EV battery-swapping finds new life in China

But, there are a lot to do for the popularization of battery-swapping. As of June 2020, 40 percent of the 452 battery-swapping stations in China were found in its capital

Get a quote

A new fully charged EV battery in five minutes: Are China''s swap

At a battery swap station near the Beijing Olympics Sports Centre, the owner of a Nio car watches as a fully charged battery is placed into his vehicle. The station''s staff drive

Get a quote

The Surge of Battery Swapping Stations: China

China is making big strides in electric vehicle infrastructure, especially with battery swapping stations. Recently, the country announced the deployment of 1,000

Get a quote

What China''s New Battery Swapping Stations Mean

It has been offering battery swapping as safe, user-friendly, and efficient, featuring a broadly automated system to minimize human

Get a quote

NIO''s 2,800th battery swapping station in China goes live

On December 16, NIO officially announced the launch of its 2,800th battery swapping station in China, and also stated that its users have conducted over 60 million battery swaps to date.

Get a quote

Nio reaches 3,000 swap stations in China

Nio (NYSE: NIO) has reached the milestone of 3,000 battery swap stations in China, as the electric vehicle (EV) maker continues to push forward

Get a quote

A new fully charged EV battery in five minutes: Are China''s swap

Chinese electric vehicle company Nio has now built over 3,300 battery swap stations in China, while Catl, China''s (and the world''s) largest EV battery producer, recently

Get a quote

China''s Swap Stations Are Charging Up | IMI

China has been testing battery swaps for some time, where drivers replace empty EV batteries with fully charged ones. Now it''s rapidly expanding stations, helped by its

Get a quote

Best top 10 battery swap station companies in China

At present, the battery swap services has formed a certain influence on market. This article focuses on the top 10 battery swap station

Get a quote

A new fully charged EV battery in five minutes: Are

A new fully charged EV battery in five minutes: Are China''s swap stations the future of electric cars? At a battery swap station near the Beijing

Get a quote

Nio marks 800+ battery swapping stations in China

The company already operates 828 stations in China, plus Nio recently opened the first battery swap outlet in Europe. Staying in China, for

Get a quote

EV battery swapping gains momentum in China

Rarely seen globally, there are already thousands of battery swap stations across China. China is combating EV infrastructural issues like long wait times for charging and

Get a quote

The Chinese EV Company That Made Battery Swapping Work

Over the next eight years, it pursued a multi-stage strategy to experiment with and expand the battery-swapping approach in China and Europe. By November 2023, Nio owned

Get a quote

Top 10 car battery swapping station manufacturers in

This article introduces the top 10 car battery swapping station manufacturers in China, including company and swapping products information.

Get a quote

China''s CATL to Launch 1,000 Battery Swap Stations in 2025

The company aims to establish 1,000 battery swap stations across China, including in Hong Kong and Macao, with a long-term objective of building 10,000 stations in

Get a quote

How China is driving battery swapping as a service in

As of June 2024, Nio had installed 2,432 power swap stations in China, including 804 swap stations based on highways. This represents the

Get a quote

China''s Swap Stations Are Charging Up | IMI

China has been testing battery swaps for some time, where drivers replace empty EV batteries with fully charged ones. Now it''s rapidly expanding

Get a quote

China''s CATL to Launch 1,000 Battery Swap Stations

The company aims to establish 1,000 battery swap stations across China, including in Hong Kong and Macao, with a long-term objective of

Get a quote

What China''s New Battery Swapping Stations Mean For The World

It has been offering battery swapping as safe, user-friendly, and efficient, featuring a broadly automated system to minimize human intervention and reduce swapping time for a

Get a quote

China''s EV Battery Swap Stations: The Future of

While battery swap stations offer a quick-fix solution, the extensive and constantly evolving infrastructure of fixed charging stations cannot be

Get a quote

A new fully charged EV battery in five minutes: Are

Chinese electric vehicle company Nio has now built over 3,300 battery swap stations in China, while Catl, China''s (and the world''s) largest EV

