Angola: Tyranna Resources to Acquire Lithium Project

Australian-based mineral exploration company, Tyranna Resources, will acquire an 80% interest in the Namibe Lithium Project in Angola. The Acquisition is expected to be

Get a quote

Luanda NCM Lithium Battery Packs Powering Angola s Energy

Summary: Explore how NCM lithium battery packs are transforming energy storage in Luanda. This article covers applications, market trends, and Angola''s growing demand for reliable

Get a quote

Angola Energy Storage Photovoltaic Power Station Project

The energy storage power station project in Angola includes several initiatives aimed at enhancing the country''s energy capacity. Key details are:296 MW of solar capacity and

Get a quote

Angola Lithium-ion Battery Energy Storage Systems Market

Historical Data and Forecast of Angola Lithium-ion Battery Energy Storage Systems Market Revenues & Volume By Power Rating for the Period 2020- 2030 Historical Data and Forecast

Get a quote

Exploring for high-grade lithium in Angola

He has investigated pegmatite-hosted lithium mineralisation in Australia, Canada, Brazil, Argentina, Namibia, Democratic Republic of Congo and most recently Angola.

Get a quote

Energy Storage Battery | Polinovel Lifepo4 Battery

Polinovel solar battery company has rich experience in the design and production of solar power energy storage systems. Our li-ion solar batteries are widely

Get a quote

Energy Storage Solutions & Companies for the Power Industry

Energy storage plays a crucial role in integrating renewable energy sources and enhancing the resilience and emergency response capabilities of power supply systems. By storing the

Get a quote

Angola Lithium Iron Phosphate Energy Storage Powering a

As Angola accelerates its renewable energy transition, lithium iron phosphate (LFP) battery storage has emerged as a game-changer. This article dives into how LFP projects are

Get a quote

Angola Photovoltaic Energy Storage Lithium Battery

How many MW of solar power will be installed in Angola? The projects will be installed in the Moxico, Lunda Norte, Lunda Sul, Bie, and Malanje provinces, adding 296 MW of solar

Get a quote

Can Angola become a hub for energy storage

By developing local expertise and promoting research in energy technology, Angola can foster domestic industries focused on energy storage.

Get a quote

Angola battery manufacturing companies in

With a focus on electric vehicles, energy storage, and UPS systems, the company boasts innovative technologies and a growing market presence, including significant expansion

Get a quote

Angola energy storage

Fernando Prioste,CEO of COBA Group,talks to The Energy Year about Angola''s potentialfor deploying pumped-storage hydroelectricity and hydrogen solutions as it develops a robust

Get a quote

Top Lithium-ion Battery Manufacturers in Spain 2025

Spain is emerging as a key player in Europe''s lithium-ion battery industry, driven by the growing demand for electric vehicles (EVs), renewable energy storage, and industrial applications.

Get a quote

MCA unit orders 319 MWh of Li-ion batteries for projects in Angola

Portuguese diversified group MCA Group has contracted 319 MWh of lithium-ion batteries from Samsung SDI for a portfolio of energy storage projects in Angola.

Get a quote

Angola energy storage battery mold

Energy storage technology is one of the most critical technology to the development of new energy electric vehicles and smart grids [1] nefit from the rapid expansion of new energy

Get a quote

Can Angola become a hub for energy storage innovation in Africa?

By developing local expertise and promoting research in energy technology, Angola can foster domestic industries focused on energy storage. This not only enhances the

Get a quote

ANGOLA NEW ENERGY COMPANIES TAKE SHAPE AFRICAN

With relatively low costs and a more robust supply chain than conventional lithium-ion batteries, magnesium batteries could power EVs and unlock more utility-scale energy storage, helping to

Get a quote

Angola Angolan lithium in the limelight

In mid-May the company struck a deal to buy 80% of Australian company Angolan Minerals, which has been quietly exploring the Namibe lithium project in the southwest of the

Get a quote

Angola Lithium-Ion Battery Energy Storage System Market (2025

Historical Data and Forecast of Angola Lithium-Ion Battery Energy Storage System Market Revenues & Volume By Residential Energy Storage Systems for the Period 2021-2031

Get a quote

ANGOLA NEW ENERGY COMPANIES TAKE SHAPE AFRICAN ENERGY

With relatively low costs and a more robust supply chain than conventional lithium-ion batteries, magnesium batteries could power EVs and unlock more utility-scale energy storage, helping to

