U.S. to place 3,251% tariffs on Southeast Asian solar panels

The United States is set to impose tariffs of up to 3,521% on solar panels imported via a small number of Southeast Asian nations.

Get a quote

US hits South East Asian solar imports with new tariffs

At the other end of the scale, panels produced in Malaysia by Chinese giant Jinko Solar face a tariff of just over 41%, while rival Trina Solar''s Thai‑made products attract a 375%

Get a quote

U.S. to impose tariffs as high as 3,521% on Southeast

On Monday, the U.S. Department of Commerce slapped high tariffs on solar panels and their related products coming from four Southeast

Get a quote

US wants to slap tariffs as high as 3,500% on solar

US trade officials finalized steep tariff levels on most solar cells from Southeast Asia, a key step toward wrapping up a year-old trade case in

Get a quote

US wants to slap tariffs as high as 3,500% on solar panels from

US trade officials finalized steep tariff levels on most solar cells from Southeast Asia, a key step toward wrapping up a year-old trade case in which American manufacturers

Get a quote

Solar squeeze: US tariffs threaten panel production

As Chinese exports of solar components to Vietnam, Thailand, Malaysia and Cambodia boomed, so did US imports of South-east Asian solar

Get a quote

© Asian Solar Co., Ltd. – Asian Solar Co., Ltd.

Asian Solar is one of Southeast Asia''s leading Solar Energy Firms. We are involved in design and installation of solar systems, as well as distributing

Get a quote

US Government Finalizes Tariffs on Southeast Asian

The U.S. government has finalized severe tariffs on imports of solar panels from four Southeast Asian countries, in connection with a

Get a quote

US sets tariffs of up to 3,521% on South East Asia solar panels

The US Commerce Department has announced plans to impose tariffs of up to 3,521% on imports of solar panels from four South East Asian countries.

Get a quote

US plans tariffs of up to 3,521% on South East Asian solar panels

The US Department of Commerce has announced plans to set tariffs of up to 3,521% on solar panels produced in Cambodia, Thailand, Malaysia and Vietnam.

Get a quote

US to Impose Tariffs of Up to 3,521% on South East Asian Solar Panel

The US Commerce Department has announced plans to impose tariffs of up to 3,521 per cent on imports of solar panels from four South East Asian countries. It comes after

Get a quote

US imposes steep tariffs on South East Asian solar

US trade authorities have confirmed high tariffs on the majority of solar cells imported from four South East Asian countries: Cambodia,

Get a quote

What does it mean to have up to 3,521% US tariffs on

The trade tensions on solar imports from Southeast Asia aren''t new. After the over-300% tariff on Chinese solar products reduced US solar

Get a quote

The US slaps anti-dumping tariffs on Southeast Asian solar panels

The US has imposed new anti-dumping tariffs on solar panels imported from Southeast Asia, tightening restrictions on Chinese manufacturers accused of using these

Get a quote

US will proceed with probe of solar imports from India, Laos and

The U.S. International Trade Commission voted on Friday to proceed with an investigation into whether solar panels from India, Laos and Indonesia are stifling domestic

Get a quote

Potential solar boom in South-east Asia an opportunity to invest in

The US recently imposed tariffs of as high as 3,500 per cent on solar exports from four South-east Asian markets: Cambodia, Malaysia, Thailand and Vietnam. These countries

Get a quote

US Announces Fresh Round of Duties on Solar Imports From

The U.S. government has announced a new tranche of tariffs on solar panel imports from four Southeast Asian nations, in response to complaints from U.S. manufacturers that

Get a quote

What next for Southeast Asia''s China-backed solar

The arrival of factories backed by Chinese solar heavyweights such as Trina, Longi, JA Solar and Jinko Solar, among nearly 20 other

Get a quote

US Commerce Department Gets Green Light for Southeast Asian Solar

The U.S. solar industry has been "materially injured" by a flood of cheap panels and components from four Southeast Asian nations, a key trade body has ruled.

Get a quote

US imposes steep tariffs on South East Asian solar cell imports

US trade authorities have confirmed high tariffs on the majority of solar cells imported from four South East Asian countries: Cambodia, Malaysia, Thailand and Vietnam.

Get a quote

It''s official: High tariffs initiated on solar cells and panels from

The U.S. International Trade Commission has made an affirmative determination in its antidumping and countervailing duty (AD/CVD) investigation concerning silicon solar cells

Get a quote

US imposes tariffs up to 3500 per cent on solar panels

US trade officials have unveiled plans to impose tariffs of up to 3500 per cent on solar panels from some South-East Asian countries.

Get a quote

What next for Southeast Asia''s China-backed solar boom?

