ANACOM releases a first assessment of 5G deployment in Portugal

According to the 5G tests carried out, there are quite uneven situations regarding the characteristics of the access to 5G available in the municipalities of the country that

Get a quote

Renewable microgeneration cooperation with base station

The energy consumption of the mobile network is becoming a growing concern for mobile network operators and it is expected to rise further with operational costs and carbon

Get a quote

Portugal: há quase 10 mil estações de base com tecnologia 5G

O início da oferta comercial e da instalação das primeiras estações de base em Portugal associadas à 5.ª geração de redes móveis teve lugar no final do ano de 2021.

Get a quote

On hybrid energy utilization for harvesting base station

In this paper, hybrid energy utilization was studied for the base station in a 5G network. To minimize AC power usage from the hybrid energy

Get a quote

E-REDES implements the first 5G substation in Portugal

E-REDES is shaping the future of energy through the 5G project, which has enabled the pioneering implementation of a 5G substation in Portugal.

Get a quote

Number of 5G base stations installed in Portugal increased by

Of the 308 municipalities in the country with 5G technology stations, 263 municipalities have base stations installed by three operators (MEO, NOS and Vodafone).

Get a quote

NOS leads the way in 5G with more than 51% of stations installed

NOS reinforced its leadership in Portugal''s coverage with 5G, having installed, by the end of 2022, 2985 5G stations, according to the report released by the communications

Get a quote

On hybrid energy utilization for harvesting base station in 5G

In this paper, hybrid energy utilization was studied for the base station in a 5G network. To minimize AC power usage from the hybrid energy system and minimize solar

Get a quote

Optimal operation strategy for renewable power plants based on 5G base

Request PDF | Optimal operation strategy for renewable power plants based on 5G base stations response | The integration of large-scale new energy sources has led to a

Get a quote

Portugal''s 5G Transformation

The rollout of this new technology was initially marred by a prolonged and contentious frequency auction, leaving Portugal second-to-last among EU countries to deploy

Get a quote

All Portuguese municipalities have 5G

The National Communications Authority (ANACOM) announced a 12% increase in 5G stations in Portugal in the second trimester of the year, revealing that "all municipalities

Get a quote

Improved hybrid sparrow search algorithm for an extreme learning

Improved hybrid sparrow search algorithm for an extreme learning machine neural network for short‐term photovoltaic power prediction in 5G energy‐routing base stations

Get a quote

Synergetic renewable generation allocation and 5G base station

The growing penetration of 5G base stations (5G BSs) is posing a severe challenge to efficient and sustainable operation of power distribution systems (PDS) due to their huge

Get a quote

Portugal: há quase 10 mil estações de base com

O início da oferta comercial e da instalação das primeiras estações de base em Portugal associadas à 5.ª geração de redes móveis teve lugar no final do ano

Get a quote

Number of 5G mobile base stations rose 35% in 2022

The number of 5G (fifth-generation mobile communications) base stations installed in Portugal increased 35% in the fourth quarter of 2022, to a total of 5,842, spread across 98%

Get a quote

5G now present in all Portuguese municipalities and in 70% of

At the end of 1st quarter 2024, according to information reported by operators, there were 9,999 base stations in Portugal with 5G technology. This represents a 12% increase in

Get a quote

Number of 5G base stations installed in Portugal

Of the 308 municipalities in the country with 5G technology stations, 263 municipalities have base stations installed by three operators

Get a quote

A Coordinated Energy Management Method For 5G Base Station

The increasing operation expenses (OPEX) of 5G base stations (BS) necessitates the efficient operational management schemes, among which one main approach is to reduce its energy

Get a quote

Over 10,000 5G stations in Portugal

The number of 5G stations installed in Portugal surpassed the 10,000 mark in the second quarter, according to a report released by Anacom, which shows that MEO is now the

Get a quote

On hybrid energy utilization for harvesting base station in 5G

Abstract In this paper, hybrid energy utilization was studied for the base station in a 5G net-work. To minimize AC power usage from the hybrid energy system and minimize solar energy

