IFC and IndiGrid Partner to Build India''s Largest Utility-Scale Energy

This investment made during the quarter ended June 30, 2025, builds on an existing collaboration between IFC and IndiGrid and reflects our shared vision of catalyzing

Get a quote

IFC and IndiGrid Partner to Build India''s Largest Utility

This investment made during the quarter ended June 30, 2025, builds on an existing collaboration between IFC and IndiGrid and reflects our

Get a quote

Navigating Policy & Regulation in Energy Storage

With a global perspective and a focus on large-scale energy storage solutions, Trina Storage is proud to play a pivotal role in driving the transition to a cleaner, more resilient

Get a quote

Powering India''s Clean Energy Transition with Solar

Innovative financing models: We explore blended financing options, such as viability gap funding and long-term PPAs with storage

Get a quote

Top 5: Battery Energy Storage Projects Commissioned in India

Here is a list of the top five notable commissioned battery energy storage projects in India, leading the way in supporting the nation''s renewable energy expansion.

Get a quote

Record renewable energy investment in 2025: Three things to know

2 days ago· Germany was the largest market for wind investments after China, and also has a strong solar portfolio building. India''s renewable energy investments reached $11.8 billion in

Get a quote

Energy transition investment trends in India

Renewable energy is advancing through wind, solar, and hydropower projects, driven by greenfield generation and integrated energy-storage solutions. A robust solar and battery

Get a quote

India''s battery storage to reach 66 GW by 2032, ₹5

New Delhi: India''s battery energy storage system (BESS) market is projected to expand to 66 GW by 2032 from less than 0.2 GW currently,

Get a quote

Invest in Energy Storage Sector in India | IIG

Invest in Energy Storage: IIG showcases 111 investment projects in Energy Storage sector in India worth USD 35.13 bn across all the states. Explore top projects & invest in Energy

Get a quote

Investment Surge: India Needs $50 Billion for Energy Storage by

India Energy Storage: $50B investment needed by 2032 to meet clean energy goals, save $7B annually in power costs, says IECC report.

Get a quote

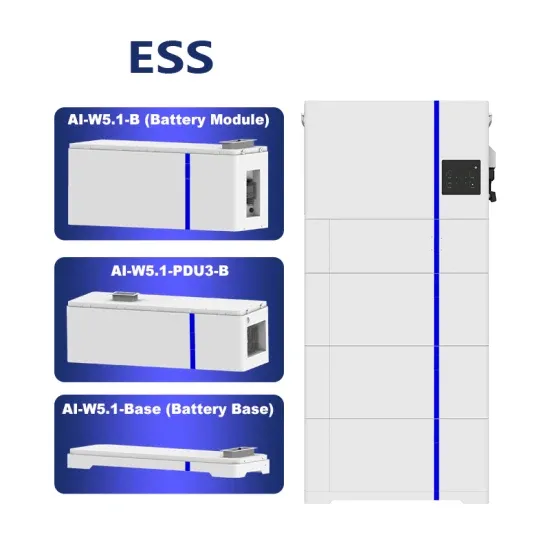

Battery Energy Storage Systems

Energy storage systems (ESS) play a crucial role in smoothening out this intermittency and enabling a continuous supply of energy when needed. Thus, for sustainable renewable energy

Get a quote

India''s Energy Storage to Grow 5X by 2032, Driven by ₹4.79

India is rapidly emerging as a global hub for energy storage, driven by strong government support and a vision to achieve climate resilience and grid stability.

