Shared Energy Storage Power Station Rental Price: Trends,

a Texas wind farm operator and an Arizona solar developer both need energy storage, but one pays ¥0.20/Wh while the other negotiates ¥0.35/Wh. Welcome to the

Get a quote

Optimal capacity configuration of wind-photovoltaic-storage hybrid

Abstract The deployment of energy storage on the supply side effectively addresses the challenge posed by the intermittency and fluctuation of renewable energy.

Get a quote

Solar and Wind''s Hidden Price Tag: Why Cost Isn''t the Whole Story

Uncover more realistic prices of solar and wind energy and understand the implications for the future of renewable electricity generation.

Get a quote

Energy storage system based on hybrid wind and photovoltaic

Clean energy sources like wind and solar have a huge potential to lessen reliance on fossil fuels. Due to the stochastic nature of various energy sources, dependable hybrid

Get a quote

How does the cost of wind and solar energy stack up?

Wind and solar power are the fastest growing electricity sources in our energy mix – but how does the cost of these renewables compare to other

Get a quote

Solar Energy vs Wind Energy: Cost, Efficiency,

Solar installations achieve 5.6 gigawatts capacity growth in early 2023, while wind turbines generate enough electricity to power 9% of

Get a quote

Wind and Solar Energy Storage System Price: Trends, Insights

Whether you''re a Texas wind farmer or a Vermont solar homeowner, understanding wind and solar energy storage system prices is now as essential as knowing your Wi-Fi password.

Get a quote

The Impact of Wind and Solar on the Value of Energy Storage

The purpose of this analysis is to examine how the value proposition for energy storage changes as a function of wind and solar power penetration. It uses a grid modeling

Get a quote

Energy storage costs

Overview Energy storage technologies, store energy either as electricity or heat/cold, so it can be used at a later time. With the growth in electric vehicle sales, battery storage costs have fallen

Get a quote

Renewable Power Generation Costs in 2022

In 2022, the global weighted average levelised cost of electricity (LCOE) from newly commissioned utility-scale solar photovoltaics (PV), onshore wind, concentrating solar power

Get a quote

Energy Storage Costs: Trends and Projections

This discussion aims to elucidate the implications of evolving energy storage costs and their impact on the energy landscape through an energy systems approach.

Get a quote

Solar-Plus-Storage: Fastest, Cheapest Way To Meet Surging Power

Utilities must build new generation at the lowest possible price to provide the electricity their customers need. Choosing unaffordable options that can''t come online in time

Get a quote

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

Solar-Plus-Storage: Fastest, Cheapest Way To Meet

Utilities must build new generation at the lowest possible price to provide the electricity their customers need. Choosing unaffordable options

Get a quote

How much does the energy storage power station sell electricity?

Pricing for energy storage power stations is greatly influenced by market dynamics, including supply and demand fluctuations, wholesale electricity prices, and the power grid''s

Get a quote

How much is the price of Xinjiang energy storage power station

The price of Xinjiang energy storage power stations varies based on several factors, including 1. Technology employed, 2. Capacity specifications, 3. Location, and 4.

Get a quote

Value of storage technologies for wind and solar energy

The average selling price without storage is lower for wind than solar, but as the energy storage increases in size (per unit rated power of solar or wind generation), the pricing

Get a quote

How much is the price of Xi''an energy storage power station

The price of energy storage power stations in Xi''an can vary widely based on several factors, including the technology utilized, capacity, and installation specifics. 1. Typical

Get a quote

Comprehensive review of energy storage systems technologies,

Energy storage is one of the hot points of research in electrical power engineering as it is essential in power systems. It can improve power system stability, shorten energy

Get a quote

Building an Energy Storage Power Station: Key Considerations

Why Energy Storage Stations Are the New Rock Stars of Clean Energy Let''s face it – if renewable energy were a rock band, energy storage power stations would be the drummer keeping the

Get a quote

How does the cost of wind and solar energy stack up?

