Investing in wind power: an investment that pays off?

The opportunities, risks and possibilities of investing in wind power: everything you need to know, here in the guide from klimaVest.

Get a quote

Investing in a Clean Energy Future: Solar Energy Research,

Solar Investment Supports the U.S. Clean Energy Revolution Solar will play an important role in reaching President Biden''s 2035 clean electricity goal – alongside other important clean

Get a quote

The Ultimate Guide to Wind Energy Investing

This ultimate guide will provide you with a comprehensive understanding of wind energy investing, from the basics of wind power to strategies for making informed investment

Get a quote

Investing in Wind Power: A Guide for New Market

From public-private partnerships to green bonds and equity financing, there are various ways to fund wind power projects. Evaluating the

Get a quote

What are the Advantages of Wind Energy and Solar

Utility-scale wind — Wind turbines bigger than 100 kilowatts that deliver electricity to power grids and end users via electric utilities or power

Get a quote

How to Invest in Wind Energy

Individuals can invest in the wind energy industry directly by investing in companies that operate wind farms or indirectly by putting money into companies that

Get a quote

How to Invest in Wind Energy: Key Strategies and Financial Insights

Discover practical strategies and financial insights for investing in wind energy, from equity opportunities to tax considerations and diversified investment options.

Get a quote

6 Best Renewable Energy Stocks to Buy | Investing

Tags: renewable energy, investing, money, wind power, solar energy, water, energy, natural gas, NextEra Energy, Fluence Energy, foreign

Get a quote

Should You Invest in Offshore Wind Energy?

Wind energy plays a big role as the U.S. moves away from fossil fuels. One of the reasons now may be a good time to invest in the domestic offshore wind industry is that the

Get a quote

Wind Power Investment → Term

Fundamentals Wind Power Investment, at its most straightforward, represents the allocation of resources – financial, technological, and human – towards projects that harness

Get a quote

How to Invest in Renewable Energy | Opportunities

Wind turbines: Direct investment in wind energy projects can involve the acquisition, development, or financing of wind farms, both onshore

Get a quote

Renewable Energy Investing | Definition & Factors to

Renewable energy investing refers to allocating financial resources to companies, projects, or financial instruments focused on generating energy

Get a quote

Investing in Wind Power: A Guide for New Market Entrants

From public-private partnerships to green bonds and equity financing, there are various ways to fund wind power projects. Evaluating the pros and cons of each model will

Get a quote

Top Wind Energy Stocks to Add to Your Portfolio for Solid Returns

4 Wind Energy Stocks to Bet on Now AES Corporation is a leading power generation and utility company in the United States and internationally. The company currently

Get a quote

Home wind turbine system: It''s renewable energy you

Wind turbines convert wind''s energy into mechanical power that can be used to run a generator to produce clean electricity without relying on

Get a quote

Best Wind Power Stocks – Forbes Advisor

For investors looking to play alternative energy, Forbes Advisor has chosen wind power stocks that we believe provide a unique opportunity for investors. The following

Get a quote

Best Wind Power Stocks – Forbes Advisor

For investors looking to play alternative energy, Forbes Advisor has chosen wind power stocks that we believe provide a unique opportunity for

Get a quote

Should You Invest in Offshore Wind Energy?

Wind energy plays a big role as the U.S. moves away from fossil fuels. One of the reasons now may be a good time to invest in the domestic

Get a quote

Investing in wind power: an investment that pays off?

The opportunities, risks and possibilities of investing in wind power: everything you need to know, here in the guide from klimaVest.

Get a quote

5 Ways to Get Started in Wind Energy Investment

Instead of choosing one sole company to invest in, you''ll have the opportunity to focus your energy on a sector of renewable energy, such as wind turbines. Explore all the

Get a quote

Renewable Energy Investment Soars With Record

Major corporations and state governments are making record investments in wind and solar projects, reshaping the energy market. With

Get a quote

Wind Investments: How To Invest in Wind Energy

Wind power is becoming an integral part of the national energy grid. This article looks at several idea for how investors can gain exposure.

Get a quote

6 FAQs about [Invest in wind power systems]

How to invest in wind energy?

There are several ways to invest in wind energy through stocks. Most notably, you can invest in companies that build turbines and other essential equipment for building wind farms. You can invest in companies that generate and sell wind energy. Or you can invest in an exchange-traded fund (ETF) or mutual fund built around this industry as a whole.

