Armenia Energy Storage Legal and Regulatory Review Report

The objective of the present report is to assess Armenia''s legal and regulatory framework for energy storage and provide recommendations for reforms that would be needed to

Get a quote

Energy security – Armenia energy profile – Analysis

Armenia''s energy security has greatly improved since the gas and power supply crisis in the early to mid-1990s. During the crisis, energy sector management

Get a quote

armenia pumped storage power plant

Pumped storage hydropower: Water batteries for solar and wind powerPumped storage Pumped storage hydropower is the world''''s largest battery technology, accounting for over 94 per cent

Get a quote

AboitizPower switches on 45-MW solar farm in Tarlac

The Armenia plant in Tarlac is the fourth operational solar facility of AboitizPower, following the activation of the 59-MWp San Carlos Sun Power Inc. power plant in Negros

Get a quote

Armenia large energy storage systems

Tesla is negotiating with the government of Armenia over supplying a grid-scale storage system, while Italy''''s grid operator revealed it is collaborating with the EV and smart energy tech maker

Get a quote

Hydropower

Hydropower has historically been one of Armenia''s main resources for electricity production. At present, the total capacity of Armenia''s hydropower stations is 1324.4 MW. Two major

Get a quote

Armenia''s Energy Future: How Hydropower Storage Stations Are

Welcome to Armenia''s energy reality. With rivers that behave like moody teenagers – unpredictable and occasionally rebellious – the need for smart energy storage hydropower

Get a quote

ARMENIA ENERGY STORAGE PROGRAM

Two studies were carried out to support the Government of Armenia''s energy storage program. "Energy Modeling and Economic/ Financial Analyses" study "Legal and Regulatory Review

Get a quote

Armenian Power Plant Energy Storage: Innovations Lighting Up

That''s Armenia today. With aging infrastructure and growing energy demands, Armenian power plant energy storage isn''t just tech jargon—it''s become the nation''s electricity

Get a quote

SRIE-Explanatory Notes on Compilation of Energy Balance

The guideline1 published by the IEA, Eurostat and Organization for Economic Cooperation And Development (OECD) as well as the "Explanatory Note on Energy Balance of Armenia"

Get a quote

ENERGY OVERVIEW OF ARMENIA

Is Armenia developing a battery storage project? Currently, Armenia is in the initial stages of developing a pilot project on battery storage, with plans for a utility-scale project with an

Get a quote

Energy system transformation – Armenia energy profile –

Constructing small HPPs is Armenia''s favoured course of action to develop the renewable energy sector and secure energy independence. Most designated, under-construction or operational

Get a quote

Armenia''s energy sector: current developments and

However, integrating more variable renewable energy presents challenges. A flexible power system with storage technologies and increased connectivity

Get a quote

Armenia energy storage in plants

Lacking indigenous resources,Armenia imports natural gas and oil for most of its energy needs (78.6% of total energy supply in 2020),mainly from the Russian Federation(hereafter,"Russia").

Get a quote

AboitizPower energizes 1st C. Luzon power plant

Aboitiz Power Corp. (AboitizPower), through its renewable energy subsidiary Aboitiz Renewables Inc. (ARI), has energized the 45-megawatt peak (MWp) Armenia Solar Project in

Get a quote

Energy system transformation – Armenia energy

Constructing small HPPs is Armenia''s favoured course of action to develop the renewable energy sector and secure energy independence. Most designated,

Get a quote

List of power stations in Iran

According to the Ministry of Energy, Germany has invested $445 million in construction of the Pareh-Sar combined cycle power plant in northern Iran, while the UAE has invested $720

Get a quote

Armenia energy storage hydropower station

The power station will have an energy storage capacity of 3.6GWh which, once commissioned, will allow hydro storage using surplus renewable energy that cannot be integrated into the

Get a quote

Armenia air energy storage power generation

What percentage of Armenia''s Energy is renewable? Renewable energy resources, including hydro, represented 7.1% of Armenia''s energy mix in 2020. Almost one-third of the country''s

Get a quote

GET_ARM_PS_01_2025_EN

A 25-35 MW-4h BESS offers a cost-effective solution to enhance system resilience. Armenia imports 81% of its primary energy supply and 100% of its fossil and nuclear fuels. These

Get a quote

AboitizPower activates first solar plant in Central Luzon

TARLAC CITY, Tarlac (December 9, 2024) — Aboitiz Power Corporation (AboitizPower), through its renewable energy arm Aboitiz

Get a quote

Huai armenia xin energy storage power plant

Armenia depends on imports to meet much of its energy needs, particularly natural gas from the Russian Federation. It is one of the few ex-Soviet republics to avoid significant energy

Get a quote

Guess what you want to know

-

Armenia Energy Storage Container Power Station Platform

Armenia Energy Storage Container Power Station Platform

-

Armenia Energy Storage Power Station Project

Armenia Energy Storage Power Station Project

-

Armenia Energy Storage Power Station

Armenia Energy Storage Power Station

-

Armenia s grid-side energy storage power station trading rules

Armenia s grid-side energy storage power station trading rules

-

How many energy storage power station projects are there in Egypt

How many energy storage power station projects are there in Egypt

-

Energy storage power station investment entities

Energy storage power station investment entities

-

Is the energy storage power station project reliable

Is the energy storage power station project reliable

-

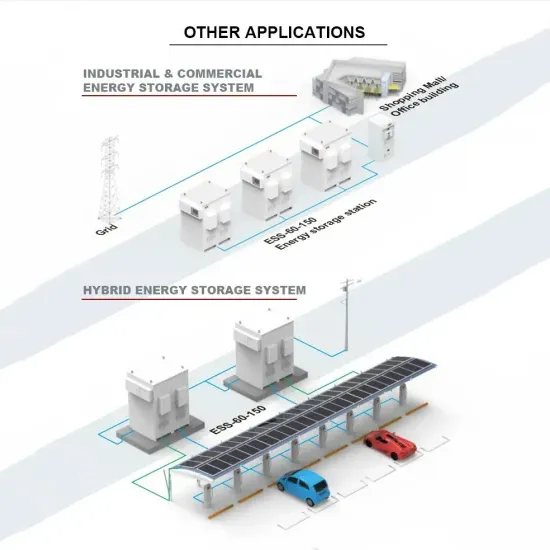

What is the voltage of an industrial and commercial energy storage power station

What is the voltage of an industrial and commercial energy storage power station

-

Brazil Hybrid Energy Storage Power Station

Brazil Hybrid Energy Storage Power Station

-

Peru Energy Storage Photovoltaic Power Station

Peru Energy Storage Photovoltaic Power Station

Industrial & Commercial Energy Storage Market Growth

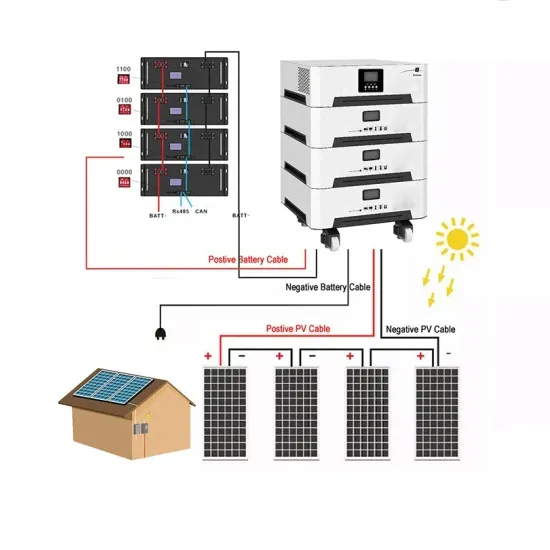

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.