Wind and solar power are the fastest growing electricity sources in our energy mix – but how does the cost of these renewables compare to other forms of generation?

Get a quote

Operation effect evaluation of grid side energy storage power station

The energy storage power station on the side of the Zhenjiang power grid played a significant role in balancing power generation and consumption during the peak summer

Get a quote

How much is the electricity price of an independent energy storage

The electricity price from independent energy storage power stations is determined by several interrelated factors. Primary among these are the costs associated with the

Get a quote

Optimal allocation method of energy storage for integrated

A wind-solar-storage integrated generation plant would solve the aforementioned problems. The integrated renewable generation plant comprises three units: wind power

Get a quote

What is the electricity price of energy storage power station?

In summary, a synthesis of these factors establishes the framework for understanding how electricity prices at energy storage stations are calculated, revealing the

Get a quote

Research on Optimal Configuration of Energy Storage in Wind-Solar

Capacity allocation and energy management strategies for energy storage are critical to the safety and economical operation of microgrids. In this paper, an improved energy

Get a quote

6 FAQs about [The price of wind and solar energy storage power stations]

Why do we need energy storage costs?

A comprehensive understanding of energy storage costs is essential for effectively navigating the rapidly evolving energy landscape. This landscape is shaped by technologies such as lithium-ion batteries and large-scale energy storage solutions, along with projections for battery pricing and pack prices.

How much will solar and battery storage cost in 2035?

But solar and battery storage costs have both fallen around 90% over the last decade. By 2035, solar costs could fall nearly 10% and battery storage costs could fall nearly 50%. “New solar plants, even without subsidies, are within touching distance of new U.S. gas plants,” said BloombergNEF’s Amar Vasdev.

How have energy storage costs changed over the past decade?

Trends in energy storage costs have evolved significantly over the past decade. These changes are influenced by advancements in battery technology and shifts within the energy market driven by changing energy priorities.

Can solar-plus-storage meet rising demand without gas?

Energy Innovation analysis shows clean energy can come online fast enough to meet rising demand without needing gas to fill the gap, and solar-plus-storage has stepped up.

How has solar-plus-storage helped keep the lights on?

Adding 19 GW of solar and 6.2 GW of storage since 2019 helped keep the lights on – an 800% increase in solar and 5,500% increase in battery storage over that period. Solar-plus-storage is solving demand growth by providing reliable power when the grid needs it most – during peak hours.

How much power does wind and solar provide?

Combined with wind power, these renewable technologies provide 17% of U.S. electricity supply, enough to power 70 million average homes – remarkable considering three years ago coal provided three times wind and solar’s combined output. That’s supplanting gas growth.

