Future Trends Shaping Industrial and Commercial Energy Storage

The Industrial and Commercial (IC) Energy Storage System market is experiencing robust growth, driven by the increasing demand for reliable power, grid stability enhancements, and the rising

Get a quote

Thermal Energy Storage 2024-2034: Technologies,

Thermal Energy Storage 2024-2034: Technologies, Players, Markets, and Forecasts Analysis of thermal energy storage (TES) for decarbonization of

Get a quote

Algeria''s Strategic Energy Vision: A Roadmap for Modernization

Algeria is progressing with its strategy to diversify its energy sector, with a focus on a balanced mix of renewable energy, green hydrogen and traditional oil and gas development.

Get a quote

Algeria''s energy outlook appears dimmer in 2024

Export volumes are stagnating as prices fall from 2022 peaks. Opportunities in Algeria''s private sector remain limited due to its tight size and underwhelming investment inflows.

Get a quote

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Meeting the national renewable energy targets requires scaling up and systematic integration of variable renewable energy (VRE) systems into the power grid, which in turn necessitates

Get a quote

European Market Outlook for Battery Storage 2025-2029

European Market Outlook for Battery Storage 2025-2029 7 May 2025 The report explores trends and forecasts across residential, commercial & industrial (C&I), and utility

Get a quote

Algeria Power Market Analysis

Companies involved in power generation, transmission, and distribution can leverage advancements in areas such as smart grids, energy storage, and renewable energy

Get a quote

Commercial and Industrial Energy Storage Systems Market

Commercial and Industrial Energy Storage Systems Market Segmentation & Forecast The report dissects the Global Commercial and Industrial Energy Storage Systems Market into various

Get a quote

Algeria''s Energy Dilemma and Sustainability | ISPI

Despite its vast fossil fuel reserves, Algeria faces a significant challenge due to rapidly increasing domestic energy demand and a lack of

Get a quote

Algeria''s Energy Dilemma and Sustainability | ISPI

Despite its vast fossil fuel reserves, Algeria faces a significant challenge due to rapidly increasing domestic energy demand and a lack of economic diversification, which

Get a quote

Algeria | Critical Minerals and The Energy Transition

Explore Algeria''s role in the global energy transition, focusing on its critical minerals like rare earths, phosphate, and natural gas, alongside its renewable energy strategies and

Get a quote

Algeria''s energy outlook appears dimmer in 2024

Export volumes are stagnating as prices fall from 2022 peaks. Opportunities in Algeria''s private sector remain limited due to its tight size and

Get a quote

Algeria Energy Storage Market (2025-2031) | Size & Revenue

The future outlook for the Algeria Energy Storage Market appears promising, with a growing focus on renewable energy integration and grid stability driving the demand for energy storage

Get a quote

Global energy storage market: review and outlook

The global energy storage market added 175.4 GWh of installed capacity in 2024, with the three major regional markets—China, the Americas, and Europe—continuing to

Get a quote

Commercial Battery Storage | Electricity | 2023 | ATB | NREL

Future Projections: Future projections are based on the same literature review data that inform Cole and Frazier (Cole and Frazier, 2020), who generally used the median of published cost

Get a quote

Energy sector in Algeria

The energy sector represents a major industrial activity and economic contributor in Algeria. The country is the leading primary energy producer in Africa, with an annual

Get a quote

Algeria Energy Storage Market 2024-2030

Energy storage technologies are essential for integrating intermittent renewable energy sources, stabilizing the grid, balancing energy supply and demand, and enhancing

Get a quote

Navigating the Challenges of Energy Storage Systems

Explore the key trends, market drivers, regulatory challenges, and innovative solutions shaping the global energy storage systems (ESS) industry.

Get a quote

Algeria Commercial and Industrial Energy Market (2025-2031)

Market Forecast By Energy Type (Electricity, Natural Gas, Bioenergy, Hydrogen), By Source (Solar, Wind, Hydroelectric, Geothermal), By Application (Industrial Plants, Commercial

Get a quote

5 Energy Projects to Watch in Algeria in 2025

Both projects are expected to start operations in 2025 and are expected to enhance Algeria''s power generation infrastructure while supporting energy security and fuelling the

Get a quote

Commercial Battery Storage | Electricity | 2021 | ATB

The 2021 ATB represents cost and performance for battery storage across a range of durations (1–8 hours). It represents lithium-ion batteries only at this

Get a quote

Energy Storage Systems Market Size, 2025-2034

The energy storage systems market size exceeded USD 668.7 billion in 2024 and is expected to grow at a CAGR of 21.7% from 2025 to 2034, driven by the

Get a quote

Algeria''s Strategic Energy Vision: A Roadmap for

Algeria is progressing with its strategy to diversify its energy sector, with a focus on a balanced mix of renewable energy, green hydrogen

