Tunisia Looking For 400MW Battery Energy Storage System Project

A consortium of Norway''s Scatec and Japan''s Aeolus, a unit of Toyota Tsusho, will develop a 100 MW PV plant near Mazouna in Sidi Bouzid Governorate, all equiped with

Get a quote

Tunisia greenlights four solar PV projects totalling 500 MW.

The Tunisian Ministry of Industry, Mines and Energy has granted development licenses for four solar PV projects in Tunisia, with a combined capacity of 500 MW.

Get a quote

Tunisia greenlights four solar PV projects totalling 500

The Tunisian Ministry of Industry, Mines and Energy has granted development licenses for four solar PV projects in Tunisia, with a combined

Get a quote

Tunisia Secures €79M Deals for Solar Power Expansion

The €79 million projects aim to help Tunisia achieve 35% renewable energy by 2030 and reduce reliance on fossil fuels. These solar plants will

Get a quote

Tunisia greenlights 500 MW of solar – pv magazine

The Tunisian government has granted licenses to four PV projects with a combined capacity of 500 MW. The selected developers are Qair

Get a quote

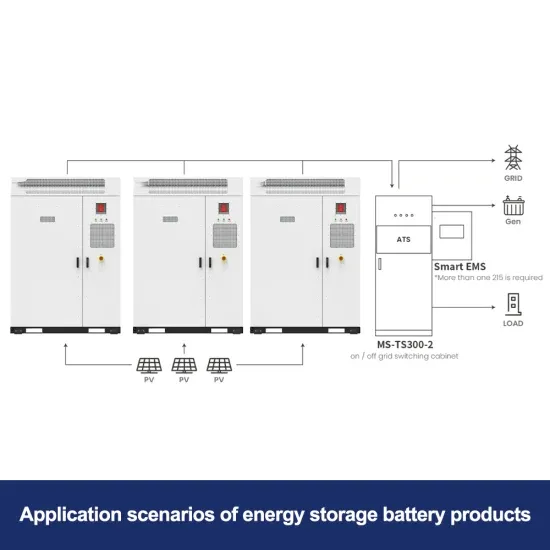

Tunisia Energy Storage Power Station Factory Operation

What are Tunisia''s energy projects? One third of the projects will be for wind farms and two thirds for solar photovoltaics. Tunisia''s national grid is connected to those of Algeria and Libya which

Get a quote

Tunisia''s energy infrastructure | African Energy

Revised in November 2024, this map provides a detailed view of the energy sector in Tunisia. The locations of power generation facilities that are

Get a quote

Tunisian utility planning 600MW pumped hydro energy storage

Tunisian utility STEG is planning to build a 400-600MW pumped hydro energy storage plant, for a 2029 commissioning date. STEG, or the Société tunisienne de l''électricité

Get a quote

Tunisia''s road to solar energy now well mapped out

Faced with growing energy dependency, Tunisia is taking a decisive step forward in its commitment to renewable energy. On December 26, the Ministry of Industry, Mines and

Get a quote

Tunisia: Qair signs project agreements with the Tunisian

Qair is an independent renewable energy company developing, financing, building, and operating solar, wind, waste-to-energy, storage and green hydrogen production assets.

Get a quote

Light storage charging, charging station, energy storage

Major players (e.g., charging operators, PV/storage firms, automakers, energy groups) are actively investing. Market Drivers: Policy Support: National Level: "Dual Carbon"

Get a quote

ENERGY PROFILE TUNISIA

Tunisia energy storage station Tunisia is planning to embrace pumped storage, considered the most mature of the stationary energy storage technologies, but also the most expensive. A

Get a quote

Tunisia Secures €79M Deals for Solar Power Expansion

The €79 million projects aim to help Tunisia achieve 35% renewable energy by 2030 and reduce reliance on fossil fuels. These solar plants will create jobs, boost electricity

Get a quote

Tunisia Awards 498MW Of Solar PV Projects For 2027 Start-...

New contracts for 498MW of solar PV projects bring Tunisia closer to its renewable energy ambitions. But a ''35% by 2030'' renewables target looks out of reach.

