Top 10 Energy Storage Investors (2025) | Industry Guide

Complete guide to Energy Storage investors and VCs. 285 investments, 20 successful exits, 7.0% success rate. Connect with leading energy storage investors.

Get a quote

How about investing in energy storage power supply

Investing in energy storage power supply offers numerous benefits that highlight its significance in the contemporary energy landscape. 1. Energy storage systems enhance grid

Get a quote

Barclays 39th Annual Energy-Power Conference

Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the "safe harbor" provisions of the Private

Get a quote

List of Energy Investors & VC Firms for Startups (2025)

Find active energy investors and VC firms funding startups. Raise capital for seed, pre-seed, and growth-stage investments in renewable energy

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium and battery technology.

Get a quote

Energy Storage Investments – Publications

Estimates indicate that global energy storage installations rose over 75% (measured by MWhs) year over year in 2024 and are expected to go beyond the terawatt-hour

Get a quote

Top Energy Storage Stocks 2025: Pure-Play Watchlist

5 days ago· In this report, we highlight the top energy storage stocks to watch, curated for exposure to breakthroughs in advanced li-ion, flow & zinc, solid-state, and green hydrogen

Get a quote

Energy Storage Market Report 2025 | StartUs Insights

The Energy Storage Market Report 2025 highlights key trends, workforce developments, investment flows, and other factors shaping the

Get a quote

Top Battery Storage Companies to Watch in 2025

This has led to substantial investment and development in alternative chemistries and mechanical systems, such as iron-air batteries (Form Energy), gravity-based storage

Get a quote

Clean Power Research & Reports | ACP

This comprehensive report offers expert analysis on the U.S. energy storage space, including the grid-scale, residential, and CCI sectors, as well as system prices, policy changes, and supply

Get a quote

Energy Transition Investment Trends 2025

This report is BNEF''s annual review of investment in the energy transition. This includes ''energy transition investment'' (spending to deploy clean technologies), as well as investment in the

Get a quote

Top 10 Energy Storage Investors in UK | PF Nexus

Energy storage is crucial to the UK''s renewable energy goals as it moves towards a low-carbon economy. Scalable storage options are needed to balance supply and demand as the

Get a quote

The 13 Best Energy Storage Stocks To Buy For

Read on to learn about some of the top energy storage stocks on the market and why you should consider investing in them. As the world shifts

Get a quote

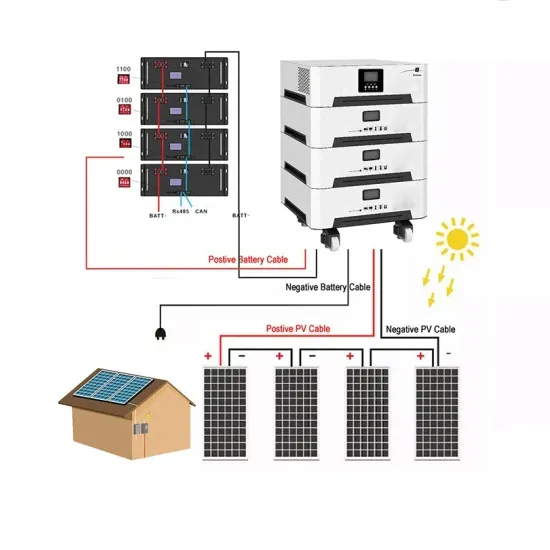

Solar x project: | C&I Energy Storage System

Solar Energy Storage Towers: Powering the Future with Sunlight and Smarts Let''s face it – solar power used to be that "cool kid" who only showed up when the sun was out. But with solar

Get a quote

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium

Get a quote

The 13 Best Energy Storage Stocks To Buy For September 2025

Read on to learn about some of the top energy storage stocks on the market and why you should consider investing in them. As the world shifts towards renewable energy,

Get a quote

Canadian Solar''s CSI Energy Storage secures 487 MWh battery supply

It is a leading manufacturer of solar photovoltaic modules, provider of solar energy and battery storage solutions, and developer of utility-scale solar power and battery storage

Get a quote

Top 19 Energy Storage Investors in the US

With federal incentives and increasing investments, the sector is poised for growth, targeting not only commercial applications but also residential energy savings, making clean energy more

Get a quote

Energy progress anticipated if investors remain enticed

3 hours ago· As Southeast Asia navigates its energy transition, the trio of offshore wind, battery storage, and green hydrogen emerges as game-changers.

Get a quote

China''s role in scaling up energy storage investments

The large-scale development of energy storage technologies will address China''s flexibility challenge in the power grid, enabling the high penetration of renewable sources. This

Get a quote

Who are the investors of energy storage projects? | NenPower

Who are the investors of energy storage projects? Investors of energy storage projects can be categorized into distinct groups: 1. Institutional investors, 2. Private equity

Get a quote

6 FAQs about [Energy storage power supply investors]

What are energy storage stocks?

Energy storage stocks are companies that produce or develop energy storage technologies, such as batteries, capacitors, and flywheels. These technologies can store energy from renewable sources like solar and wind power, or from traditional sources like coal and natural gas.

Are energy storage stocks a good investment?

