China Battery Energy Storage System Report 2024

China is committed to steadily developing a renewable-energy-based power system to reinforce the integration of demand- and supply-side

Get a quote

China Huaneng builds Europe''s largest battery energy

The Minety Battery Storage Project is one of the largest energy storage projects in Europe and the first large battery storage project

Get a quote

2.1GWh! Two Companies Sign Major Energy Storage Deals,

The collaboration includes multiple energy storage projects, such as those in Jiangyin''s Xuxiake Town, Nanjing Gaochun, and Zhenjiang Xinhua. Specific procurement

Get a quote

Europe Fails to Affect China''s Battery Dominance

China''s Battery Dominance China leads the global EV production and battery manufacturing market, with CATL being the world''s largest battery

Get a quote

Greenvolt, BYD to develop Poland''s energy storage projects

Greenvolt Group has been active in Poland for nearly 18 years, developing wind, solar, and energy storage projects through Greenvolt Power. BYD Energy Storage is one of

Get a quote

List of energy storage power plants

The 150 MW Andasol solar power station is a commercial parabolic trough solar thermal power plant, located in Spain. The Andasol plant uses tanks of molten

Get a quote

Chinese Companies Secure Landmark Energy Storage Contracts

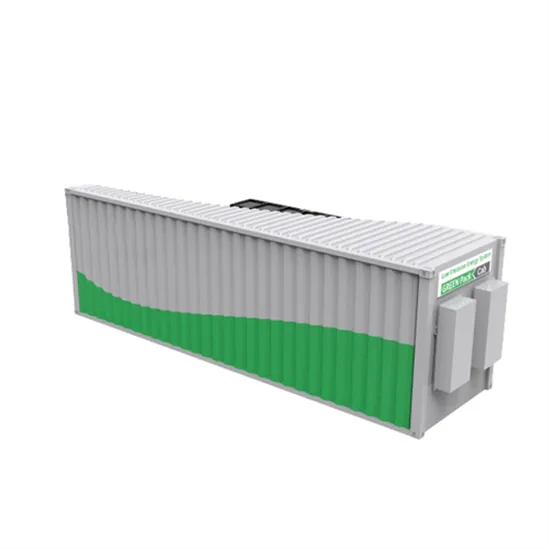

The agreement outlines plans to establish a 1.5 GWh energy storage system project in Italy using ChuNeng''s proprietary CORNEX M5 20-foot, 5 MWh prefabricated battery

Get a quote

Chinese Companies Secure Landmark Energy Storage Contracts in Europe

The agreement outlines plans to establish a 1.5 GWh energy storage system project in Italy using ChuNeng''s proprietary CORNEX M5 20-foot, 5 MWh prefabricated battery

Get a quote

Chinese Investments in Europe''s Energy Sector Creates Risk

In recent years, Chinese investments in Europe''s battery and electric vehicle (EV) sector has surged, giving Beijing a growing role in the energy industrial base that will power

Get a quote

2.1GWh! Two Companies Sign Major Energy Storage Deals,

The collaborations span commercial and industrial (C&I) energy storage sectors. China''s First Hybrid Grid-Forming Energy Storage Project Goes Live On March 6, the

Get a quote

Chinese power company shows way forward with energy storage

Its battery energy storage project, located in Minety, in southwest England, has been hailed as a landmark of China-Britain green development cooperation by the top Chinese

Get a quote

New report: European battery storage grows 15% in 2024, EU

21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing

Get a quote

Global Installed Energy Storage Capacity Exploded in 2022, and

The global new energy storage sector is experiencing a period of rapid expansion. According to CNESA, the cumulative installed capacity of new energy storage worldwide

Get a quote

Comparison of the energy storage industry in China and the

In March this year, the Energy Storage Application Branch of the China Chemical and Physical Power Industry Association also released the statistical analysis data of China''s

Get a quote

Summary of Global Energy Storage Market Tracking

Figure 2: Cumulative installed capacity of new energy storage projects commissioned in China (as of the end of June 2023) In the first half of

Get a quote

China energy storage project pipeline grows by 140 GWh in July

According to data from China''s Energy Storage Application Branch (CESA), mainland China has seen a surge in energy storage activity, with 1,468 new project

Get a quote

China-Europe Power Storage Collaboration: Accelerating the

As Europe races to achieve 55% emission reduction by 2030 and China targets 1,200 GW renewable capacity, power storage equipment has become the linchpin of this energy revolution.

Get a quote

China-Europe Energy Storage Project Policy: The New Power

Both regions have rolled up their sleeves to tackle grid instability and renewable intermittency through bold policy frameworks. But here''s the kicker: China-Europe energy

Get a quote

Regional opportunities – CCUS in Clean Energy

The rest of this chapter focuses on opportunities for deploying CCUS in the United States – the leading country for CCUS today – Europe and China.

Get a quote

China Energy Transition Review 2025

Faster, broader, deeper: China''s energy transition is transforming global energy realities China''s clean energy transition is fundamentally reshaping the economics of energy across the world.

