The Global Solar Panel Market to Skyrocket on the Shift Towards

Starting from 2021, electricity generated by new solar capacities is to be sold either at local coal-fired power prices or at market prices. This may hamper the domestic solar panel market

Get a quote

How Trade Policies Are Reshaping Global Solar PV Markets

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral agreements that significantly

Get a quote

How to sell solar panels for foreign trade | NenPower

To effectively sell solar panels for foreign trade, one must navigate a landscape of regulatory, economic, and technological factors. 1.

Get a quote

US-China solar power rivalry: A global battleground

Stricter trade measures may protect US companies but could also drive-up solar panel prices, potentially slowing the deployment of renewable energy. As solar power

Get a quote

''Solar strike'': US imposes up to 3521% tariffs on Asian battery

The United States has imposed new duties of up to 3521% on imports of solar panels from four Southeast Asian countries, Bloomberg reports. The tariffs announced on April 21 are the

Get a quote

Solar panels foreign trade market

Foreign-made solar panels flood into US, hit 14.2 GW in Q3 Measured by panel capacity, US imports totaled 14.2 GW the third quarter, up from 11.6 GW in the second quarter, according to

Get a quote

Making solar a source of EU energy security

Europe''s solar dependency on China By 2008, China emerged as the dominant producer of solar PV panels. By 2012, it accounted for 64 % of worldwide production and, as of 2017, eight of

Get a quote

How about solar energy foreign trade products | NenPower

Solar energy foreign trade products encompass a diverse array of goods and technologies associated with solar power generation, distribution, and utilization. 1. Growth

Get a quote

U.S. trade uncertainty presents domestic opportunities

Solar panel modules are larger assemblies comprised of multiple solar cells, cell wiring, frames, glass, and other bonding and sandwiching

Get a quote

How Tariffs Could Upend the Transition to Cleaner

The share of Chinese exports of wind turbines, solar panels and electric vehicles that go to low- or middle-income countries, as opposed to the

Get a quote

Powering trade: Fine-tuning trade policy for solar and wind energy

Most developing countries are slipping into traditional trade patterns, exporting raw materials for solar and wind energy technologies while importing intermediate and finished products. Better

Get a quote

The State of the Solar Industry

"Net Generation" includes DPV generation. Net generation does not take into account imports and exports to and from each state and therefore the percentage of solar consumed in each state

Get a quote

Reconfiguring Globali sation: A Review of Tariffs, Industrial

Xinjiang, where industrial power prices consistently undercut those in the power-deficient Eastern regions. Local governments seized this opportunity to foster upstream solar industry clust

Get a quote

How is the foreign trade of solar energy products? | NenPower

The foreign trade landscape of solar energy products reflects an evolving and complex interplay between market dynamics, technological advancements, and environmental

Get a quote

Trump tariffs deal damage to US solar

US industries are broadly grappling with the new foreign trade policy environment onset by President Donald Trump''s "reciprocal tariffs" that apply

Get a quote

US tariffs, Europe slowdown reshape global solar panels trade

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since the first round of tariffs in June. In the

Get a quote

Distributed solar power generation foreign trade export

Legislative support for solar power has existed since 2013 and the total installed capacity of distributed solar generation reached 270 MW in 2022. Uruguay receives an average 1,700 KW

Get a quote

What are the import tariffs and trade policies affecting solar

Snippet paragraph: Current U.S. solar panel tariffs include Section 201 at 14%, anti-dumping duties up to 50%, and Section 301 at 25% on Chinese goods. Section 201 applies to

Get a quote

U.S. Solar Tariff Decision Sets Stage for Stronger Trade Fairness

In a move aimed at reinforcing fair trade practices and boosting the domestic clean energy sector, the United States has finalized tariff measures on solar cell imports from

Get a quote

What are the import tariffs and trade policies affecting solar panels

Snippet paragraph: Current U.S. solar panel tariffs include Section 201 at 14%, anti-dumping duties up to 50%, and Section 301 at 25% on Chinese goods. Section 201 applies to

Get a quote

Powering trade: Fine-tuning trade policy for solar and

Most developing countries are slipping into traditional trade patterns, exporting raw materials for solar and wind energy technologies while importing

Get a quote

3,500 percent solar tariff divides US industry

The International Trade Commission concluded unanimously that U.S. manufacturers have been "materially injured" by imported solar cells and panels from

Get a quote

American Alliance for Solar Manufacturing Trade

Solar power stands as the most cost-effective source of new electricity generation capacity. In 2023, less than one-third of the 35 GW of new solar panels

Get a quote

US tariffs, Europe slowdown reshape global solar

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since

Get a quote

Shining a Light on Global Solar Trade for Businesses

This in-depth analysis compares solar trade policies across key global markets, helping businesses understand the impact on supply chains, project costs, and international solar

Get a quote

How Trade Policies Are Reshaping Global Solar PV

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral

Get a quote

The Outlook for Global Solar Energy Continues to Be Bright

Policymakers in some of the world''s largest economies are reducing support for solar power generation. Even so, Goldman Sachs Research expects rapid growth in the

Get a quote

3,500 percent solar tariff divides US industry

The International Trade Commission concluded unanimously that U.S. manufacturers have been "materially injured" by imported solar cells and

Get a quote

6 FAQs about [Solar panel power generation foreign trade]

How do international trade policies shape the global solar photovoltaic landscape?

