May 2024 Energy transition update: Levelized cost of

1. Despite recent higher costs, solar PV and onshore wind remain the cheapest option for new electricity generation in most countries.5 Over the longer term, LCOE from wind and solar PV

Get a quote

Europe''s solar power surge hits prices, exposing

OSLO/PARIS, June 21 (Reuters) - Europe has clocked a record number of hours of negative power prices this year due to a mismatch between demand and

Get a quote

Analysis first half of2025The first half of 2025 leaves records for

In the first half of 2025, the average price in most major European electricity markets exceeded €60/MWh and was the highest since the second half of 2023 in several markets. Rising

Get a quote

EU battery storage is ready for its moment in the sun

Years of strong solar growth and high gas prices have increased electricity price volatility across the EU, strengthening opportunities for battery

Get a quote

European Electricity Review 2024

About The European Electricity Review analyses full-year electricity generation and demand data for 2023 in all EU-27 countries to understand the region''s progress in

Get a quote

European Solar Generation Boost Sends Power

A recent surge in solar power generation across Europe has led to instances of negative electricity prices, particularly in Germany, the

Get a quote

European Market Outlook for Battery Storage 2024-2028

SolarPower Europe has published its new "European Market Outlook for Battery Storage", covering 2024-2028. The study delves into the specifics of the residential, C&I and

Get a quote

Europe''s solar power surge hits prices, exposing storage needs

OSLO/PARIS, June 21 (Reuters) - Europe has clocked a record number of hours of negative power prices this year due to a mismatch between demand and supply as solar power

Get a quote

Solar is EU''s biggest power source for the first time ever

Solar takes top spot in the EU for the first month ever In June 2025, solar was the largest source of EU electricity for the first time, with multiple

Get a quote

Expert analysis: Key challenges and opportunities for

The renewable energy landscape in Europe faced several notable challenges in 2024, highlighting the complexities of transitioning to a cleaner

Get a quote

Global Market Outlook For Solar Power 2024

Welcome to the Global Market Outlook for Solar Power 2024-2028. For an established sector like solar, approaching double growth in one year was simply not part of

Get a quote

''Solar-plus-storage is the answer'': What record power

Record-breaking power prices across Europe have turned the spotlight on the role fossil fuel plants play in generating electricity and how the transition to renewables-plus-storage...

Get a quote

Guide to PV Europe: Costs, Considerations, and Why

With energy prices fluctuating across Europe, installing a solar PV system lets you lock in lower electricity costs for decades. Plus, many EU

Get a quote

Turning to the sun: Solar rise in Central Europe | Ember

2 days ago· About This report examines electricity generation trends in Central European countries (Czechia, Hungary, Poland, Slovakia) from 2019 to 2024, with insights from 2025.

Get a quote

European Electricity Review 2024

About The European Electricity Review analyses full-year electricity generation and demand data for 2023 in all EU-27 countries to understand the region''s progress in transitioning from fossil

Get a quote

European solar market 2024-2025: balancing growth,

The EU solar PV market in 2024-2025 stands at a pivotal moment, influenced by policy-driven growth, persistent pricing pressures, and shifting

Get a quote

''Solar-plus-storage is the answer'': What record power

Record-breaking power prices across Europe have turned the spotlight on the role fossil fuel plants play in generating electricity and how the

Get a quote

Europe''s Negative Power Prices Highlight the Need for Energy Storage

European wholesale electricity markets have seen zero or negative power prices for the most hours on record this year amid soaring renewable energy generation and a

Get a quote

EU Market Outlook for Solar Power: 2025 Mid-Year Analysis

Welcome to our EU Market Outlook 2025: Mid-Year Analysis. This publication marks a new addition to SolarPower Europe''s solar and battery storage market outlook series.

Get a quote

EU Energy Outlook to 2060: power prices and revenues

The "EU Energy Outlook 2060" explains and compares the developments in Energy Brainpool''s "Central" and "GoHydrogen" power price scenarios for the EU 27, including

Get a quote

European Solar Generation Boost Sends Power Prices Below Zero

A recent surge in solar power generation across Europe has led to instances of negative electricity prices, particularly in Germany, the Netherlands, and Belgium. This

Get a quote

New analysis reveals European solar battery storage market

Latest analysis from SolarPower Europe reveals that, in 2023, Europe installed 17.2 GWh of new battery energy storage systems (BESS); a 94% increase compared to 2022.

