ASEAN Caught Between China''s Export Surge and Global De

The U.S. crackdown on solar panel exports from Chinese companies in ASEAN is likely a harbinger of more to come. As developed economies work to reduce their reliance on Chinese

Get a quote

Trade court orders retroactive duties on solar panels imported

The 2023 decision extended tariffs to Southeast Asian exports of (1) silicon cells using Chinese wafers and (2) silicon solar panels using Chinese wafers that also use three

Get a quote

EU''s solar plans in SE Asia caught in US-China trade

US tariffs on Southeast Asian solar exports could further weaken solar panel producers in the European Union, but also help the EU''s green

Get a quote

What does it mean to have up to 3,521% US tariffs on solar imports?

The trade tensions on solar imports from Southeast Asia aren''t new. After the over-300% tariff on Chinese solar products reduced US solar imports from China to nearly zero, the

Get a quote

U.S. trade uncertainty presents domestic opportunities

Recent United States (U.S.) tariffs on Southeast Asian solar panels are likely to adversely impact most solar photovoltaic (PV) exports from

Get a quote

What next for Southeast Asia''s China-backed solar

In little over a decade, Southeast Asia has become one of the world''s top exporters of solar power equipment – a success driven significantly

Get a quote

Vietnam, Malaysia and two other Asean countries hit

HANOI: The US has officially imposed steep tariffs on solar energy products imported from four South-East Asian countries, including Vietnam,

Get a quote

US wants to slap tariffs as high as 3,500% on solar

US trade officials finalized steep tariff levels on most solar cells from Southeast Asia, a key step toward wrapping up a year-old trade case in

Get a quote

CEIC Article: US slaps solar-panel tariffs on ASEAN countries

Even before Donald Trump returns to office, the US is moving to impose more tariffs. The Biden Administration views the solar industry as a critical sector, and the Commerce Department just

Get a quote

The impact of green trade barriers on China''s

In the context of the global push towards a green economy, this research investigates the impact of green trade barriers on the export trade

Get a quote

In Cambodia''s solar panel industry, a little spark can go a long way

As a result, solar cell and module exports to the US from these four Association of Southeast Asian Nations members increased sharply, accounting for almost 80 per cent of the

Get a quote

Cambodia''s Solar Panel Exports: A Little Spark or a

For decades, Cambodia''s high economic growth has been fueled by strong garment exports, supported by tourism. However, a new trend in the

Get a quote

The Vulnerability of ASEAN''s Solar PV Trade – ACI Perspectives

The rising adoption of solar PV technology drives the global trade of relevant products. While China remains the dominant player, ASEAN has emerged as a major exporter

Get a quote

Exploring Australia''s Solar Energy Exports

Australia''s abundant solar resources position it as a renewable energy export leader. Through innovative methods like undersea cables and green hydrogen production,

Get a quote

U.S. trade uncertainty presents domestic opportunities for

Recent United States (U.S.) tariffs on Southeast Asian solar panels are likely to adversely impact most solar photovoltaic (PV) exports from Malaysia, Thailand, Vietnam, and

Get a quote

South-east Asia''s chip and solar exports to US plunge

Amid the slump in Asean, only Indonesia and Laos bucked the trend, recording increases in US demand for semiconductor and solar-related components from the region.

Get a quote

US finalizes tariffs on Southeast Asian solar imports

The petitioner group, the American Alliance for Solar Manufacturing Trade Committee, accused big Chinese solar panel makers with factories in Malaysia, Cambodia,

Get a quote

US crackdown on South-east Asia''s solar exports

Still, some experts see a silver lining – closer China-Asean ties and a glut of solar panel supply could ultimately lower costs for regional

Get a quote

South-east Asia''s chip and solar exports to US plunge

A longstanding concern of US solar manufacturers has been the excessively cheap solar imports from Chinese-owned manufacturers in South-east Asia that circumvented the US

Get a quote

The impact of green trade barriers on China''s photovoltaic

In the context of the global push towards a green economy, this research investigates the impact of green trade barriers on the export trade volume of Chinese

Get a quote

Vietnam, Malaysia and two other Asean countries hit with US

HANOI: The US has officially imposed steep tariffs on solar energy products imported from four South-East Asian countries, including Vietnam, Malaysia, Thailand and

Get a quote

"Block China''s Indirect Exports" – U.S. Imposes Up to 3,500

U.S. ITC Slaps Solar Tariffs on Four ASEAN Member States Local U.S. solar companies requested the tariffs Chinese firms reduce indirect exports and build production

Get a quote

Sinovoltaics Southeast Asia SEA Solar Energy Supply Chain Map

This edition of the Southeast Asia Solar Supply Chain Map provides a detailed snapshot of current realities and future ambitions, as the region navigates complex trade, investment, and

Get a quote

Cambodian solar panel exports face an unheard-of over 3,500

Solar products from Cambodia face unprecedented duties of more than 3,500 percent, said a release from the US Department of Commerce, on Monday.

Get a quote

US imposes over 3000% duties on South-east Asian solar imports

[SAN FRANCISCO] The US set new duties as high as 3,521 per cent on solar imports from four South-east Asian countries, delivering a win for domestic manufacturers

Get a quote

Cambodia''s Solar Panel Exports: A Little Spark or a Mighty Flame?

For decades, Cambodia''s high economic growth has been fueled by strong garment exports, supported by tourism. However, a new trend in the country''s exports has

Get a quote

US Tariffs, Europe Slowdown Reshape Global Solar Panels Trade

SINGAPORE (Reuters) -Solar panel makers in Laos and Indonesia, mostly owned by Chinese firms, boosted their share in the U.S. market after steep tariffs hit exports from

Get a quote

5 FAQs about [ASEAN solar panel exports]

Are solar panels imported or re-exported in Cambodia?

