Solar exports from China increase by a third

The growth in solar exports from China is helping to meet growing demand for clean, affordable power, driven by markets like Europe and South Africa that are aiming to

Get a quote

Carbon Footprint Comparison of Photovoltaic Industries in China

Eighty-five percent of the embodied GHG emissions are from PV panel production processes in China and other Asia–Pacific countries.

Get a quote

China dominates EU solar photovoltaic (PV) market: 98% of solar panels

The European Union''s green transition is hampered by its dependence on China for solar photovoltaic panels. Despite efforts to reduce energy dependence, 98% of solar panel

Get a quote

Smarter European Union industrial policy for solar panels

Executive summary The European Union plans a major increase in solar PV capacity from 263 GW today to almost 600 GW by 2030. If nothing changes, this expansion

Get a quote

China dominates EU solar photovoltaic (PV) market:

The EU imported €19.7 billion worth of solar photovoltaic panels from China in 2023. In 2023, the EU imported €19.7 billion worth of solar

Get a quote

Billions of dollars of Chinese solar panels sit in European

European imports of Chinese solar photovoltaic (PV) panels have significantly outpaced installations, underscoring Europe''s continued dependence on inexpensive Chinese

Get a quote

China-EU green energy partnership drives sustainable

Amid lush greenery, fragrant flowers, and the gentle murmur of grazing flocks of sheep lies an endless array of photovoltaic panels, creating a mesmerizing scene of

Get a quote

China dominates the world in renewable energy,

Asia How China came to dominate the world in renewable energy China now eclipses every other country in the world — including the United

Get a quote

With solar industry in crisis, Europe in a bind over

Europe''s green energy transition is stuck between a rock and a hard place. A flood of cheap Chinese solar panel imports is driving record

Get a quote

China dominates EU solar photovoltaic (PV) market:

The European Union''s green transition is hampered by its dependence on China for solar photovoltaic panels. Despite efforts to reduce

Get a quote

China accounted for 98% of all solar panels imported into the EU

China is by far the largest exporter of solar panels to the European Union, accounting for 98% of all EU imports in 2023, new data from Eurostat has shown.

Get a quote

Outshone By China, Can Europe Make A Solar Comeback Before

While China''s dominance of solar manufacturing is undisputed, a growing chorus of investors, innovators, and policymakers believes Europe can still rebound—if it acts decisively.

Get a quote

China-EU green energy partnership drives sustainable

As exemplified by the Spanish PV plant, China''s rapid progress in the renewable energy sector has played a pivotal role in advancing the European Union''s (EU) green transition.

Get a quote

Worldwide rooftop photovoltaic electricity generation

Rooftop photovoltaic systems are often seen as a niche solution for mitigation but could offer large-scale opportunities. Using multi-source

Get a quote

European solar report hails China''s role in green energy expansion

China accounted for around half of both newly added and total global solar photovoltaic (PV) capacity in 2024, a milestone hailed by European analysts as a major

Get a quote

Billions of dollars of Chinese solar panels sit in

European imports of Chinese solar photovoltaic (PV) panels have significantly outpaced installations, underscoring Europe''s continued

Get a quote

Life Cycle Assessment of Future Photovoltaic

The photovoltaics (PV) industry is growing rapidly to meet the increasing demand of green power. As the industry grows, the manufacturing processes and the

Get a quote

Making solar a source of EU energy security

Europe''s solar dependency on China By 2008, China emerged as the dominant producer of solar PV panels. By 2012, it accounted for 64 % of worldwide production and, as of 2017, eight of

Get a quote

EU launches 2 probes into China solar manufacturers

One includes the German subsidiary of Longi Green Energy Technology, one of the world''s largest manufacturers of photovoltaic cells and solar panels. The other is made up of

Get a quote

EU snubs dying solar manufacturers as China poised to

EU snubs dying solar manufacturers as China poised to swallow market The industry asked the European Commission for urgent help to keep factories open as layoffs begin.

Get a quote

With solar industry in crisis, Europe in a bind over Chinese imports

Europe''s green energy transition is stuck between a rock and a hard place. A flood of cheap Chinese solar panel imports is driving record solar energy installations.

Get a quote

China Photovoltaic Greenhouse Manufacturers Factory

Solar Panel Greenhouse Solar pv greenhouse is a greenhouse that integrates photovoltaic power generation, intelligent control, and modern planting technology.

Get a quote

Renewable energy

Renewable energy sources, such as solar and wind power, have seen significant cost reductions over the past decade, making them more competitive with traditional fossil fuels. [5] In some

Get a quote

China accounted for 98% of all solar panels imported

China is by far the largest exporter of solar panels to the European Union, accounting for 98% of all EU imports in 2023, new data from Eurostat

Get a quote

Europe hoarding Chinese solar panels

European countries are desperate to get their hands on affordable solar infrastructure to advance their renewable energy targets, decarbonize and avoid paying

Get a quote

China''s dominance of solar poses difficult choices for

China manufactures 80 per cent of all the solar panels produced globally. And, as the IEA notes, China''s dominance is even more pronounced

Get a quote

6 FAQs about [China-Europe photovoltaic panels greenhouse solar energy]

Are Chinese-manufactured solar panels putting up in European warehouses?

Chinese-manufactured solar photovoltaic (PV) panels are piling up in European warehouses, with Rystad Energy forecasting 100 GWdc of solar capacity in storage by the end of 2023.

Why are Chinese solar panels being shipped to Europe?

