Middle East Solar Inverter Industry Report 2025 | Market Size

Major companies such as Huawei Technologies Co. Ltd., SMA Solar Technology AG, and ABB Ltd. dominate the market, accounting for a significant share of the global market. In February

Get a quote

Top 10 Inverter Manufacturers In Middle East

In this article, we will discuss the top 10 inverter manufacturers in the Middle East, and various manufacturers with well-known brands in the

Get a quote

Sellers in Middle East | PV Companies List | ENF Company

List of Middle Eastern solar sellers. Directory of companies in Middle East that are distributors and wholesalers of solar components, including which brands they carry.

Get a quote

Middle East emerges as key frontier for top solar PV

Wood Mackenzie notes that several top 20 manufacturers are planning to establish production facilities in Egypt, Oman, Saudi Arabia, Qatar,

Get a quote

Middle-East Solar Power Companies

Get access to the business profiles of top 11 Middle-East Solar Power companies, providing in-depth details on their company overview, key products and services, financials, recent

Get a quote

Middle East PV market: Photovoltaic inverter still rely

There is no photovoltaic manufacturing industry in the Middle East, and photovoltaic inverter and modules are all dependent on imports.

Get a quote

Middle East & Africa Solar Inverters Market

The UAE would lead the Middle East & Africa solar inverters market in 2022. FIMER S.a.p, Delta Electronics, Enertechups, GOODWE, Sineng Electric, SMA Solar Technology AG, SolarEdge

Get a quote

Middle East emerges as key frontier for top solar PV manufacturers

Wood Mackenzie notes that several top 20 manufacturers are planning to establish production facilities in Egypt, Oman, Saudi Arabia, Qatar, and the UAE. This move is driven by

Get a quote

Top 10 Inverter Manufacturers In Middle East

In this article, we will discuss the top 10 inverter manufacturers in the Middle East, and various manufacturers with well-known brands in the Middle East.

Get a quote

Solar Panels, Solar Energy and Panel Manufacturers | Trina Solar

Our track record speaks for itself As one of the leading solar photovoltaic manufacturers in the world, Trinasolar delivers a smart, industry leading solution for year energy needs.

Get a quote

Inverter & Photovoltaics Solutions | SMA South East Asia

Discover the global specialist for inverters, photovoltaic & solar technology from the private solar system to the megawatt PV power plant.

Get a quote

Solec Solar Energy Systems Solar energy provider in

Many solar manufacturing plants located outside of China are dependent on Chinese imports for raw materials such as aluminium framing and solar PV

Get a quote

Middle East and Africa Solar PV Inverters Market

Conclusion The Middle East and Africa solar PV inverters market is witnessing significant growth driven by the increasing adoption of renewable energy and

Get a quote

Top 6 Solar Inverter Companies in Dubai, UAE

Here, we take a closer look at the top 6 solar inverter companies in Dubai that are making a mark with their top-notch products. Primroot is a leading-edge professional solar inverter

Get a quote

Middle East and Africa Solar PV Inverters Market Size

The Middle East and Africa Solar PV Inverters Market is growing at a CAGR of 7.39% over the next 5 years. Omron Corporation, Mitsubishi

Get a quote

Middle-East Solar Power Companies

Get access to the business profiles of top 11 Middle-East Solar Power companies, providing in-depth details on their company overview, key products and

Get a quote

19 Years of Solis: Reflecting on Transformative Energy Projects in

Ginlong (Solis) Technologies, a leading global photovoltaic inverter manufacturer, celebrates its 19th anniversary this year with a tribute to its customers and partners across Africa and the

Get a quote

Wholesaler and solutions provider in Photovoltaics

During our time in business we have worked with hundreds of B2B client s from over 50 countries. Our business partners are installers, EPCs, distributors,

Get a quote

Middle East Solar Projects Intelligence Tracker

This bring immense opportunity for the entire spectrum of solar value chain that is Developer, OEM, Manufacturer, EPC, O&M. Not only in above country but many other region as well.