Get a quote

REPORT: Energy Storage''s Meteoric Rise Breaks

The American Clean Power Association (ACP) is the leading voice of today''s multi-tech clean energy industry, representing energy storage, wind,

Get a quote

Industrial and Commercial Energy Storage Systems Solutions

Despite these challenges, the long-term outlook for the IC energy storage systems solutions market remains positive, driven by supportive government policies, technological innovations,

Get a quote

Powering Ahead: 2024 Projections for Growth in the

Since 2022, China has emerged as the global leader in the energy storage market. Currently, there is a noticeable surge in demand for both

Get a quote

China Commercial and Industrial Energy Storage Outlook 2025

Report Summary: Wood Mackenzie''s ''China commercial and industrial energy storage outlook'' is a 30+ page report containing charts, tables and graphs providing an in

Get a quote

6 FAQs about [Algeria s Industrial and Commercial Energy Storage Outlook]

How is Algeria diversifying its energy sector?

Algeria is progressing with its strategy to diversify its energy sector, with a focus on a balanced mix of renewable energy, green hydrogen and traditional oil and gas development.

What is the energy sector in Algeria?

The energy sector represents a major industrial activity and economic contributor in Algeria. The country is the leading primary energy producer in Africa, with an annual generation of close to seven quadrillion British thermal units.

Why does Algeria produce so much energy?

The large energy production is due to the abundance of natural resources such as oil and natural gas, which are the main energy sources used in the country. In fact, despite Algeria’s ambitious renewable energy plans, clean energy sources remain largely untapped as of 2022.

Is Algeria a key supplier of gas to the global market?

A renewed focus on unconventional gas reserves – reflected through recent MoUs signed with energy majors ExxonMobil and Chevron – are set to tap into underexplored basins, while positioning Algeria as a critical supplier of gas to the global market.

How many MW does Algeria's new power plant generate?

Both plants, being developed by Algeria’s state-owned Sonelgaz, will each generate 1,340 MW. Both projects are expected to start operations in 2025 and are expected to enhance Algeria’s power generation infrastructure while supporting energy security and fuelling the country’s economic growth.

How much is Algeria investing in oil & gas?

In fact, the Algerian government is investing $50 billion in oil and gas projects through 2027, targeting increased production from flagship assets as well as bringing new output online.

Guess what you want to know

-

Algeria Industrial and Commercial Energy Storage Inverter

Algeria Industrial and Commercial Energy Storage Inverter

-

Power distribution cabinet in industrial and commercial energy storage

Power distribution cabinet in industrial and commercial energy storage

-

Energy Storage Container Mobile Industrial and Commercial

Energy Storage Container Mobile Industrial and Commercial

-

European Industrial and Commercial Energy Storage Cabinet Factory Price Inquiry

European Industrial and Commercial Energy Storage Cabinet Factory Price Inquiry

-

Azerbaijan s industrial and commercial energy storage prices

Azerbaijan s industrial and commercial energy storage prices

-

Industrial and Commercial Energy Storage Solutions

Industrial and Commercial Energy Storage Solutions

-

Ivory Coast Industrial and Commercial Energy Storage Cabinet Manufacturer

Ivory Coast Industrial and Commercial Energy Storage Cabinet Manufacturer

-

Congolese industrial and commercial energy storage cabinet customization

Congolese industrial and commercial energy storage cabinet customization

-

Kenya Industrial and Commercial Energy Storage Cabinet Supplier

Kenya Industrial and Commercial Energy Storage Cabinet Supplier

-

Requirements for high-voltage side access to the grid for industrial and commercial energy storage

Requirements for high-voltage side access to the grid for industrial and commercial energy storage