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral agreements that significantly impact market dynamics and industry growth.

How does international trade affect solar PV?

International trade policies significantly influence manufacturing costs and investment returns throughout the solar PV supply chain. Tariffs and trade barriers can increase component prices by 10-30%, directly impacting module costs and project viability.

How do regional trade agreements shape the global solar PV market?

Regional trade agreements significantly shape the global solar PV market through preferential tariffs and standardized regulations. The European Union’s Solar Alliance and the Asia-Pacific Economic Cooperation (APEC) Renewable Energy Partnership stand out as influential frameworks that facilitate cross-border solar technology trade.

Which countries export solar panels to the United States?

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since the first round of tariffs in June. In the same period, exports from regional neighbours Indonesia and Laos grew around eight-fold, the trade data showed.

How is the solar PV industry adapting to changing trade policies?

The solar PV industry demonstrates remarkable resilience in adapting to evolving trade policies through strategic diversification and innovation. Companies are increasingly establishing regional manufacturing hubs to mitigate tariff impacts and reduce supply chain vulnerabilities.

Are US manufacturers'materially injured' by imported solar panels?

The International Trade Commission concluded unanimously that U.S. manufacturers have been “materially injured” by imported solar cells and panels from Cambodia, Malaysia, Thailand and Vietnam. The commission’s finding clears the way for the Commerce Department to issue the trade penalties.

Guess what you want to know

-

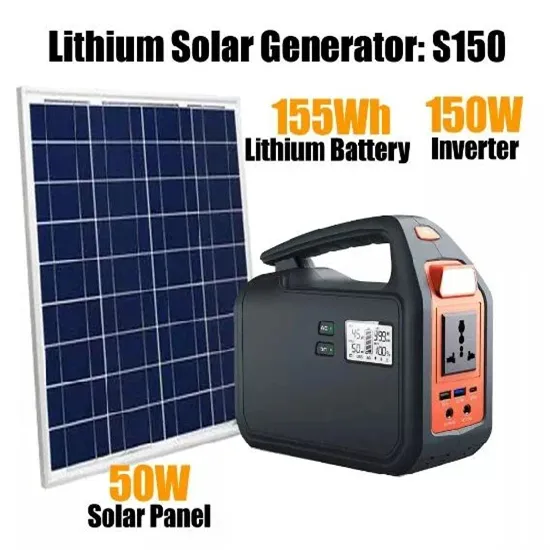

Solar power generation panel supporting system

Solar power generation panel supporting system

-

Rooftop solar panel power generation system

Rooftop solar panel power generation system

-

Brunei container solar panel power generation

Brunei container solar panel power generation

-

Solar panel photovoltaic power generation transformer

Solar panel photovoltaic power generation transformer

-

Home solar panel power generation system

Home solar panel power generation system

-

South Korea Solar Panel Photovoltaic Power Generation Project

South Korea Solar Panel Photovoltaic Power Generation Project

-

Guinea Photovoltaic Power Generation Curved Solar Panel Wholesale

Guinea Photovoltaic Power Generation Curved Solar Panel Wholesale

-

Saint Lucia Solar Panel Power Generation Project

Saint Lucia Solar Panel Power Generation Project

-

Solar panel power generation system project

Solar panel power generation system project

-

Bosnia and Herzegovina 20 watt solar panel power generation

Bosnia and Herzegovina 20 watt solar panel power generation

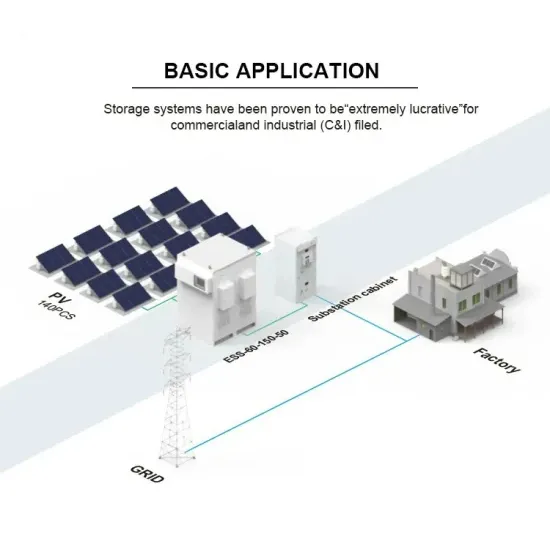

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.