China miles ahead of the US in clean energy race

The U.S. added 33 GW of solar and 12 GW of wind capacity, far behind China''s scale. The IEA projects that the U.S. will remain the second-largest contributor to renewable

Get a quote

Comprehensive review of the material life cycle and sustainability

Given its rapid growth potential and the considerable investments involved, the PV market is increasingly competitive globally, particularly in Europe, China, and the United States [2].

Get a quote

How the US Lost the Solar Power Race to China

Bloomberg Opinion''s climate columnist visited Michigan, the former heart of the solar industry, and China to learn how good, old-fashioned

Get a quote

Shaping the solar future: An analysis of policy evolution,

Over recent decades, China has risen to a preeminent global position in both solar photovoltaic (PV) adoption and production, a feat underpinned by a suite of pivotal policy

Get a quote

How do China and America think about the energy

China and the United States have very different energy systems and respective advantages and disadvantages in the clean energy transition.

Get a quote

Quantifying the cost savings of global solar photovoltaic

We develop a two-factor learning model using historical capacity, component and input material price data of solar PV deployment in the United States, Germany and China.

Get a quote

US-China solar power rivalry: A global battleground | illuminem

In summary, the ongoing competition between the US and China in the solar industry reflects a larger tension between the urgent need for renewable energy and national

Get a quote

The solar duel: China vs. the United States | MIT Energy Initiative

In the past decade, the massive expansion of China''s production and export of silicon photovoltaic (PV) cells and panels has cratered the price of those items globally,

Get a quote

U.S. solar factories: From announcements to reality –

Now that incentives from the US Inflation Reduction Act (IRA) are well understood, global manufacturers are announcing factories in the United

Get a quote

The United States Can Beat China on Solar | RealClearEnergy

Already, American-made solar panels are more efficient than those made in China, and we can continue this progress into the future. Now is not the time to step on the brakes on

Get a quote

China in Command of the U.S. Domestic Solar Panel

1 Within a year, China will own enough solar manufacturing plants in the United States to serve about half of the nation''s solar panel production capacity.

Get a quote

A Solar Panel Standoff Threatens U.S. Climate Plans

American manufacturers are calling for additional trade restrictions on Asian imports amid what they say are market-flooding practices by China

Get a quote

China''s ''spare'' solar capacity offers climate and

About This analysis looks at the gap between the potential output of the world''s existing solar panel factories and projected global solar power

Get a quote

Fall 2023 Solar Industry Update

Global Solar Deployment • H1 2023 PV installations increased significantly (y/y) in China (153%) and Germany (102%), and to a lesser extent the United States (34%). Australian and Indian

Get a quote

America''s solar gap widens as China installs panels rapidly

The growing disparity between the solar energy capabilities of the United States and China has reached alarming levels, with China now leading the world by installing a

Get a quote

A Solar Panel Standoff Threatens U.S. Climate Plans

American manufacturers are calling for additional trade restrictions on Asian imports amid what they say are market-flooding practices by China that are undermining U.S.

Get a quote

The Current Situation and Development Trends of the Solar Photovoltaic

China and the United States, the two major energy powers in the world, are also the major powers in the world today. They have completely different political systems and

Get a quote

The solar duel: China vs. the United States | MIT

In the past decade, the massive expansion of China''s production and export of silicon photovoltaic (PV) cells and panels has cratered the price

Get a quote

State of global solar energy market: Overview, China''s role,

The majority of these rare earth elements (REEs) is concentrated in China, followed by the United States, which has contributed to their price increase in recent years (Stratiotou

Get a quote

Solar Supply Chain and Industry Analysis | Solar Market

Investment trends and business models Updates on related government programs and policies. Featured Publications An Updated Life Cycle Assessment of Utility-Scale Solar

Get a quote

US-China solar power rivalry: A global battleground

In summary, the ongoing competition between the US and China in the solar industry reflects a larger tension between the urgent need for

Get a quote

The Current Situation and Development Trends of the

China and the United States, the two major energy powers in the world, are also the major powers in the world today. They have completely

Get a quote

China in Command of the U.S. Domestic Solar Panel

The United States put tariffs on Chinese solar products and banned goods linked to China''s Xinjiang region over concerns about forced labor to try to develop a domestic solar

Get a quote

Assessing the United States'' Solar Power Play

Despite these efforts, the U.S. solar industry lags behind China''s. In 2023, the cost of Chinese solar panels fell by 42 percent due to a combination of state support, real innovation,

Get a quote

China''s Domination Over Global Solar PV Supply Chain

Europe is aware of this problematic reliance, but it prioritizes solar PV demand over domestic solar PV supply to decrease its electricity prices

