Solar exports from China increase by a third

Exports of solar panels from China increased by 34% in the first half of 2023 compared to the same period last year. This report analyses

Get a quote

Solar exports from China increase by a third

Exports of solar panels from China increased by 34% in the first half of 2023 compared to the same period last year. This report analyses Chinese customs data on exports

Get a quote

Recent developments and prospects of the global photovoltaic

Europe: In 2022, European countries imported 86.6 gigawatts of PV modules from China, accounting for 56% of China''s annual PV module exports, and a significant increase of

Get a quote

Photovoltaic Module Export Process and Classification,

Navigate the complexities of solar panel export with our comprehensive guide. Understand the export process, module classification, and key advantages & disadvantages

Get a quote

Indian solar PV exports surging | IEEFA

The export of Indian photovoltaic (PV) modules has risen exponentially by more than 23 times between Fiscal Year (FY) 2022 and FY2024, primarily to the US, which

Get a quote

Analysis of countries exporting Chinese photovoltaic

Regarding export market distribution, Europe and Asia are the main export destinations, accounting for 42% and 40% of total exports,

Get a quote

Chinese module exports up 5% MoM despite declines in the

Chinese module exports up 5% MoM despite declines in the Americas and Middle East China exported 17.34 GW of modules in October, up nearly 5% MoM from 16.53 GW

Get a quote

2024 Monthly Solar Photovoltaic Module Shipments Report

Data source: U.S. Energy Information Administration, Form EIA-63B, Monthly Photovoltaic Module Shipments Report Note: Includes both domestic shipments and exports.

Get a quote

Developing Australia''s Solar PV Supply Chain

This is an extract from a recent report "Silicon to Solar" prepared by the Australian PV Institute. "Australia''s biggest opportunity for growth and prosperity is the global shift to

Get a quote

Status of PV Module Take-Back and Recycling in Germany

Approach for Evaluation of Take-Back and Recycling Situation in Germany Two workshops were held in 2021 and 2022 with ~20-30 experts from both industry and research representing

Get a quote

From January to February, the photovoltaic export data was

However, judging from the situation from 2023 to the present, as the data listed above, the phenomenon of "volume increase and price reduction" in the export of mainland

Get a quote

European market demand and long-term outlook for 2024

Europe has been actively deploying renewable energy to achieve energy security and net-zero emissions in recent years, with solar the major focus. InfoLink estimates that

Get a quote

Can reshoring policies hinder China''s photovoltaic module

China''s PV module exports are expected to experience cyclical fluctuations. The primary export market for China''s PV modules will mainly be in the EU region. Energy

Get a quote

Shaping the solar future: An analysis of policy evolution,

Over recent decades, China has risen to a preeminent global position in both solar photovoltaic (PV) adoption and production, a feat underpinned by a suite of pivotal policy

Get a quote

Analysis of countries exporting Chinese photovoltaic energy

Regarding export market distribution, Europe and Asia are the main export destinations, accounting for 42% and 40% of total exports, respectively. The Netherlands,

Get a quote

Photovoltaic Turmoil: Will the US Impose Anti

The main sources of US photovoltaic module imports are Southeast Asia, with about 80% of the products coming from Cambodia, Malaysia, Thailand, and Vietnam, and a

Get a quote

US tariffs, Europe slowdown reshape global solar

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since

Get a quote

Can reshoring policies hinder China''s photovoltaic module exports

China''s PV module exports are expected to experience cyclical fluctuations. The primary export market for China''s PV modules will mainly be in the EU region. Energy

Get a quote

US tariffs, Europe slowdown reshape global solar panels trade

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since the first round of tariffs in June. In the

Get a quote

New edition of China PV Industry Development Roadmap released

The China Photovoltaic Industry Association on Thursday released this year''s edition of the China PV Industry Development Roadmap.

Get a quote

Solar Supply Chain and Industry Analysis | Solar Market

Solar Supply Chain Analyses NREL conducts detailed supply chain analysis for specific photovoltaic module technologies. These analyses include production locations,

Get a quote

Executive summary – Solar PV Global Supply Chains

This has led to tight global supplies and a quadrupling of polysilicon prices over the last year. Solar PV products are a significant export for China. In 2021, the value of China''s solar PV

Get a quote

Monthly Solar Photovoltaic Module Shipments Report

This table includes the total shipments, values, and average values of module shipments by year and month. This table is a compilation of annual Tables 2, 3, and 4.