Get a quote

Strategic Pathways for Energy Storage in India through 2032

As India''s grid attains higher penetrations of renewables, balancing generation variability through a spectrum of flexible resources, particularly energy storage, becomes increasingly important

Get a quote

Gap Analysis for Deployment of Grid-Scale Storage

The Government of India 2018 announced the creation of the National Energy Storage Mission to facilitate large-scale integrated electric storage and to set up a national

Get a quote

Press Release:Press Information Bureau

The unveiling of the Advanced Grid-Scale Energy Storage Technologies study represents a significant stride in India''s commitment to fostering innovative and sustainable

Get a quote

India requires $50 billion new investment in Energy storage

India will need 61 GW of energy storage by 2030 and 97 GW by 2032 to support clean energy capacity, a massive leap from today''s 6 GW (mostly pumped hydro). Due to

Get a quote

Energy storage sector to attract Rs. 4,79,000 crore (US$ 56.07

India''s energy storage sector is set to attract US$ 56.07 billion in investments by 2032, with a five-fold growth expected between 2026 and 2032, driven by rising demand for

Get a quote

IndiGrid, BII, Norfund form EnerGrid to invest $300

New Delhi: IndiGrid, India''s first and largest listed power sector infrastructure investment trust (InvIT) announced a partnership with British

Get a quote

Schneider plans next phase of India investments, eyes energy storage

Electrical equipment maker Schneider Electric is working on the next phase of investments in India and would soon roll out its capital expenditure (capex) plans, a top

Get a quote

India set for 12-fold increase in energy storage capacity to 60

India''s energy storage capacity is set to grow 12-fold to 60 GW by FY32, driven by rising renewable energy integration, addressing grid stability concerns as VRE generation triples.

Get a quote

India Energy Storage Sector: India to boost energy

New Delhi: India''s energy storage sector is set to grow by over 12 times to 60 GW by FY32, driven by a massive increase in variable renewable

Get a quote

Top 5: Battery Energy Storage Projects

Here is a list of the top five notable commissioned battery energy storage projects in India, leading the way in supporting the nation''s renewable

Get a quote

Energy storage sector to attract Rs. 4,79,000 crore (US$ 56.07

India''s energy storage sector is poised to attract an investment of Rs. 4,79,000 crore (US$ 56.07 billion) by 2032, as per the India Energy Storage Alliance (IESA). The sector

Get a quote

India Energy Storage Week 2025: Rs 8000 Cr

India Energy Storage Week 2025 in New Delhi aims to attract over Rs 8,000 crore in investments for energy storage, EVs, and green hydrogen.

Get a quote

India Energy Storage Sector: India to boost energy storage 12

New Delhi: India''s energy storage sector is set to grow by over 12 times to 60 GW by FY32, driven by a massive increase in variable renewable energy (VRE) and the need to

Get a quote

India set to attract over ₹8,000 crore investment in

New Delhi: India is poised to attract investments exceeding ₹8,000 crore in the fields of energy storage, electric vehicles (EVs), and green

Get a quote

6 FAQs about [New Energy Storage Investments in India]

How will India's energy storage sector grow by fy32?

New Delhi: India’s energy storage sector is set to grow by over 12 times to 60 GW by FY32, driven by a massive increase in variable renewable energy (VRE) and the need to maintain grid stability, according to an SBICAPS report.

Will India's energy storage sector grow by 2032?

India’s energy storage sector is set to attract US$ 56.07 billion in investments by 2032, with a five-fold growth expected between 2026 and 2032, driven by rising demand for sustainable energy solutions.

How big is India's energy storage sector?

India’s energy storage sector is poised to attract an investment of Rs. 4,79,000 crore (US$ 56.07 billion) by 2032, as per the India Energy Storage Alliance (IESA). The sector is projected to grow five-fold between 2026 and 2032, driven by the country’s increasing need for energy storage solutions.

How much does energy storage cost in India?

The state currently has over 30 GW of renewable energy capacity, which is set to drive demand for energy storage solutions. The cost of energy storage systems has decreased significantly over the last few years, from Rs. 10 lakh (US$ 11,712.69) per megawatt per month to Rs. 2.5 lakh (US$ 2,928.17) per megawatt.

Is India a leader in energy storage innovation?

The Stationary Energy Storage India (SESI) 2025 conference brought together 200+ global leaders, signaling robust policy, investment, and innovation momentum. With national and international collaboration, India is positioning itself not only as a leader in renewable energy deployment but also as a major force in energy storage innovation.

Are battery energy storage systems the future of energy in India?

Harsh Shah, Managing Director, IndiGrid, said, “Battery Energy Storage Systems are central to the future of energy in India. They bridge the intermittency of renewables, reduce fossil fuel dependency, and unlock flexible, reliable power delivery.

