Cracking the Code: Smart Profit Models in the Energy Storage Field

The Nuts and Bolts of Energy Storage Profit Models Let''s face it – the energy storage field isn''t just about megawatts and lithium-ion cells. It''s a financial puzzle where

Get a quote

Profit analysis of hydroelectric energy storage

The study maximizes the total profit of a hybrid power system with cascaded hydropower plants, thermal power plants, pumped storage hydropower plants, and wind and solar power plants

Get a quote

How is Energy Storage Profitable? Unlocking the Billion-Dollar

But here''s the kicker – energy storage profitability isn''t fictional. In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030.

Get a quote

How much profit do energy storage projects have? | NenPower

1. Energy storage projects can yield substantial profits due to their operational flexibility, participation in various market revenue streams, capitalizing on high-demand

Get a quote

Conclusion of Semi-annual Reports of Overseas Energy Storage

Summary Based on the semi-annual reports of overseas energy storage companies in 2023, it''s evident that the demand in the global energy storage market remains robust, and

Get a quote

Financial and economic modeling of large-scale gravity energy storage

The power system faces significant issues as a result of large-scale deployment of variable renewable energy. Power operator have to instantaneously balance the fluctuating

Get a quote

Energy Storage Cost and Performance Database

DOE''s Energy Storage Grand Challenge supports detailed cost and performance analysis for a variety of energy storage technologies to accelerate their development and deployment.

Get a quote

HOW DO GRID-SIDE ENERGY STORAGE PROJECTS

Is it profitable to provide energy-storage solutions to commercial customers? The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial

Get a quote

How much profit does energy storage project construction make?

The profit margins for energy storage projects can fluctuate considerably, as several interconnected factors such as local energy prices, installation costs, and the return on

Get a quote

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get a quote

How Energy Storage Projects Are Generating Millions: Real Profit

Why do some energy storage projects achieve 20%+ ROI while others struggle to break even? The answer lies in market strategy, technology selection, and policy leverage.

Get a quote

What Profit Analysis Does Energy Storage Include? A 2025 Deep

Let''s crack open the profit pizza of energy storage - where every slice represents a different revenue stream. From California''s solar farms to Guangdong''s factories, energy

Get a quote

How much profit do energy storage projects have? | NenPower

Energy storage projects can yield substantial profits due to their operational flexibility, participation in various market revenue streams, capitalizing on high-demand

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

Energy Storage Infrastructure Profit Analysis: Unlocking the

Let''s face it: energy storage infrastructure profit analysis isn''t exactly dinner table chatter. But if you''re reading this, you''re probably part of the 3% who realize this is where the real action is.

Get a quote

Battery Energy Storage System Production Cost

Case Study on Battery Energy Storage System Production: A comprehensive financial model for the plant''s setup, manufacturing, machinery and operations.

Get a quote

Energy storage costs

Overview Energy storage technologies, store energy either as electricity or heat/cold, so it can be used at a later time. With the growth in electric vehicle sales, battery storage costs have fallen

Get a quote

Exploration of Shared Energy Storage Business Model

Abstract. This article takes the shared energy storage business model as the discussion object. Based on the definition and classification of business models, it analyzes

Get a quote

Energy Storage Cost and Performance Database

DOE''s Energy Storage Grand Challenge supports detailed cost and performance analysis for a variety of energy storage technologies to accelerate their

Get a quote

Economic Benefits of Energy Storage

Energy storage economic benefits Storage lowers costs and saves money for businesses and consumers by storing energy when the price of electricity is low and later discharging that

Get a quote

GB BESS Outlook Q4 2024: How will battery markets

Battery energy storage systems in Great Britain earn revenue through a variety of markets with different mechanisms. The revenue stack for batteries has

Get a quote

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Get a quote

Energy storage project profitability analysis

The findings show that the energy storage energy self-consumption and the availability of subsidies have an impact on the profitability of a photovoltaic-integrated battery

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

4 FAQs about [Energy storage project profit price]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Should energy storage be undervalued?

The revenue potential of energy storage is often undervalued. Investors could adjust their evaluation approach to get a true estimate—improving profitability and supporting sustainability goals.