Get a quote

China''s Stealthy Solar Exports Stay One Step Ahead of US Tariffs

China''s Stealthy Solar Exports Stay One Step Ahead of US Tariffs Chinese solar firms appear to be assembling products in Indonesia and skirting US tariffs.

Get a quote

Indian Solar PV Exports Surging

Key Findings The export of Indian photovoltaic (PV) modules has risen exponentially by more than 23 times between Fiscal Year (FY) 2022 and FY2024, primarily to the US, which

Get a quote

6 FAQs about [Photovoltaic module export situation]

Does India export photovoltaic modules?

The export of Indian photovoltaic (PV) modules has risen exponentially by more than 23 times between Fiscal Year (FY) 2022 and FY2024, primarily to the US, which accounted for more than 97% of India’s exports in both FY2023 and FY2024.

Is India a net importer or exporter of photovoltaic (PV) products?

India is making significant progress in transitioning from a net importer to a net exporter of photovoltaic (PV) products. In Fiscal Year (FY) 2024, Indian PV manufacturers exported approximately US$2 billion worth of PV modules. The export value of PV modules from India increased by more than 23 times in just two years between FY2022 and FY2024.

Are photovoltaic module shipments published?

U.S. photovoltaic module shipments by state or territory Individual data for most states are not published to protect the confidentiality of individual company data. Individual data for most states are not published to protect the confidentiality of individual company data.

Do I need to report a monthly photovoltaic module shipment report?

Beginning in January 2017, we required some of the respondents for the annual survey Form EIA-63B, Photovoltaic Module Shipments Report, to report monthly data. The subset of respondents now must report monthly accounts for about 90% of photovoltaic (PV) activity in the United States, based on 2021 data.

How has China shaped the global supply and demand of solar PV?

Government policies in China have shaped the global supply, demand and price of solar PV over the last decade. Chinese industrial policies focusing on solar PV as a strategic sector and on growing domestic demand have enabled economies of scale and supported continuous innovation throughout the supply chain.

Do you have to report a monthly photovoltaic account?

The subset of respondents now must report monthly accounts for about 90% of photovoltaic (PV) activity in the United States, based on 2021 data. Data collected on both the monthly and annual Form EIA-63B are protected from disclosure of individual company data. As a result of this protection, monthly data are not published in some tables.