Guess what you want to know

-

India s electric new energy storage

India s electric new energy storage

-

Andorra New Energy Storage Planning Company

Andorra New Energy Storage Planning Company

-

Bhutan s latest policy on new energy storage

Bhutan s latest policy on new energy storage

-

New budget proposals for four energy storage projects

New budget proposals for four energy storage projects

-

New Energy Container Energy Storage Base Station

New Energy Container Energy Storage Base Station

-

Uruguay s new energy storage solution

Uruguay s new energy storage solution

-

Price of new energy storage power generation cabinet

Price of new energy storage power generation cabinet

-

Huawei Estonia New Energy Storage Project

Huawei Estonia New Energy Storage Project

-

French new energy storage vehicle

French new energy storage vehicle

-

New Zealand Mobile Energy Storage Project

New Zealand Mobile Energy Storage Project

Industrial & Commercial Energy Storage Market Growth

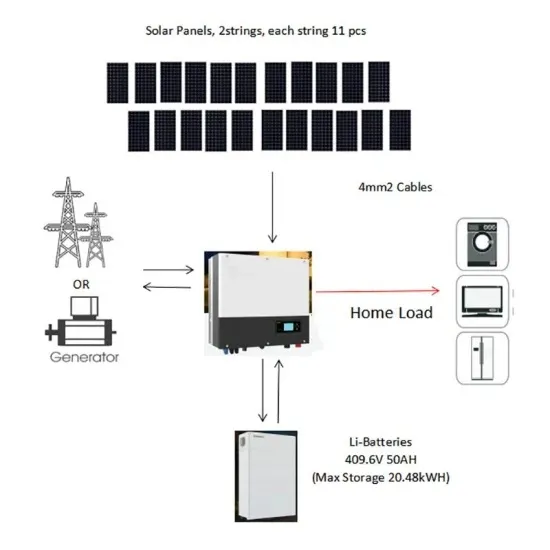

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

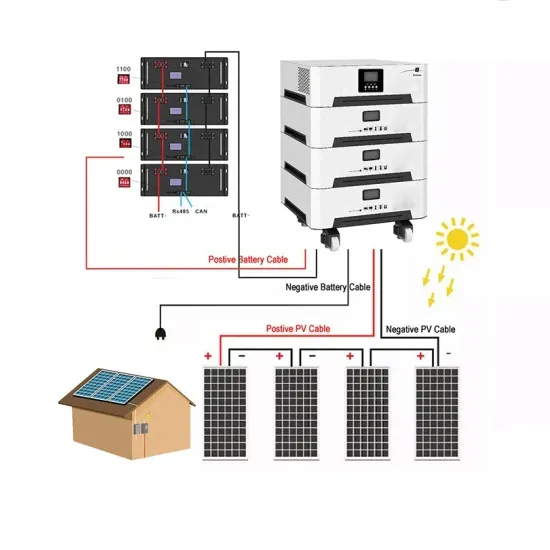

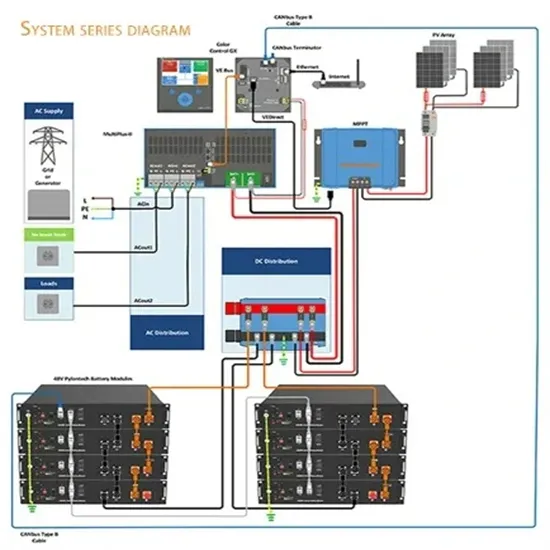

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.