Five solar businesses added to forced labor list, banned from U.S

Under the Uyghur Forced Labor Prevention Act (UFLPA), five businesses in China were added to an entity list, making them ineligible to provide products and services in the

Get a quote

Solar inverters guide: How to decide what''s right for you

Discover how solar energy inverters work, which types are available, and how to choose the right one for your system in this

Get a quote

Solar PV Energy

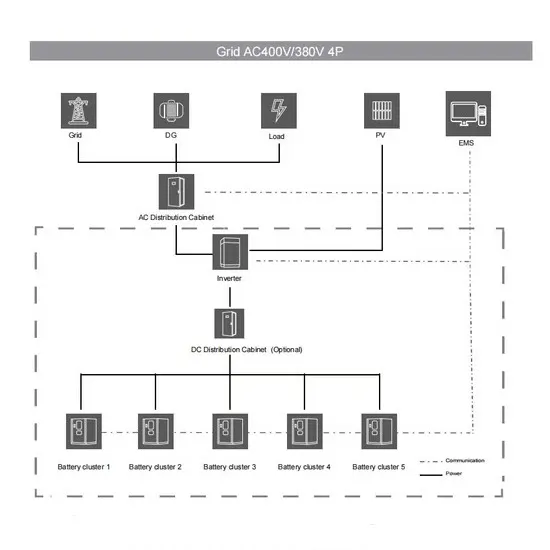

A wide range of inverters (solar pv and storage), tailored to suit any type of system scale: residential, commercial, industrial and utility scale. With more than 50 years'' experience in the

Get a quote

Overview of Use of U.S. Trade Restrictions on Clean

This policy brief provides an overview of the primary provisions of U.S. trade law that have been used to address trade concerns in clean energy.

Get a quote

Explainer on the Inverter-Based Resources Notice of

On November 17, 2022, the Federal Energy Regulatory Commission (FERC or Commission) issued a Notice of Proposed Rulemaking (NOPR) that focuses

Get a quote

India Reinstates Restrictions on Importing Solar

The Indian government has reintroduced the Approved List of Models and Manufacturers (ALMM) for solar module manufacturers, effective

Get a quote

Europe considers ban on Chinese solar inverters,

Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions

Get a quote

PHOTOVOLTAIC MODULES AND INVERTERS

Advances in the PV industry also bring environmental and social sustainability concerns. These include use of critical and toxic materials in PV modules as well as the chemical pollution

Get a quote

Explainer on the Inverter-Based Resources Notice of Proposed

On November 17, 2022, the Federal Energy Regulatory Commission (FERC or Commission) issued a Notice of Proposed Rulemaking (NOPR) that focuses on reliability issues related to

Get a quote

EU Restricts Chinese Inverters In The Name Of Safety

According to data from the European Solar Manufacturing Council (ESMC), Chinese inverters account for 70% of the European market share, and companies such as

Get a quote

Proposed US rule changes could alter solar supply chains

Considering the pervasive presence of Chinese ties to the US solar industry, the rules could affect all manner of businesses – distributors, importers, investment funds,

Get a quote

EU Restricts Chinese Inverters In The Name Of Safety

According to data from the European Solar Manufacturing Council (ESMC), Chinese inverters account for 70% of the European market share,

Get a quote

China''s solar industry remains in red as trade war adds to problems

China''s solar manufacturers reported losses this week as U.S. President Donald Trump''s trade war put further pressure on demand in an industry where top manufacturers

Get a quote

Inverter Market Share, Size, Industry Growth

Inverter Market Outlook 2031 The global industry was valued at US$ 15.0 Bn in 2022 It is estimated to grow at a CAGR of 6.1% from 2023 to 2031 and reach

Get a quote

Utility Scale PV Inverter Market Size & Share, Growth Statistics

The utility scale pv inverter market size was valued at USD 15.69 billion in 2024 and is expected to reach USD 43.71 billion by 2037, expanding at around 8.2% CAGR during the forecast

Get a quote

Five solar businesses added to forced labor list,

Under the Uyghur Forced Labor Prevention Act (UFLPA), five businesses in China were added to an entity list, making them ineligible to

Get a quote

Summer 2023 Solar Industry Update

U.S. Photovoltaic (PV) Deployment In Q2 2023, the Internal Revenue Service (IRS) released initial guidance on several key provisions within the Inflation Reduction Act, including:

Get a quote

Restrict Remote Access of PV Inverters from High-Risk Vendors

The European Solar Manufacturing Council (ESMC) today issued a clear and urgent warning: Europe''s energy sovereignty is at serious risk due to the unregulated and

