Sungrow Holds the Global No. 1 Position in PV Inverter

HEFEI, July 11, 2024 - Sungrow, the global leading PV inverter and energy storage system provider, secured the top spot in the 2023 global PV inverter shipment rankings according to

Get a quote

shutters-alkazar

HEFEI, July 11, 2024 - Sungrow, the global leading PV inverter and energy storage system provider, secured the top spot in the 2023 global PV inverter shipment rankings according to

Get a quote

Shipment Ranking

After thorough research and field visits by Solarbe and Solarbe Consulting, we hereby announce the 2025 first half-year PV module shipment rankings for your... According to data released by

Get a quote

AISWEI Tops Wood Mackenzie''s Global Residential Inverter Shipment

Wood Mackenzie, a globally authoritative research institution for renewable energy, energy, and natural resource markets, has officially released the 2024 Global PV Inverter Shipment

Get a quote

Sineng Electric Retains No. 4 in Global PV Inverter Shipment Rankings

About Sineng Sineng Electric is the global leading supplier of a comprehensive product portfolio including PV inverters, energy storage inverters, and digital power products.

Get a quote

2021 Energy Storage Inverter Shipment Ranking

Global top 10 solar PV inverter vendors account for 82% of Solar & Energy Storage Summit 23-24 April 2025, Denver Register now. Browse Events Europe took up 23% of the global market

Get a quote

The evolving dynamics of battery energy storage

S&P Global has released its latest Battery Energy Storage System (BESS) Integrator Rankings report, using data for installed and contracted

Get a quote

What next for the 5 biggest BESS integrators?

Fluence, Sungrow, Wärtsilä, Tesla & Hyperstrong named the world''s biggest storage integrators Fluence''s high safety standards and speedy deployment proving popular

Get a quote

Sineng Electric Rises to No.4 in Global PV Inverter Shipment

Known for the engineering excellence, rigorous testing standards, and consistent quality, Sineng has earned recognition as a BloombergNEF tier 1 PV inverter maker and ranks

Get a quote

Energy storage inverter (PCS) shipments to reach

PCS shipments to front-of-the-meter (FTM) energy storage siting accounted for over 50% of total global shipments over the forecast period

Get a quote

Sino-American showdown! The top 10 global energy storage

On the AC side, the top 10 global energy storage system integrators are Tesla, Sungrow (SZ: 300274), CRRC Zhuzhou Institute, Fluence, Hipostron (SH: 688411), Envision

Get a quote

2025 Energy Storage Inverter Ranking: Top Players and Market

If solar panels are the rockstars of renewable energy, then energy storage inverters are the backstage crew making the show possible. As we dive into the 2025 energy storage

Get a quote

Global energy storage system shipment ranking

Global energy storage system shipment ranking XIAMEN, China, Oct. 31, 2022 /PRNewswire/ -- International authoritative research institution IHS Markit (now a part of S& P Global)

Get a quote

Fluence | A Siemens and AES Company

Our products are designed for the most demanding industrial applications and have stood the test of time. Discover the Fluence energy storage product that''s right for you.

Get a quote

Sineng Electric Rises to No.4 in Global PV Inverter Shipment Rankings

Known for the engineering excellence, rigorous testing standards, and consistent quality, Sineng has earned recognition as a BloombergNEF tier 1 PV inverter maker and ranks

Get a quote

Energy storage inverter (PCS) shipments to reach almost 900GW

PCS shipments to front-of-the-meter (FTM) energy storage siting accounted for over 50% of total global shipments over the forecast period (2023-30), with the United States and

Get a quote

2021 Energy Storage Inverter Shipment Ranking

Are energy storage inverters the future of energy storage? Shipments of energy storage inverters more than doubled in 2020 to reach over 11 GW. As the world''s major economies increasingly

Get a quote

2021 energy storage inverter shipment ranking

2021 energy storage inverter shipment rankingAbout 2021 energy storage inverter shipment ranking As the photovoltaic (PV) industry continues to evolve, advancements in 2021 energy

Get a quote

2024 Global and non-China shipments of energy storage cell:

The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year

Get a quote

Top 20 Solar Inverter Manufacturers: A Global Overview of the

Discover the top 20 Solar Inverter Manufacturers worldwide, showcasing leading brands and their innovations in clean energy solutions.

Get a quote

2024 Global energy storage system (ESS) shipment ranking

InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

Get a quote

Global Energy Storage Cell Shipment Ranking 1Q-3Q24

The energy storage cell market experienced robust sequential growth during the first three quarters, with shipments in Q3 rising by 16%

Get a quote

Pcs energy storage inverter shipment ranking | Solar Power

By interacting with our online customer service, you''ll gain a deep understanding of the various Pcs energy storage inverter shipment ranking featured in our extensive catalog, such as high

Get a quote

2025 Energy Storage Inverter Ranking: Top Players and Market

Why Energy Storage Inverters Are the Unsung Heroes of Renewable Energy If solar panels are the rockstars of renewable energy, then energy storage inverters are the backstage

Get a quote

Global Energy Storage Cell Shipment Ranking 1Q-3Q24

The energy storage cell market experienced robust sequential growth during the first three quarters, with shipments in Q3 rising by 16% QoQ, setting a record high for single

Get a quote

6 FAQs about [Energy Storage Inverter Shipment Ranking]

Is Sungrow the world's leading PV inverter provider?

