Ukraine''s Energy Future: A Modern Blueprint with

By taking advantage of the simplified approval processes, Ukraine can develop new thermal generation capacity quickly and at a lower cost than

Get a quote

Ukraine''s Energy Future: Mapping Opportunities and

To support a green and sustainable energy transition in Ukraine, it is crucial to eschew investment projects that could trap Ukraine in lock-in

Get a quote

Ukraine''s Decentralised Energy Future: IEA

The report highlights distributed energy resources (DERs) as a vital solution to address their power deficit while enhancing Ukraine''s energy security, resilience, and

Get a quote

Russia hits Kyiv power facility as Trump says he''s ''not happy'' with

4 days ago· Russian drones attacked a thermal power generation facility in the Kyiv region overnight on Sunday, Ukraine''s Energy Ministry said.

Get a quote

Ukraine''s Energy Future: A Modern Blueprint with American

By taking advantage of the simplified approval processes, Ukraine can develop new thermal generation capacity quickly and at a lower cost than many European countries.

Get a quote

Keeping the lights on: How Ukraine can build a resilient energy

Looking ahead, the EU should apply the lessons from Ukraine to strengthen its own energy system – building resilience and removing structural vulnerabilities. One critical

Get a quote

As Ukraine Builds New Reactors, Renewables Beckon

What Ukraine needs and can afford during wartime, they argue, is a large number of smaller power plants—generators that are relatively cheap, quick to build, less reliant on the

Get a quote

Oil rigs moved due to iceberg threat ; OPEC daily basket price

Oil & Gas Jobs. Offshore Jobs. Maritime Jobs. Water Well Rigs Ingersoll Rand Rigs Gardner Denver Rigs Atlas Copco Rigs Speedstar Rigs Schramm Rigs Driltech Rigs Reichdrill Rigs

Get a quote

Container Generators in Odessa Ukraine Power Solutions for

Odessa, Ukraine''s bustling port city, faces unique energy challenges. From industrial zones to renewable projects, the demand for reliable power is soaring. Container generators have

Get a quote

Ukraine''s Energy Strategy Shows How Democracy Can Outlast

22 hours ago· Even as Russia targets Ukraine''s power grid, decentralized renewables, batteries, and global partnerships keep the lights on—and show how freedom bests autocracy.

Get a quote

Empowering Ukraine Through a Decentralised Electricity System

DERs – such as solar PV, wind, batteries, and small modular gas turbines – enable local power generation while also reducing vulnerability to targeted attacks. IEA

Get a quote

Ukrainian energy crisis

Ukrainian energy crisis In 2024, Ukraine faced an energy infrastructure crisis unprecedented in its national history as a result of sustained Russian military attacks on its power generation

Get a quote

Empowering Ukraine Through a Decentralised

DERs – such as solar PV, wind, batteries, and small modular gas turbines – enable local power generation while also reducing vulnerability to

Get a quote

How Ukraine Can Rebuild Its Energy System – Eurasia Review

The researchers created high-resolution maps of Ukraine''s various regions, showing the areas in which power generation from solar and wind energy is most favourable.

Get a quote

QIANEN 200KW Portable Solar Power Container System MPPT OEM Solar Power

Load Power (W) 200KW Pre-sales project design Y Brand Name QIANEN Model Number QN40HQ-M-200KW-HY Application Commercial Battery Type Lithium Ion Mounting Type

Get a quote

EBRD supports decentralisation of Ukraine power generation

Decentralising its energy system is a key priority for Ukraine, which is operating at about one-third of its pre-war generating capacity as a result of the Russian attacks.

Get a quote

Russia has occupied 18 GW of Ukrainian power generation since

Russia has occupied 18 GW of Ukrainian power generation since the start of the full-scale war in 2022. Source: Ukraine''s Energy Minister Herman Halushchenko Details: "The

Get a quote

Ukraine carries out one of its biggest-ever drone

Ukraine launched one of its biggest-ever drone attacks on Russia over the weekend, hitting a refinery and power station deep inside the country,

Get a quote

Why a decentralized grid is central to Ukraine''s efforts to rebuild

Hundreds of thousands of electricity distribution lines, substations, and high-voltage transformers have been destroyed, and power generation plants of all kinds remain

Get a quote

Keeping the lights on: How Ukraine can build a resilient energy

More than ever, Ukraine needs support to transition towards a long-term energy system that is resilient, flexible and secure. The EU has the expertise, the ability and the will to

Get a quote

Decentralizing Ukraine''s energy future: microgrids as

As Ukraine rebuilds its energy infrastructure, embracing decentralisation and microgrids is crucial for enhancing energy security,

