Deciphering solar supply chain challenges and where we go from

Deciphering solar supply chain challenges and where we go from here Brian Lynch calls on U.S. manufacturers to re-evaluate their supply chain strategies and partners, with a

Get a quote

Chinese Firms Set to Control Nearly Half of U.S. Domestic Solar Panel

As a result, China now controls more than 80% of the global solar panel supply chain, from raw polysilicon to finished solar modules. This massive investment, coupled with

Get a quote

Solar PV Global Industry Report 2025: Growth Opportunities

Dublin, June 19, 2025 (GLOBE NEWSWIRE) -- The "Solar PV Industry, Global, 2023-2035" report has been added to ResearchAndMarkets ''s offering. Solar PV accounted for 45% of all

Get a quote

Solar Panel Manufacturers, PV Module Suppliers and Materials

Sinovoltaics offers dedicated supply chain maps for North America, Europe, Southeast Asia, and India. Each map highlights the region''s existing and future solar module manufacturers. Our

Get a quote

What Is the Global Supply Chain for Solar Panels? A Deep Dive

Discover the complex global supply chain behind solar panels, from raw materials like silicon and aluminum to manufacturing hubs led by China, and global distribution challenges.

Get a quote

Solar Supply Chain and Industry Analysis

NREL conducts detailed supply chain analysis for specific photovoltaic module technologies. These analyses include production locations, supply chain risk and costs, and

Get a quote

Solar Panel Manufacturers, PV Module Suppliers and

Sinovoltaics offers dedicated supply chain maps for North America, Europe, Southeast Asia, and India. Each map highlights the region''s existing and

Get a quote

What Is the Global Supply Chain for Solar Panels? A

Discover the complex global supply chain behind solar panels, from raw materials like silicon and aluminum to manufacturing hubs led by China, and global

Get a quote

Progress in Diversifying the Global Solar PV Supply Chain

Section 1 provides an overview of the global solar PV supply chain. It presents crystalline silicon modules as the undisputed solar PV technology, points out silicon, silver, aluminum, and

Get a quote

The world needs more diverse solar panel supply

It finds that new solar PV manufacturing facilities along the global supply chain could attract USD 120 billion of investment by 2030. And the

Get a quote

Solar PV module market outlook 2025: emerging trends and

The global solar photovoltaic (PV) module market has been growing at pace and is projected to rise to $133.12bn in market value by 2028, according to Power Technology ''s

Get a quote

''Oversupply is still there'' – pv magazine International

At the World Future Energy Summit in Abu Dhabi, <b>pv magazine</b> spoke with two OPIS analysts about the current and projected

Get a quote

Should Australia make solar panels? Supply chain security

Mapping the global solar supply chain The solar panel supply chain is typically broken down into four segments: polysilicon, ingots and wafers, solar cells, and solar modules,

Get a quote

The Outlook for Global Solar Energy Continues to Be Bright

Policymakers in some of the world''s largest economies are reducing support for solar power generation. Even so, Goldman Sachs Research expects rapid growth in the

Get a quote

Special Report on Solar PV Global Supply Chains

This special report examines solar PV supply chains from raw materials all the way to the finished product, spanning the five main segments of the manufacturing process: polysilicon, ingots,

Get a quote

World stuck in major solar panel ''supply glut''; module prices

S&P Global Commodity Insights forecasts global solar additions of 399 GW in 2024, and 465 GW in 2028. This "significant supply glut" has already created an environment

Get a quote

Solar Energy Statistics By Country, Costs And

Solar Energy Statistics stated that the global solar market is expected to grow at a rate of 27% between 2021 and 2031. The majority of

Get a quote

Special Report on Solar PV Global Supply Chains | OECD

Because diversification is one of the key strategies for reducing supply chain risks, the report assesses the opportunities and challenges of developing solar PV supply chains in terms of

Get a quote

Yahoo Finance

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your

Get a quote

Global Solar Council | Supply Chain

Significant efforts should also be made to create transparent, fair, and competitive solar supply chains that bolster national and regional industries, creating jobs

Get a quote

Understanding the Global Solar Energy Supply Chain

A recent report exposes the presence of forced labour in the world''s dominant supply chain of solar panels. Australian companies should pay attention. Australians are adopting renewables

Get a quote

6 FAQs about [Global solar panel supply]

What is the global solar PV supply chain worth?