Get a quote

SolarPower Europe report: EU solar market with only weak growth

A flexible, electrified system will slash 2030 day-ahead energy prices by 25%, while boosting the solar business case by 71%. Amongst other flexibility tools, this will require

Get a quote

EU Market Outlook for Solar Power: 2025 Mid-Year Analysis

Following years of rapid expansion, the solar market stagnated in 2024. As it looks now, the market will most likely contract slightly in 2025, primarily due to a sharp decline in

Get a quote

Energy Storage in Europe

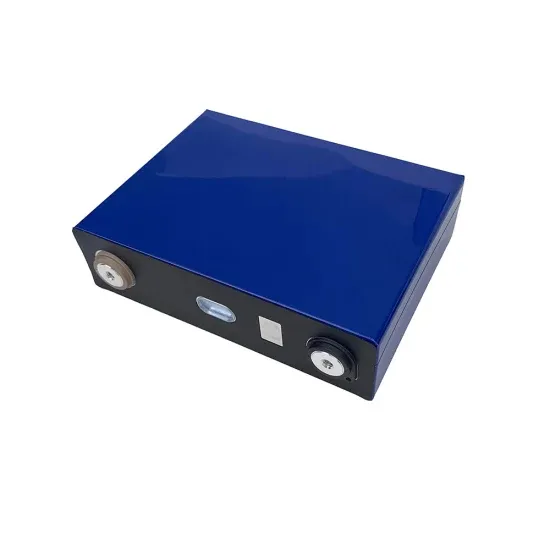

LFP spot price comes from the ICC Battery price database, where spot price is based on reported quotes from companies, battery cell prices could be even lower if batteries are purchased in

Get a quote

Europe''s Negative Power Prices Highlight the Need for Energy

European wholesale electricity markets have seen zero or negative power prices for the most hours on record this year amid soaring renewable energy generation and a

Get a quote

EU battery storage is ready for its moment in the sun | Ember

Years of strong solar growth and high gas prices have increased electricity price volatility across the EU, strengthening opportunities for battery storage. In turn, batteries can

Get a quote

European electricity prices rise despite daily solar production

Rising electricity demand and higher CO2 emissions prices drove up average power prices last week across most major European markets, according to AleaSoft Energy

Get a quote

6 FAQs about [EU photovoltaic power generation and energy storage prices]

How does solar power affect battery storage in the EU?

Years of strong solar growth and high gas prices have increased electricity price volatility across the EU, strengthening opportunities for battery storage. In turn, batteries can increase power demand at peak solar times, supporting solar revenues.

Does Europe have a slowdown in photovoltaic growth?

The new European market report from SolarPower Europe shows a sharp decline in the growth of photovoltaics. After four years of soaring growth, the EU solar sector has hit its first deployment slowdown of the 2020s, dropping from 53% growth in 2023 to 4% in 2024. This represents a 92% slowdown of solar growth.

Why are European wholesale electricity prices so low?

European wholesale electricity markets have seen zero or negative power prices for the most hours on record this year amid soaring renewable energy generation and a mismatch between supply and demand hours for solar power.

How can the EU save energy?

With adequate growth in electricity storage, demand side flexibility and cross-border interconnectivity to help take advantage of abundant home-grown clean power, the EU could reduce fossil dependance, avoid costly energy imports, and protect consumers and businesses from volatile international energy prices.

Will low-cost solar bring Europe into a new era of competitiveness?

Amongst other flexibility tools, this will require a 16-fold growth from 48 GWh of EU battery storage today to 780 GWh of battery storage in 2030. Dries Acke, Deputy CEO at SolarPower Europe said: “Low-cost solar is the best option for bringing Europe into a new era of competitiveness.

How much energy does wind and solar produce in the EU?

In the twelve months to July 2024 (inclusive), wind and solar produced more than half of EU power in 7% of hours, up from just 2% of hours in the twelve months prior. In the same period, solar and wind covered a minimum of 6% of EU electricity demand across all hours.

Guess what you want to know

-

Kuwait photovoltaic power generation and energy storage prices

Kuwait photovoltaic power generation and energy storage prices

-

Paraguay photovoltaic power generation and energy storage prices

Paraguay photovoltaic power generation and energy storage prices

-

Cambodia photovoltaic power generation energy storage battery price company

Cambodia photovoltaic power generation energy storage battery price company

-

Cambodia s photovoltaic power generation and energy storage requirements

Cambodia s photovoltaic power generation and energy storage requirements

-

Djibouti greenhouse photovoltaic power generation energy storage cabinet

Djibouti greenhouse photovoltaic power generation energy storage cabinet

-

Bolivia photovoltaic power generation and energy storage investment and construction

Bolivia photovoltaic power generation and energy storage investment and construction

