook 2024–2033: Trends

Emerging applications in off-grid microgrids and industrial backup systems are expanding the market footprint, with regions like Asia-Pacific and Europe leading regional

Get a quote

What Are Flow Batteries? A Beginner''s Overview

Flow batteries have a storied history that dates back to the 1970s when researchers began experimenting with liquid-based energy storage solutions. The

Get a quote

Vanadium Flow Batteries: Industry Growth & Potential

Vanadium is a high-strength, corrosion-resistant metal widely used to improve the performance of steel alloys, but it is also emerging as a promising material in next-generation

Get a quote

Vanadium Redox Battery Market Size, Share | CAGR

A Vanadium Redox Battery (VRFB) is a type of rechargeable flow battery that utilizes vanadium ions in different oxidation states to store chemical potential

Get a quote

Vanadium Redox Flow Battery Market | Industry Report, 2030

As the demand for renewable energy sources grows, so does the need for advanced energy storage technologies, and vanadium flow batteries are emerging as a key player in this space

Get a quote

Flow batteries for grid-scale energy storage

One challenge in decarbonizing the power grid is developing a device that can store energy from intermittent clean energy sources such as solar and wind generators. Now,

Get a quote

Development status, challenges, and perspectives of key

Abstract All-vanadium redox flow batteries (VRFBs) have experienced rapid development and entered the commercialization stage in recent years due to the

Get a quote

Electrolyte engineering for efficient and stable vanadium redox flow

Abstract The vanadium redox flow battery (VRFB), regarded as one of the most promising large-scale energy storage systems, exhibits substantial potential in the domains of

Get a quote

Flow Battery Market Size, Share and Trends

Flow Battery Market by Battery Type (Redox, Hybrid), Material (Vanadium, Zinc Bromine, Organic, All-iron, Hydrogen Bromine), Storage (Large Scale & Small

Get a quote

Fact Sheet: Vanadium Redox Flow Batteries (October 2012)

Improving the performance and reducing the cost of vanadium redox flow batteries for large-scale energy storage Electricity Delivery & Energy Reliability

Get a quote

Vanadium Battery Energy Storage: The Future of Grid-Scale

Let''s face it—when you think of batteries, your mind probably jumps to lithium-ion powering smartphones or electric cars. But there''s a new player in town that''s perfect for

Get a quote

Australia needs better ways of storing renewable

Emeritus Professor Maria Skyllas-Kazacos with a prototype of the vanadium flow battery now being built at grid-scale storage capacity in Australia and across

Get a quote

The Future of Clean Energy in the U.S. | Vanadium Redox Flow Battery

The U.S. clean energy transition is accelerating, and energy storage is at its core. With corporate commitments, technological advancements, and government support, now is

Get a quote

The rise of vanadium redox flow batteries: A game-changer in energy storage

This article explores the role of vanadium redox flow batteries (VRFBs) in energy storage technology. The increasing demand for electricity necessitates a rise in energy

Get a quote

Top 10 Companies in the All-Vanadium Redox Flow Batteries

In this analysis, we profile the Top 10 Companies in the All-Vanadium Redox Flow Batteries Industry —technology innovators and project developers who are commercializing

Get a quote

Vanadium Redox Flow Batteries

This white paper provides an overview of the state of the global flow battery market, including market trends around deployments, supply chain issues, and partnerships for VRFB

Get a quote

Vanadium Redox Flow Battery Market | Industry

As the demand for renewable energy sources grows, so does the need for advanced energy storage technologies, and vanadium flow batteries are

Get a quote

Vanadium Battery for Energy Storage Decoded: Comprehensive

The vanadium redox flow battery (VRFB) market for energy storage is experiencing robust growth, driven by increasing demand for grid-scale energy storage

Get a quote

6 FAQs about [Vanadium flow battery energy storage trends]

How can vanadium redox flow batteries increase their share in energy storage?

