Top five energy storage projects in South Korea

This report aims to identify and examine the key success factors of Korea''s energy storage industry, including government policies, roles of private companies, and global market factors.

Get a quote

South Korea launches its largest energy storage bid to bolster

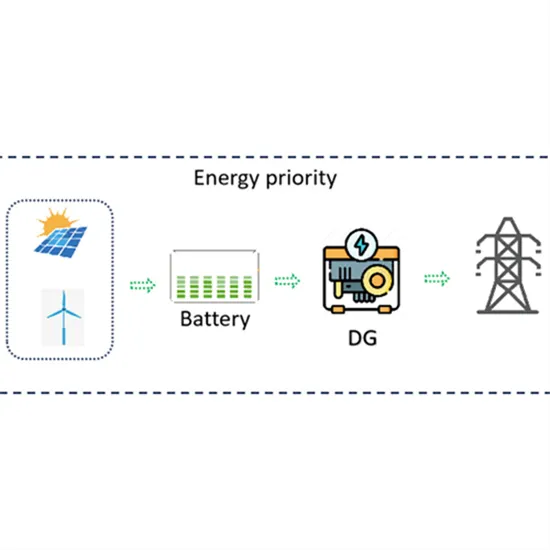

The project aims to help reduce electricity waste from renewable sources by storing surplus power during low-demand periods and releasing it when demand is high.

Get a quote

South Korea user-side energy storage power station

Currently, the research on the evaluation model of energy storage power station focuses on the cost model and economic benefit model of energy storage power station, and less

Get a quote

South Korea''s Power Plans: Ambitious expansion

South Korea aims to have 30 nuclear plants by 2038 and to more than triple its solar and wind power output to 72 GW by 2030. The government

Get a quote

Korean 11th Basic Plan for Power Confirmed

On 21 February 2025, the Ministry of Trade, Industry and Energy confirmed the 11th Basic Plan for Supply and Demand of Power. It applies from 2024 to 2038. The

Get a quote

Top five energy storage projects in South Korea

Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database. GlobalData uses proprietary data and

Get a quote

South Korea''s Green Transition Hinges on Expanding

BNEF''s New Energy Outlook: South Korea indicates that decarbonizing electricity supply is key to the country staying on track with the

Get a quote

State-owned company signs deal to build 500MW hydrogen power plant

4 days ago· State-owned company signs deal to build 500MW hydrogen power plant in South Korea The 1.2trn-won ($865m) facility is said to be the largest ever investment in a single

Get a quote

South Korea''s Green Transition Hinges on Expanding Clean Power

Doing so rests on a rapid scale-up of clean electricity and carbon capture and storage capabilities, according to a report published today by BloombergNEF. The power

Get a quote

South korea s energy storage scale

Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''''s power database. GlobalData uses proprietary data and analytics to provide a

Get a quote

A clean energy Korea by 2035: Transitioning to 80% carbon-free

We find that accelerated renewable energy deployment by 2035 is achievable in a cost-effective and reliable manner, offering substantial economic, environmental, and energy

Get a quote

Muju Pumped Storage Power Plant South Korea

Muju Pumped Storage Power Plant South Korea is located at Jeoksang Mountain, Muju-gun, Jeollabuk-do, South Korea. Location coordinates are: Latitude= 35.9632,

Get a quote

KOREA''S ENERGY STORAGE THE SYNERGY OF PUBLIC

Korea''s battery storage industry has experienced remarkable growth for the accounting for more than 80% of the total lithium-ion battery (hereinafter, Korea''s LiB ESS market size reached

Get a quote

Background Reference: South Korea

South Korea''s government scaled back long-term plans to rely on nuclear power in its most recent power plan, the 8th Basic Plan for Long-term Electricity Supply and Demand, released at the

Get a quote

South Korea''s Power Plans: Ambitious expansion strategy for a

South Korea aims to have 30 nuclear plants by 2038 and to more than triple its solar and wind power output to 72 GW by 2030. The government also plans to replace ageing

Get a quote

South korea pumped storage

The Yangyang Pumped Storage Power Station uses the water of the Namdae-Chun River to operate a 1,000-megawatt (1,300,000 hp) pumped storage hydroelectric power

Get a quote

South Korea power storage capacity

What is Korea energy storage system 2020? Among them Korea Energy Storage System 2020 action plan(K-ESS 2020) was announced by Ministry of Knowledge and Economy in 2011 to

Get a quote

KOREA''S ENERGY STORAGE THE SYNERGY OF PUBLIC

This report aims to identify and examine the key success factors of Korea''s energy storage industry, including government policies, roles of private companies, and global market factors.

Get a quote

South Korea power storage capacity

Spent Fuel Management in South Korea: The Illogic of Locations of South Korea''''s nuclear power plants.3 # This report is to be published by the Nonproliferation Education Center and as a

Get a quote

World''s Largest Frequency Regulation Battery Energy

Advantageous performance characteristics, declining costs and power market regulatory reform are fueling deployment of utility-scale battery

Get a quote

Energy storage systems in South Korea

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more

Get a quote

How about the Korean energy storage power station | NenPower

Beyond environmental and technological advantages, Korean energy storage power stations foster significant economic benefits. The development of these facilities

Get a quote

South Korea''s Green Transition Hinges on Expanding

Doing so rests on a rapid scale-up of clean electricity and carbon capture and storage capabilities, according to a report published today by

Get a quote

Korea Energy Storage Power: Innovations, Challenges, and the

Let''s face it—storing energy isn''t as simple as stacking kimchi in a fridge. With Korea aiming to achieve 20% renewable energy by 2030, energy storage systems (ESS) have

Get a quote

Country Analysis Brief: South Korea

South Korea was the world''s seventh-largest energy consumer in 2021.3 The country''s economic growth is fueled by exports, most notably exports of automobiles, ships, semiconductors, and

Get a quote

6 FAQs about [Benefits of South Korea s energy storage power plants]

What is energy storage capacity in Korea?

k (IRENA,2018).06Grid Energy StorageIn KoreaSince 2018,the total capacity of all energy storage systems (ESS) connected to the Korean power sy tem has reached 1.6 GWand 4.8 GWh (NARS,2021). In terms of power capacity,40% of ESS are used for peak load reduction,36% in hybrid systems (i.e.,a combination of

Are South Korean companies investing in energy storage systems?