Get a quote

China Huaneng builds Europe''s largest battery energy storage project

The Minety Battery Storage Project is one of the largest energy storage projects in Europe and the first large battery storage project undertaken by Chinese power generation

Get a quote

Chinese Companies Develop Europe''s Largest Energy Storage Project into

On August 25, the largest energy storage project in Europe developed by China Huaneng Group Co., Ltd.—the British Mendi Battery Energy Storage Project began cold

Get a quote

Energy Outlook 2025: Energy Storage

Beyond batteries, China is further developing a number of non-battery storage projects including the world''s largest flywheel energy storage project (30 MW) which was

Get a quote

6 FAQs about [China-Europe Power Storage Project]

Why do Chinese companies invest in Europe's energy sector?

Chinese investments in Europe’s energy sector provide strategic influence and leverage across the EU. Chinese companies—often with state backing—have pursued extensive investments across Europe’s energy sector. These investments span renewable energy, fossil fuel assets, electricity transmission grids, battery manufacturing, and nuclear power.

Will China invest in Europe's next-generation transport systems?

In recent years, Chinese investments in Europe’s battery and electric vehicle (EV) sector has surged, giving Beijing a growing role in the energy industrial base that will power Europe’s next-generation transport systems.

What is Europe's largest lithium-ion battery storage system?

The Minety project is touted as Europe's largest lithium-ion battery storage system to date. The facility stores electricity from the national grid at times of low demand and feeds it back when demand increases.

Could China's Energy Infrastructure be a strategic vulnerability?

China’s role in financing and constructing critical energy infrastructure across Europe has created a web of structural dependencies—interdependencies that may appear benign in times of stability but could become strategic vulnerabilities during periods of tension.

Why do Chinese power Giants own wind farms in Europe?

Chinese power giants have historically taken stakes in wind farms across at least nine European countries, not only to diversify portfolios but also to absorb operational expertise, particularly from Europe’s global leaders in offshore wind energy sector.

Is China using critical infrastructure as a foreign policy tool?

This evolution, though uneven across the continent, reflects growing convergence with U.S. concerns about China’s use of critical infrastructure as a foreign policy tool. The European experience offers a warning and a blueprint: when strategic sectors are treated as market commodities, influence follows ownership.

Guess what you want to know

-

Malta Wind Solar Energy Storage Power Station Project

Malta Wind Solar Energy Storage Power Station Project

-

Brunei Photovoltaic Power Generation and Energy Storage Project

Brunei Photovoltaic Power Generation and Energy Storage Project

-

Angola Energy Storage Power Supply Procurement Project

Angola Energy Storage Power Supply Procurement Project

-

Zambia Photovoltaic Energy Storage Power Generation Project

Zambia Photovoltaic Energy Storage Power Generation Project

-

Austria Energy Storage Container Power Station Project

Austria Energy Storage Container Power Station Project

-

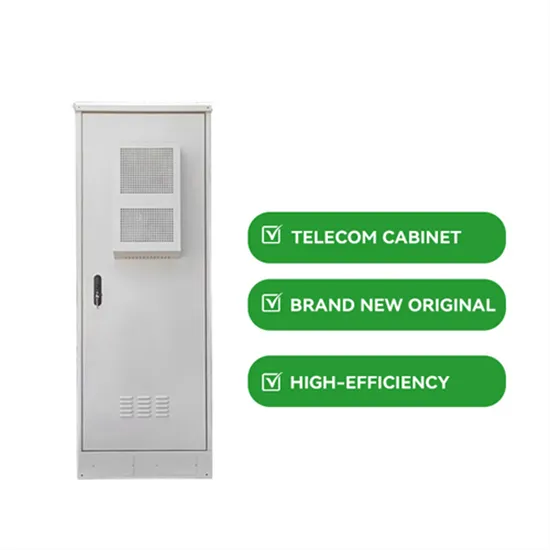

Niger Electric Power Institute BESS Telecommunication Energy Storage Project

Niger Electric Power Institute BESS Telecommunication Energy Storage Project

-

San Marino Photovoltaic Energy Storage Power Generation Project

San Marino Photovoltaic Energy Storage Power Generation Project

-

Canada Photovoltaic Power Station Energy Storage Project

Canada Photovoltaic Power Station Energy Storage Project

-

Ghana Wind Power Energy Storage Project

Ghana Wind Power Energy Storage Project

-

Huawei Duolun Wind Power Energy Storage Project

Huawei Duolun Wind Power Energy Storage Project

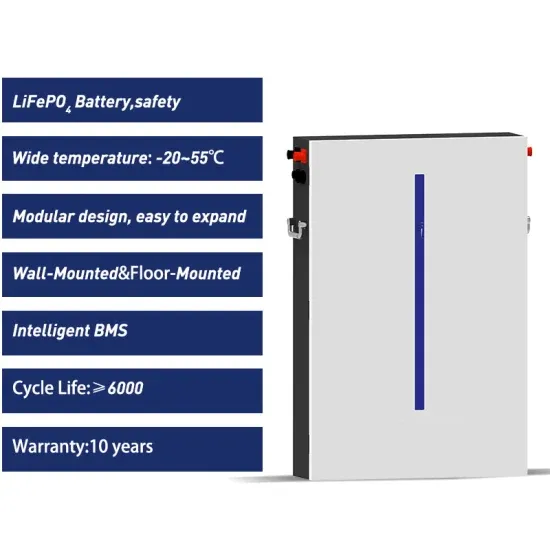

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.