During the same period, the country’s solar panel imports rose rapidly and doubled to USD272 million but the volume was significantly lower than solar panel exports (Figure 1). This trade pattern suggests that a substantial portion of Cambodia’s solar panel exports may have been assembled domestically rather than imported and re-exported.

Which country exports the most solar panels in 2023?

Cambodia’s performance stood out. Its solar panel exports to the U.S. in 2023 accounted for over 90 percent of the country’s total solar panel exports. Remarkably, more than 90 percent of Cambodia’s solar panel imports came from China in both 2022 and 2023.

Why should ASEAN invest in solar energy?

Furthermore, ASEAN's solar energy targets are also enabled by strategic partnerships and foreign investments. Through collaborations with global players, the region aims to leverage both expertise and resources, fostering a conducive environment for solar energy development across borders.

Is Southeast Asia ready for solar energy?

Positioned near the equator, Southeast Asia’s solar irradiance levels was up 10 per cent in 2023, highlighting the region’s potential for solar energy advancement. Southeast Asia’s total solar and wind energy generation have surged from 4.2 terawatt-hours (TWh) in 2015 to over 50 TWh in 2022.

How much will US tariffs affect solar panel imports?

According to the US Department of Commerce, solar cell and panel imports will face varying countervailing duties — as high as 3,403.9 per cent for Cambodia, 799.5 per cent for Thailand, 542.6 per cent for Vietnam, and 168.8 per cent for Malaysia.

Guess what you want to know

-

Household flat solar panel custom manufacturers recommend

Household flat solar panel custom manufacturers recommend

-

550W small solar panel

550W small solar panel

-

Photovoltaic panels to solar panel equipment

Photovoltaic panels to solar panel equipment

-

Bifacial Solar Panel Company

Bifacial Solar Panel Company

-

Sudan solar panel photovoltaic panel factory

Sudan solar panel photovoltaic panel factory

-

Kiribati Solar Panel Group

Kiribati Solar Panel Group

-

Samoa solar panel assembly factory

Samoa solar panel assembly factory

-

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

-

UK New Energy Building Solar Panel Components Wholesale

UK New Energy Building Solar Panel Components Wholesale

-

Huawei solar photovoltaic panel professional

Huawei solar photovoltaic panel professional

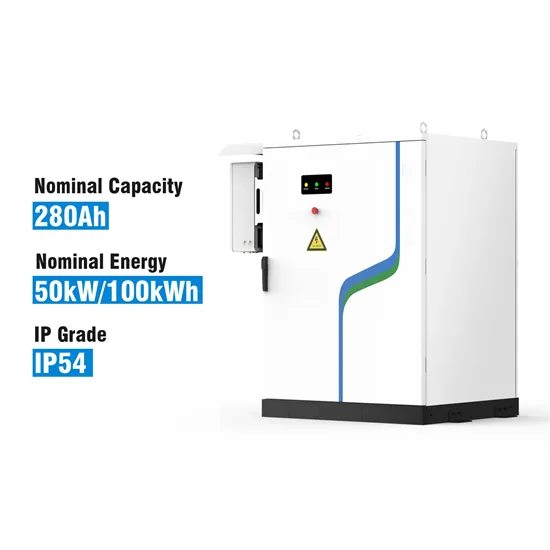

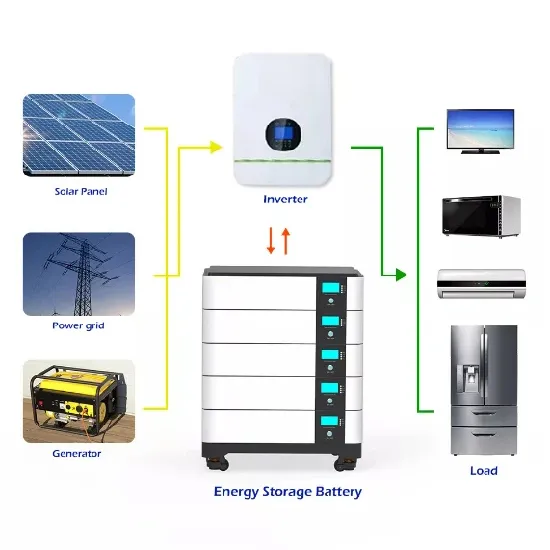

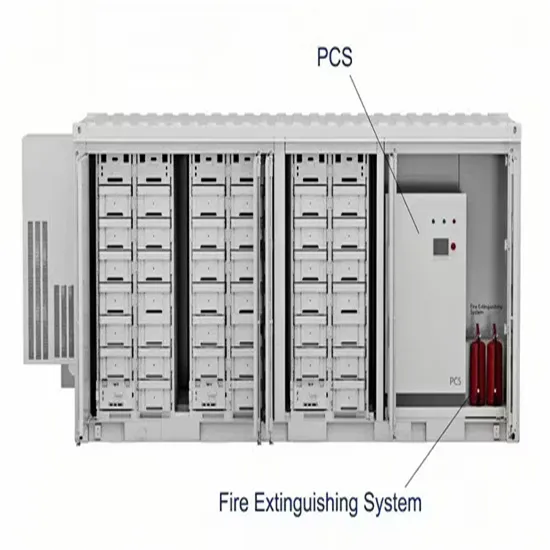

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.