Get a quote

Tunisia: Qair signs project agreements with the Tunisian

Qair is an independent renewable energy company developing, financing, building, and operating solar, wind, waste-to-energy, storage and green hydrogen production assets.

Get a quote

Tunisia greenlights 500 MW of solar – pv magazine International

The Tunisian government has granted licenses to four PV projects with a combined capacity of 500 MW. The selected developers are Qair International, Voltalia,

Get a quote

Africa Energy Futures: Tunisia

By 2030, Tunisia plans to develop second-generation clean energies (concentrated solar thermal power (CSP), pumped storage and turbines (STEP)) to boost hydrocarbon

Get a quote

Scaling Up Energy Storage to Accelerate Renewables

This tool informs estimations for early discussions around new greenfield solar PV and battery energy storage hybrid projects in developing

Get a quote

Tunisia plans 1.7 GW of renewable energy projects

The Tunisian government is planning 1,700 MW of new renewable energy projects that should be implemented between 2023 and 2025 across

Get a quote

Tunisia Advances Renewables: New solar plants in Sidi Bouzid

Two agreements have been signed at Kasbah Palace between the Tunisian government and Norwegian and Japanese renewable energy companies, "Scatec" and

Get a quote

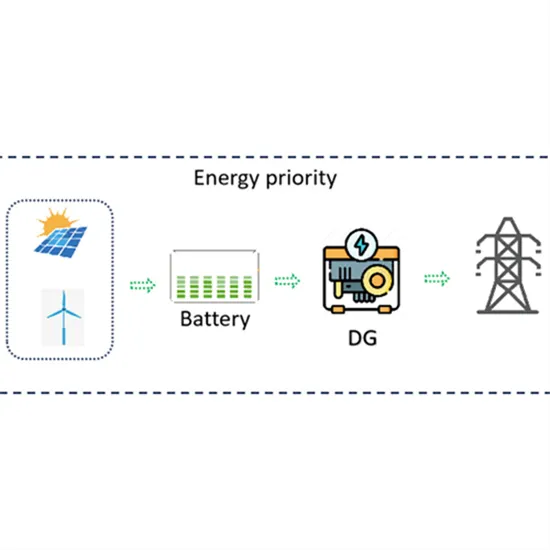

Tunisia energy storage integration

As the photovoltaic (PV) industry continues to evolve, advancements in Tunisia energy storage integration have become critical to optimizing the utilization of renewable energy sources.

Get a quote

Deploying Battery Energy Storage Solutions in Tunisia

ed their renewable energy potential, such as Tunisia. The objective of this report is to look into the potential of Battery Energy Storage System (BESS) development in Tunisia, in line with

Get a quote

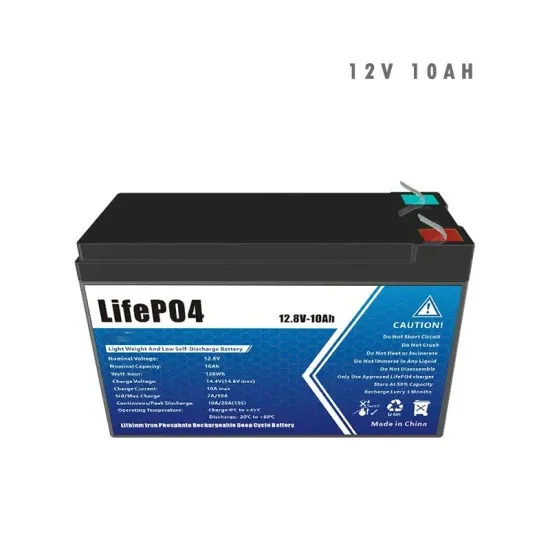

Tunisia produces energy storage batteries

Tunisia''''s energy sector can become an engine of green The large-scale development of renewable energy could catalyze economic growth in Tunisia in several ways: firstly, by

Get a quote

Tunisia taps four international firms to build 500 MW of solar projects

TUNIS, March 24 (Reuters) - Tunisia granted licenses to four international firms to build solar farms with a total capacity of 500 megawatts, together worth 1.2 billion dinars

Get a quote

In a study conducted by Khan et al. (Citation 2020), a techno-economic analysis of grid-connected renewable energy systems using biogas and solar PV-biogas generators was carried out for

Get a quote

6 FAQs about [Tunisia is developing photovoltaics and energy storage]

Which solar projects have been approved in Tunisia?