Get a quote

Europe considers ban on Chinese solar inverters, citing

Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions about restricting high-risk

Get a quote

Solar Tariffs in 2025: What Homeowners Should Know

As the solar industry continues to grow in the United States, 2025 has brought a major shift with the implementation of new solar tariffs on imported panels, inverters, and other

Get a quote

Solar Market Insight Report 2024 Year in Review – SEIA

The industry continued breaking records and experiencing unprecedented growth, accounting for 66% of all new generating capacity added in 2024. All solar segments set

Get a quote

DOE/ID-Number

Since PV modules make up a larger part of the overall cost of the system, their domestic manufacture is weighted heavier, despite the fact that the inverters and other digital or "smart"

Get a quote

Solar and storage 2025: US policy risks and the new global

The US PV market is undergoing major policy changes, with the most significant shift stemming from the anti-dumping and countervailing duties (AD/CVD) on PV modules and

Get a quote

6 FAQs about [PV inverter industry restrictions]

Are solar inverters a threat to Europe's energy sovereignty?

The European Solar Manufacturing Council (ESMC) today issued a clear and urgent warning: Europe’s energy sovereignty is at serious risk due to the unregulated and remote control capabilities of PV inverters from high-risk, non-European manufacturers – most notably from China. Study by DNV provides the evidence.

Should Chinese inverters be banned?

Critics argue that banning Chinese inverters could raise costs and disrupt supply chains, as European alternatives are 30-50% more expensive. The European Commission is assessing cybersecurity risks in the solar value chain, with the ESMC advocating for measures like Lithuania's 2023 ban on Chinese inverters.

Are China-made photovoltaic inverters a cybersecurity risk?

Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions about restricting high-risk suppliers from connecting to its power systems.

Are modern inverters a risk?

The risk is not theoretical. Modern inverters are required to be connected to the internet to fulfill essential grid functions or to participate in the power market. However, these connections also allow for software updates – meaning any manufacturer can alter the performance of these devices remotely.

Will Lithuania ban inverters from China?

A replication of Lithuania’s proactive legislation – banning inverters from China – across all EU Member States – ensuring security measures apply to PV systems of all sizes. “Europe must act now to prevent a future energy crisis that would rival the gas dependency on Russia,” said Podewils.

Who makes the most secure solar inverters in 2023?

In 2023, Chinese vendors supplied 70% of global secure solar inverters, with Huawei holding the largest market share. Recent developments have heightened scrutiny. Huawei has been expelled from European solar associations, including SolarPower Europe and BusinessEurope, while Eurelectric is considering suspending Huawei's membership by June.

Guess what you want to know

-

Syria PV Energy Storage 200kw Inverter Price

Syria PV Energy Storage 200kw Inverter Price

-

Panama PV Off-Grid Inverter

Panama PV Off-Grid Inverter

-

Thailand PV inverter requirements

Thailand PV inverter requirements

-

Cook Islands Solar PV Panel Inverter

Cook Islands Solar PV Panel Inverter

-

Maximum PV inverter capacity

Maximum PV inverter capacity

-

PV panel inverter adaptation

PV panel inverter adaptation

-

Venezuela Three PV Inverter Sales

Venezuela Three PV Inverter Sales

-

PV power inverter company

PV power inverter company

-

Somaliland Micro PV Inverter

Somaliland Micro PV Inverter

-

Micro PV Inverter Type

Micro PV Inverter Type

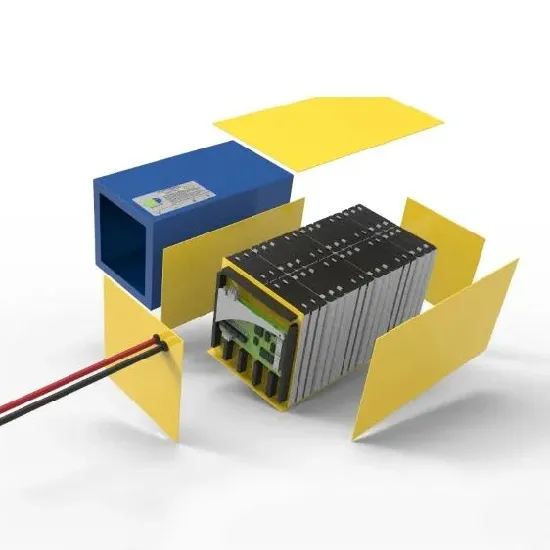

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.