Get a quote

Battery-exchangeable electric car taxi starts full-scale

For reference, the battery replacement cost is calculated based on the mileage. For example, if you replace the battery when the accumulated

Get a quote

EV battery swapping gains momentum in China

Rarely seen globally, there are already thousands of battery swap stations across China. China is combating EV infrastructural issues like long

Get a quote

China''s CATL to operate 10,000 battery swap stations by 2030

The Chinese battery giant, starting this year, has been partnering with Chinese automaker GAC and ride-hailing platform Didi to build battery swap stations for commercial

Get a quote

China''s EV battery swapping stations surge despite

Recently, Nio''s battery swap stations have completed initial coverage of all counties in Guangdong province in southern China, marking

Get a quote

The Surge of Battery Swapping Stations: China Deploys 1000

China is making big strides in electric vehicle infrastructure, especially with battery swapping stations. Recently, the country announced the deployment of 1,000 new EV battery swapping

Get a quote

Nio reaches 3,000 swap stations in China

Nio (NYSE: NIO) has reached the milestone of 3,000 battery swap stations in China, as the electric vehicle (EV) maker continues to push forward with infrastructure

Get a quote

6 FAQs about [Are there any battery replacement stations in China ]

How many battery swap stations are there in China?

Chinese electric car company Nio has now built over 3,300 battery swap stations in China, but has also developed vehicles equipped with fast-charging technology (Credit: Iris Liu) The Chinese government has extended considerable financial assistance to battery swapping schemes.

How many Nio battery swap stations are there in China?

The company added six battery swap stations in China today, bringing the total number to 3,003, 949 of which are located along highways, according to data compiled by CnEVPost from Nio's charging map. Nio completed its first battery swap station in Shenzhen on May 20, 2018, and on July 6, 2022 saw the 1,000th battery swap station come online.

Does China support battery swapping?

The Chinese government has extended considerable financial assistance to battery swapping schemes. In its 2021 pilot programme, three of the 11 cities are primarily focusing on battery swapping for trucks. Some provinces in China have also provided substantial financial incentives for the advancement of battery swapping technology.

Are EV swap stations safe in China?

In 2021, China’s EV main regulatory body, the Ministry of Industry and Information Technology, published a safety standard for battery swap stations.

Will China expand battery swapping infrastructure in 2025?

Inconsistencies may occur. China's leading electric vehicle (EV) battery manufacturer, CATL, has announced plans to significantly expand its battery swapping infrastructure in 2025.

Are Chinese EV companies leading the battery swap trend?

EV maker Nio is leading the battery swap trend, but more Chinese EV companies and battery makers are joining in and standardizing battery specs. Experts point to profitability questions and investment hurdles as reasons this trend might not spread outside of China just yet.

Guess what you want to know

-

Battery replacement stations in Zambia

Battery replacement stations in Zambia

-

Canada has many lithium battery replacement stations

Canada has many lithium battery replacement stations

-

Distribution of 5G base stations in China Industrial Park Communications

Distribution of 5G base stations in China Industrial Park Communications

-

Lithium battery cost for energy storage power stations

Lithium battery cost for energy storage power stations

-

What are the base stations of China s communication network

What are the base stations of China s communication network

-

What are the specifications and sizes of battery cabinets for base stations

What are the specifications and sizes of battery cabinets for base stations

-

China digs out companies that have discovered batteries for communication base stations

China digs out companies that have discovered batteries for communication base stations

