Battery storage is booming in Africa

According to the report, the combination of solar energy and battery storage is becoming standard for new utility-scale projects and for upgrading existing renewable energy

Get a quote

Leveraging Battery Energy Storage Systems (BESS) in shaping Africa

By developing local supply chains for battery manufacturing, African countries can meet their energy storage needs while creating jobs and stimulating economic growth in

Get a quote

Africa''s Competitiveness in Global Battery Supply Chains

African countries, particularly Tanzania and Morocco, could competitively produce and export LFP batteries to Europe by 2030 at USD 68-72/kWh.

Get a quote

Africa''s growing energy storage capacity is key to energy self

Africa''s energy goals are closely tied to advancements in battery storage technology – not only in the generation of electricity but also in its efficient storage and

Get a quote

''Energy storage boom'' in Africa from 31MWh in 2017

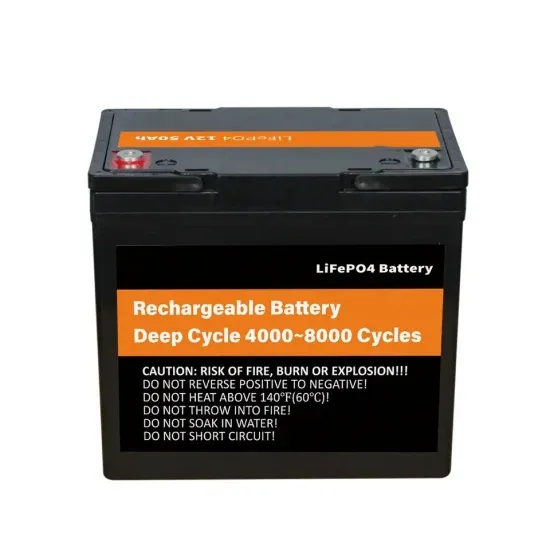

The rise in interest surrounding BESS in Africa arose from the introduction of lithium batteries, which enabled greater flexibility as opposed to

Get a quote

Top 3 East Africa Energy Storage Solutions for Reliable Power

Looking for reliable power solutions in East Africa? Explore solar energy storage systems designed to avoid blackouts and lower your energy costs.

Get a quote

BESS market''s potential in Africa needs a targeted approach

The confirmed development of Battery Energy Storage Systems across Africa is still small compared to global projections – less than 0.5% of the global BESS capacity of 358GW

Get a quote

Six solar battery projects paving the way in Africa

With the push for renewable energy solutions in Africa gaining momentum, various solar battery projects are taking centre stage in the region. Not only do these projects address

Get a quote

The Future of Battery Market in the Middle East & Africa

This report explores the key dynamics shaping the battery market across the region: from the rise of lithium-ion and solid-state technologies to growing applications in energy storage, electric

Get a quote

Energy Storage: The key to energy access in East Africa

Pumped hydro dams are prominently used as energy storage in East Africa, but that is changing with the increase in renewable energy and battery energy storage systems.

Get a quote

Role of Energy Storage

The use of electricity from renewable energy plus battery energy storage systems can help in meeting the peak demand with clean energy instead of using fossil-fuel-based power plants.

Get a quote

EVE Energy to begin mass production of 600Ah+ ESS

Tier 1 battery manufacturer EVE Energy will be the first to mass-produce LFP cells with more than 600Ah capacity for BESS applications.

Get a quote

Africa''s Battery Boom: Charting the Rise of Energy Storage on the

Not Just Utility-Scale; Batteries are powering East Africa''s Commercial Energy Future. While utility-scale battery projects continue to expand rapidly — especially in North

Get a quote

Electrochemical energy conversion and Storage Systems: A

Although Africa is rich in renewable resources, their use remains limited. Implementing electrochemical energy conversion and storage (EECS) technologies such as

Get a quote

Middle East and Africa Battery Market 2025-2034 | Size,Share,

Market Overview The Middle East and Africa (MEA) battery market is witnessing significant growth, driven by the increasing demand for reliable power sources in various sectors.

Get a quote

MENA Solar and Renewable Energy Report

In collaboration with: The Middle East and North Africa saw 2019 again confirm the growth and importance of commissioning large projects and launching additional phases of their

Get a quote

''Energy storage boom'' in Africa from 31MWh in 2017 to

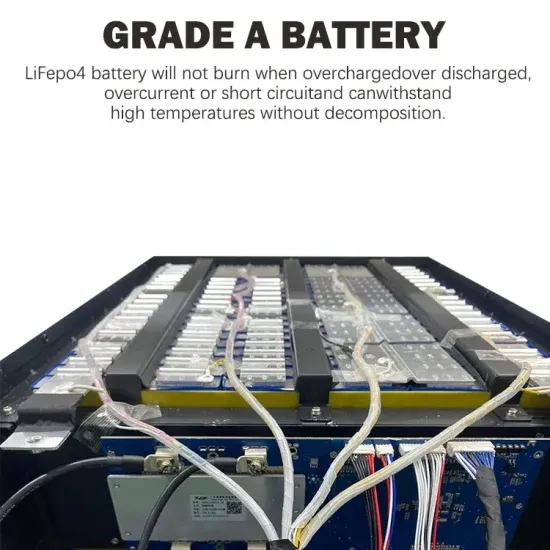

The rise in interest surrounding BESS in Africa arose from the introduction of lithium batteries, which enabled greater flexibility as opposed to gel and lead batteries.

