Solar Energy Suppliers In Europe

my-PV was founded in 2011 by Dr. Gerhard Rimpler and Markus Gundendorfer, two former executives of a solar inverter manufacturer. Many years of experience, idealism, persistence,

Get a quote

Inverter Manufacturer Suppliers In Europe

my-PV was founded in 2011 by Dr. Gerhard Rimpler and Markus Gundendorfer, two former executives of a solar inverter manufacturer. Many years of experience, idealism, persistence,

Get a quote

The weekend read: Europe''s inverted solar ambition – pv

IHS Markit put the European share at around 24% of the world''s inverter market in 2020, falling over the past decade. Germany''s SMA alone shipped 50% of the world''s single

Get a quote

Europe PV inverter Companies | Market Research Future

Elevate your solar projects with Europe PV Inverter Companies. Harnessing the power of photovoltaics, these companies redefine energy efficiency and reliability across the European

Get a quote

Top 10 solar PV inverter vendors account for 86% of

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year

Get a quote

Top PV inverter brands in the EU

The EU Solar Manufacturing map gives an overview of solar manufacturing companies active along the solar PV chain. On this map, you''''ll find manufacturers spanning from polysilicon to

Get a quote

Top 8 Solar Inverter Manufacturers in Europe: 2025 Guide

This article will focus on the top eight solar inverter manufacturers that are paving the way for a sustainable future in Europe. And if you are aslo interested in solar panel manufacturers in

Get a quote

European Solar Inverter Industry Bids for IPCEI

The European solar industry has launched their initiative to deliver an Important Project of Common European Interest (IPCEI) for solar inverters. At the launch of the paper

Get a quote

Leading Solar Inverter and Energy Storage Solutions Provider

Sungrow, a global leader in renewable energy solutions in the USA, provides innovative solar power systems for diverse programs in North America.

Get a quote

Solarworld

Leading the inverter shipments statistics for the past 4 consecutive years, Huawei developed to the largest inverter manufacturer globally. Highly efficient inverters for residential, commercial

Get a quote

Top 8 Solar Inverter Manufacturers in Europe (2024)

The pivotal role of solar inverters in maximizing the potential of solar energy systems has driven the growth of many outstanding manufacturers in this region. This article will focus on the top

Get a quote

Top 5 inverter manufacturers in Europe

In the growing renewable energy storage industry, inverters that convert DC power stored by the battery into usable AC power are essential. The article provides profiles of the

Get a quote

Inverters Explained 2.0: Strengthening Europe''s Inverter Industry

The industry employed around 35,000 jobs in the EU in 2023, making it the most significant contributor of solar manufacturing employment in Europe. However, European

Get a quote

Top 8 Solar Inverter Manufacturers in Europe (2024)

The pivotal role of solar inverters in maximizing the potential of solar energy systems has driven the growth of many outstanding manufacturers in this

Get a quote

Top 10 Best Inverter Manufacturers in Europe

In this article, we will inform you About the Top 10 best inverter manufacturers in Europe, which include SMA Solar Technology, REFUsol, Tycorun, KACO New Energy,

Get a quote

Inverter Manufacturer Suppliers In Europe

Since our start in 2007, we have become one of the biggest solar inverter manufacturers in China. In 2009, our idea grew into a movement, spreading to Europe and Australia.

Get a quote

New inverter certification to bolster Huawei''s focus on

And with Huawei''s inverters now found to be compliant with Spain''s grid codes, a spokesperson for the manufacturer told PV Tech the

Get a quote

Southern European quality inverter recommended manufacturers

Which country is the largest solar inverter market in Europe? In particular, Germany is expected to be a significant market for these companies due to its status as Europe''s largest solar

Get a quote

Europe Solar Inverter Companies

Get access to the business profiles of top 10 Europe Solar Inverter companies, providing in-depth details on their company overview, key products and services, financials, recent developments

Get a quote

Top 10 Solar PV Inverter Manufacturers 2024 in the

The solar industry is booming in 2024, and solar PV inverter manufacturers are key players in this growth. From residential setups to large

Get a quote

The weekend read: Europe''s inverted solar ambition –

IHS Markit put the European share at around 24% of the world''s inverter market in 2020, falling over the past decade. Germany''s SMA alone

Get a quote

Europe Solar PV Market Share, Outlook 2025-2034

The Europe solar PV market size crossed USD 63.1 billion in 2024 and is set to register at a CAGR of 7.1% from 2025 to 2034, due to the growing focus on

Get a quote

Inverter Manufacturer Suppliers In Europe

Established in 2006, SolarEdge developed the DC optimized inverter solution that changed the way power is harvested and managed in photovoltaic (PV) systems. The SolarEdge intelligent

Get a quote

6 FAQs about [Southern Europe Photovoltaic Inverter Manufacturer]

Who are the top 5 solar inverter manufacturers in Europe in 2024?