HEFEI, July 11, 2024 - Sungrow, the global leading PV inverter and energy storage system provider, secured the top spot in the 2023 global PV inverter shipment rankings according to S&P Global Commodity Insights, reaffirming its position with exceptional capabilities.

Which battery energy storage system integrators are the best in 2024?

AC side: Leading manufacturers between China and the U.S. maintain strong positions amid competition. The top five global battery energy storage system (BESS) integrators in the AC side for 2024 were Tesla, Sungrow, CRRC Zhuzhou Institute, Fluence, and HyperStrong. Tesla and Sungrow secured the top two global positions.

What are the top 5 energy storage cell shipments in 2024?

The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients. Stability: With years of industry experience, CATL maintains a clear market advantage and firmly holds the top position in the industry.

What are the top 5 energy storage manufacturers?

The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants. According to InfoLink, 300Ah+ cells now account for nearly 50% of the global utility-scale energy storage market in a single quarter.

What was the energy storage industry like in 2024?

In 2024, industry concentration remains high, with CR10 reaching 90.9%, roughly the same as in the first three quarters of the year. The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients.

What percentage of PCs shipments are to front-of-the-Meter (FTM) energy storage?

PCS shipments to front-of-the-meter (FTM) energy storage siting accounted for over 50% of total global shipments over the forecast period (2023–30), with the United States and China mainland accounting for the majority of these shipments.

Guess what you want to know

-

Ghana Energy Storage Bidirectional Inverter

Ghana Energy Storage Bidirectional Inverter

-

Inverter Planning for Mobile Energy Storage Sites in Morocco

Inverter Planning for Mobile Energy Storage Sites in Morocco

-

Base station lithium battery energy storage 100kw inverter manufacturer

Base station lithium battery energy storage 100kw inverter manufacturer

-

Inverter in energy storage device

Inverter in energy storage device

-

Energy storage inverter connected to 48v lithium battery

Energy storage inverter connected to 48v lithium battery

-

Ranking of UAE photovoltaic energy storage cabinet companies

Ranking of UAE photovoltaic energy storage cabinet companies

-

South Korean photovoltaic energy storage 80kw inverter manufacturer

South Korean photovoltaic energy storage 80kw inverter manufacturer

-

Italian photovoltaic energy storage 20kw inverter company

Italian photovoltaic energy storage 20kw inverter company

-

Huawei portable energy storage inverter

Huawei portable energy storage inverter

-

Chilean energy storage container industry ranking

Chilean energy storage container industry ranking

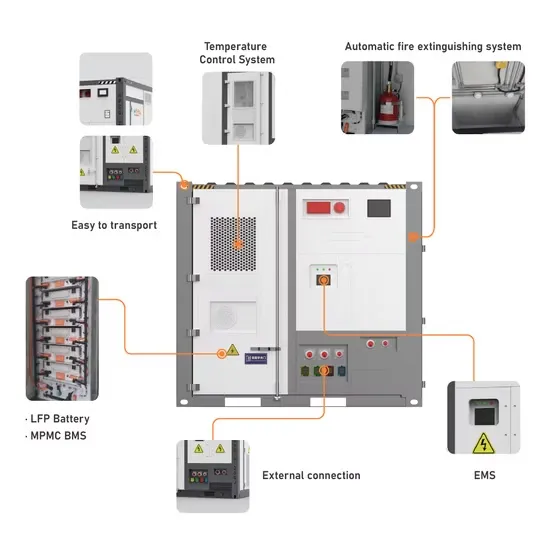

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

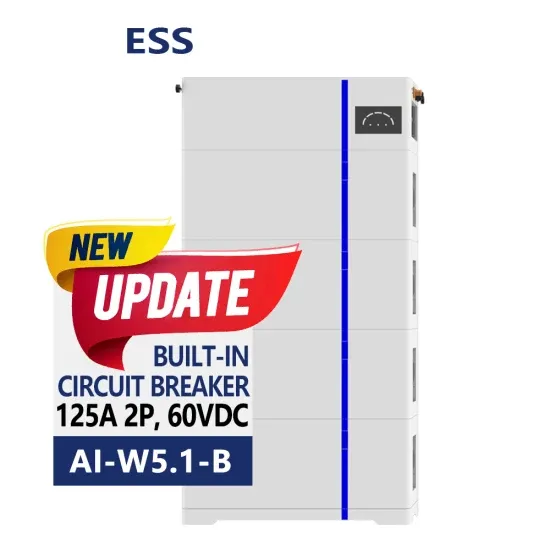

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.