7 Energy Storage Stocks to Invest In | Investing | U.S. News

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays. The landmark tax-and-spending legislation signed into law by President

Get a quote

How much investment can be recovered from energy storage power stations

Investment recovery from energy storage power stations emerges as a complex yet promising venture. Navigating this terrain requires comprehensive insight into financial,

Get a quote

The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get a quote

Research on investment decision-making of energy storage

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Get a quote

A comprehensive review of the impacts of energy storage on power

This manuscript illustrates that energy storage can promote renewable energy investments, reduce the risk of price surges in electricity markets, and enhance the security of

Get a quote

Top Renewable Energy & Battery Storage Stocks

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

Development and Prospect of the Pumped Hydro Energy Stations in

Effective energy storage has the potential to enhance the global hosting capacity of renewable energy in power systems, accelerate the global energy transition, and reduce our

Get a quote

How much investment can be recovered from energy storage

Investment recovery from energy storage power stations emerges as a complex yet promising venture. Navigating this terrain requires comprehensive insight into financial,

Get a quote

Research on investment decision-making of energy storage power station

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays. The landmark tax-and-spending

Get a quote

Energy Storage Investments – Publications

Estimates indicate that global energy storage installations rose over 75% (measured by MWhs) year over year in 2024 and are expected to go beyond the terawatt-hour

Get a quote

How about investing in energy storage power station companies?

The prospects for energy storage power station companies appear increasingly favorable in light of the escalating emphasis on renewable energy. As nations strive to meet

Get a quote

The prospects of independent energy storage power stations

Abstract: The shared energy storage service provided by independent energy storage operators (IESO) has a wide range of application prospects, but when faced with the interrelated and

Get a quote

Research Status and Development Trend of Compressed Air Energy Storage

Introduction Compressed air energy storage (CAES), as a long-term energy storage, has the advantages of large-scale energy storage capacity, higher safety, longer

Get a quote

How much profit can energy storage power station investment

Therefore, establishing energy storage power stations is not merely a trend; it signifies a monumental shift towards sustainable and reliable energy solutions. Investment in

Get a quote

How much profit does an energy storage power station make?

1. Profit generation for an energy storage power station can vary significantly based on multiple factors, including geographical location, market conditions, technology used,

Get a quote

LQ&KLQDXQGHUWKHEDFNJURXQGRI

The development characteristics and prospect of pumped storage power station as the main energy storage facility in China under the background of double Carbon To cite this article:

Get a quote

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get a quote

The Development of New Power System and Power Storage

The capacity tariff reflects the value of the auxiliary services provided by the pumped storage power station, such as frequency regulation, voltage regulation, system standby and black

Get a quote

Energy Storage Power Station Investment Insights: Breaking

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

Capacity investment decisions of energy storage power stations

To this end, this paper constructs a decision-making model for the capacity investment of energy storage power stations under time-of-use pricing, which is intended to

Get a quote

(PDF) Developments and characteristics of pumped

This paper introduces the current development status of the pumped storage power (PSP) station in some different countries based on

Get a quote

Top Renewable Energy & Battery Storage Stocks Worth Investing

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing global electricity demand.

Get a quote

6 FAQs about [Investment prospects for energy storage power stations]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Why do we need reliable energy storage solutions?

As industries across the board are rapidly embracing renewable energy worldwide for a more sustainable future, the need for reliable energy storage solutions has surged significantly over the past decade.

Should energy storage be undervalued?

The revenue potential of energy storage is often undervalued. Investors could adjust their evaluation approach to get a true estimate—improving profitability and supporting sustainability goals.

Is Bloom Energy a good energy storage stock?

Bloom Energy is one of the smaller picks on this list, but it may be the most dynamic energy storage stock out there. It specializes in advanced fuel cell energy platforms, which use a proprietary solid oxide technology to convert natural gas, biogas or hydrogen into electricity with low or even zero carbon emissions.