ABB’s commitment to quality and innovation is reflected in the robustness and efficiency of its solar inverter solutions. In conclusion, this article introduces the top 5 inverter manufacturers in Europe in 2024, namely Solaredge, Power Electronics, SMA, INGETEAM and ABB.

Who is a leader in Europe solar inverter market?

Schneider Electric SE, Siemens AG, FIMER SpA, Mitsubishi Electric Corporation and General Electric Company are the major companies operating in the Europe Solar Inverter Market. This report lists the top Europe Solar Inverter companies based on the 2023 & 2024 market share reports.

Does Europe have a solar inverter industry?

Ensuring interoperability. Europe has a strong foundation in its inverter manufacturing industry. In 2023, there was equivalent of 82.1 GW of solar inverter manufacturing capacity in the EU (compared to around 60 GW of solar installed in the same period).

Which country is the largest solar inverter market in Europe?

In particular, Germany is expected to be a significant market for these companies due to its status as Europe's largest solar photovoltaic market. These corporations are also expected to benefit from trends such as an increase in larger solar PV installations. 1. COMPETITIVE LANDSCAPE Who are the key players in Europe Solar Inverter Market?

How competitive is the European solar inverter market?

The European solar inverters market is highly competitive and fragmented, with several key players striving for innovation and adoption of the latest solar technologies. These businesses are focusing on the development of central inverters, which are often used in solar photovoltaic systems with rated outputs over 100 kWp.

Who makes the most solar PV inverters in the world?

In 2023, the global shipment of solar PV inverters reached 536 GWac, with Chinese solar inverter manufacturers responsible for half of these shipments. Companies like Huawei, Sungrow, and Ginlong Solis dominate the top ranks, securing more than 50% of the global market share.

Guess what you want to know

-

Southern Europe Photovoltaic Grid-connected Inverter

Southern Europe Photovoltaic Grid-connected Inverter

-

Southern Europe Photovoltaic Equipment Container

Southern Europe Photovoltaic Equipment Container

-

Lesotho rooftop photovoltaic inverter manufacturer

Lesotho rooftop photovoltaic inverter manufacturer

-

Swedish solar photovoltaic water pump inverter manufacturer

Swedish solar photovoltaic water pump inverter manufacturer

-

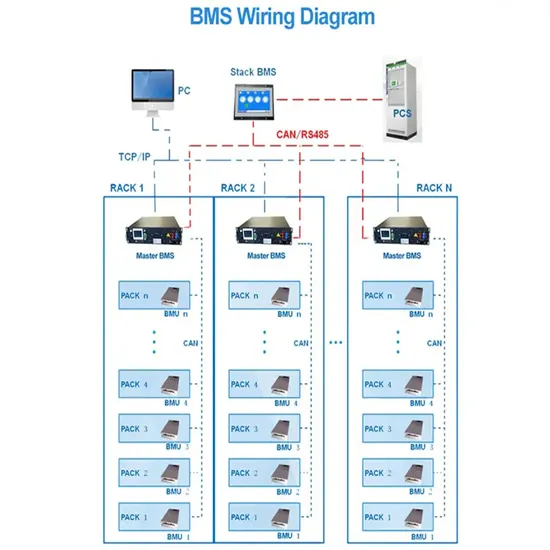

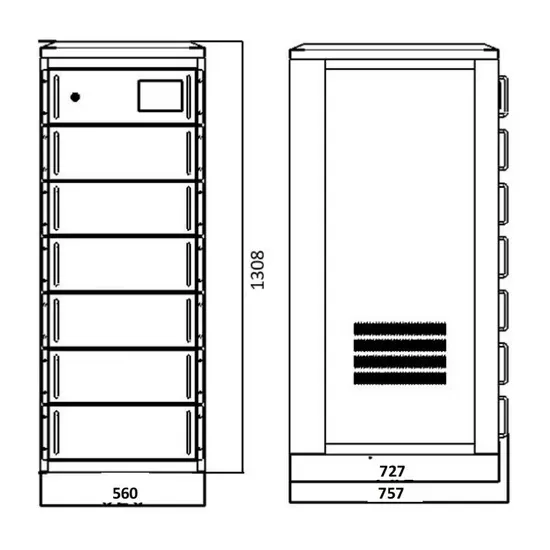

Southern Europe lithium battery bms manufacturer

Southern Europe lithium battery bms manufacturer

-

Sudan Micro Photovoltaic Inverter Manufacturer

Sudan Micro Photovoltaic Inverter Manufacturer

-

South Korean photovoltaic energy storage 80kw inverter manufacturer

South Korean photovoltaic energy storage 80kw inverter manufacturer

-

Chilean solar photovoltaic water pump inverter manufacturer

Chilean solar photovoltaic water pump inverter manufacturer

-

Burkina Faso home photovoltaic inverter manufacturer

Burkina Faso home photovoltaic inverter manufacturer

-

Philippines photovoltaic energy storage 300kw inverter manufacturer

Philippines photovoltaic energy storage 300kw inverter manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.