The Tunisian government has granted licenses to four PV projects with a combined capacity of 500 MW. The selected developers are Qair International, Voltalia, Toyota Tsusho and Scatec. Tunisia's Minister of Industry, Mines and Energy, Fatima Al-Thabat Shibb, has approved four solar projects with a combined capacity of 500 MW.

What is the productivity of photovoltaic systems in Tunisia?

Given these favourable conditions, the productivity of photovoltaic systems in Tunisia is very high. According to the International Renewable Energy Agency’s (IRENA) Global Atlas, annual electricity production from PV systems ranges from 1,450 kWh per kilowatt peak (kWp) in the northwest to 1,830 kWh/kWp in the extreme southeast.

Is Tunisia ready for a large-scale solar project?

It previously completed a 500 MW solar tender in December 2019. In October 2024, Tunisia launched a new tender for 200 MW of large-scale solar, with submissions due by Jan. 15, 2025. Tunisia’s total solar capacity reached 506 MW by the end of 2023, according to the International Renewable Energy Agency (IRENA).

How many MW is a solar power system in Tunisia?

It is subject to authorisation by MIEM and is set by Decree No. 2016-1123: 10 MW for solar PV and solar thermal; 30 MW for wind energy; 15 MW for biomass; and 5 MW for projects using other renewable resources. Box 3. Addressing power system flexibility in Tunisia

What are grid-connected solar PV systems in Tunisia?

Grid-connected solar PV systems are recent in Tunisia. Their installation started upon the issuance of Law No. 2009-7, which authorises self-production of electricity from renewable energy sources. Grid-connected solar PV has mainly been implemented through the Prosol électrique programme, initiated in May 2010 by ANME and STEG.

How much is a solar farm worth in Tunisia?

TUNIS, March 24 (Reuters) - Tunisia granted licenses to four international firms to build solar farms with a total capacity of 500 megawatts, together worth 1.2 billion dinars ($386.31 million), the energy ministry said on Monday.

Guess what you want to know

-

Can photovoltaics be used to charge energy storage

Can photovoltaics be used to charge energy storage

-

Which energy storage solution should I choose for photovoltaics

Which energy storage solution should I choose for photovoltaics

-

Can photovoltaics and energy storage provide power at the same time

Can photovoltaics and energy storage provide power at the same time

-

How much energy storage should be provided for off-grid photovoltaics

How much energy storage should be provided for off-grid photovoltaics

-

Huawei Tunisia Energy Storage System

Huawei Tunisia Energy Storage System

-

Tunisia Energy Storage Mobile Power Inverter

Tunisia Energy Storage Mobile Power Inverter

-

North African companies engaged in energy storage photovoltaics

North African companies engaged in energy storage photovoltaics

-

What energy storage will rooftop photovoltaics use

What energy storage will rooftop photovoltaics use

-

Moldova s commercial and industrial photovoltaics with energy storage

Moldova s commercial and industrial photovoltaics with energy storage

-

The relationship between energy storage power stations and photovoltaics

The relationship between energy storage power stations and photovoltaics

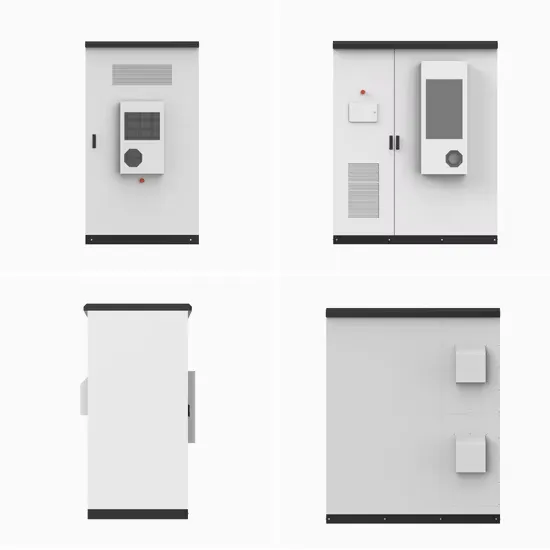

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.