Solar-Plus-Storage: Fastest, Cheapest Way To Meet

U.S. power demand is surging as data centers plug in. The cheapest, fastest way to keep the lights on? Solar-plus-storage, not gas

Get a quote

How Much Does A Solid State Battery Cost Per Kwh?

Experts predict that within 10 years, solid-state battery prices will decrease considerably. The price drop will open up markets and potentially

Get a quote

The Surging U.S. Power Sector and Rising Electricity Prices in

As we look at this evolving landscape, it''s becoming increasingly clear that clean energy and battery storage are not just part of the solution - they''re strategic hedges against

Get a quote

Global Energy Storage Growth Upheld by New Markets

The global energy storage market is poised to hit new heights yet again in 2025. Despite policy changes and uncertainty in the world''s two

Get a quote

Battery Report 2024: BESS surging in the "Decade of

The Battery Report refers to the 2020s as the "Decade of Energy Storage", and it''s not difficult to see why. With falling costs, larger installations,

Get a quote

Battery energy storage prices spike in Q2 2025

According to Anza''s Q2 Storage pricing insights report, the second quarter saw the sharpest single jump in battery energy storage prices since

Get a quote

Can homes with solar panels increase the sale price of your home?

4 days ago· Discover how solar panels can increase your home''s value by 6.9% on average. Learn about location factors, system specs, and energy storage benefits.

Get a quote

What Does Green Energy Storage Cost in 2025?

Energy storage systems (ESS) for four-hour durations exceed $300/kWh, marking the first price hike since 2017, largely driven by escalating raw material costs

Get a quote

The AI revolution is likely to drive up your electricity bill. Here''s

Beyond price increases, the heightened energy demand from data centers could also compromise the reliability of the grid, according to experts.

Get a quote

A comprehensive review of the impacts of energy storage on

Energy storage can affect market prices by reducing price volatility and mitigating the impact of renewable energy intermittency on the power system. For example, energy

Get a quote

Battery energy storage prices spike in Q2 2025

According to Anza''s Q2 Storage pricing insights report, the second quarter saw the sharpest single jump in battery energy storage prices since 2021, when the industry was

Get a quote

Battery storage prices spike as manufacturers react to U.S. tariffs

The tariff actions in the United States have caused a sharp increase in battery prices, according to the Q2 Storage Pricing Insights Report.

Get a quote

What Does Green Energy Storage Cost in 2025?

Energy storage systems (ESS) for four-hour durations exceed $300/kWh, marking the first price hike since 2017, largely driven by escalating raw material costs and supply chain disruptions.

Get a quote

Storage is booming and batteries are cheaper than ever. Can it

The U.S. energy storage market is stronger than ever, and the cost of the most commonly used battery chemistry is trending downward each year. Can we keep going like

Get a quote

Where will lithium-ion battery prices go in 2025?

After tumbling to record low in 2024 on the back of lower metal costs and increased scale, lithium-ion battery prices are expected to enter a period of stabilization.

Get a quote

Tariff Threats: Energy Storage Prices Could Rise 35

If steeper tariffs are enacted on the global battery energy storage supply chain under the Trump Administration, the near-term impact could

Get a quote

Tariff Threats: Energy Storage Prices Could Rise 35% or More

If steeper tariffs are enacted on the global battery energy storage supply chain under the Trump Administration, the near-term impact could raise U.S. costs on battery

Get a quote

Battery storage prices spike as manufacturers react to

The tariff actions in the United States have caused a sharp increase in battery prices, according to the Q2 Storage Pricing Insights Report.

Get a quote

US energy storage costs could spike 50% – tariffs are

Wood Mackenzie estimates energy storage project costs could rise from 12% to over 50%, depending on the scenario. That''s because, in 2024,

Get a quote

2025 Energy Predictions: Battery Costs Fall, Energy Storage

Battery prices have fallen over 90% in the past 15 years and will continue to fall as production costs decline and emerging battery technologies mature.

Get a quote

US energy storage costs could spike 50% – tariffs are to blame

Wood Mackenzie estimates energy storage project costs could rise from 12% to over 50%, depending on the scenario. That''s because, in 2024, nearly all utility-scale battery

Get a quote

A 2025 Update on Utility-Scale Energy Storage Procurements

Changes in trade and tax policy may increase costs and put a damper on near-term forecasted energy storage projects. On February 4, 2025, an additional 10% tariff on all goods

Get a quote

PJM Capacity Prices Spike 8X: How Distributed

If your business is in PJM, your energy bill is about to increase. Here''s how your business can reduce those costs with an on-site renewable

Get a quote

2025 Energy Storage Battery Prices: Trends, Drivers, and What''s

Why 2025 Is a Pivotal Year for Energy Storage Costs 2025 is shaping up to be the year when energy storage battery prices make lithium-ion cells cheaper than a Starbucks latte

Get a quote

6 FAQs about [Increase in energy storage prices]

How much does energy storage cost?

