Advancing Energy Storage: Breakthrough in Porous Silicon

The quest for advanced energy storage solutions has stimulated extensive research into the discovery and development of high-capacity anode materials. Silicon is considered a highly

Get a quote

How Japan is Driving BESS Investment

Gore Street Capital and ITOCHU Corporation have been selected by the Tokyo Metropolitan Government (TMG) to manage Japan''s first fund dedicated to grid-scale energy

Get a quote

Malaysia Begins Construction of $435 Million Polysilicon Plant by Japan

Japanese chemical firm Tokuyama Corporation and South Korean polysilicon producer OCI have commenced construction of a 10,000 metric ton polysilicon facility at the Samalaju Industrial

Get a quote

Japan''s Energy Storage Industrial Parks: Powering the

Enter energy storage industrial parks – these massive battery installations are becoming the linchpin of Japan''s carbon neutrality roadmap. But where exactly are these game-changing

Get a quote

Japan: Large-scale battery storage opportunities in an evolving

Eku Energy COO Tom Best at a ceremonial event to mark the start of construction at the 30MW/120MWh Hirohara BESS in September 2024. Image: Eku Energy Japan''s energy

Get a quote

NYCEDC Advances Green Economy Action Plan with

The facility will serve as a large-scale battery energy storage system capable of charging from, and discharging into, the New York power

Get a quote

Shell and Silicon Ranch to build solar project in Canada

Once built, the project will provide 20 per cent of the refinery''s energy needs with renewable electricity. Shell''s transformation of Scotford into an energy and

Get a quote

Top five energy storage projects in Japan

Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData''s power database. GlobalData uses proprietary data and analytics to

Get a quote

Home | NEDO Representative Office in Silicon Valley

NEDO is Japan''s largest public R&D management organization established in 1980, under the supervision of METI (Ministry of Economy, Trade and Industries). We are addressing energy

Get a quote

Large-scale energy storage business

Here, we will delve into our path taken to launch a completely new business and start operation of the first large-scale energy storage facility in Japan in 2024,

Get a quote

Manoa Energy

Overview Project Infinity is a 50 MW / 100 MWh utility-scale Battery Energy Storage System (BESS) under development in Maibara City, Shiga Prefecture. Positioned to serve the Kansai

Get a quote

Korea, Japan industrial titans break ground on RM2 bln

By Karen Bong BINTULU, July 17: Sarawak marked another significant leap in its high-technology industrial journey as OCI Tokuyama Semiconductor Materials Sdn Bhd

Get a quote

Japan Battery Energy Storage System

Gurīn Energy is developing a pipeline of utility-scale battery energy storage system (BESS) projects to enable greater flexibility of the grid and

Get a quote

Silicon Ranch Energizes First Utility-Scale Solar Project in

Silicon Ranch, one of the largest independent power producers specializing in solar energy, agrivoltaics, battery storage, and carbon solutions in the U.S., today announced

Get a quote

Large-scale energy storage business

Here, we will delve into our path taken to launch a completely new business and start operation of the first large-scale energy storage facility in Japan in 2024, as well as the challenges and

Get a quote

Eco-Industrial Developments in Japan: A Working Paper

Explore eco-industrial projects in Japan, their drivers, categories, and policy implications. Learn about sustainable development and industrial ecology.

Get a quote

Japan''s first fund dedicated to grid storage batteries begins full

Going forward, the plan is to launch the first energy storage station around fiscal 2025, and then proceed with the development and operation of energy storage stations one after another.

Get a quote

Energy Storage System Industrial Parks in Japan: Powering the

With a $33 billion global energy storage market [1], Japan is building specialized industrial hubs to tackle its unique energy challenges. From Fukushima''s revival to robot-staffed facilities, let''s

Get a quote

Japan''s Long-Planned Photovoltaics: Space-Based Solar Power

Solutions are emerging to conquer solar power''s shortcomings, namely, limited installation sites and low-capacity utilization rates. Japan is spearheading the development of two promising

Get a quote

Orix Plans Japan''s Largest Power Storage Plant Using Tesla

The project in Maibara, Shiga prefecture, will incorporate Tesla''s Megapack units with a total capacity of 548 megawatt-hours. The facility, scheduled to begin operations in

Get a quote

Japan Energy Storage Policies and Market Overview

Projects led by Hitachi Energy and JAPEX are already deploying batteries for grid stability and renewable integration. As policy, technology, and decarbonization goals