-

The benefits of photovoltaic power generation and energy storage in the UAE

The benefits of photovoltaic power generation and energy storage in the UAE

-

Which photovoltaic power generation and energy storage company is best in Egypt

Which photovoltaic power generation and energy storage company is best in Egypt

-

Cambodia Siem Reap Photovoltaic Power Generation and Energy Storage Project

Cambodia Siem Reap Photovoltaic Power Generation and Energy Storage Project

-

Photovoltaic power generation energy storage cabinet in the Algerian factory

Photovoltaic power generation energy storage cabinet in the Algerian factory

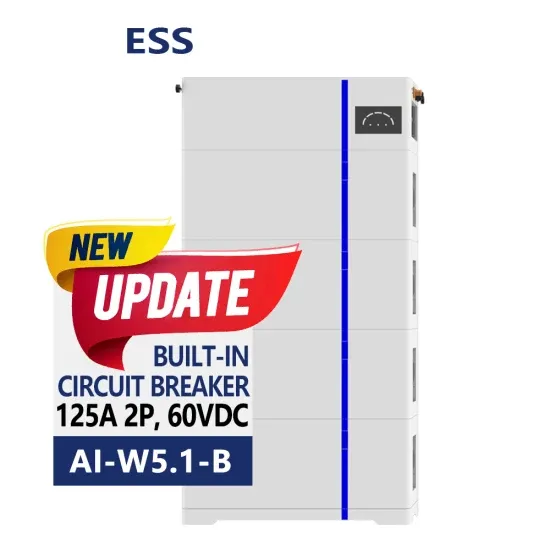

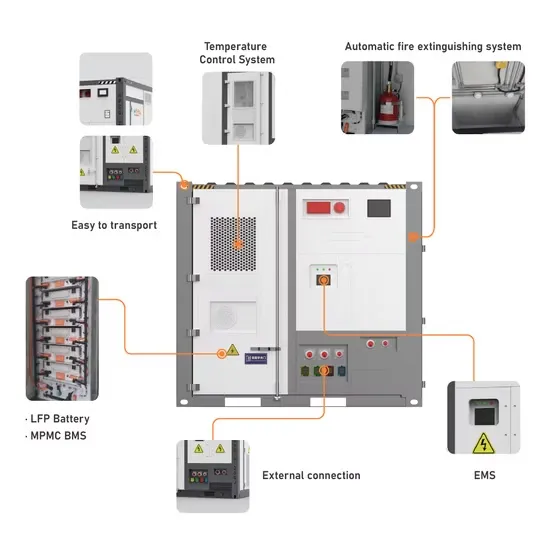

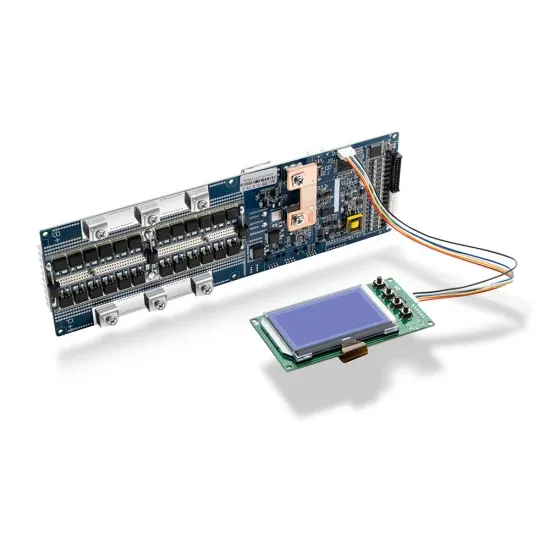

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

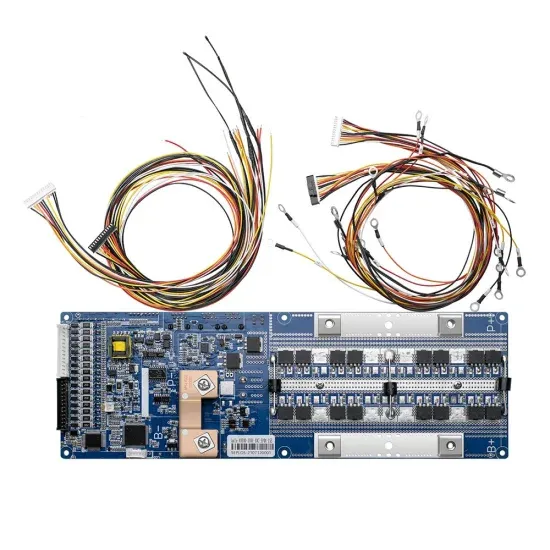

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.