Guess what you want to know

-

Profit model of wind solar and energy storage power stations

Profit model of wind solar and energy storage power stations

-

What are the current wind solar and energy storage power stations

What are the current wind solar and energy storage power stations

-

Photovoltaic wind power energy storage solar thermal

Photovoltaic wind power energy storage solar thermal

-

Albania Wind Solar Energy Storage Power Station Project

Albania Wind Solar Energy Storage Power Station Project

-

Wind and solar energy storage power station safety

Wind and solar energy storage power station safety

-

Bolivia builds a complete wind solar and energy storage power station

Bolivia builds a complete wind solar and energy storage power station

-

Price of energy storage system for solar thermal power station

Price of energy storage system for solar thermal power station

-

New Zealand Wind and Solar Energy Storage Power Station

New Zealand Wind and Solar Energy Storage Power Station

-

Energy storage price wind power price

Energy storage price wind power price

-

What does wind and solar energy storage power generation mean

What does wind and solar energy storage power generation mean

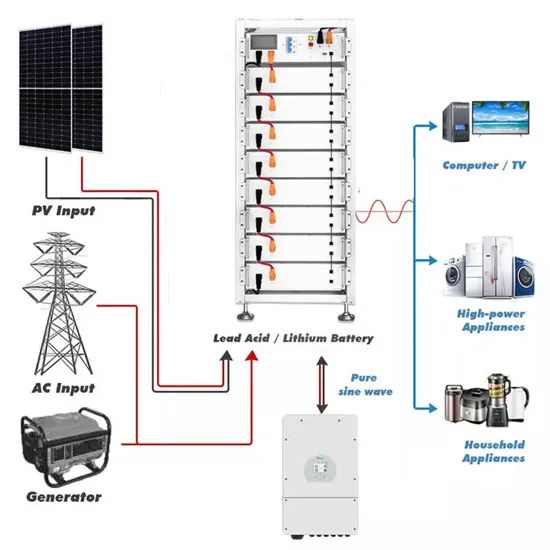

Industrial & Commercial Energy Storage Market Growth

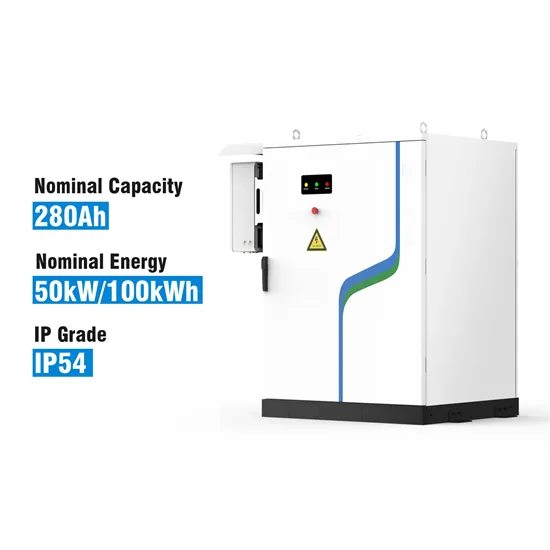

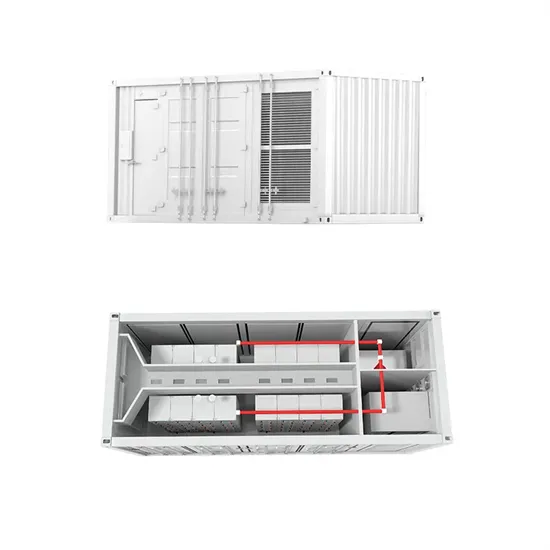

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

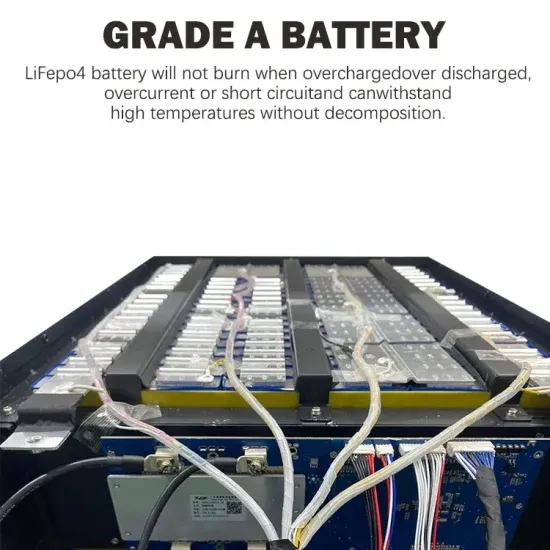

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.