Get a quote

Takasago Hydrogen Park, the World''s First Integrated

Takasago Hydrogen Park is divided into sections according to three hydrogen-related functions: hydrogen production, storage, and

Get a quote

Japan Battery Energy Storage System

Gurīn Energy is developing a pipeline of utility-scale battery energy storage system (BESS) projects to enable greater flexibility of the grid and support the increased use of

Get a quote

Report: Energy Storage Landscape in Japan | EU-Japan

The aim of this report is to provide an overview of the energy storage market in Japan, address market''s characteristics, key success factors as well as challenges and opportunities in this

Get a quote

6 FAQs about [Japan Silicon Industrial Park Energy Storage Project]

What is Japan's first energy storage project?

In 2015, we started Japan's first demonstration project covering energy storage connected to the power grid in the Koshikishima, Satsumasendai City, Kagoshima. This project is still operating in a stable manner today. One feature of our grid energy storage system is that it utilizes reused batteries from EVs.

How big is Japan's energy storage capacity?

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Japan had 1,671MW of capacity in 2022 and this is expected to rise to 10,074MW by 2030. Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData’s power database.

What is Japan's energy storage policy?

As policy, technology, and decarbonization goals converge, Japan is positioning energy storage as a critical link between its climate targets and energy reliability. Japan’s energy storage policy is anchored by the Ministry of Economy, Trade and Industry (METI), which outlined its ambitions in the 6th Strategic Energy Plan, adopted in 2021.

How is Japan's energy storage landscape changing?

Japan’s energy storage landscape is shifting, pushed by household demand, corporate ESG mandates, and domestic battery manufacturing. The residential lithium-ion market, projected to grow at a CAGR of 33.9% through 2030, remains one of the fastest-expanding segments.

Does Japan's energy storage rollout face structural headwinds?

Despite strong policy signals, Japan’s energy storage rollout faces deep structural headwinds. The nation’s split-grid architecture—50 Hz in the east and 60 Hz in the west—limits electricity transfer and complicates nationwide deployment.

What is Japan's first fund dedicated to grid storage batteries?

Japan's first fund dedicated to grid storage batteries begins full-scale operation Raised over 8 billion yen from 11 public and private investors Norbert Gehrke Oct 02, 2024 Share this post Japan Startup Observer Japan's first fund dedicated to grid storage batteries begins full-scale operation Copy link Facebook Email Notes More Share

