5G Base Station Evolution | OpenRAN: RUs, DUs,

From 4G to 5G technologies, Faststream has followed an evolutionary approach, with a strong emphasis on delivering able next-generation experiences and

Get a quote

Guinée: Guinée Télécom lance ses services la 4G et la 5G

La Société des télécommunications de Guinée (SOTELGUI), désormais Guinée Télécom, sera opérationnelle avant la fin du mois de janvier 2023, a indiqué le ministre des

Get a quote

Guinee Telecom set to be operational in Guinea by end of month

State-owned telco Societe des Telecoms de Guinee (Sotelgui), now known as Guinee Telecom, could be operational in the Republic of Guinea as early as the end of this

Get a quote

Long Term Evolution Base Station Market

1 day ago· The LTE base station market commands a substantial share within its parent markets, reflecting its pivotal role in modern telecommunications infrastructure. Within the wireless

Get a quote

Top 5G Base Station gNodeB Manufacturers & Vendors

This Base Station is very compact and supports all radio technologies (2G, 3G, 4G, 4.5G, 4.9G) in addition to 5G. It also supports all network topologies such as distributed RAN, Centralized

Get a quote

Guinee Telecom set to be operational in Guinea by

State-owned telco Societe des Telecoms de Guinee (Sotelgui), now known as Guinee Telecom, could be operational in the Republic of

Get a quote

5G NR Base Station Types

5G New Radio (NR) base stations play a critical role in the deployment of 5G networks. They are responsible for transmitting and receiving signals to and from user

Get a quote

5g-nokia-equipment-specifications

The base stations are modular and scalable, allowing operators to upgrade from 4G to 5G with minimal hardware changes. Frequency Bands: Supports sub-6 GHz (n78, n77,

Get a quote

5G Base Station Chips: Driving Future Connectivity by 2025

The evolution of wireless technology has brought the world to the brink of a connectivity revolution. As 5G networks become the backbone of modern communication, 5G

Get a quote

3G / 4G / 5G coverage in Guinea

This map represents the coverage of 2G, 3G, 4G and 5G mobile network. See also : mobile bitrates map and Orange Mobile, MTN Mobile, Cellcom Mobile mobile networks coverage.

Get a quote

What is 5G NR Base Station Types

5G New Radio (NR) base stations, also known as gNBs, are classified into different types based on their deployment scenarios, frequency ranges, and technical requirements. Here''s a

Get a quote

Guinée: Guinée Télécom lance ses services la 4G et

La Société des télécommunications de Guinée (SOTELGUI), désormais Guinée Télécom, sera opérationnelle avant la fin du mois de

Get a quote

Cradle to the Grave: Sustainability and the Life of a

Around 30 years ago, telecom networks were huge monstrosities, the size of a garden shed – but some modern "small cells" are no larger than

Get a quote

5G Base Station Companies

5G Base Station Company List Mordor Intelligence expert advisors identify the Top 5 5G Base Station companies and the other top companies based on 2024 market position. Get access to

Get a quote

Electrical Enclosures and Connectors for Telecom Industry | E

2 days ago· Discover how E-abel enclosures and Weipu connectors create reliable, scalable solutions for telecom networks. Applications include 5G base stations, fiber hubs, and smart

Get a quote

5G base station architecture, Part 1: Evolution

In this multi-part article, I will examine the view and challenges of the big players in this market from semiconductor suppliers, to Test &

Get a quote

Guinea Telecom MNO Market Size, Share & 2030 Growth Trends

The Guinea telecom MNO Market size extracted from these regions remains modest in 2025, but share of new base-station deployments is rising as tower-cos sign build-to

Get a quote

What is 5G base station architecture?

Before you can think about 5G network components, you need to consider the base station. To get started, find out what you need to know about the architecture.

Get a quote

Base Station and Population Coverage

Number of base stations deployed and coverage of market population worldwide. Includes summaries and data tables for BTS and NodeB and population coverage.

Get a quote

Network coverage in Guinea

5G is the fifth generation of mobile phone communications standards. It is a successor to 4G and promises to be faster than previous generations while opening up new uses cases for mobile

Get a quote

Guinea Draws Inspiration from Senegal''s 5G Success

In Guinea, no official announcement has been made regarding a potential 5G launch timeline. However, it was anticipated that the new state-owned enterprise, Guinea

Get a quote

6 FAQs about [Guinea Telecom 5G base station]

What is a 5G base station?

They help fill coverage gaps, improve network reliability, and handle high data traffic. In cities, more than 60% of 5G base stations are small cells, placed on rooftops, lampposts, and building facades. These mini base stations are crucial for delivering consistent 5G speeds in crowded areas like stadiums, shopping malls, and business districts.

Who makes 5G base station equipment?

19. The top 5 telecom equipment providers for 5G base stations are Huawei, Ericsson, Nokia, ZTE, and Samsung When it comes to 5G base station equipment, five companies dominate the market: Huawei, Ericsson, Nokia, ZTE, and Samsung. These firms provide the hardware and software needed to power the world’s 5G networks.

How many 5G base stations does China have?

China has deployed over 2.4 million 5G base stations as of 2023, accounting for over 60% of the global total China is leading the 5G revolution. With over 2.4 million base stations, the country accounts for more than 60% of all 5G infrastructure globally.

Why are telecom companies installing indoor 5G base stations?

To solve this, telecom companies are installing indoor 5G base stations, which are growing at a compound annual growth rate (CAGR) of over 30%. For businesses operating in offices, malls, or large commercial spaces, installing indoor 5G solutions can greatly enhance connectivity.

