Latest Residential Storage Pricing in Spain

So, what are the latest pricing trends for home energy storage systems in Spain? We''ve gathered exclusive quotes from local distributors to give you a quick reference.

Get a quote

Spain Lithium-ion Battery Market Size, Share, Trends and

IMARC''s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain lithium-ion

Get a quote

Spain Rechargeable Battery Market Size | Mordor

Over the medium term, the declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy

Get a quote

Real Cost Behind Grid-Scale Battery Storage: 2024

Recent industry analysis reveals that lithium-ion battery storage systems now average €300-400 per kilowatt-hour installed, with projections

Get a quote

Energy storage regulation in Spain | CMS Expert Guides

Currently, lithium-ion battery technology is an area of focus in Spain. In fact, Red Eléctrica de España, the system operator, is currently running a project (Project Almacena),

Get a quote

National Blueprint for Lithium Batteries 2021-2030

Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid storage, critical to

Get a quote

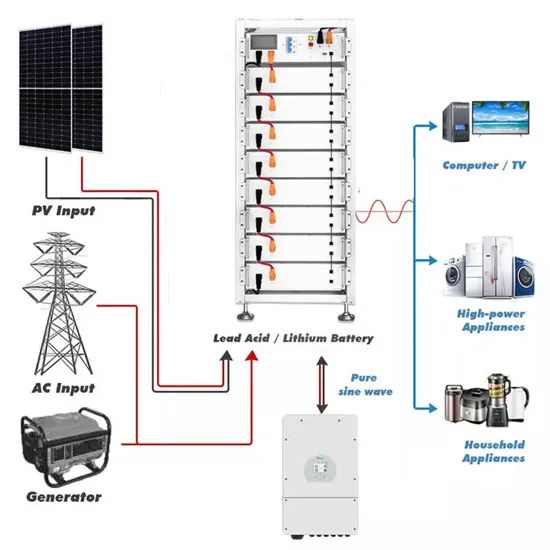

Dyness 14.33 kWh Lithium Battery (LV) Power Brick

Shop Dyness 14.33 kWh Lithium Battery (LV Power Brick) – a high-capacity solar energy storage solution with long cycle life, LiFePO4 safety, modular design, and seamless inverter compatibility.

Get a quote

Prices of Lithium Battery Packs and Cells: Updated Data

The decline in prices is attributed to several factors, including excess battery cell production capacity, economies of scale, low metal and

Get a quote

Lithium Prices – Historical Graph [Realtime Updates]

The extraction of lithium involves mining or extracting lithium-containing ores and processing them to obtain lithium compounds suitable for various industrial

Get a quote

SPAIN

The market for utility-scale storage projects remains comparatively small at around 100MW, though a pipeline of projects is beginning to emerge.2,3,4,5 Much of Spain''s existing utility

Get a quote

Lithium-Ion battery prices drop to USD 115 per kWh in

The global average price of lithium-ion battery packs has fallen by 20% year-on-year to USD 115 (EUR 109) per kWh in 2024, marking the

Get a quote

Spain Lithium Market Report

This report highlights the key trends and factors influencing the lithium industry in Spain, focusing on its applications in renewable energy and electric vehicles (EVs), alongside the regulatory

Get a quote

Backup power for Europe

Currently, Spain has 6.3GW of hydroelectric and 1GW of thermal storage capacity installed. In fact, the non-BESS storage capacity in Spain is higher than in any other European

Get a quote

Spain Rechargeable Battery Market Size | Mordor Intelligence

Over the medium term, the declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector aided by government initiatives

Get a quote

BESS in Spain: the situation of the energy storage market

By observing the widespread adoption of these systems in other leading renewable energy countries, such as Germany and the United States, we can identify a number of key

Get a quote

Real Cost Behind Grid-Scale Battery Storage: 2024 European

Recent industry analysis reveals that lithium-ion battery storage systems now average €300-400 per kilowatt-hour installed, with projections indicating a further 40% cost