Get a quote

Middle East and Africa Solar PV Inverters Market

Several countries in the Middle East and Africa, such as Saudi Arabia, United Arab Emirates, Egypt, and South Africa, are leading the solar PV inverters

Get a quote

Middle East and Africa Distributed Photovoltaic

Middle East and Africa Distributed Photovoltaic Inverter Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX

Get a quote

Middle East And Africa Solar PV Inverter Market Growth, Size,

The major key players in the Middle East And Africa Solar PV Inverter Market are: Delta Energy Systems Inc., Enphase Energy Inc., FIMER SpA, Huawei Technologies Co. Ltd, Mitsubishi

Get a quote

Top 11 Solar Panel Manufacturers in UAE: A Ultimate

Enerwhere, established in 2012, is a Dubai-based solar company specializing in the installation of medium to large-scale solar power systems for commercial

Get a quote

Middle East And Africa Solar PV Inverter Market

The major key players in the Middle East And Africa Solar PV Inverter Market are: Delta Energy Systems Inc., Enphase Energy Inc., FIMER SpA, Huawei

Get a quote

Middle East and Africa Solar PV Inverters Market Analysis

Several countries in the Middle East and Africa, such as Saudi Arabia, United Arab Emirates, Egypt, and South Africa, are leading the solar PV inverters market in the region due to

Get a quote

Middle East PV market: Photovoltaic inverter still rely on imports

There is no photovoltaic manufacturing industry in the Middle East, and photovoltaic inverter and modules are all dependent on imports.

Get a quote

Menlo Electric And Deye Partner To Expand Solar Energy

Menlo Electric, the fastest-growing solar component distributor in Europe, the Middle East, and Africa, has signed a strategic business cooperation agreement with Deye, a guiding

Get a quote

Guess what you want to know

-

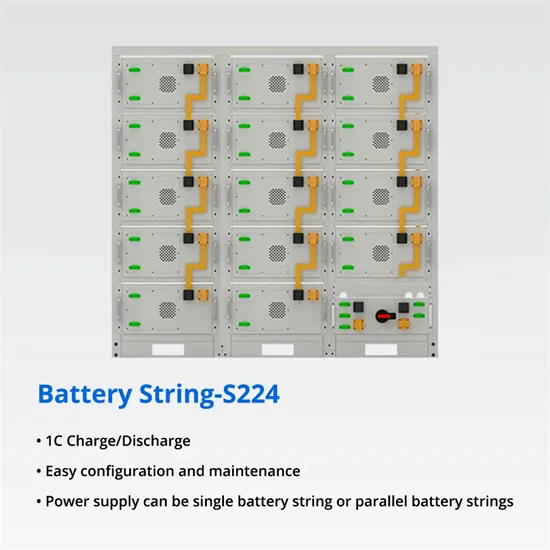

Middle East Photovoltaic Energy Storage 200kw Inverter

Middle East Photovoltaic Energy Storage 200kw Inverter

-

Middle East rooftop photovoltaic panel manufacturer

Middle East rooftop photovoltaic panel manufacturer

-

Middle East sun room photovoltaic panel manufacturer

Middle East sun room photovoltaic panel manufacturer

-

Middle East Electric 12v 79000 Inverter

Middle East Electric 12v 79000 Inverter

-

Huawei Middle East solar photovoltaic panels

Huawei Middle East solar photovoltaic panels

-

Photovoltaic inverter manufacturers and models prices

Photovoltaic inverter manufacturers and models prices

-

Middle East 20kw single phase 220v inverter

Middle East 20kw single phase 220v inverter

-

Middle East 265 photovoltaic panel prices

Middle East 265 photovoltaic panel prices

-

Middle East high-end inverter prices

Middle East high-end inverter prices

-

Annual power generation of photovoltaic panels in the Middle East

Annual power generation of photovoltaic panels in the Middle East

Industrial & Commercial Energy Storage Market Growth

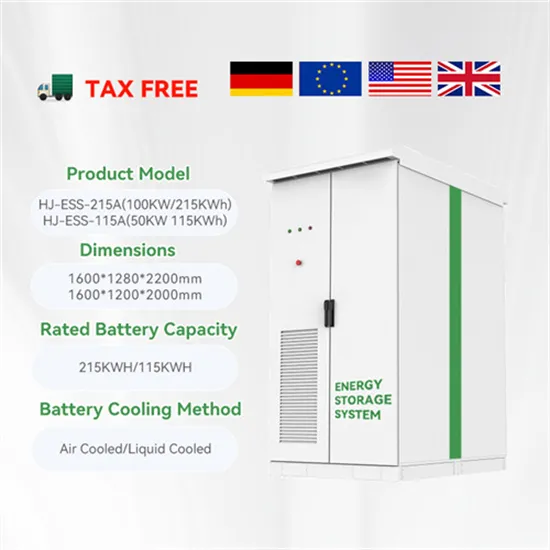

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.