Guess what you want to know

-

Brunei Energy Storage Industrial Park Project Planning

Brunei Energy Storage Industrial Park Project Planning

-

Georgia Energy Storage Industrial Park Project

Georgia Energy Storage Industrial Park Project

-

Hungarian Industrial Park Energy Storage Project Design Unit

Hungarian Industrial Park Energy Storage Project Design Unit

-

Italian Energy Storage Industrial Park Project

Italian Energy Storage Industrial Park Project

-

Kyrgyzstan Energy Storage Industrial Park Project

Kyrgyzstan Energy Storage Industrial Park Project

-

Belarus Energy Storage Industrial Park Project

Belarus Energy Storage Industrial Park Project

-

100MW Energy Storage Project in Serbia Industrial Park

100MW Energy Storage Project in Serbia Industrial Park

-

Huawei Qatar Industrial Park Energy Storage Project

Huawei Qatar Industrial Park Energy Storage Project

-

Colombia Lithium Battery Energy Storage Industrial Park

Colombia Lithium Battery Energy Storage Industrial Park

-

Industrial and commercial energy storage power station project

Industrial and commercial energy storage power station project

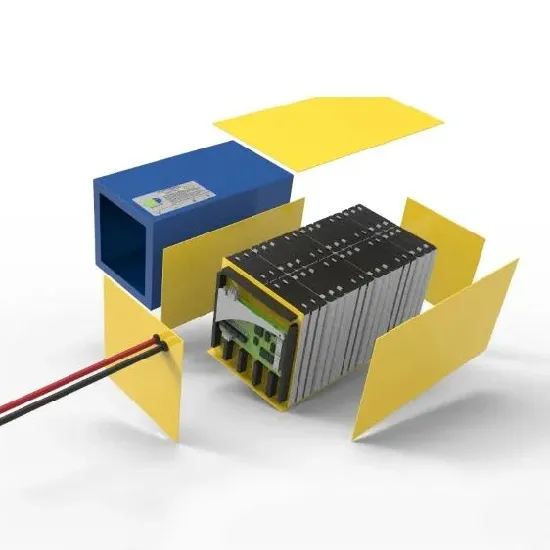

Industrial & Commercial Energy Storage Market Growth

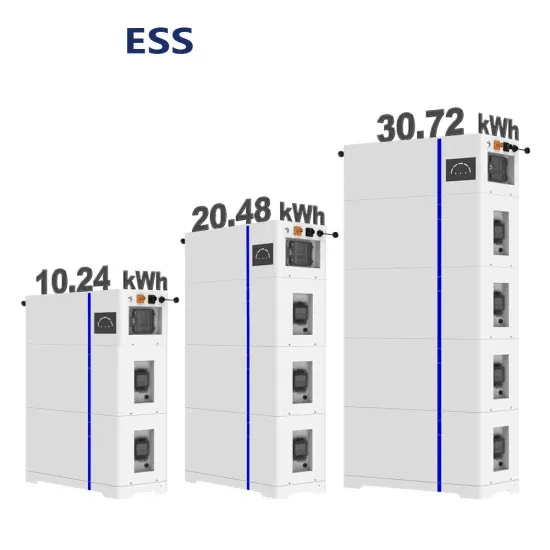

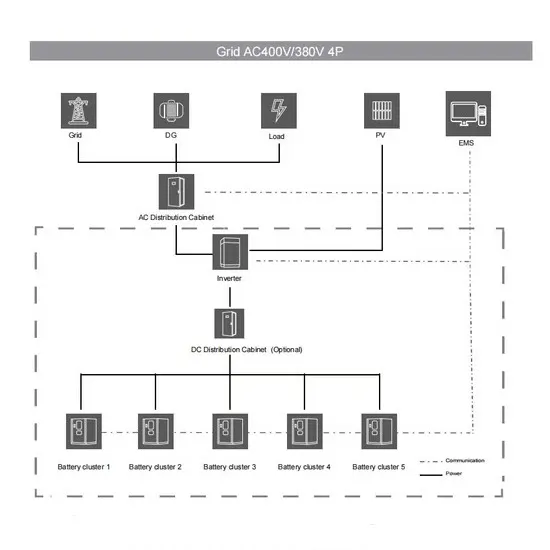

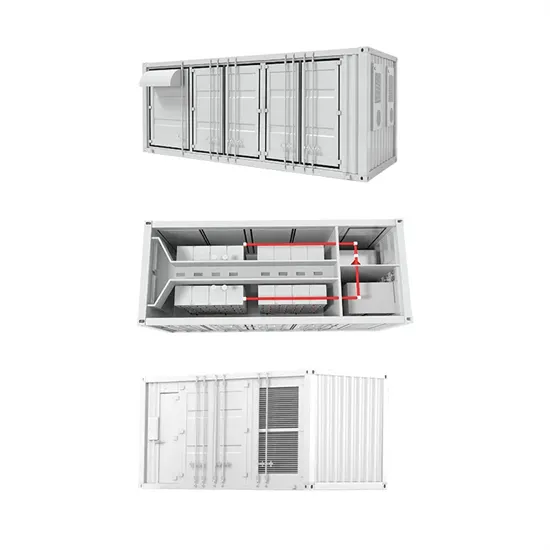

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

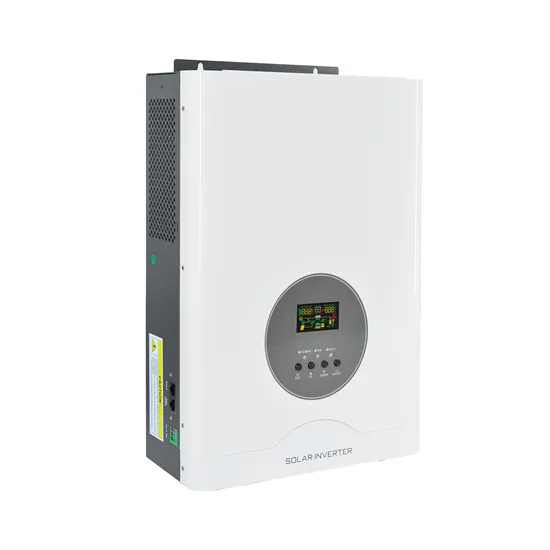

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.