How many 5G base stations are there in Japan?

Japan had over 100,000 active 5G base stations by 2023 Japan’s 5G network is expanding rapidly, with over 100,000 active base stations by 2023. The country has taken a strategic approach, focusing on major urban centers first and gradually expanding to rural areas.

What are the advantages of a 5G base station?

Massive MIMO: The use of a large number of antennas allows the base station to serve multiple users simultaneously by forming multiple beams and spatially multiplexing signals. Modulation Techniques: 5G base stations support advanced modulation schemes, such as 256-QAM (Quadrature Amplitude Modulation), to achieve higher data rates.

Guess what you want to know

-

Korea Telecom Company 5G Base Station

Korea Telecom Company 5G Base Station

-

Rwanda Telecom Operator 5G Base Station

Rwanda Telecom Operator 5G Base Station

-

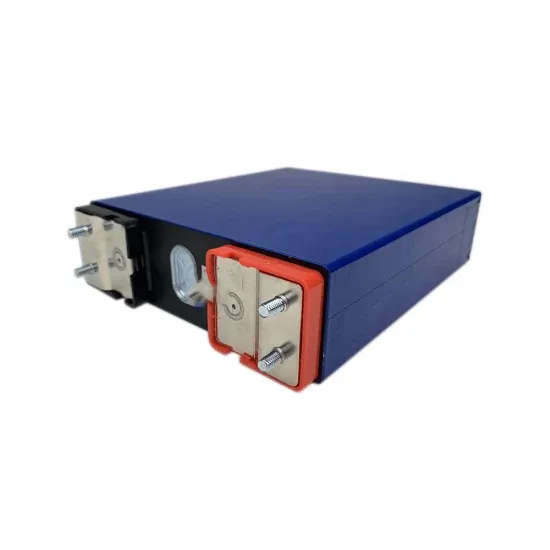

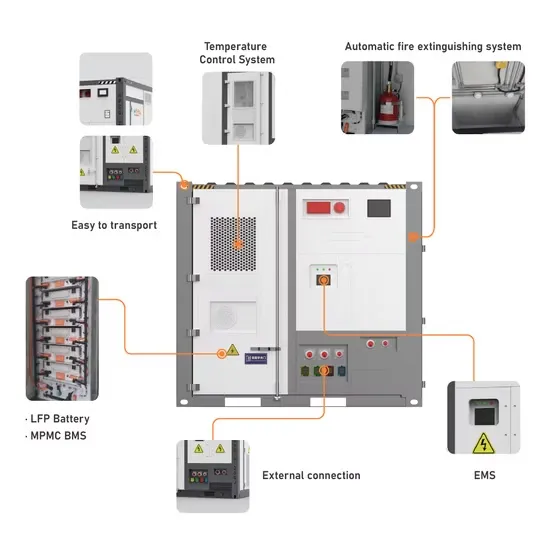

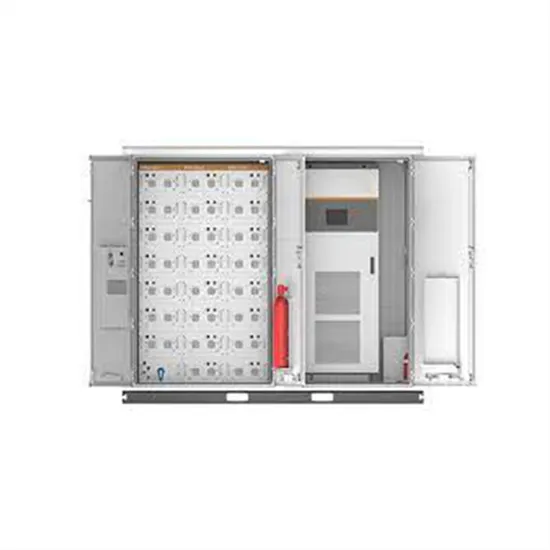

Guinea 5G communication base station battery energy storage

Guinea 5G communication base station battery energy storage

-

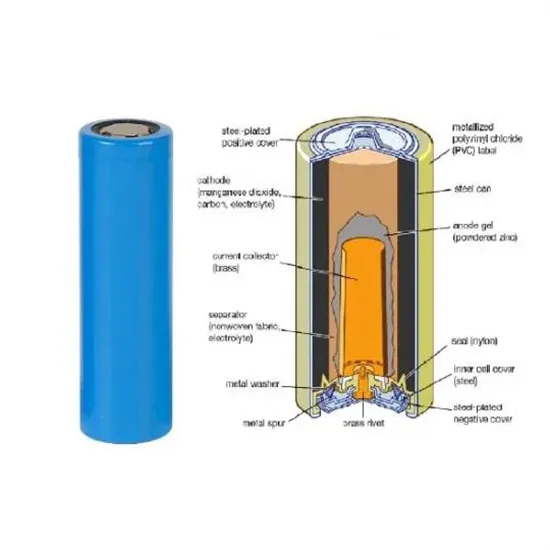

Lithium iron phosphate battery 5G energy storage base station

Lithium iron phosphate battery 5G energy storage base station

-

How much electricity does a 5G base station in Switzerland use

How much electricity does a 5G base station in Switzerland use

-

HVDC powered 5G base station

HVDC powered 5G base station

-

Huawei 5g base station power solar energy

Huawei 5g base station power solar energy

-

United Communications 5G Base Station

United Communications 5G Base Station

-

5g indoor base station power supply wind power

5g indoor base station power supply wind power

-

How much hybrid power supply does a 5G communication base station have

How much hybrid power supply does a 5G communication base station have

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.