Get a quote

Which lithium battery energy storage companies are

Based on exploration of the landscape of lithium battery energy storage, the notable companies include 1. Tesla, 2. LG Chem, 3. Panasonic,

Get a quote

Angola''s landmark lithium project

Angola has a huge potential for any commodity you can think of. It''s a sleeping giant just waiting to be awakened. Paulo Nunes, country manager of Angolitio, and Peter

Get a quote

Biggest Lithium & Cobalt Mining Companies Australia 2025

Explore the biggest lithium miner and cobalt mining companies in Australia for 2025, highlighting their pivotal roles in global battery supply, clean energy, and technological

Get a quote

MCA unit orders 319 MWh of Li-ion batteries for

Portuguese diversified group MCA Group has contracted 319 MWh of lithium-ion batteries from Samsung SDI for a portfolio of energy storage

Get a quote

Energy storage statistics Angola

Fernando Prioste,CEO of COBA Group,talks to The Energy Year about Angola''s potentialfor deploying pumped-storage hydroelectricity and hydrogen solutions as it develops a robust

Get a quote

6 FAQs about [Angola Lithium Energy Storage Power Production Company]

Are Angola's lithium resources in the limelight?

The mineral is essential for the manufacture of batteries, a key element in the energy transition, and has become highly sought after. However, Australian Securities Exchange (ASX)-listed junior Tyranna Resources may put Angola's lithium resources in the limelight.

How many non-listed companies are launching lithium projects in Angola?

Up to now, only a few non-listed companies have launched lithium projects in the country. Tyranna has confirmed that initial data from Angolan Minerals, from field campaigns in 2019 and 2021, has been encouraging. Further studies may begin soon.

Could Tyranna Resources put Angola's lithium resources in the limelight?

However, Australian Securities Exchange (ASX)-listed junior Tyranna Resources may put Angola's lithium resources in the limelight. In mid-May the company struck a deal to buy 80% of Australian company Angolan Minerals, which has been quietly exploring the Namibe lithium project in the southwest of the country.

Is Angola a good place to invest in lithium?

Despite boasting extensive and diverse mineral resources, up to now there has been limited international investment in Angola's lithium in comparison to its neighbours, such as the DR Congo, Namibia, Zimbabwe and Botswana.

Who owns the Namibe Lithium Project?

Tyranna Resources, an Australian-based mineral exploration company, will acquire an 80% interest in the Namibe Lithium Project. The Acquisition is expected to be finalized by July 2022, positioning the company as the majority owner of the project.

Which energy transition metals should Angola invest in?

In recent years, the main energy transition metals that have been of interest to Angola's investors have been cobalt, nickel and copper. However, a listed junior is now targetting lithium, an essential metal for battery manufacturing, which is highly sought after on the African continent.

