5G in Finland

The 5G market in Finland is dominated by three key players, Elisa, Telia, and DNA. The coverage of 5G in the country is challenged by a vast contrast between urban and rural

Get a quote

Base stations

In cities and urban areas, so-called macro cell base stations serving a large area are often placed on the roofs or exterior walls of buildings. In sparsely populated areas, more base station

Get a quote

Base Station Transmits: 5G

The goal of Base Station Transmits is to discuss challenges faced by engineers and technicians who must optimize today''s wireless networks. Topics include antenna systems,

Get a quote

Kyocera develops AI-powered 5G virtualized base station for the

Kyocera develops AI-powered 5G virtualized base station for the telecommunication infrastructure market Innovative solution for next-generation networks

Get a quote

World''s first liquid cooled 5G base station deployed in Finland

Finnish telecom operator Elisa has deployed the world''s first commercial liquid cooled 5G base station. The technology has been developed by Nokia and allows using the waste energy of

Get a quote

How To Orientate A Directional 4G/5G Antenna

How to orient 4G/5G antennas? The antennas are oriented towards the optimal teleoperator''s base station. You can find the locations of the base stations from the Cellmapper map

Get a quote

Case Report: Illness After 5G Antennas on Rooftop

2Swedish Radiation Protection Foundation, Gredby 14, SE-178 92 Adelsö, Sweden Abstract In this case, report two previously healthy persons,

Get a quote

Electrical works in Finland

For more details on applying for qualification, please visit SETI''s website. Please read this entire page for further information on legal obligations and electrical safety requirements in Finland.

Get a quote

Automation, Instrumentation and Electrical Installation

We have worked in nearly all process industry plants in Finland, implementing extensive and demanding projects on schedule. We also have

Get a quote

Base Station Installation & Maintenance

Installation and the upgrading of base stations are underway to expand to 5G coverage. To ensure stable communication between a base station and connect with the stability of mobile

Get a quote

Telia kicks off 5G era in Helsinki

The first base stations are now operational in Helsinki, and the first phase of the roll-out will continue during the autumn. Telia Company''s 5G network operates on test frequencies

Get a quote

4G & 5G Base Station Antennas Market Analysis and Forecast

The 4G & 5G Base Station Antennas Market grew from USD 5.64 billion in 2024 to USD 6.68 billion in 2025. It is expected to continue growing at a CAGR of 18.72%, reaching

Get a quote

Automation, Instrumentation and Electrical Installation Services

We have worked in nearly all process industry plants in Finland, implementing extensive and demanding projects on schedule. We also have extensive experience in

Get a quote

How many Electrical installation services are in Finland?

Comprehensive Electrical installation service business data for Finland. Get detailed insights, statistics, and sample data for 924 verified businesses with complete contact information,

Get a quote

Worldwide: 5G base stations in selected markets

In data collected between July 2022 and June 2024, China was reported to have had around *** million 5G base stations installed across the

Get a quote

Finland''s Telia Tests 5G at a Nokia Base Station Factory

Finnish operator Telia conducted a 5G trial at a Nokia base station factory in Oulu, Finland. The trial is significant because it demonstrated how 5G networks can be used to make...

Get a quote

5G RAN Architecture: Nodes And Components

5G RAN Architecture The 5G RAN architecture is composed of multiple nodes and components that work together to provide seamless connectivity to users. These nodes

Get a quote

Base Station Installation & Maintenance Test Solutions

Installation and the upgrading of base stations are underway to expand to 5G coverage. To ensure stable communication between a base station and connect with the stability of mobile

Get a quote

5G Installation

What is 5G Installation? 5G network installation includes the setup, deployment, and verification of new radios, antennas, fiber links, and power sources. The next-generation of radio access

Get a quote

Top 45 5G Companies in Finland (2025) | ensun

Verkotan Inc. specializes in 5G wireless testing services, providing accredited OTA testing solutions for 5G products, including 5G NR FR1 base station assessments. With over 15 years

Get a quote

What should electricians know before moving to Finland for work

Electricians must be familiar with the national standards and regulations, particularly the SFS 6000 standard, which governs electrical installations in Finland. This standard

Get a quote

Installing, commissioning and testing a private 5G network

To test the capabilities of 5G technology and research possible new use cases, LUT Uni-versity commissioned a private 5G network on their Lappeenranta campus. The network includes

Get a quote

What should electricians know before moving to

Electricians must be familiar with the national standards and regulations, particularly the SFS 6000 standard, which governs electrical

Get a quote

5G frequencies: what is there to know? | Article | Telia

"Businesses can also affect the way base stations are located in their areas. Telia pays rent for the base station places," he specifies. Even an extensive 5G

Get a quote

6 FAQs about [Finland 5G base station installation electrician]

Where can I get a certification for electrical work in Finland?

The certificate of qualification (S1, S2 or S3) is issued by SETI Oy. If the appointed supervisor of electrical work holds a valid qualification from another EU country, SETI can typically issue the equivalent Finnish qualification with minimal additional requirements. For more details on applying for qualification, please visit SETI’s website.

How can a business be authorised to perform electrical work in Finland?

For a business to be authorised to perform electrical work in Finland, it must: use the necessary measuring devices and other tools. have access to operational electrical safety regulations, standards and instructions. have either a business id in the Finnish Trade Register or an id equivalent to a Finnish business id.

How is safety maintained during electrical work in Finland?

how safety is maintained during electrical works. For a business to be authorised to perform electrical work in Finland, it must: use the necessary measuring devices and other tools. have access to operational electrical safety regulations, standards and instructions.

Why are electrical works regulated in Finland?