The arrival of factories backed by Chinese solar heavyweights such as Trina, Longi, JA Solar and Jinko Solar, among nearly 20 other competitors, has transformed

Get a quote

U.S. to impose tariffs as high as 3,521% on Southeast Asian solar

On Monday, the U.S. Department of Commerce slapped high tariffs on solar panels and their related products coming from four Southeast Asian countries, Malaysia,

Get a quote

US sets tariffs of up to 3,521% on South East Asia

The US Commerce Department has announced plans to impose tariffs of up to 3,521% on imports of solar panels from four South East Asian

Get a quote

New US solar tariffs on Southeast Asia to raise prices,

A new round of U.S. solar panel import tariffs on Southeast Asian producers is expected to raise consumer prices and cut into producer profit

Get a quote

US slaps tariffs as high as 3,521% on solar imports

San Francisco – The US set new duties as high as 3,521 per cent on solar imports from four South-east Asian countries, delivering a win for

Get a quote

Potential solar boom in South-east Asia an opportunity to invest in

[SINGAPORE] In the face of punishing solar tariffs from the US, South-east Asia has a silver lining: a glut in the supply of photovoltaic panels could make solar projects

Get a quote

US imposes new duties on solar imports from

The United States set new duties as high as 3,521% on solar imports from four Southeast Asian countries, delivering a win for domestic

Get a quote

It''s official: High tariffs initiated on solar cells and

The U.S. International Trade Commission has made an affirmative determination in its antidumping and countervailing duty (AD/CVD)

Get a quote

6 FAQs about [East Asian Solar Panels]

Why are Chinese solar panels booming in Southeast Asia?

Chinese-owned solar manufacturing facilities have popped up across Southeast Asia as companies sought to navigate U.S.-China trade frictions. While Cambodia is still primarily an agrarian economy, solar panels were the Southeast Asian country’s top export to the U.S. last year, according to data from consultancy Oxford Economics.

Why are solar panels uncompetitive in Southeast Asia?

The American Alliance for Solar Manufacturing Trade Committee also argued that Southeast Asian companies received an unfair level of subsidies, making U.S.-made solar panels uncompetitive. Chinese-owned solar manufacturing facilities have popped up across Southeast Asia as companies sought to navigate U.S.-China trade frictions.

Why are US tariffs on solar panels coming to Southeast Asia?

The U.S. government has announced a new tranche of tariffs on solar panel imports from four Southeast Asian nations, in response to complaints from U.S. manufacturers that companies based in the countries are flooding the market with unfairly cheap goods.

Are Chinese solar panels making US solar panels non-competitive?

The committee has accused major Chinese solar panel manufacturers with facilities in Malaysia, Cambodia, Thailand and Vietnam of selling panels below production costs and receiving unjust subsidies, rendering US products non-competitive.

Are solar imports from Southeast Asia unfairly benefiting from government aid?

Accepting the Committee’s claim that solar imports from Southeast Asia are unfairly benefiting from government aid, the Department then announced anti-subsidy countervailing duties on all solar imports from the four Southeast Asian nations.

Where are solar panels made?

Most solar panels installed in the US are currently made abroad, and around 80% of those imported solar panels are made in Malaysia, Vietnam, Thailand, and Cambodia.