Get a quote

Cooperative Planning of Distributed Renewable Energy Assisted 5G Base

The surging electricity consumption and energy cost have become a primary concern in the planning of the upcoming 5G systems. The integration of distributed renewable

Get a quote

5G means Batteries. A lot of them

In base stations and other network infrastructure, battery-based UPSs are most often used as backup power sources to keep the installations operational

Get a quote

ANACOM

At the end of the 4th quarter of 2024, according to the information reported by the four operators, the number of base stations installed in Portugal with 5G technology amounted

Get a quote

Collaborative optimization of distribution network and 5G base stations

In this paper, a distributed collaborative optimization approach is proposed for power distribution and communication networks with 5G base stations. Firstly, the model of 5G

Get a quote

Portugal Has Installed More Than 10,000 5G Stations

There have been reports by the operators that around 10,368 5G stations have been installed in the country by the end of the second quarter.

Get a quote

Portugal Has Installed More Than 10,000 5G Stations Within The

There have been reports by the operators that around 10,368 5G stations have been installed in the country by the end of the second quarter. This number of phase stations

Get a quote

6 FAQs about [Does Portugal have 5G base stations with hybrid energy sources ]

How many base stations in Portugal have 5G?

Since the end of the first half of 2022, ANACOM has been reporting quarterly on progress in the implementation of these latest-generation mobile communications networks. At the end of 1st quarter 2024, according to information reported by operators, there were 9,999 base stations in Portugal with 5G technology.

How many municipalities have 5G technology stations?

Of the 308 municipalities in the country with 5G technology stations, 263 municipalities have base stations installed by three operators (MEO, NOS and Vodafone). Compared to last quarter, there are 36 more municipalities where all operators have installed 5G sites.

Which operator has installed the most 5G base stations?

Analysing the data by operator, NOS has installed the most 5G base stations (4,705), followed by Vodafone (3,816) and MEO (1,478). In terms of the number of stations installed per operator compared to the previous quarter, Vodafone reported an increase of 18% (+583 stations), NOS 11% (+470 stations) and MEO 1% (+19 stations).

What is the density of 5G base stations in Portugal?

At the end of 1st quarter 2024, the density of 5G base stations in Portugal was one base station per 10 km2 - on average, 97 5G base stations per 100,000 inhabitants.

Are 5G networks growing in Portugal?

While these indicators demonstrate the growth of 5G networks in Portugal, distribution throughout the territory has not been homogeneous, with a greater concentration of stations evident along the western coastal strip, mainly between Viana do Castelo and Setúbal, and along the southern coastal strip (Algarve).

How many 5G base stations are there in 2023?

At the end of the 2 nd quarter of 2023, according to information reported to ANACOM, the number of base stations installed in the national territory using 5G technology totalled 7831 stations, spread across 308 municipalities (100% of the country’s municipalities) and 1833 civil parishes (59% of the country’s civil parishes).