In Finland electrical works are for safety reasons regulated by law and law-related regulations. These regulations lay down binding requirements, which cover e.g.: how safety is maintained during electrical works. For a business to be authorised to perform electrical work in Finland, it must: use the necessary measuring devices and other tools.

What are Finnish electrical safety regulations?

The Finnish electrical safety regulations lay down three kinds of inspections: the commissioning inspection, the certification inspection and the periodical inspection. Installation work has to be inspected thoroughly by the installer. This commissioning inspection has to be done for all kinds of installation work whether large or small.

Where can I get a certificate of qualification in Finland?

The certificates of qualification are issued by Henkilö- ja yritysarviointi SETI Oy (), which is the nominated evaluation body in Finland. Further details about qualification requirements can be asked for there. The evaluation body also takes into account education and working experience obtained in a foreign country.

Guess what you want to know

-

Czech hybrid energy 5G base station installation

Czech hybrid energy 5G base station installation

-

Moldova hybrid energy 5G base station installation

Moldova hybrid energy 5G base station installation

-

5g base station installation contact

5g base station installation contact

-

Which 5G base station power supply companies are there

Which 5G base station power supply companies are there

-

South Sudan 5G Communication Base Station Flow Battery Construction Project

South Sudan 5G Communication Base Station Flow Battery Construction Project

-

5g base station communication co-construction

5g base station communication co-construction

-

5G base station power supply ratio

5G base station power supply ratio

-

5g base station external power introduction

5g base station external power introduction

-

5g base station power consumption management system

5g base station power consumption management system

-

Peru 5G base station contact

Peru 5G base station contact

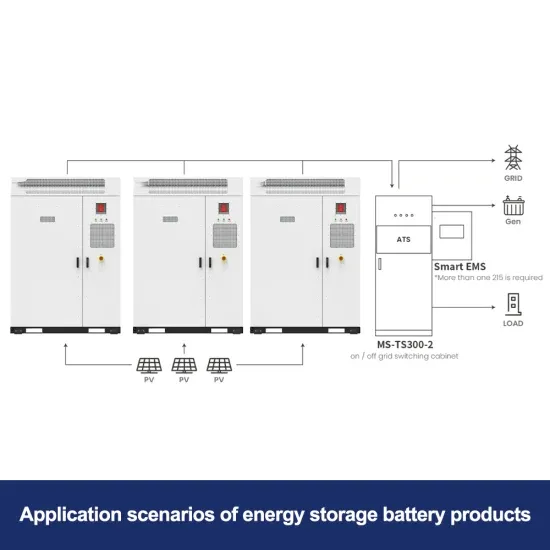

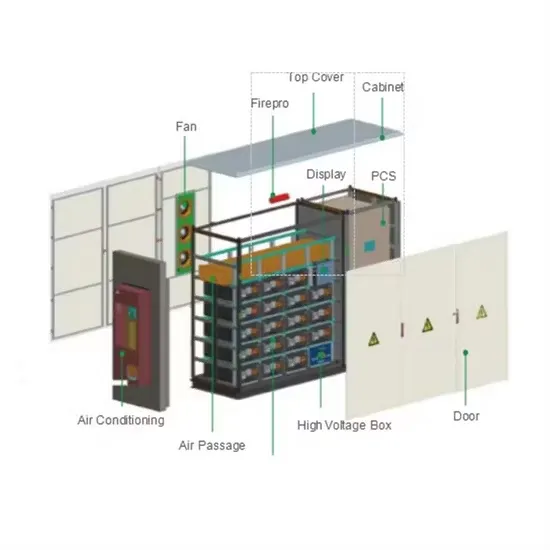

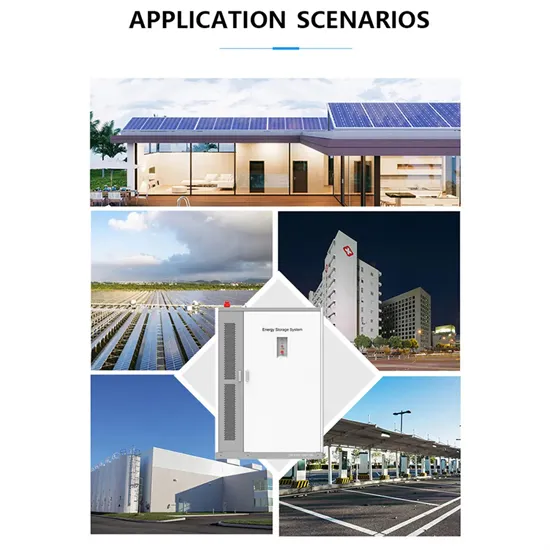

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

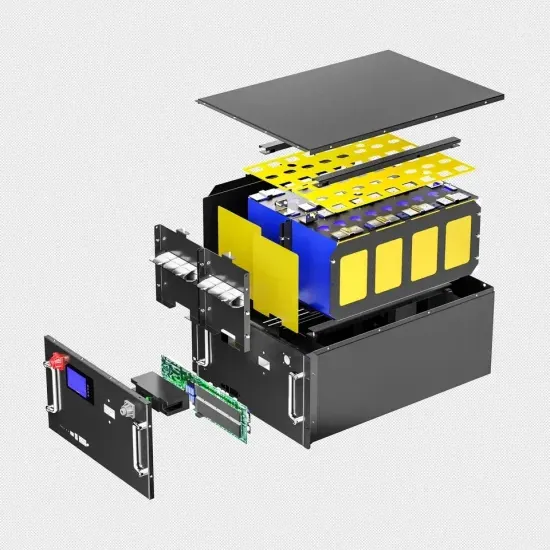

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.