Ontario awards 739MW of battery storage contracts

Rendering of Oneida, the government-backed 250MW/1,000MWh project by NRStor and Northland Power, which is being contracted for separately to the new

Get a quote

DOE ESHB Chapter 20 Energy Storage Procurement

This chapter supports procurement of energy storage systems (ESS) and services, primarily through the development of procurement documents such as Requests for Proposal (RFPs),

Get a quote

Energy Storage

The following provides information on California energy storage legislation, the CPUC energy storage program and projects evaluation, CPUC energy storage proceedings,

Get a quote

The Energy Storage Supply Landscape: A Guide to BESS Procurement

In this Energy Storage News Webinar, CEA''s energy storage experts take a deep dive into BESS procurement strategies with guidance and advice on how to navigate this

Get a quote

A 2025 Update on Utility-Scale Energy Storage Procurements

A recent spate of fires involving battery energy storage facilities may increase scrutiny from lawmakers and regulators on battery energy storage facilities and this may

Get a quote

Reducing battery procurement risk for US energy storage projects

In the rapidly growing but still relatively new battery energy storage sector, equipment procurement and integration for large projects presents numerous risks. Jared

Get a quote

Step-by-Step BOQ for Battery Energy Storage

In the rapidly evolving energy landscape, Battery Energy Storage Systems (BESS) play a pivotal role in stabilizing grids, optimizing renewable

Get a quote

Agreements signed with battery energy storage projects

Minister of Electricity and Energy, Dr Kgosientsho Ramokgopa has signed two project agreements and the commercial close of two projects appointed as preferred bidders

Get a quote

Desert Power: A Deep Dive into the Massive Solar + Storage Project

Discover how solar plus storage systems transform energy use in Nevada, promoting sustainability and efficiency in Clark County.

Get a quote

Procurement_Cliburn_09_2021.pptx

Solar-Plus for Electric Co-ops (SPECs) was launched to help optimize the planning, procurement, and operations of battery storage and solar-plus-storage for electric cooperatives. SPECs was

Get a quote

The Energy Storage Supply Landscape: A Guide to BESS

In this Energy Storage News Webinar, CEA''s energy storage experts take a deep dive into BESS procurement strategies with guidance and advice on how to navigate this

Get a quote

Reducing battery procurement risk for US energy

In the rapidly growing but still relatively new battery energy storage sector, equipment procurement and integration for large projects presents

Get a quote

Battery Energy Storage Procurement Framework and Best

North Carolina Electric Membership Corporation (NCEMC) and several of its member distribution cooperatives are gaining extensive experience in the deployment of battery energy storage

Get a quote

New Mexico utility seeks approvals for battery storage

Public Service Company of New Mexico is seeking approval of off-take agreements for third-party BESS contracts and a project it will own.

Get a quote

A 2025 Update on Utility-Scale Energy Storage

A recent spate of fires involving battery energy storage facilities may increase scrutiny from lawmakers and regulators on battery energy

Get a quote

Battery Energy Storage System Procurement Checklist

Checklist provides federal agencies with a standard set of tasks, questions, and reference points to assist in the early stages of battery energy

Get a quote

Engineering, procurement and construction

In the second installment of our series addressing best practices, challenges and opportunities in utility-scale battery energy storage systems

Get a quote

Energy Storage Procurement

projects at each scale. Clean Energy States Alliance previously produced a webinar on the topic of energy storage procurement, featuring presentations by Sandia National Lab. ratories and

Get a quote

New York utility Con Ed launches RFP for energy storage projects

The New York State Public Service Commission (NYPSC) directed New York state utilities to procure 350MW of energy storage projects. According to NYPSC''s orders, detailed

Get a quote

Battery purchase contracts | Norton Rose Fulbright

The latest update in market trends from the Energy Information Administration predicts installed capacity for battery energy storage projects will contribute more than 10,000

Get a quote

Battery purchase contracts: Key pitfalls

Anyone developing a battery energy storage project should be prepared to address two main issues. The first, and the topic of an earlier article, is the general contracting

Get a quote

Maine Energy Storage Program

The GEO evaluated multiple program design options, including pay-for-performance mechanisms, clean peak credits, tolling agreements, and an index storage credit

Get a quote

Governor Moore Signs Next Generation Energy Act, Propelling

To date, the PJM grid has only 375 MW of battery energy storage installed. This deployment pales in comparison to California (with 12,000 MW of storage capacity) and Texas

Get a quote

Procurement_Cliburn_09_2021.pptx

A well-structured RFP minimizes risks, streamlines vendor selection, and ensures that your BESS project aligns with performance, safety, and budgetary goals. This guide