Guess what you want to know

-

Lithium Battery Energy Storage Power Company

Lithium Battery Energy Storage Power Company

-

Kyrgyzstan lithium energy storage power direct sales company

Kyrgyzstan lithium energy storage power direct sales company

-

Azerbaijan lithium energy storage power supply procurement company

Azerbaijan lithium energy storage power supply procurement company

-

Argentina Energy Storage Power Production Company

Argentina Energy Storage Power Production Company

-

Panama lithium power energy storage company

Panama lithium power energy storage company

-

Energy storage power station investment company

Energy storage power station investment company

-

Finnish power company energy storage

Finnish power company energy storage

-

Tanzanian energy storage battery production company

Tanzanian energy storage battery production company

-

Iran lithium energy storage power supply sales

Iran lithium energy storage power supply sales

-

China Energy Storage Power Company

China Energy Storage Power Company

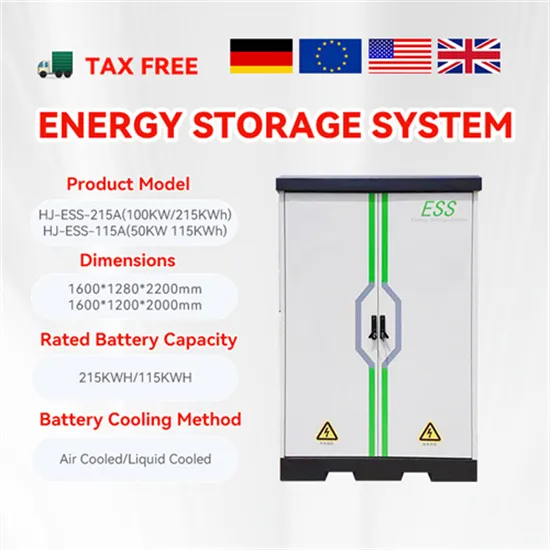

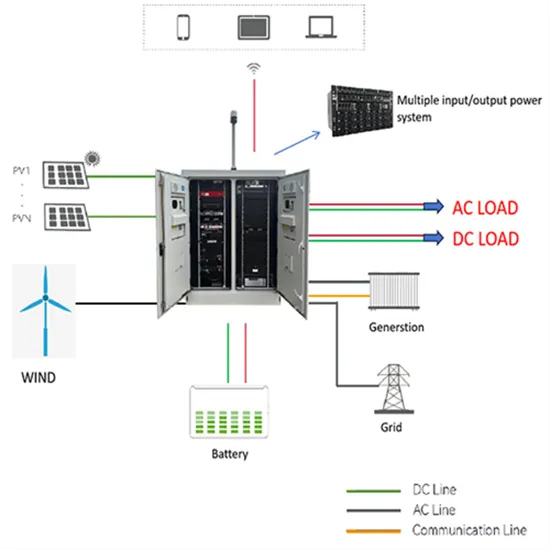

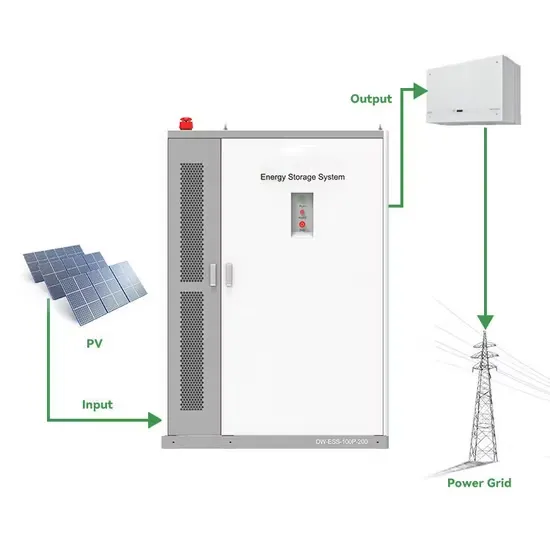

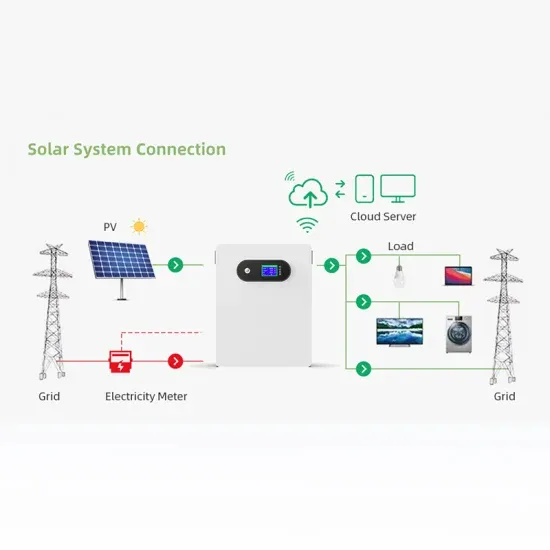

Industrial & Commercial Energy Storage Market Growth

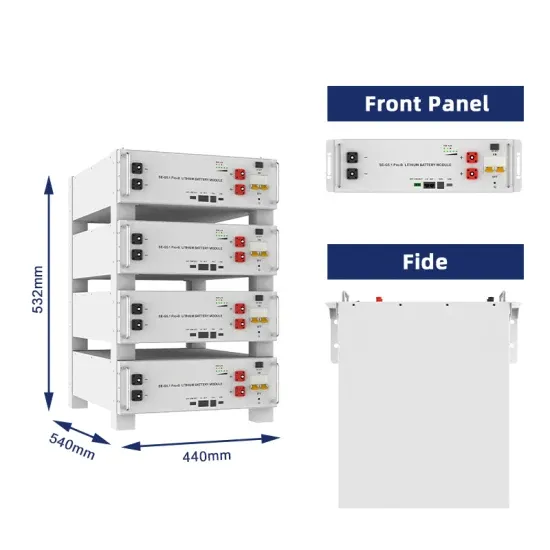

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.