Are thermal energy storage project developers transforming the TES industry?

The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Guess what you want to know

-

Profit model of water pump inverter energy storage project

Profit model of water pump inverter energy storage project

-

Bangladesh energy storage project electricity price

Bangladesh energy storage project electricity price

-

Energy storage project price

Energy storage project price

-

Energy storage project EPC price

Energy storage project EPC price

-

Huawei Jamaica Energy Storage Base Project

Huawei Jamaica Energy Storage Base Project

-

Albania Hydropower Energy Storage Project

Albania Hydropower Energy Storage Project

-

The latest photovoltaic power station energy storage electricity price standard

The latest photovoltaic power station energy storage electricity price standard

-

Power sales price of Portugal s energy storage power station

Power sales price of Portugal s energy storage power station

-

Lead-Carbon Energy Storage Project

Lead-Carbon Energy Storage Project

-

Does the Jordanian photovoltaic project need to be equipped with energy storage

Does the Jordanian photovoltaic project need to be equipped with energy storage

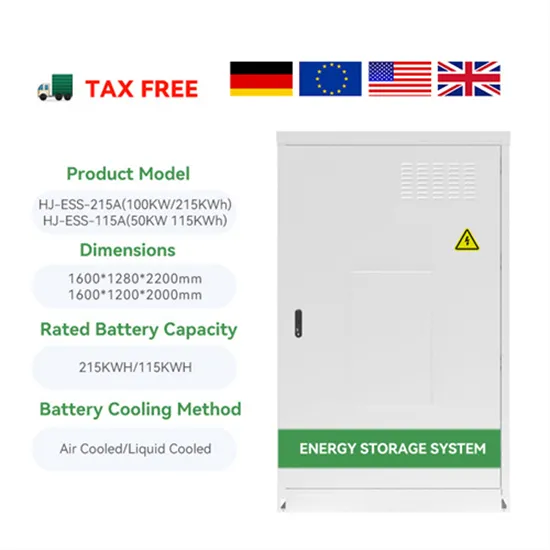

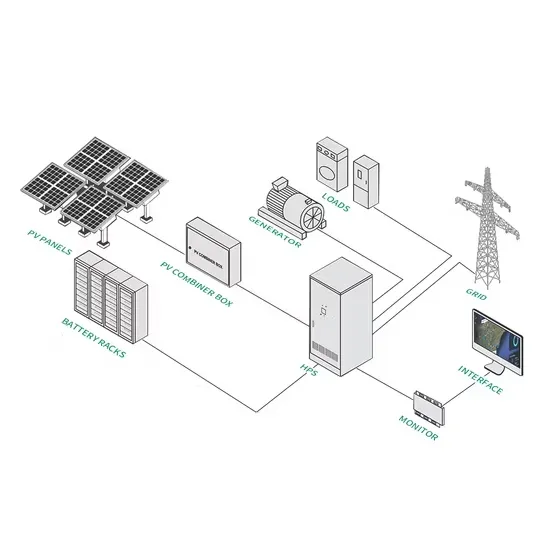

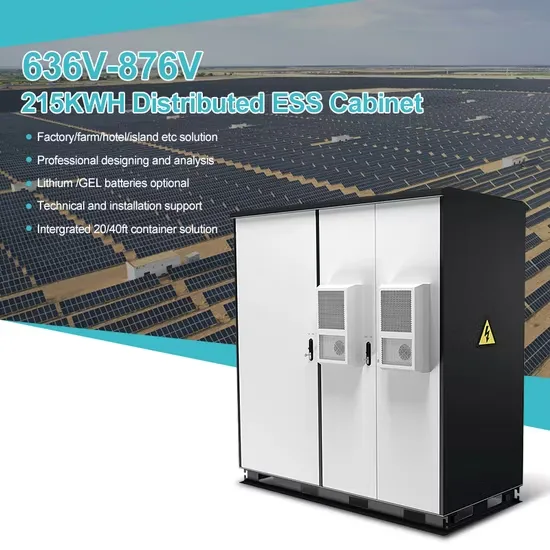

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.