In that last year, the global solar PV chain reached an industrial business value of some 104.7 billion U.S. dollars, with China dominating the market, and followed by the United States and Malaysia. Discover all statistics and data on Global solar PV supply chain now on statista.com!

How big is the solar supply glut in 2024 & 2028?

S&P Global Commodity Insights forecasts global solar additions of 399 GW in 2024, and 465 GW in 2028. This "significant supply glut" has already created an environment of low panel prices and led to a stockpiling of imported Chinese modules in Europe and the US, the IEA said.

What is the solar PV supply chain?

The solar PV supply chain is one of the most geographically concentrated supply chains globally, as China dominates raw material mining and refining and manufactures over 90% of critical inputs such as polysilicon, ingots and wafers.

Where can I find a solar supply chain map?

Our map resources include: Sinovoltaics offers dedicated supply chain maps for North America, Europe, Southeast Asia, and India. Each map highlights the region’s existing and future solar module manufacturers. Our maps also break down the area’s critical suppliers for cells, wafers, ingots, and polysilicon.

What is the global investment in solar PV manufacturing facilities?

Global cumulative investment in solar PV manufacturing facilities more than doubled in the past decade to almost USD 100 billion in 2021. Overall, polysilicon and ingots/wafers together account for almost 70% of all investment in solar PV manufacturing due their high capital requirements.

How has global solar PV manufacturing capacity changed over the last decade?

Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade. China has invested over USD 50 billion in new PV supply capacity – ten times more than Europe − and created more than 300 000 manufacturing jobs across the solar PV value chain since 2011.

Guess what you want to know

-

Swaziland Solar Panel Outdoor Power Supply

Swaziland Solar Panel Outdoor Power Supply

-

Photovoltaic solar panel supply in Guinea-Bissau

Photovoltaic solar panel supply in Guinea-Bissau

-

Solar Panel Battery Outdoor Power Supply

Solar Panel Battery Outdoor Power Supply

-

Solar panel outdoor power supply brand

Solar panel outdoor power supply brand

-

Latvian solar panel power supply system

Latvian solar panel power supply system

-

Which solar panel power supply for communication base stations is the most affordable

Which solar panel power supply for communication base stations is the most affordable