Guess what you want to know

-

Total number of hybrid energy 5G base stations

Total number of hybrid energy 5G base stations

-

How many hybrid energy 5G base stations are there in the Maldives

How many hybrid energy 5G base stations are there in the Maldives

-

Hybrid energy and mobile co-construction of 5G base stations

Hybrid energy and mobile co-construction of 5G base stations

-

What hybrid energy sources are needed for communication base stations

What hybrid energy sources are needed for communication base stations

-

Are there many hybrid energy sources for Libyan communication base stations

Are there many hybrid energy sources for Libyan communication base stations

-

Jamaica Hybrid Energy Networks builds 5G base stations

Jamaica Hybrid Energy Networks builds 5G base stations

-

Are hybrid energy sources for communication base stations all round

Are hybrid energy sources for communication base stations all round

-

Hybrid Energy Where Does 5G Come From Without Base Stations

Hybrid Energy Where Does 5G Come From Without Base Stations

-

What are the hybrid energy sources for communication base stations in Swaziland

What are the hybrid energy sources for communication base stations in Swaziland

-

Wind and solar hybrid energy for communication base stations

Wind and solar hybrid energy for communication base stations

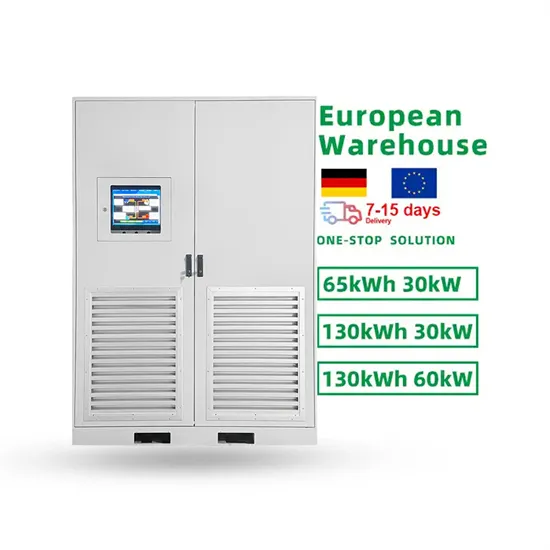

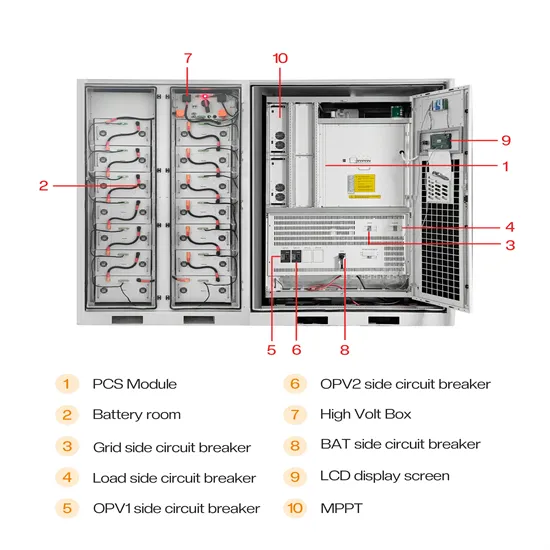

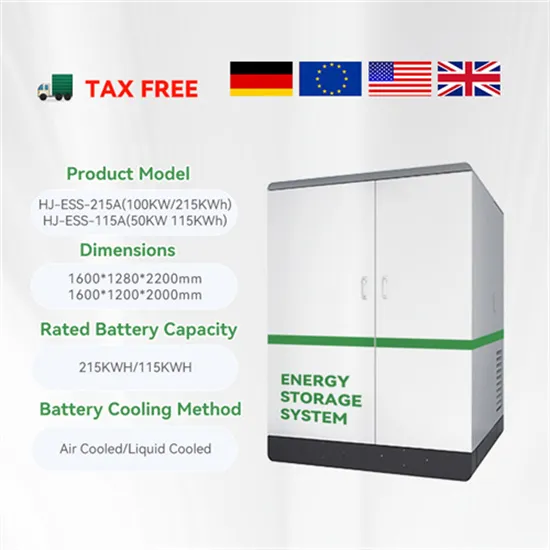

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

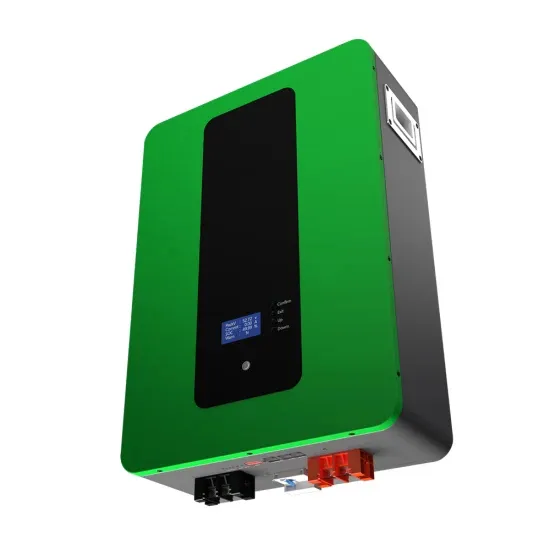

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.