Get a quote

California utility PG&E proposes 1.6GW/6.4GWh of

The site includes separately utilised standalone battery storage and solar-plus-storage facilities Image: Terra-Gen / CPA. Plans to procure

Get a quote

Energy Storage Initiative

Energy storage is a significant strategic opportunity for Massachusetts. It can improve grid operations, reduce energy costs, provide backup power through storms, and benefit the local

Get a quote

Battery Energy Storage System (BESS) Procurement Checklist

A well-structured RFP minimizes risks, streamlines vendor selection, and ensures that your BESS project aligns with performance, safety, and budgetary goals. This guide

Get a quote

Battery Energy Storage System Procurement Checklist

Checklist provides federal agencies with a standard set of tasks, questions, and reference points to assist in the early stages of battery energy storage systems (BESS) project

Get a quote

All to Know About the World''s Largest BESS Projects

The government is soliciting bids to develop four battery energy storage system (BESS) projects. Furthermore, it is expected that each will

Get a quote

6 FAQs about [Energy Storage Battery Procurement Project]

What is a battery energy storage system checklist?

Checklist provides federal agencies with a standard set of tasks, questions, and reference points to assist in the early stages of battery energy storage systems (BESS) project development.

What is the general contracting structure for a battery energy storage system?

The first, and the topic of an earlier article, is the general contracting structure. Developers of battery energy storage system, or BESS, projects are using a multi-contractor, split-scope contracting structure instead of the more traditional single-contractor, turnkey approach. (See "Battery Purchase Contracts" in the December 2021 NewsWire.)

Should a battery procurement contract aggregate liability in a collective project?

For example, if a developer has a number of projects supplying battery storage under a single offtake contract, then it might prefer a single battery procurement contract aggregating liability in the collective project, given that liability under the offtake contract may be connected for failure to develop the collective project.

How can battery storage improve solar energy production?

Note rising interest in value streams that are locally realized, e.g., time-shifting to balance rising distributed energy resources (DERs) locally. Battery storage can prevent solar over-production, while facilitating local high-renewables goals. It also may sometimes defer the need for a distribution upgrade (non-wires alternative).

What are the challenges of procurement for utility-side storage & solar-plus projects?

The challenges of procurement for utility-side storage and solar-plus projects center largely on early-stage decisions: defining the top-priority use case, but also exploring ways to get more value out of the project and to prepare for market changes over its life.

Who led the energy storage project in North Carolina?

Cliburn and Associates, LLC, led the project team, including North Carolina Clean Energy Technology Center (NCCETC), Cobb Electric Membership Corporation, Kit Carson Electric Cooperative, United Power, and stakeholders from other co-ops and public power utilities and wholesale suppliers, market experts, and the energy storage industry.

Guess what you want to know

-

Somalia Energy Storage Battery Project

Somalia Energy Storage Battery Project

-

Energy Storage Vanadium Battery Project

Energy Storage Vanadium Battery Project

-

Huawei South Ossetia Energy Storage Battery Project

Huawei South Ossetia Energy Storage Battery Project

-

Estonia Tartu Energy Storage Battery Project

Estonia Tartu Energy Storage Battery Project

-

Croatia Energy Storage Battery Project

Croatia Energy Storage Battery Project

-

Niger energy storage battery project investment

Niger energy storage battery project investment

-

Sierra Leone Energy Storage Project Procurement

Sierra Leone Energy Storage Project Procurement

-

Bangladesh Energy Storage Project Battery Plant

Bangladesh Energy Storage Project Battery Plant

-

New Zealand Photovoltaic Energy Storage Battery Project

New Zealand Photovoltaic Energy Storage Battery Project

-

Huawei Jordan Energy Storage Battery Project

Huawei Jordan Energy Storage Battery Project

Industrial & Commercial Energy Storage Market Growth

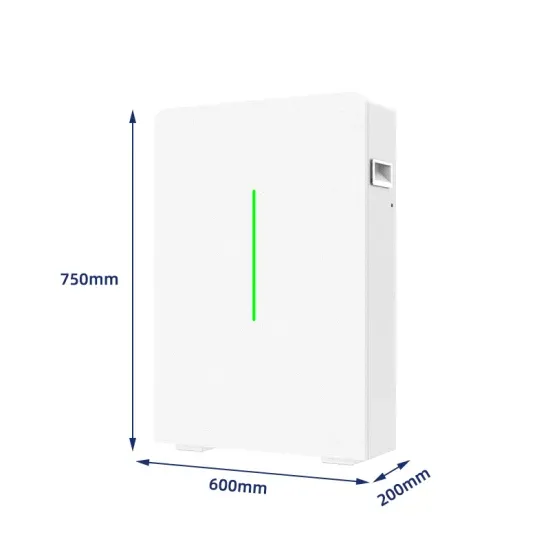

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.