-

Battery foundation for residential rooftop communication base stations

Battery foundation for residential rooftop communication base stations

-

Zambia recruits battery energy storage for telecommunication base stations

Zambia recruits battery energy storage for telecommunication base stations

-

Mobile lithium battery for communication base stations

Mobile lithium battery for communication base stations

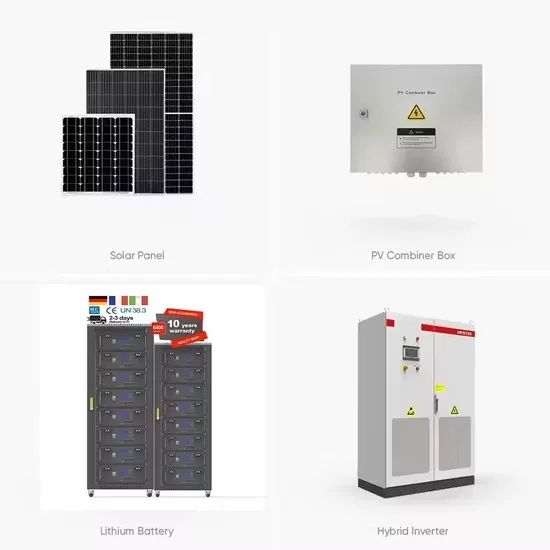

Industrial & Commercial Energy Storage Market Growth

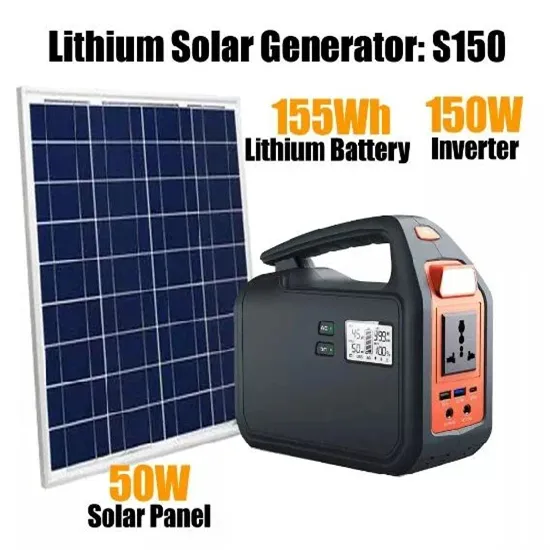

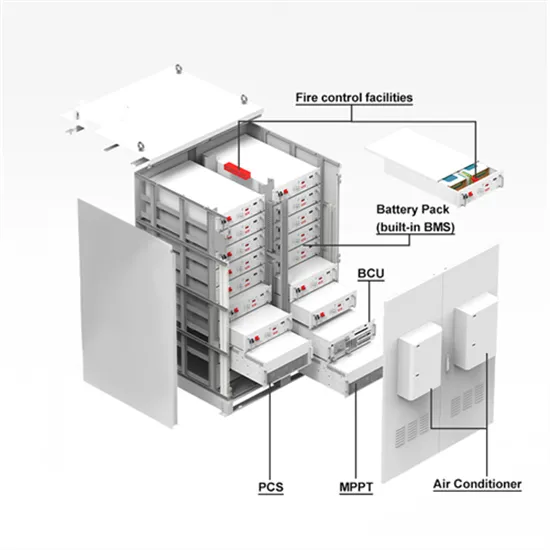

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

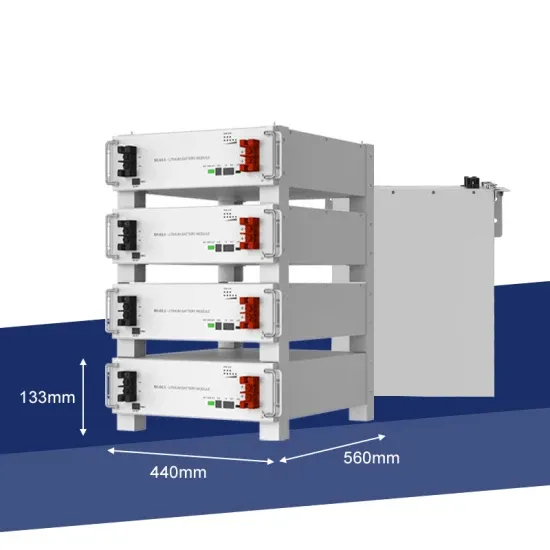

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.