-

Nepal solar panel outdoor power supply

Nepal solar panel outdoor power supply

-

BESS solar panel power supply system

BESS solar panel power supply system

-

Solar panel price supply and demand trends

Solar panel price supply and demand trends

-

Home solar panel power supply system

Home solar panel power supply system

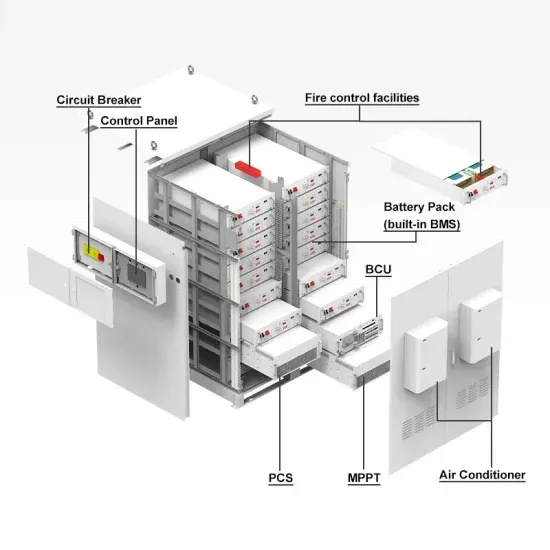

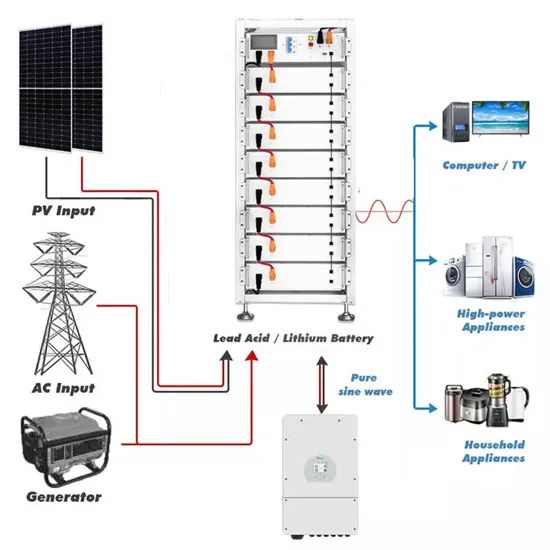

Industrial & Commercial Energy Storage Market Growth

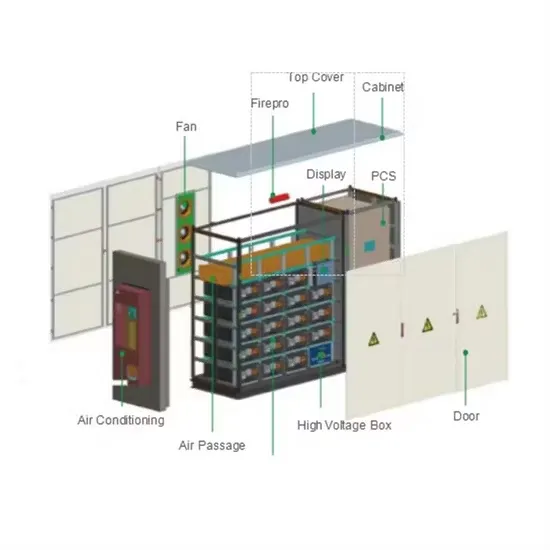

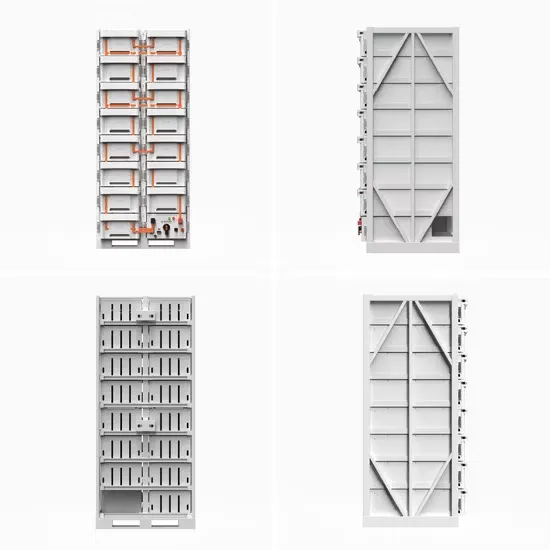

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

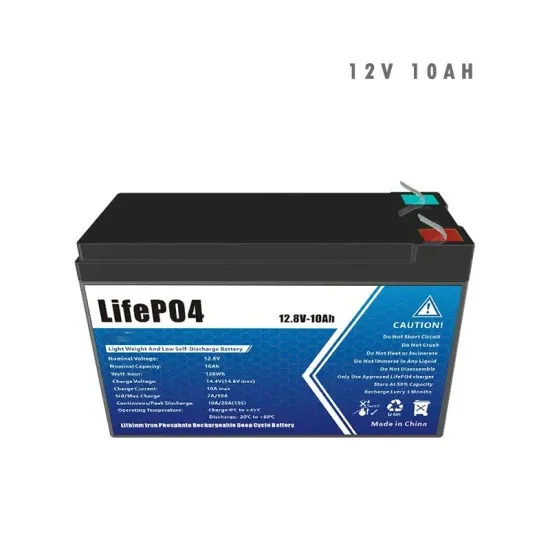

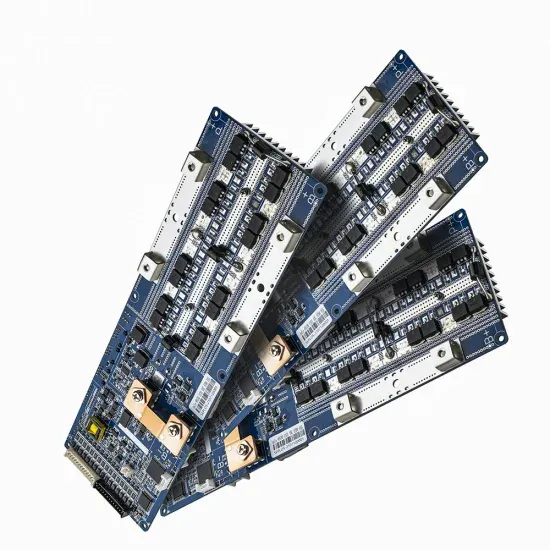

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.