The proper classification of fixed assets — AccountingTools

Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment.

Get a quote

Fixed Asset General Accounting Procedures

Fixed assets can be defined as tangible property that have significant value and can be used over an extended period of time. Fixed assets are not

Get a quote

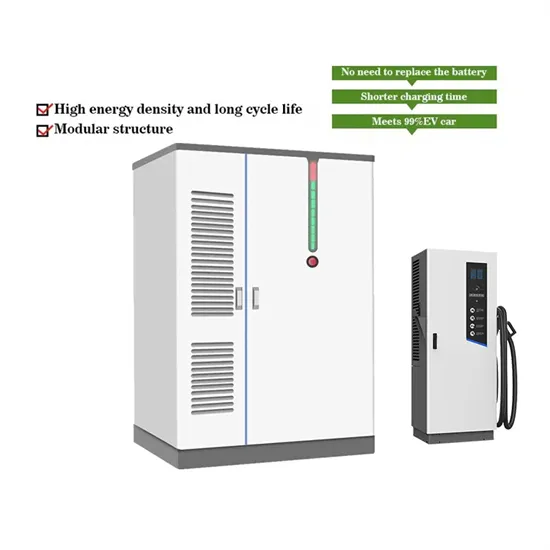

FAQS: LITHIUM-ION BATTERIES IN THE DATA CENTER

Q. How important is battery monitoring? e UL listing to enhance operation and safety. Additionally, the battery cabinets can be monitored via MODB ou Q. What is the impact on service and

Get a quote

I have tools set up as an expense, I believe they

I''m happy to assist you with your tools. May I ask which tools you are referring to? There are several different types of tools that you can

Get a quote

Understanding Office Equipment In Balance Sheet: Classification

Financial statements can be represented in a simple form or as classified statements. Classified statements represent the assets, liabilities, expenses, and revenues of an enterprise in a more

Get a quote

MACRS-QUICK LIFE CHART – CountingWorks

In this release, learn more about the MACRS Quick Life Chart, a helpful guide for asset class lives frequently encountered in tax prep. Reference key IRS

Get a quote

What Items Are Included in Fixed Assets?

When you purchase business assets, you classify them as either current assets or fixed assets. Fixed assets exceed your capitalization threshold and have a life span of one year or longer.

Get a quote

Guide to Battery Cabinets for Lithium-Ion Batteries: 6

Conclusion Choosing the right battery cabinet for lithium-ion batteries is crucial for maintaining safety in your business or facility. By

Get a quote

Understanding Furniture, Fixtures, and Equipment (FF&E):

For accounting purposes, furniture is a type of asset that is moved from one location to another but remains a part of the business''s operations. Furniture includes desks,

Get a quote

What Is Tangible Personal Property and How Is It Taxed?

Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. It is taxed by states.

Get a quote

Choosing the Right Battery Storage Cabinet: A

The right lithium-ion battery storage cabinet not only protects your assets but also enhances workplace safety and regulatory compliance. Given

Get a quote

Electrical Improvements Depreciation Life: How to Classify and

Capital expenses, as defined by the IRS, are costs that provide a benefit extending beyond the current tax year. These are typically associated with acquiring or improving long

Get a quote

What Items Are Included in Fixed Assets?

When you purchase business assets, you classify them as either current assets or fixed assets. Fixed assets exceed your capitalization threshold and have a

Get a quote

Furniture and fixtures definition — AccountingTools (2025)

FAQs Furniture and fixtures definition — AccountingTools? › Furniture and fixtures are larger items of movable equipment that are used to furnish an office. Examples are

Get a quote

Types of Assets

What are the Main Types of Assets? An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic

Get a quote

What Is a Battery Rack Cabinet and Why Is It Essential?

A battery rack cabinet is a specialized enclosure designed to securely house multiple batteries in energy storage systems. It ensures thermal management, safety, and

Get a quote

9 General Categories of Fixed Assets (With Explanation)

What are the Main Types of Assets? An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic

Get a quote

MACRS asset life table

Includes furniture and fixtures that are not a structural component of a building. Includes such assets as desks, files, safes, and communications equipment. Does not include

Get a quote

9 General Categories of Fixed Assets (With Explanation)

These assets are typically used in the business''s daily operations and are expected to be sold or consumed soon. Examples of current assets include cash and cash equivalents, accounts

Get a quote

1.35.6 Property and Equipment Accounting | Internal

1.35.6 Property and Equipment Accounting Manual Transmittal June 28, 2024 Purpose (1) This transmits revised IRM 1.35.6, Financial

Get a quote

Fixed Asset General Accounting Procedures

Fixed assets can be defined as tangible property that have significant value and can be used over an extended period of time. Fixed assets are not intentionally acquired for resale,

Get a quote

Leasehold Improvements: Accounting Under ASC 842

We''ll explore the details of leasehold improvements and best practices for accounting for these improvements for commercial property.

Get a quote

6 FAQs about [What kind of assets are battery cabinets ]

What are the different types of assets?

An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic benefit. Common types of assets include current, non-current, physical, intangible, operating, and non-operating.

What is the difference between fixed assets and assets?

The Difference Between Assets and Fixed Assets Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment.

What are current assets?

Current assets refer to assets that are either expected to be converted into cash or consumed within one year or the operating cycle of the business, whichever is longer. These assets are typically used in the business’s daily operations and are expected to be sold or consumed soon.

Which building is considered a fixed asset?

Although office buildings and factories are commonly known as fixed assets, any permanent structure can be considered a building for fixed asset classification. Modular office buildings, trailers and warehouses are fixed assets. Your company parking lot, customer parking garage and company vehicle garage also qualify.

What are the different types of fixed assets?

The following are the general list categories of fixed assets: Buildings include an office building, warehouse, and other similar kinds. Their useful life is normally longer compared to other fixed assets. Computer equipment: Laptops, desktops, servers, printers, and other similar equipment.

What are examples of current assets?

Current assets are also termed liquid assets and examples of such are: 2. Fixed or Non-Current Assets Non-current assets are assets that cannot be easily and readily converted into cash and cash equivalents. Non-current assets are also termed fixed assets, long-term assets, or hard assets.

Guess what you want to know

-

What kind of battery cabinets are more common in Mexico

What kind of battery cabinets are more common in Mexico

-

What kind of battery is Huawei s energy storage project

What kind of battery is Huawei s energy storage project

-

What kind of battery is suitable for outdoor power supply

What kind of battery is suitable for outdoor power supply

-

What is the energy density of outdoor communication battery cabinets in Armenia

What is the energy density of outdoor communication battery cabinets in Armenia

-

What types of liquid-cooled energy storage battery cabinets are included

What types of liquid-cooled energy storage battery cabinets are included

-

What kind of battery is used for industrial and commercial energy storage batteries

What kind of battery is used for industrial and commercial energy storage batteries

-

What types of single battery cabinets are included

What types of single battery cabinets are included

-

What kind of battery is best for mobile base stations

What kind of battery is best for mobile base stations

-

What is the future of battery cabinets

What is the future of battery cabinets

-

What are the protection standards for outdoor battery cabinets

What are the protection standards for outdoor battery cabinets

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.