Get a quote

Energy Storage Costs: Trends and Projections

As the global community increasingly transitions toward renewable energy sources, understanding the dynamics of energy storage costs has become imperative. This

Get a quote

BESS in Spain: the situation of the energy storage

By observing the widespread adoption of these systems in other leading renewable energy countries, such as Germany and the United States,

Get a quote

Top 8 Lithium Ion Battery Suppliers in Spain 2025

Among the many battery manufacturers, how can you make a smart choice? This article has put together a list of lithium battery suppliers in Spain for you. It will help you save

Get a quote

Iberia: Why are there no batteries in Spain?

Spain''s battery energy storage market is at a critical point. Despite being a leader in renewable energy deployment in Europe, the country has only 18 MW of standalone batteries installed,

Get a quote

Spain''s Cegasa unveils its first utility-scale battery

Spanish energy storage manufacturer Cegasa will participate in the Smarter E 2025 trade show, from May 7 to May 9 in Munich, Germany, and display its products at stand

Get a quote

port of spain lithium energy storage power wholesale price list

The Erasmo Solar PV park – Battery Energy Storage System is a 80,000kW lithium-ion battery energy storage project located in Saceruela, Castile-La Mancha, Spain.

Get a quote

port of spain lithium energy storage power production company

Rising Lithium Costs Threaten Grid-Scale Energy Storage Lithium-ion Battery Storage. Until recently, battery storage of grid-scale renewable energy using lithium-ion batteries was cost

Get a quote

Roman lithium energy storage power supply price

Why have Lithium prices stabilized in 2024? As of 2024, lithium prices have stabilized from their major plunge of 2022-2023. The current price is attributed to several factors: Increased

Get a quote

6 FAQs about [Current price of lithium energy storage power in Spain]

Why do we need battery energy storage systems in Spain?

Due to the large capacity of installed hydroelectric and thermal storage systems and the resilience of the Spanish power grid, the need for Battery Energy Storage Systems (BESS) in Spain has been relatively low. The lack of a clear regulatory framework for BESS has also hindered its development in Spain so far.

How much energy storage capacity does Spain have?

When it comes to installed energy storage capacity in general, Spain is one of the leading countries within Europe (see figure 2). Currently, Spain has 6.3GW of hydroelectric and 1GW of thermal storage capacity installed. In fact, the non-BESS storage capacity in Spain is higher than in any other European country.

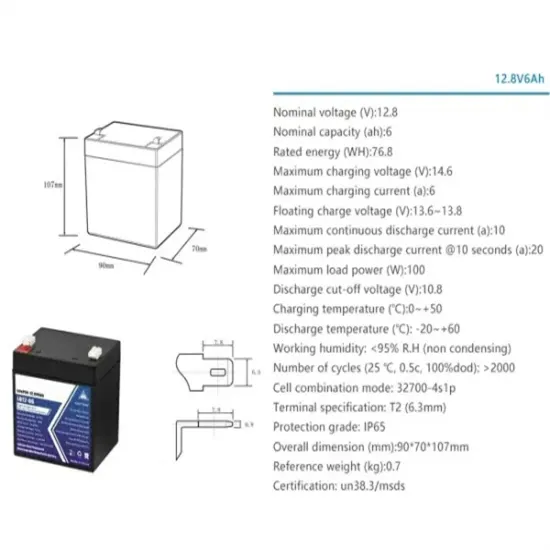

How much does a lithium-ion battery storage system cost?

Recent industry analysis reveals that lithium-ion battery storage systems now average €300-400 per kilowatt-hour installed, with projections indicating a further 40% cost reduction by 2030. For utility operators and project developers, these economics reshape the fundamental calculations of grid stabilization and peak demand management.

How does Spain support the development of energy storage?