Get a quote

Comparison of solar energy between CN and US

The United States confronts a formidable energy risk as it grapples with China''s overwhelming dominance in solar panel production. Fifteen years ago, China exceeded the

Get a quote

China miles ahead of the US in clean energy race

The U.S. added 33 GW of solar and 12 GW of wind capacity, far behind China''s scale. The IEA projects that the U.S. will remain the second

Get a quote

Guess what you want to know

-

Selling solar photovoltaic panels in the United States

Selling solar photovoltaic panels in the United States

-

Photovoltaic modules and solar panels produced in the United States

Photovoltaic modules and solar panels produced in the United States

-

Photovoltaic panel installation and power generation in the United States

Photovoltaic panel installation and power generation in the United States

-

Building solar panel curtain wall photovoltaic transformation

Building solar panel curtain wall photovoltaic transformation

-

Micronesia solar panel photovoltaic panel manufacturer

Micronesia solar panel photovoltaic panel manufacturer

-

Swedish photovoltaic solar panel installation manufacturer

Swedish photovoltaic solar panel installation manufacturer

-

Photovoltaic solar energy storage cabinet manufacturer contact China

Photovoltaic solar energy storage cabinet manufacturer contact China

-

How much watt can a solar photovoltaic panel produce

How much watt can a solar photovoltaic panel produce

-

The photovoltaic solar panel cycle energy storage cabinet cannot be started without power

The photovoltaic solar panel cycle energy storage cabinet cannot be started without power

-

Photovoltaic panel single wave solar panel removal equipment

Photovoltaic panel single wave solar panel removal equipment

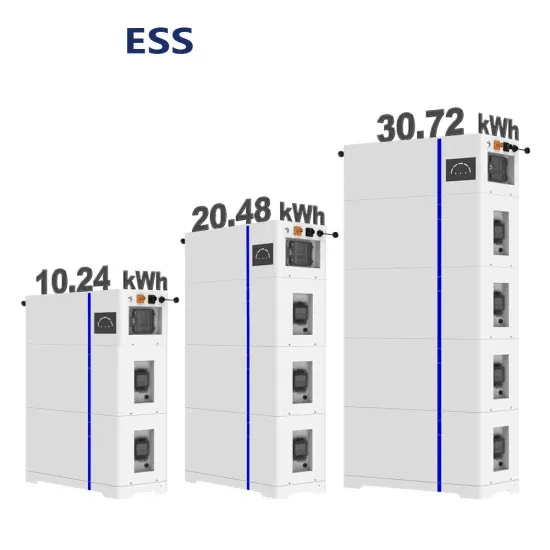

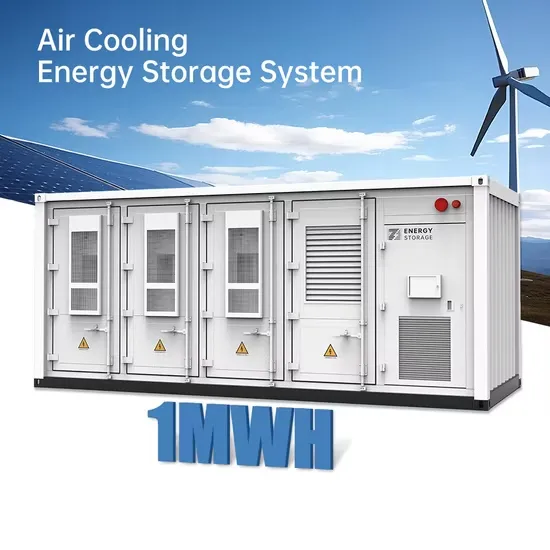

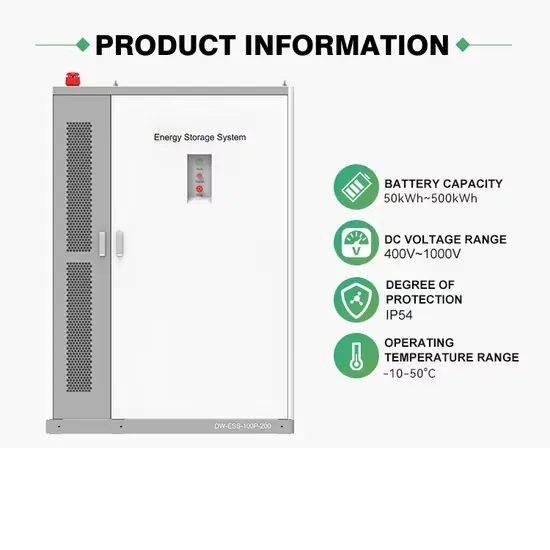

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.