Tough tariffs against Chinese imports in the US means that most excess panels are shipped to Europe. Xuyang Dong of Climate Energy Finance, an Australian think-tank, said that “China’s estimated wafer, cell and module capacity that will come online in 2024 is sufficient to meet annual global demand now through to 2032.

Where do European solar panels come from?

The vast majority of those panels and parts came from China – in some cases, 95%, International Energy Agency data show. Yet the green energy boom hasn't helped Europe's few local solar panel manufacturers, which have hit crisis point, crushed by cheaper imports and oversupply.

Are cheap Chinese solar panels driving record solar energy installations?

A flood of cheap Chinese solar panel imports is driving record solar energy installations. But those same imports are crushing Europe's few local solar manufacturers. Governments and industry are split over how to respond. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here.

Is Europe playing catch up with China's solar industry?

With some Chinese solar firms able to sell even below production costs, Europe is playing catch up. "The solar industry in China has been strategically subsidised with hundreds of billions of dollars for years," Erfurt told Reuters. ($1 = 0.9310 euros) Reporting by Kate Abnett and Nina Chestney.

When will European Solar supply chain leaders buy European solar panels?

Although efforts are underway to build a reliable solar supply chain in Europe, the need for panels now means leaders cannot wait until 2025 or later to buy European. Marius Mordal Bakke, senior supply chain analyst, Rystad Energy

Guess what you want to know

-

Photovoltaic panels greenhouse solar energy in Lebanon

Photovoltaic panels greenhouse solar energy in Lebanon

-

Solar photovoltaic panels provide on-site energy

Solar photovoltaic panels provide on-site energy

-

The highest solar energy conversion rate of photovoltaic panels

The highest solar energy conversion rate of photovoltaic panels

-

Lebanon s new energy photovoltaic solar panels

Lebanon s new energy photovoltaic solar panels

-

Energy storage cabinet outdoor solar panels installed in carport photovoltaic

Energy storage cabinet outdoor solar panels installed in carport photovoltaic

-

North Korea s new energy photovoltaic solar panels

North Korea s new energy photovoltaic solar panels

-

Energy storage container solar photovoltaic greenhouse

Energy storage container solar photovoltaic greenhouse

-

China s energy storage container solar photovoltaic panels

China s energy storage container solar photovoltaic panels

-

Solar ultra-large energy storage photovoltaic panels

Solar ultra-large energy storage photovoltaic panels

-

Niue photovoltaic panel greenhouse solar energy

Niue photovoltaic panel greenhouse solar energy

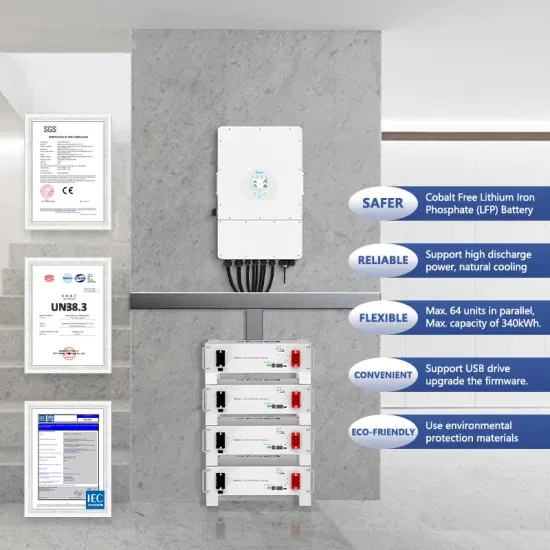

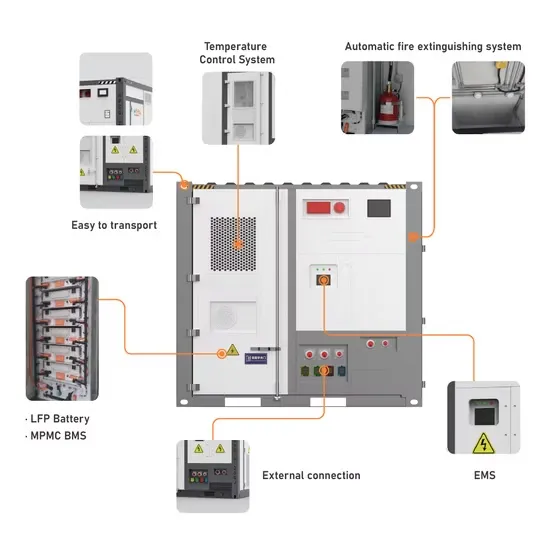

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

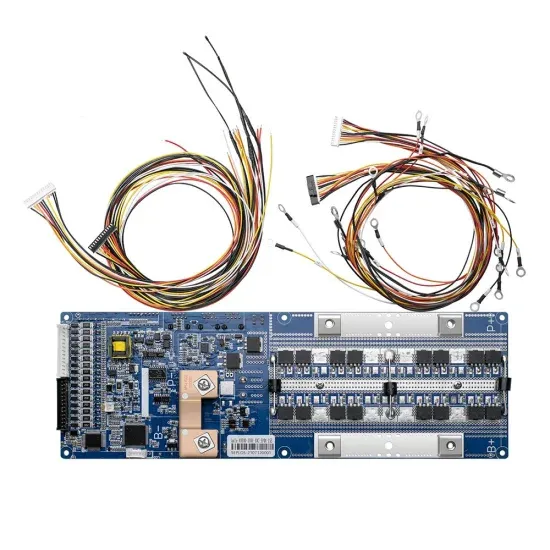

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.