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more sustainable energy future. However, a string of ESS-related fires and a lack of infrastructure had dampened investments in this market.

How will South Korea transform its energy sector?

The country has unveiled an ambitious plan to transform its energy sectors, aiming to generate 70 per cent of its electricity from carbon-free sources by 2038. South Korea aims to have 30 nuclear plants by 2038 and to more than triple its solar and wind power output to 72 GW by 2030.

Does South Korea have an energy transition?

We thus present a comprehensive perspective on Korea’s energy transition in the power sector. South Korea relies on imported fossil fuels for over 60% of its electricity generation, making it vulnerable to energy security risks and fuel price volatility.

How much power does South Korea have in 2022?

The company South Korea had 6,848MW of capacity in 2022 and this is expected to rise to 36,454MW by 2030. Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database.

What is energy storage system (ESS) in South Korea?

Energy storage system (ESS) can mediate the smart distribution of local energy to reduce the overall carbon footprint in the environment. South Korea is actively involved in the integration of ESS into renewable energy development. This perspective highlights the research and development status of ESS in South Korea.

Guess what you want to know

-

South Korea Huijue Energy Storage Power Supply Supplier

South Korea Huijue Energy Storage Power Supply Supplier

-

South Korea Energy Storage Power Station Construction Project

South Korea Energy Storage Power Station Construction Project

-

South Korea Power Grid 30kw Energy Storage

South Korea Power Grid 30kw Energy Storage

-

South Sudan s energy storage power demand in 2025

South Sudan s energy storage power demand in 2025

-

South Korean photovoltaic energy storage power supply distributor

South Korean photovoltaic energy storage power supply distributor

-

Can chemical plants build energy storage power stations

Can chemical plants build energy storage power stations

-

South Ossetia 100MW energy storage power station

South Ossetia 100MW energy storage power station

-

South Korea s rural photovoltaic energy storage

South Korea s rural photovoltaic energy storage

-

Energy storage in photovoltaic power plants

Energy storage in photovoltaic power plants

-

Solar energy storage in South Korea

Solar energy storage in South Korea

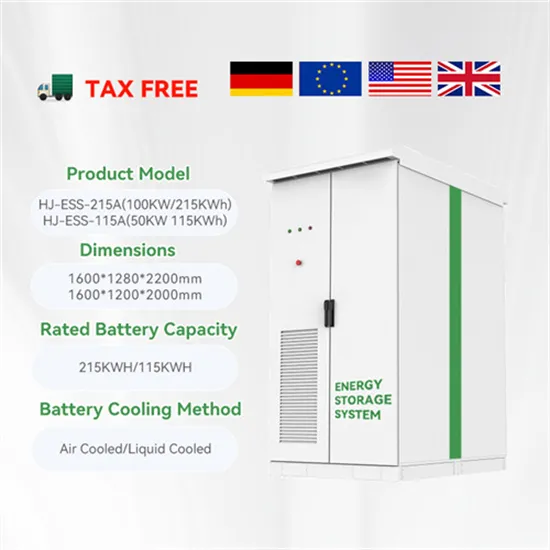

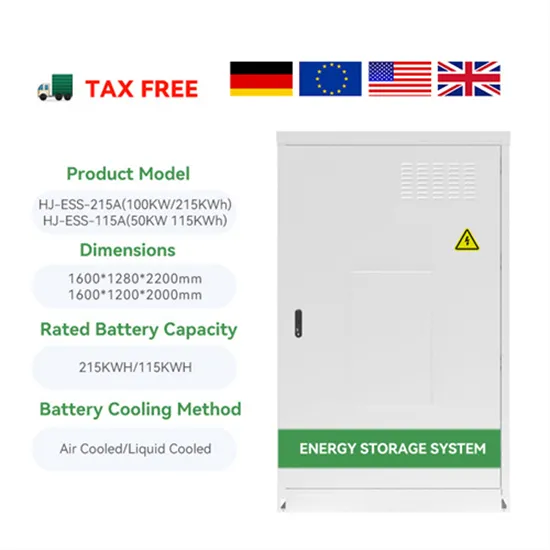

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

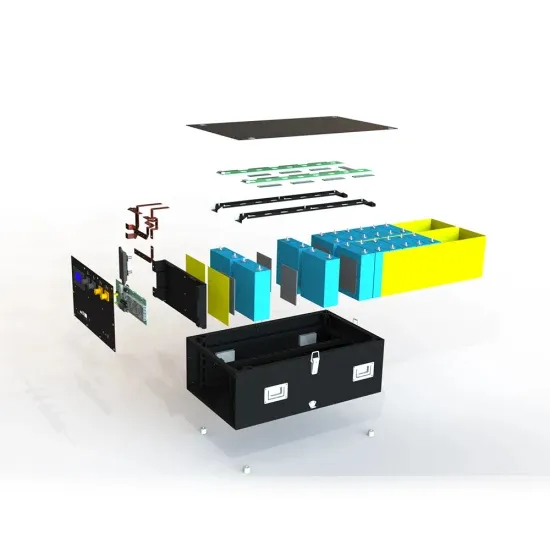

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.