Guess what you want to know

-

Japanese photovoltaic module export company

Japanese photovoltaic module export company

-

Export photovoltaic module sales

Export photovoltaic module sales

-

Philippines photovoltaic module export tariffs

Philippines photovoltaic module export tariffs

-

Photovoltaic module export channels

Photovoltaic module export channels

-

Photovoltaic module export enterprises

Photovoltaic module export enterprises

-

Rooftop double-glass photovoltaic module quotation

Rooftop double-glass photovoltaic module quotation

-

Photovoltaic module inverter production

Photovoltaic module inverter production

-

Thin-film photovoltaic module subsidies

Thin-film photovoltaic module subsidies

-

Burundi photovoltaic module project

Burundi photovoltaic module project

-

Photovoltaic panel single glass module manufacturer

Photovoltaic panel single glass module manufacturer

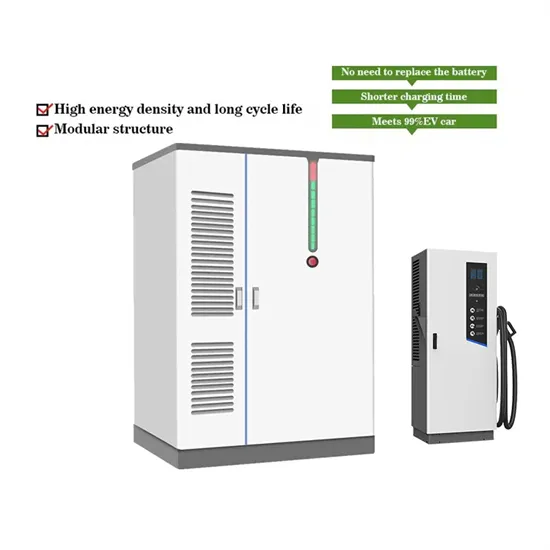

Industrial & Commercial Energy Storage Market Growth

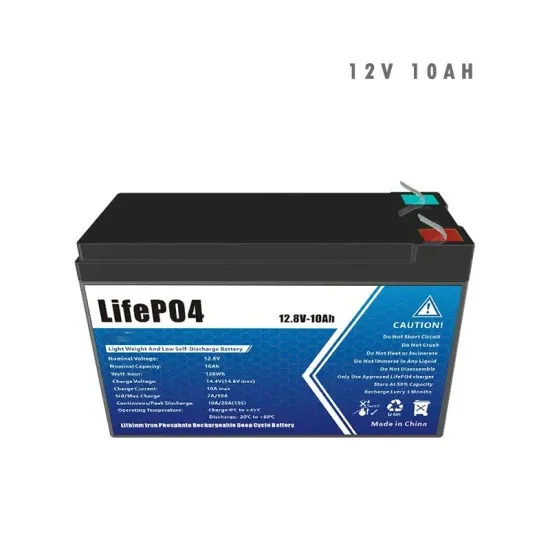

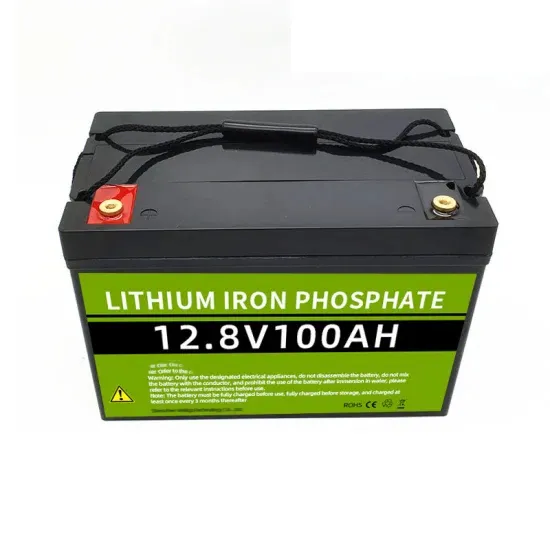

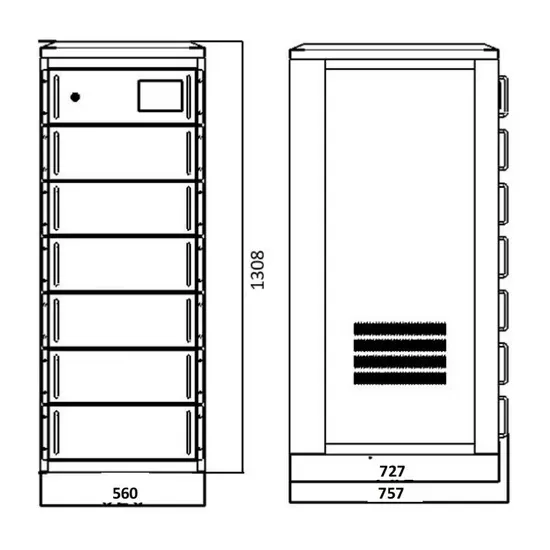

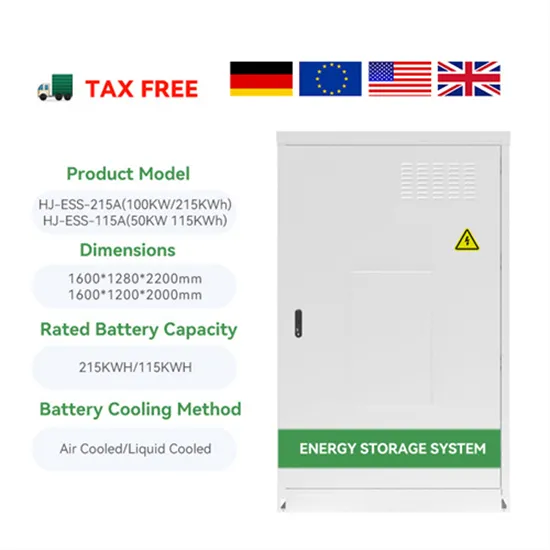

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.