Industrial & Commercial Energy Storage Market Growth

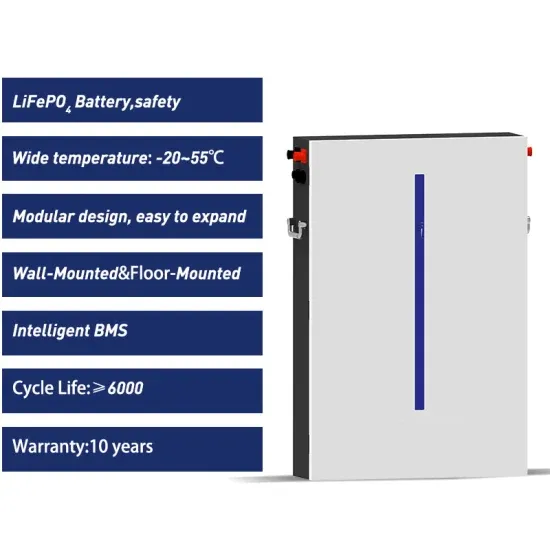

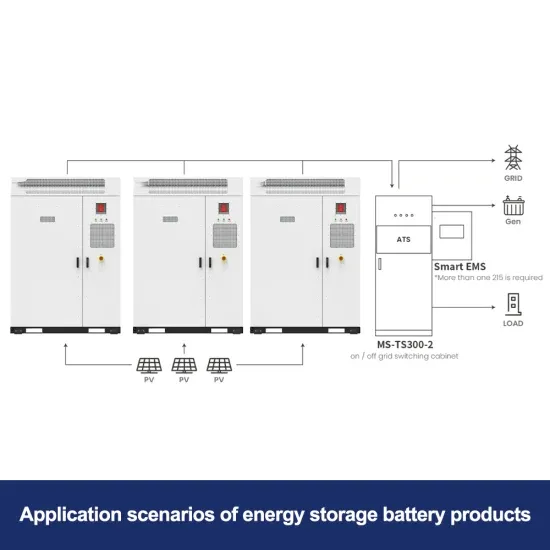

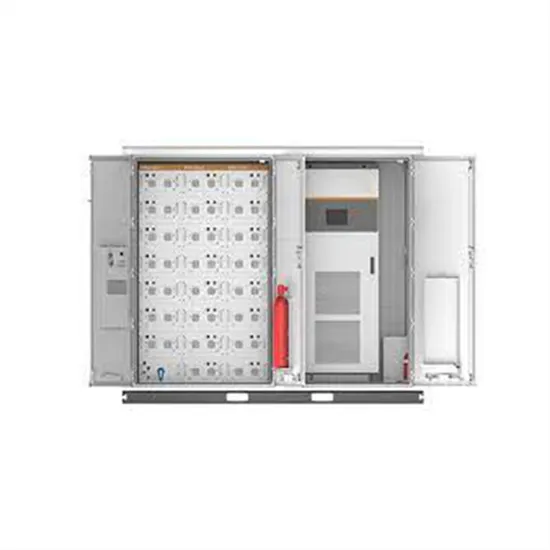

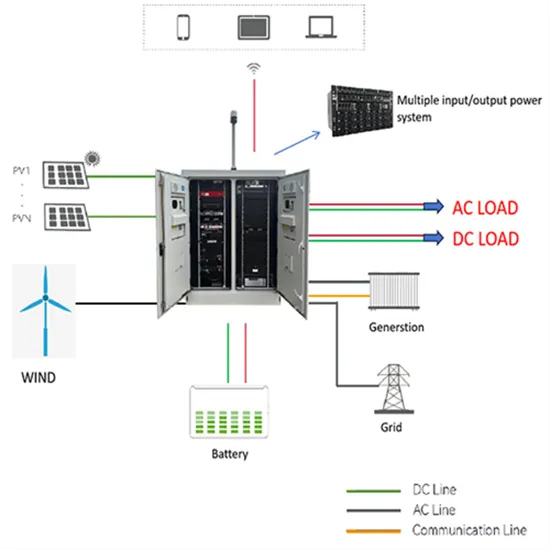

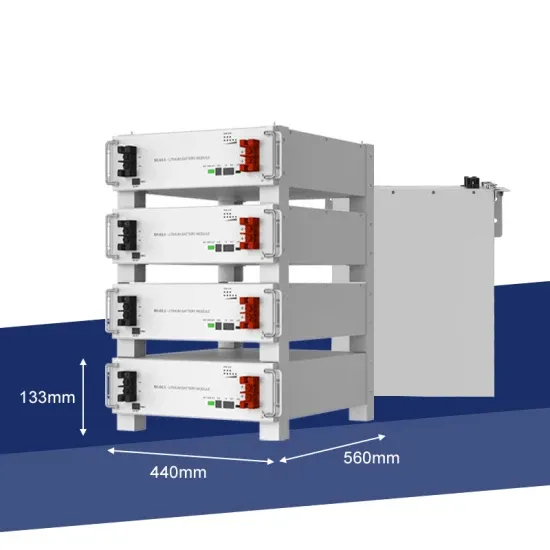

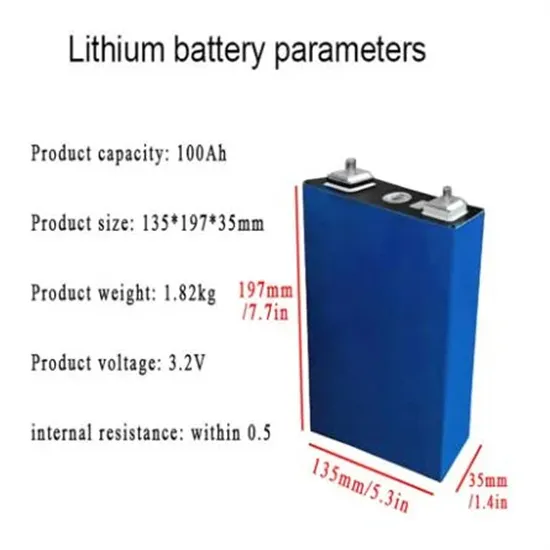

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.