Get a quote

Why a decentralized grid is central to Ukraine''s efforts

Hundreds of thousands of electricity distribution lines, substations, and high-voltage transformers have been destroyed, and power generation

Get a quote

Russia building major new explosives facility as

NEW YORK/LONDON - Russia is undertaking a major factory expansion in remote Siberia to ramp up production of a powerful explosive

Get a quote

Ukraine''s Energy Future: Mapping Opportunities and Challenges

To support a green and sustainable energy transition in Ukraine, it is crucial to eschew investment projects that could trap Ukraine in lock-in situations and instead promote a

Get a quote

As Ukraine Builds New Reactors, Renewables Beckon

What Ukraine needs and can afford during wartime, they argue, is a large number of smaller power plants—generators that are relatively cheap,

Get a quote

Decentralizing Ukraine''s energy future: microgrids as a path to

As Ukraine rebuilds its energy infrastructure, embracing decentralisation and microgrids is crucial for enhancing energy security, resilience and independence. However,

Get a quote

6 FAQs about [Ukraine container power generation]

Should Ukraine build a decentralized and diversified energy system?

The Ukrainian government (2023) recently declared that building a decentralized and diversified energy system—one that is more resilient against military attacks or natural disasters and can enhance energy security while facilitating the transition to renewable energy sources (RES)—will be a key priority.

Does Ukraine need a long-term energy system?

More than ever, Ukraine needs support to transition towards a long-term energy system that is resilient, flexible and secure. The EU has the expertise, the ability and the will to help make that happen. Ukraine's energy systems have suffered significant damage since the full-scale invasion of 2022.

Can a decentralised electricity system empower Ukraine?

Hence, in context of the report Empowering Ukraine Through a Decentralised Electricity System, a pioneering, detailed and bottom-up approach was developed to create a new high-resolution dataset of capacity and generation potential for Ukraine.

What kind of energy does Ukraine need?

Ukraine heavily depends on imported oil, coal and natural gas Before the war, Ukraine’s energy needs were met through a mix of domestic production and imports. According to the International Energy Agency (IEA), Ukraine’s total energy supply in 2022 comprised coal (21.7%), nuclear (26.5%), natural gas (25.1%) and oil (18.6%).

Should Ukraine embrace decentralisation and microgrids?

As Ukraine rebuilds its energy infrastructure, embracing decentralisation and microgrids is crucial for enhancing energy security, resilience and independence. However, overcoming legislative and regulatory barriers is essential for unlocking the full potential of these technologies.

How can Ukraine build a more resilient and modern power system?

The roadmap also lays out seven key policy recommendations for Ukraine to build a more resilient and modern power system by establishing a vision for decentralisation and by strengthening regulatory frameworks, coordination mechanisms, electricity markets and relevant technical requirements.

Guess what you want to know

-

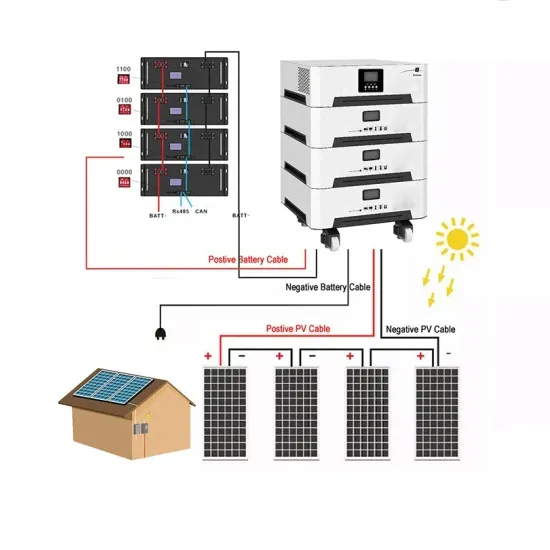

Photovoltaic power generation container power connection

Photovoltaic power generation container power connection

-

Cargo ship power generation container

Cargo ship power generation container

-

Qatar container power generation

Qatar container power generation

-

Northern Cyprus container BESS power generation

Northern Cyprus container BESS power generation

-

Spanish power generation container

Spanish power generation container

-

Laos power generation container

Laos power generation container

-

Refrigerated container with power generation

Refrigerated container with power generation

-

Niger container power generation manufacturer

Niger container power generation manufacturer

-

Myanmar container power generation and communication power supply

Myanmar container power generation and communication power supply

-

French power generation equipment container house

French power generation equipment container house

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.