How much profit does energy storage project construction make?

Several elements influence the profitability of energy storage projects, including market demand, technology employed, and regulatory frameworks. Regional energy

Get a quote

A huge $2 billion solar + storage project in California powers up

One of the US''s largest solar + battery storage projects is now fully online in Mojave, California. Arevon Energy''s Eland Solar-plus-Storage Project combines 758

Get a quote

High-Yield Energy Storage Projects: Where Innovation Meets Profitability

Why Energy Storage Is the Ultimate "Money Battery" Imagine buying electricity at midnight prices and selling it at premium afternoon rates – that''s exactly what modern high

Get a quote

Google, Salt River Project to research non-lithium long-duration energy

18 hours ago· Salt River Project (SRP) and Google this week announced what the companies are calling a "first-of-its-kind" research collaboration to better understand the real-world

Get a quote

How is Energy Storage Profitable? Unlocking the Billion-Dollar

But here''s the kicker – energy storage profitability isn''t fictional. In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030.

Get a quote

ERCOT Energy Storage | Paths to Profit

The profitability of assets within the energy storage fleet can be attributed to three key factors: battery size, operating strategy and location. Enverus Intelligence Research (EIR)

Get a quote

Google, Salt River Project to research non-lithium long-duration

18 hours ago· Salt River Project (SRP) and Google this week announced what the companies are calling a "first-of-its-kind" research collaboration to better understand the real-world

Get a quote

A Look into the Performance of CAISO''s Two Largest

The forced outage of Moss Landing in September and extraordinarily high energy prices in February significantly impacted the performance of each of these

Get a quote

Tyba: $13.9 Million (Series A) Raised For Improving Profitability

Tyba, a leading energy storage optimization platform, announced $13.9 million in Series A funding led by Energize Capital. This funding round includes new investments from

Get a quote

How do government policies influence the profitability

Government policies significantly influence the profitability of utility-scale energy storage projects through financial incentives, market

Get a quote

The Profitability Challenges of Utility-Scale Battery

Increased energy storage is one of the most promising ways to handle the challenges from introducing lots of non-dispatchable generators to the grid.

Get a quote

Energy storage battery project profitability

Below are a few factors and situations that may make a BESS project viable. Co-locating a battery storage system as part of a solar power plant. Energy storage installations are often co

Get a quote

Energy storage project profitability analysis

The findings show that the energy storage energy self-consumption and the availability of subsidies have an impact on the profitability of a photovoltaic-integrated battery

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

The rise of bankable BESS projects in Europe

As the renewable energy sector rapidly evolves, battery energy storage systems (BESS) are emerging as a critical pillar for decarbonization.

Get a quote

Profitability, risk, and financial modeling of energy storage in

Revenues from energy arbitrage were identified using the proposed models to get a better view on the profitability of the storage system. Moreover, the feasibility of energy

Get a quote

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Get a quote

Analytics Can Help Energy Storage Operators Find More Revenue

6 days ago· Using modeling through analytics, battery energy storage system operators can determine exactly what size system they need for their site with advanced predictive software.

Get a quote

Energy storage project profit margin

The profit margins for energy storage projects can fluctuate considerably, as several interconnected factors such as local energy prices, installation costs, and the return on

Get a quote

What is the gross profit margin of energy storage

The gross profit margin of energy storage projects varies significantly based on several factors, such as market conditions, technology

Get a quote

Financial and economic modeling of large-scale gravity energy storage

The findings show that the energy storage energy self-consumption and the availability of subsidies have an impact on the profitability of a photovoltaic-integrated battery

Get a quote

Empirical Study on Cost–Benefit Evaluation of New Energy Storage

Energy storage technology is a critical component in supporting the construction of new power systems and promoting the low-carbon transformation of the energy system.

Get a quote

6 FAQs about [Energy storage project profitability]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Are thermal energy storage project developers transforming the TES industry?

The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Guess what you want to know

-

Energy storage project profitability

Energy storage project profitability

-

Brazil Industrial Energy Storage Project

Brazil Industrial Energy Storage Project

-

Namibia Energy Storage Project Related Companies

Namibia Energy Storage Project Related Companies

-

Congo Kinshasa Chemical Energy Storage Project

Congo Kinshasa Chemical Energy Storage Project

-

Energy Storage System Special Project

Energy Storage System Special Project

-

New Zealand Photovoltaic Energy Storage Battery Project

New Zealand Photovoltaic Energy Storage Battery Project

-

Cyprus Energy Storage Battery Project

Cyprus Energy Storage Battery Project

-

Beiya Huijue Lithium Battery Energy Storage Project

Beiya Huijue Lithium Battery Energy Storage Project

-

Construction of a centralized energy storage project in Zimbabwe

Construction of a centralized energy storage project in Zimbabwe

-

Qatar Energy Storage Power Station Construction Project

Qatar Energy Storage Power Station Construction Project

Industrial & Commercial Energy Storage Market Growth

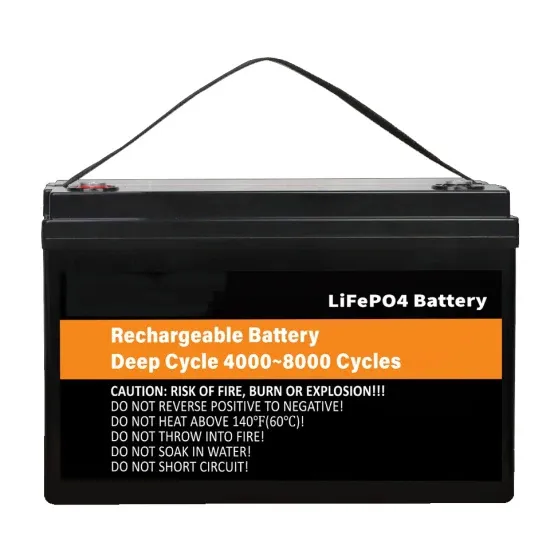

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.