To support this growth, Spain has implemented several policies and regulations that encourage the development of energy storage. The Energy Storage Strategy 2030, promoted by the Ministry for the Ecological Transition and the Demographic Challenge, is one of the key initiatives. This strategy aims to achieve a storage capacity of 20 GW by 2030.

How much does a lithium ion battery cost?

In the European market, lithium-ion batteries currently range from €200 to €300 per kilowatt-hour (kWh), with prices continuing to decrease as manufacturing scales up and technology improves. Power conversion systems, including inverters and transformers, represent approximately 15-20% of the total investment.

How does Spain's pumped hydro energy storage compete with Bess?

Spain's pumped hydro energy storage competes directly against BESS, limiting the battery storage opportunity in wholesale markets. 3. Missing ancillary markets Unlike Great Britain or Texas, Spain never created ancillary service markets that net-zero systems need:

Guess what you want to know

-

How much is the price of lithium energy storage power supply in Brunei

How much is the price of lithium energy storage power supply in Brunei

-

Guyana lithium energy storage power supply price

Guyana lithium energy storage power supply price

-

Madagascar lithium energy storage power supply sales price

Madagascar lithium energy storage power supply sales price

-

How much is the price of lithium energy storage power in Micronesia

How much is the price of lithium energy storage power in Micronesia

-

Current price of photovoltaic energy storage power in Moldova

Current price of photovoltaic energy storage power in Moldova

-

What is the current price of energy storage power in Lesotho

What is the current price of energy storage power in Lesotho

-

Mauritania lithium energy storage power supply price

Mauritania lithium energy storage power supply price

-

East Africa Multifunctional Energy Storage Power Supply Price

East Africa Multifunctional Energy Storage Power Supply Price

-

Timor-Leste energy storage container power station price

Timor-Leste energy storage container power station price

-

Price of lithium battery energy storage cabinets in the Central African Republic

Price of lithium battery energy storage cabinets in the Central African Republic

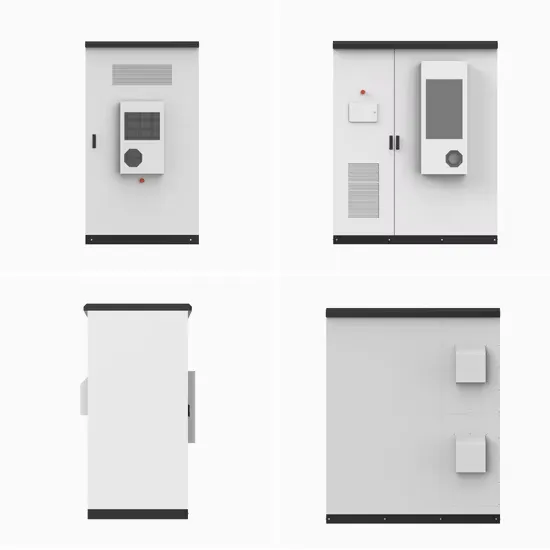

Industrial & Commercial Energy Storage Market Growth

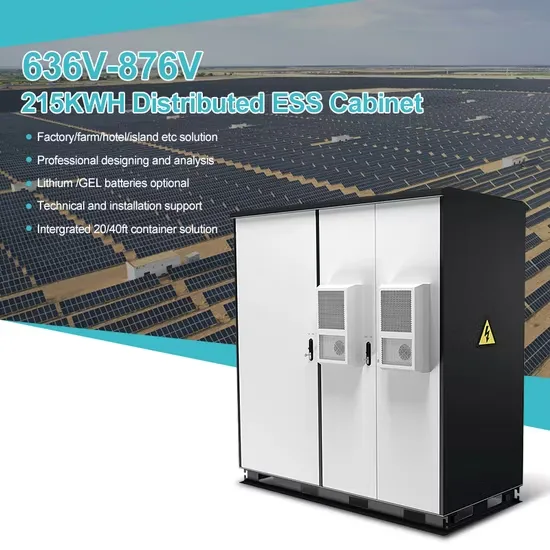

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.