Overcoming the barriers related to high capital costs, new supply chains, and limited deployments will allow VRFBs to increase their share in the energy storage market. Guidehouse Insights has prepared this white paper, commissioned by Vanitec, to provide an overview of vanadium redox flow batteries (VRFBs) and their market drivers and barriers.

Is the vanadium redox flow battery (VRFB) industry poised for growth?

Cell stacks at a large-scale VRFB demonstration plant in Hubei, China. Image: VRB Energy. The vanadium redox flow battery (VRFB) industry is poised for significant growth in the coming years, equal to nearly 33GWh a year of deployments by 2030, according to new forecasting.

Will flow battery suppliers compete with metal alloy production to secure vanadium supply?

Traditionally, much of the global vanadium supply has been used to strengthen metal alloys such as steel. Because this vanadium application is still the leading driver for its production, it’s possible that flow battery suppliers will also have to compete with metal alloy production to secure vanadium supply.

Are flow batteries a barrier to long-duration storage capacity?

As mentioned earlier, one barrier for flow batteries has been the limited number of deployments historically relative to Li-ion technologies. However, as demand for long-duration storage capability grows, flow batteries and especially VRFBs are poised to accelerate in deployment capacity.

Why are flow batteries accelerating in deployment capacity?

However, as demand for long-duration storage capability grows, flow batteries and especially VRFBs are poised to accelerate in deployment capacity. This is important not only to build confidence in the commercial performance of VRFBs but also to achieve economies of scale and become more cost-effective.

Why are vanadium batteries so expensive?

Vanadium makes up a significantly higher percentage of the overall system cost compared with any single metal in other battery technologies and in addition to large fluctuations in price historically, its supply chain is less developed and can be more constrained than that of materials used in other battery technologies.

Guess what you want to know

-

Indonesia s new vanadium titanium GW-grade all-vanadium liquid flow energy storage battery

Indonesia s new vanadium titanium GW-grade all-vanadium liquid flow energy storage battery

-

Albania Vanadium Flow Battery Energy Storage Station

Albania Vanadium Flow Battery Energy Storage Station

-

Dominica s new vanadium titanium GW-grade all-vanadium liquid flow energy storage battery

Dominica s new vanadium titanium GW-grade all-vanadium liquid flow energy storage battery

-

Vanadium titanium all-vanadium liquid flow energy storage battery

Vanadium titanium all-vanadium liquid flow energy storage battery

-

Niue zinc-bromine flow energy storage battery

Niue zinc-bromine flow energy storage battery

-

Liquid Flow Energy Storage Battery System

Liquid Flow Energy Storage Battery System

-

Energy Storage Vanadium Battery Project

Energy Storage Vanadium Battery Project

-

Liquid Flow Energy Storage Battery Company

Liquid Flow Energy Storage Battery Company

-

Equipment required for vanadium battery energy storage

Equipment required for vanadium battery energy storage

-

Italian all-vanadium liquid flow energy storage battery

Italian all-vanadium liquid flow energy storage battery

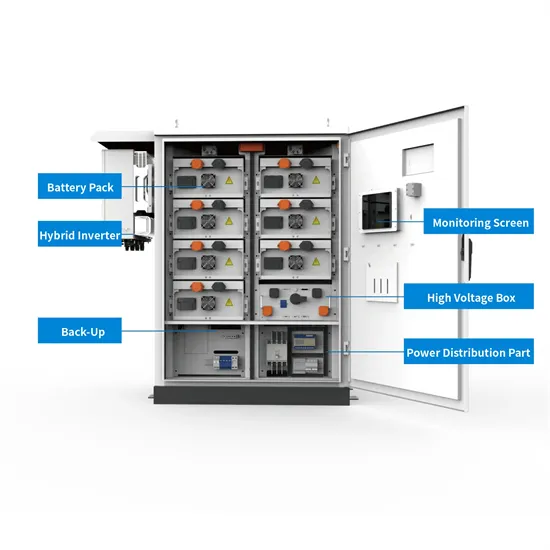

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.