Why should you invest in wind power?

More domestic energy production means more job opportunities. The U.S. can lead in wind energy capacity and provide job growth at the same time. By investing in wind power, you’re investing in the US economy. There’s no need for new land acquisition. Unlike other energy sources, wind turbines can be built on existing farms.

What are wind energy investments?

Wind energy investments are financial stakes in companies and projects focused on generating electricity through wind power. Wind turbines, sometimes called windmills, harness this power by collecting the energy created by wind and converting it into electricity.

Should you invest in wind energy stocks?

Investors who don’t want to pick individual stocks to invest in can always look to mutual funds and exchange-traded funds (ETFs) that provide exposure to wind energy companies and investments. A growing number of index funds invest in a basket of companies involved in the wind energy industry.

Are wind turbines a good investment?

Truthfully, there are actually more than a few benefits that investing in wind turbines will bring. These include: Wind power is a cost-effective energy source. Since fuel is free, there’s a cost savings for using wind power. In fact, wind power is one of the lowest-cost energy sources available. Wind turbines allow for domestic growth.

Should you invest in offshore wind energy?

If you're an investor interested in the energy transition in the U.S., it's worth considering offshore wind energy. While onshore wind has been a leader in installed capacity, offshore wind is a growing opportunity with giant wind farms out in the ocean or in the Great Lakes.

Guess what you want to know

-

Small and medium-sized wind power generation systems in Vietnam

Small and medium-sized wind power generation systems in Vietnam

-

What soft systems does a wind power plant have

What soft systems does a wind power plant have

-

What are the energy storage systems in the wind power market

What are the energy storage systems in the wind power market

-

Eight wind power systems

Eight wind power systems

-

Innovation in wind power generation systems

Innovation in wind power generation systems

-

Photovoltaic and wind power generation systems in Cape Verde

Photovoltaic and wind power generation systems in Cape Verde

-

Types of Wind Power Generation Systems

Types of Wind Power Generation Systems

-

Forestry photovoltaic and wind power generation systems

Forestry photovoltaic and wind power generation systems

-

Wind power station data collection system

Wind power station data collection system

-

The weight of a 20kw wind power generation system

The weight of a 20kw wind power generation system

Industrial & Commercial Energy Storage Market Growth

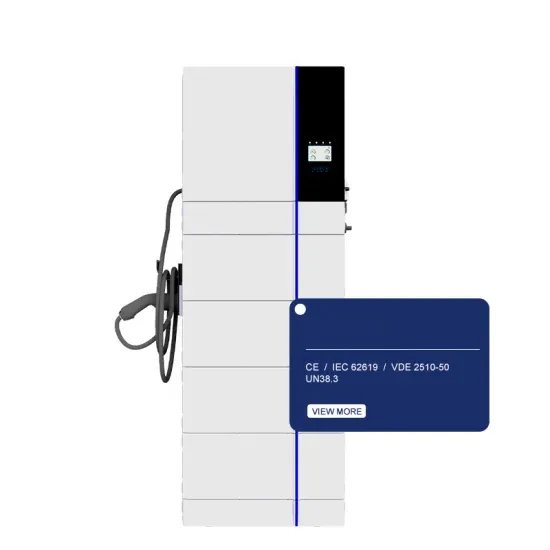

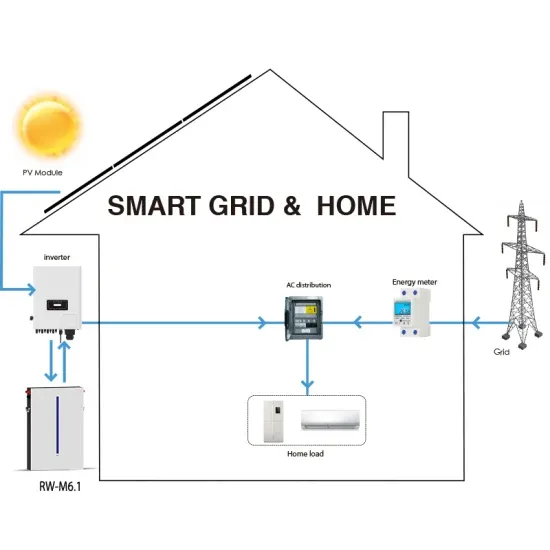

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.