Guess what you want to know

-

Investment scale of energy storage power stations

Investment scale of energy storage power stations

-

Investment in energy storage power stations exceeding 10 million

Investment in energy storage power stations exceeding 10 million

-

Open up investment in wind solar and energy storage power stations

Open up investment in wind solar and energy storage power stations

-

Geological requirements for wind solar and energy storage power stations

Geological requirements for wind solar and energy storage power stations

-

Profits and taxes of energy storage power stations

Profits and taxes of energy storage power stations

-

Syria has several energy storage power stations

Syria has several energy storage power stations

-

Which companies have energy storage photovoltaic power stations in the Democratic Republic of the Congo

Which companies have energy storage photovoltaic power stations in the Democratic Republic of the Congo

-

Russia Construction Investment Energy Storage Power Station

Russia Construction Investment Energy Storage Power Station

-

What are the independent energy storage power stations in Algeria

What are the independent energy storage power stations in Algeria

-

Profit model of wind solar and energy storage power stations

Profit model of wind solar and energy storage power stations

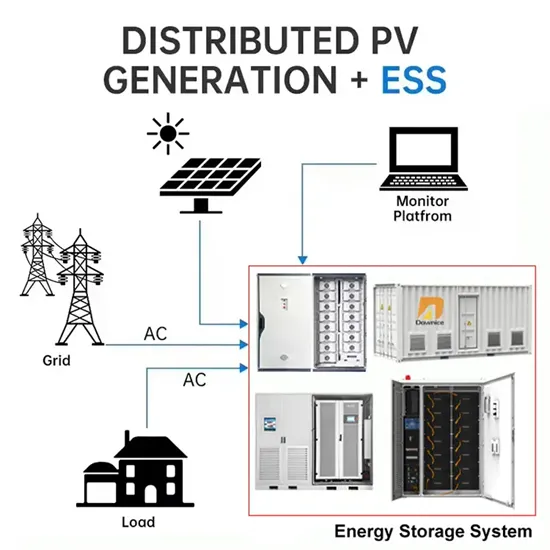

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

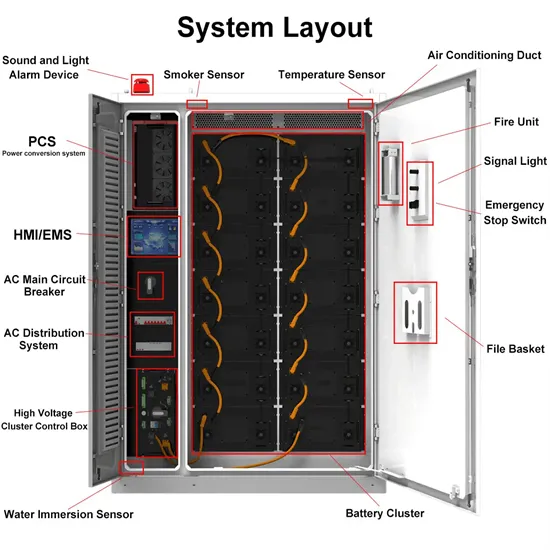

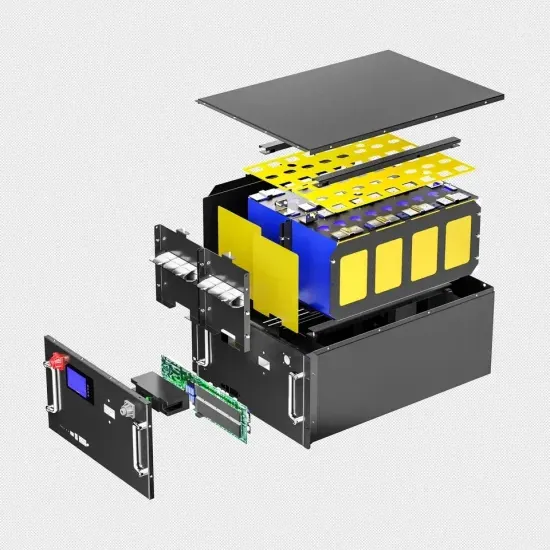

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.