Get a quote

Battery storage is booming in Africa

AFRICA is experiencing a major boom in battery storage, as residential homes, businesses and institutions like hospitals and schools cut down their dependence on national

Get a quote

Firms Signs JV to establish Battery Energy Storage System Production

This exciting collaboration aims to leverage Hithium''s expertise in energy storage and Hithium MANAT''s local insight to better serve the Saudi Arabia market. The joint venture

Get a quote

Lithium-Ion Battery Market | Global Market Analysis Report

2 days ago· The lithium-ion battery market is influenced by several upstream sectors. Electric vehicle (EV) manufacturers account for approximately 42%, integrating lithium-ion cells into

Get a quote

173GWh! Projections for Global Energy Storage

MEA (Middle East and Africa): Projections indicate new installations reaching 10 GWh in 2024, showcasing a robust 54% year-on-year increase.

Get a quote

Leveraging Battery Energy Storage Systems (BESS) in shaping

By developing local supply chains for battery manufacturing, African countries can meet their energy storage needs while creating jobs and stimulating economic growth in

Get a quote

Top Lithium Projects in Africa: Key Opportunities

Thanks to its vast lithium reserves and increasing investments in mining and processing facilities, Africa is emerging as a key player in the

Get a quote

6 FAQs about [Battery Energy Storage Production in East Africa]

Are lithium-ion batteries a viable energy source in Africa?

Although Africa is rich in renewable resources, their use remains limited. Implementing electrochemical energy conversion and storage (EECS) technologies such as lithium-ion batteries (LIBs) and ceramic fuel cells (CFCs) can facilitate the transition to a clean energy future.

Why should African countries develop local supply chains for battery production?

The continent is rich in minerals such as lithium, cobalt, and graphite, essential components for battery production. By developing local supply chains for battery manufacturing, African countries can meet their energy storage needs while creating jobs and stimulating economic growth in related sectors.

Can a company build a battery recycling plant in Africa?

1. May include interim storage of sorted and dismantled parts (warehousing) for pickup by transport and logistics provider Note: There is currently insufficient accessible battery waste in Africa to make it profitable for a company to build a large battery recycling plant.

Can lithium batteries and fuel cells transform Africa's energy landscape?

In summary, while lithium batteries and fuel cells have the potential to transform Africa's energy landscape, addressing end-of-life challenges is critical for sustainability. In tandem with adoption efforts, cultivating the expertise and infrastructure for safe, efficient recycling can unlock their maximum potential and create jobs.

How can Africa improve its energy storage and distribution infrastructure?

Improving Africa's energy storage and distribution infrastructure. This could involve expanding or upgrading the grid infrastructure to make it more reliable, efficient, or adequate to meet the growing energy demand.

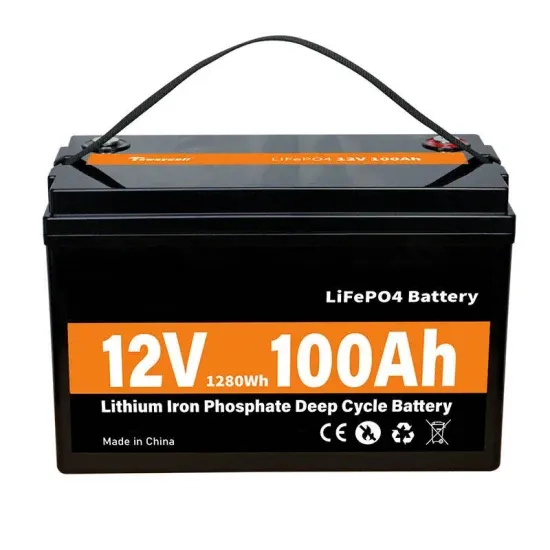

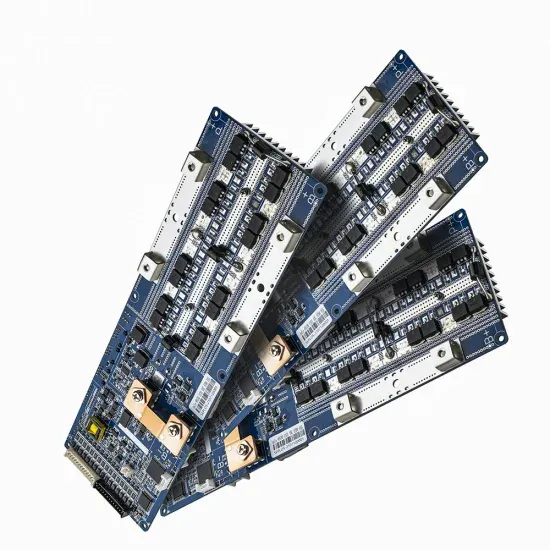

How can a battery pack be assembled in Africa?

Context Battery packs can be assembled in African countries by importing cells and components (e.g., BMS, sensors, inverters) and tailoring battery modules to customer needs. Setting up a battery assembly facility (~USD 2-5 million) to produce ~10 GWh annually could meet internal LFP battery cell demand (~7 GWh by 2030).

Guess what you want to know

-

Battery Energy Storage Charging in East Africa

Battery Energy Storage Charging in East Africa

-

East Africa Lithium Battery Energy Storage System Project

East Africa Lithium Battery Energy Storage System Project

-

Cost price of energy storage cabinet battery production site

Cost price of energy storage cabinet battery production site

-

Libya battery energy storage production plant

Libya battery energy storage production plant

-

Algeria home energy storage battery production

Algeria home energy storage battery production

-

Tanzanian energy storage battery production company

Tanzanian energy storage battery production company

-

Africa Photovoltaic New Energy Storage Battery

Africa Photovoltaic New Energy Storage Battery

-

Energy storage cabinet inverter battery production battery

Energy storage cabinet inverter battery production battery

-

Estonian home energy storage battery production company

Estonian home energy storage battery production company

-

North Africa Telecommunications Energy Storage Battery

North Africa Telecommunications Energy Storage Battery

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.