Currently, energy storage stocks are a relatively safe investment to make for the future, and if trends hold, they have solid potential for growth. However, if this doesn’t appear to be a good fit for your investment portfolio, then it’s best to look at other options.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

Is Bloom Energy a good energy storage stock?

Bloom Energy is one of the smaller picks on this list, but it may be the most dynamic energy storage stock out there. It specializes in advanced fuel cell energy platforms, which use a proprietary solid oxide technology to convert natural gas, biogas or hydrogen into electricity with low or even zero carbon emissions.

Could a solid-state energy storage stock reset the value chain?

Among energy storage stocks, solid-state is the moonshot sleeve: binary outcomes, but a single winner could reset the entire value chain across electric markets. HQ: USA; Lithium-metal solid-state batteries using ceramic separators.

Is Enphase Energy a good stock to buy?

When you combine it with its growth prospects, it appears to be a good company to buy amid the present stock market downturn. Enphase Energy is a leading provider of solar energy storage systems for homes and businesses and is also considered one of the top renewable energy stocks.

Guess what you want to know

-

UAE Photovoltaic Energy Storage Power Supply Manufacturing Plant

UAE Photovoltaic Energy Storage Power Supply Manufacturing Plant

-

Which energy storage power supply company is the best in North Asia

Which energy storage power supply company is the best in North Asia

-

Papua New Guinea portable energy storage power supply price

Papua New Guinea portable energy storage power supply price

-

Sudan Huijue Energy Storage Power Supply Purchase

Sudan Huijue Energy Storage Power Supply Purchase

-

Ecuador mobile energy storage power supply price

Ecuador mobile energy storage power supply price

-

Household Energy Storage Emergency Power Supply

Household Energy Storage Emergency Power Supply

-

Zambia Mobile Energy Storage Power Supply

Zambia Mobile Energy Storage Power Supply

-

Energy storage power supply charging time

Energy storage power supply charging time

-

Danish customized mobile energy storage power supply

Danish customized mobile energy storage power supply

-

Turkmenistan outdoor energy storage power supply distributor

Turkmenistan outdoor energy storage power supply distributor

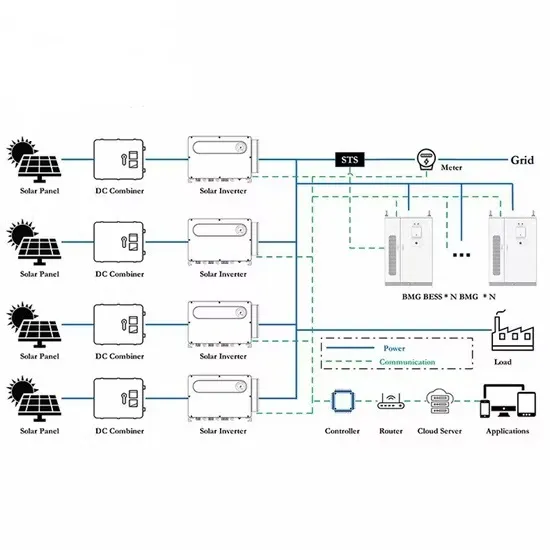

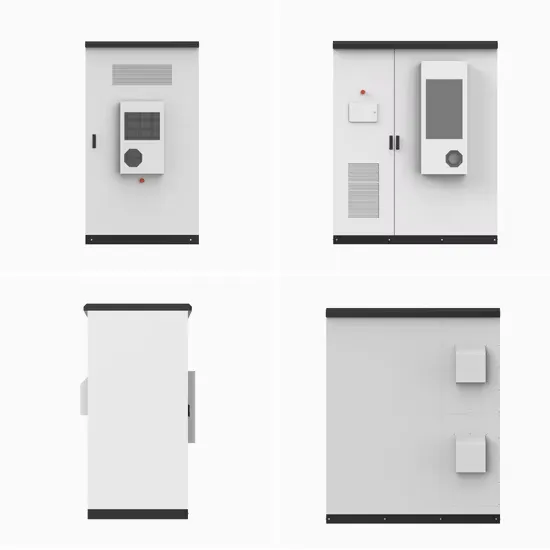

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

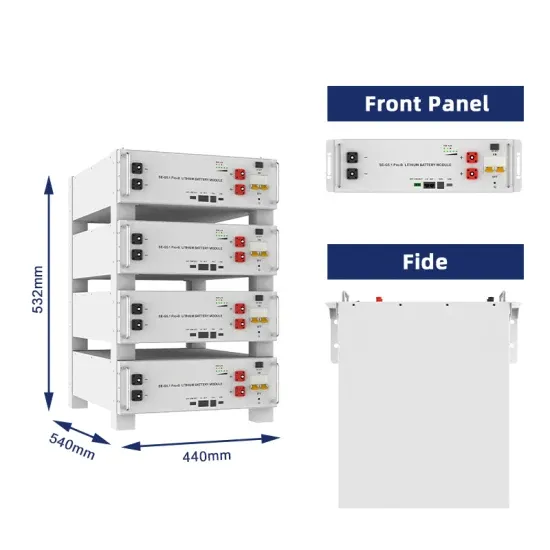

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.