Energy storage system costs for four-hour duration systems exceed $300/kWh for the first time since 2017. Rising raw material prices, particularly for lithium and nickel, contribute to increased energy storage costs. Fixed operation and maintenance costs for battery systems are estimated at 2.5% of capital costs.

Why are energy storage systems so expensive?

Energy storage systems (ESS) for four-hour durations exceed $300/kWh, marking the first price hike since 2017, largely driven by escalating raw material costs and supply chain disruptions. Geopolitical issues have intensified these trends, especially concerning lithium and nickel.

How much does energy storage cost in 2024?

As we look ahead to 2024, energy storage system (ESS) costs are expected to undergo significant changes. Currently, the average cost remains above $300/kWh for four-hour duration systems, primarily due to rising raw material prices since 2017.

How does energy storage impact economic growth?

Submit a case study with the chance to be featured in Renewable Energy World. ACP adds that increased energy storage deployment not only enhances reliability and affordability but also drives U.S. economic expansion, supporting growing industries like manufacturing and data centers.

Could China's rising energy costs lead to higher energy costs?

The rising costs could prove even higher for the Chinese-based materials such as direct current (DC) blocks, the report forecasts. The Clean Energy Associates (CEA) study used a base case of Section 301 tariffs increased to 60% on these imported battery energy storage technologies.

Could tariffs drive up energy costs?

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast. Tariffs could drive up US clean energy costs – especially energy storage – by up to 50%, warns Wood Mackenzie in a new report.

Guess what you want to know

-

How much is the cost increase between low-voltage energy storage and high-voltage

How much is the cost increase between low-voltage energy storage and high-voltage

-

Samoa energy storage system prices

Samoa energy storage system prices

-

Commercial side energy storage manufacturer prices

Commercial side energy storage manufacturer prices

-

US Energy Storage Cabinet Battery Prices

US Energy Storage Cabinet Battery Prices

-

Energy storage cabinet capacity distribution base stations and prices

Energy storage cabinet capacity distribution base stations and prices

-

Tajikistan photovoltaic energy storage prices are affordable

Tajikistan photovoltaic energy storage prices are affordable

-

Asia Energy Storage Container Prices

Asia Energy Storage Container Prices

-

Suriname energy storage product prices

Suriname energy storage product prices

-

Photovoltaic energy storage peak and valley electricity prices

Photovoltaic energy storage peak and valley electricity prices

-

Battery energy storage container prices in Somaliland

Battery energy storage container prices in Somaliland

Industrial & Commercial Energy Storage Market Growth

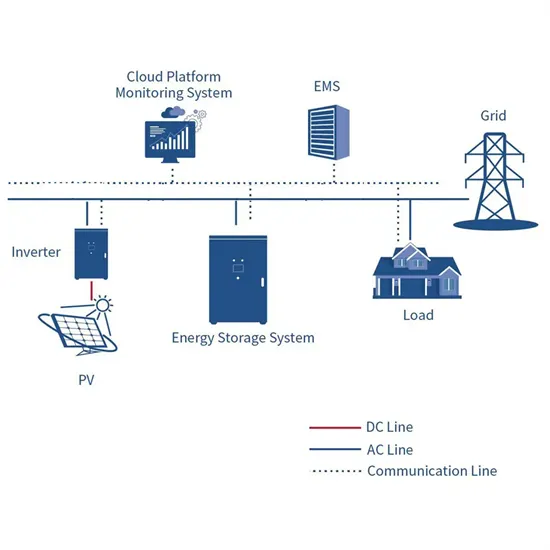

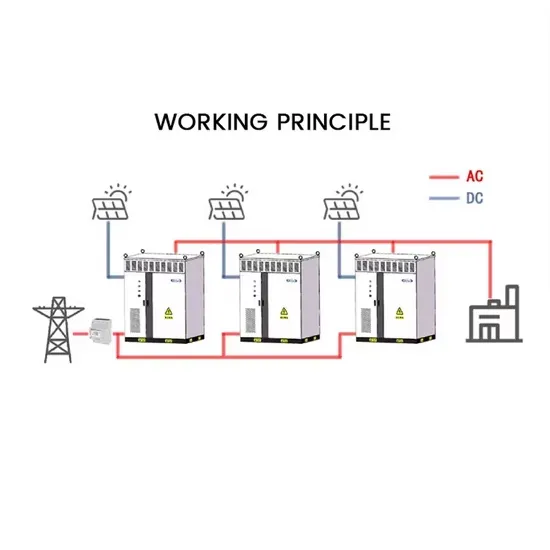

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.