Guess what you want to know

-

Photovoltaic solar panels for East African homes

Photovoltaic solar panels for East African homes

-

East Asia factory photovoltaic solar panels

East Asia factory photovoltaic solar panels

-

Huawei Middle East solar photovoltaic panels

Huawei Middle East solar photovoltaic panels

-

Middle East solar panels 250 watts

Middle East solar panels 250 watts

-

Are Nicaragua s solar photovoltaic panels reliable

Are Nicaragua s solar photovoltaic panels reliable

-

Top three solar photovoltaic panels

Top three solar photovoltaic panels

-

How many watts of solar panels are needed for rooftop power generation

How many watts of solar panels are needed for rooftop power generation

-

Solar distributed photovoltaic panels

Solar distributed photovoltaic panels

-

Waste sizes suitable for solar panels in Venezuela

Waste sizes suitable for solar panels in Venezuela

-

Three solar panels of different wattages

Three solar panels of different wattages

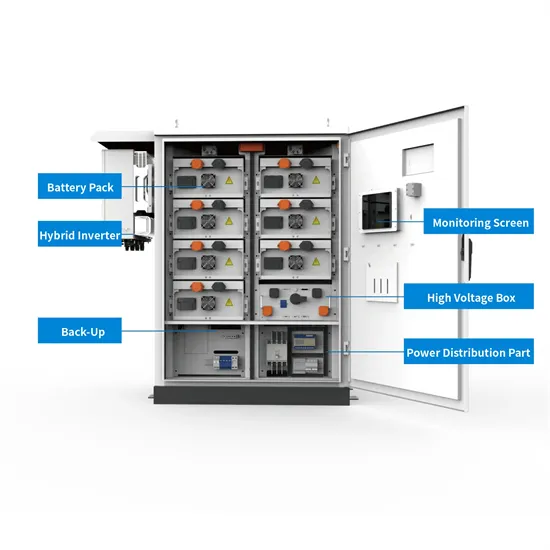

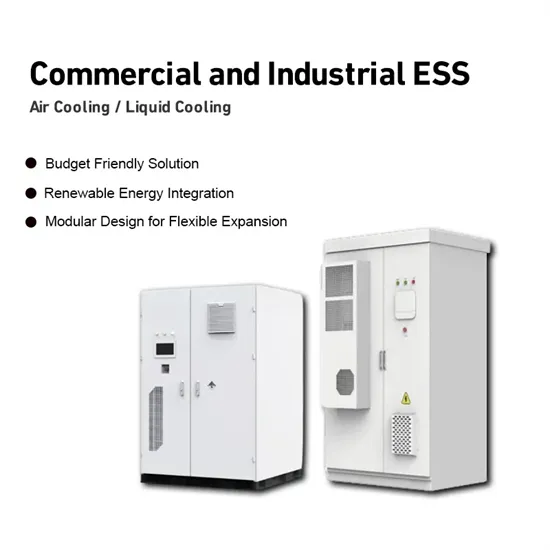

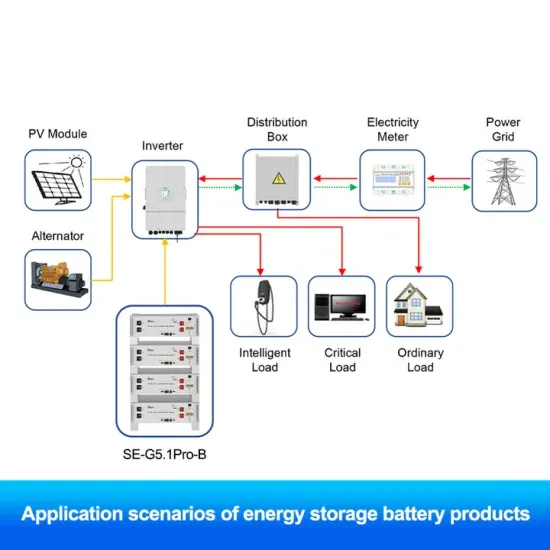

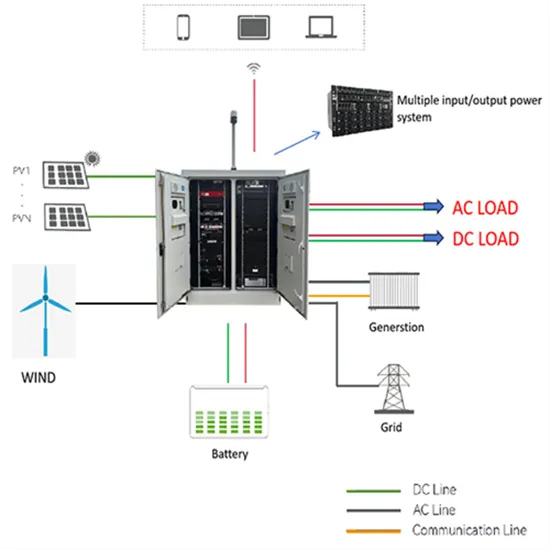

Industrial & Commercial Energy Storage Market Growth

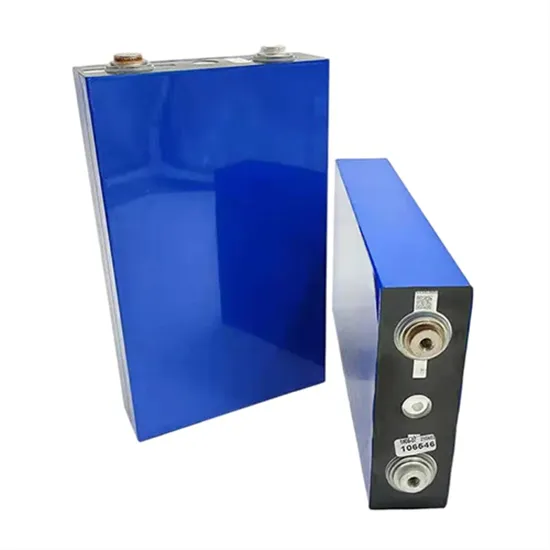

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.