The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get a quote

Top 10 BESS Investors in Europe

Battery Energy Storage Systems (BESS) investment in Europe is gaining popularity due to its ability to provide backup power and reduce curtailment. According to Aurora Energy

Get a quote

Energy Storage: A New Asset Class Buyers Of Power Should

When buyers invest in renewable projects such as energy storage through power purchase agreements (which my company helps facilitate), they can dictate how the assets

Get a quote

Enlight Renewable Energy completes major Israeli solar and storage project

The Israel-based renewable energy company plans to use the proceeds to fund large-scale renewable energy projects across the United States, Europe, and the MENA region.

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid-scale storage and other

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid

Get a quote

Investing in the grid: PE''s battery storage strategy

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands.

Get a quote

Global Renewable Energy Investment Still Reaches New Record

London, August 26, 2025 – Global investment in new renewable energy projects hit a record $386 billion in the first half of 2025, up 10% from the previous year. However, asset finance for utility

Get a quote

Energy Storage: A New Asset Class Buyers Of Power Should

When buyers invest in renewable projects such as energy storage through power purchase agreements (which my company helps facilitate), they can dictate how the assets

Get a quote

NextEra Energy Resources | What We Do | Energy

Investing in Battery Energy Storage As one of America''s largest energy infrastructure developers, NextEra Energy Resources has earned a reputation

Get a quote

Energy Storage Investments – Publications

Through the first three quarters of 2024, 83 energy storage financing and investment deals were reported completed for a total of $17.6 billion invested [1]. Of these

Get a quote

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

What are the investment models for energy storage projects?

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through different financial mechanisms,

Get a quote

What are the investment models for energy storage

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through

Get a quote

ENERGY STORAGE PROJECTS

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors,

Get a quote

Investing in the grid: PE''s battery storage strategy

The project is expected to be one of Europe''s largest battery energy storage systems. Partners Group''s January investment in Green

Get a quote

U.S. Energy Storage Industry to Invest $100 Billion in

Today''s investment commitment aims to advance a manufacturing expansion in the United States that could enable American-made batteries to satisfy 100% of domestic energy storage project

Get a quote

What does investing in energy storage include? | NenPower

Investing in energy storage entails 1. capital allocation in diverse technologies, 2. understanding regulatory frameworks and market dynamics, 3. evaluating performance and

Get a quote

California Sees Unprecedented Growth in Energy

The California Energy Commission is leading the state to a 100 percent clean energy future. It has seven core responsibilities: developing

Get a quote

Overview and key findings – World Energy Investment

Global energy investment is set to exceed USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure.

Get a quote

U.S. Department of Energy Selects 11 Projects to

WASHINGTON, D.C. — The U.S. Department of Energy (DOE) today announced an investment of $25 million across 11 projects to advance

Get a quote

Investing in the grid: PE''s battery storage strategy

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE

Get a quote

Investment Insights into Energy Storage Power Stations: Cost

11 hours ago· Investing in energy storage systems demands a data-informed approach that considers every element from battery technology and scale to geography and financing. With

Get a quote

Clean Hydrogen Investment Soars Past $110 Billion

2 days ago· The clean hydrogen industry has attracted over $110 billion in investment across more than 500 projects despite recent delays and cancellations, according to a new report by

Get a quote

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get a quote

How to invest in solar farms and storage projects in Europe?

Steps of Investment in Renewable Energy Projects: Including Construction Project Investing in renewable energy projects, such as solar farms, wind projects, energy storage

Get a quote

Energy Storage Stocks: Investment Opportunities in Renewables

As the world increasingly transitions towards renewable energy, the importance of energy storage has never been more pronounced. This article explores various energy storage

Get a quote

6 FAQs about [Investing in energy storage projects]

Why is PE investment in battery energy storage growing?

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE investments in energy storage and infrastructure have more than doubled since 2014, reaching $21.1 billion in 2024 alone.

What is energy storage?

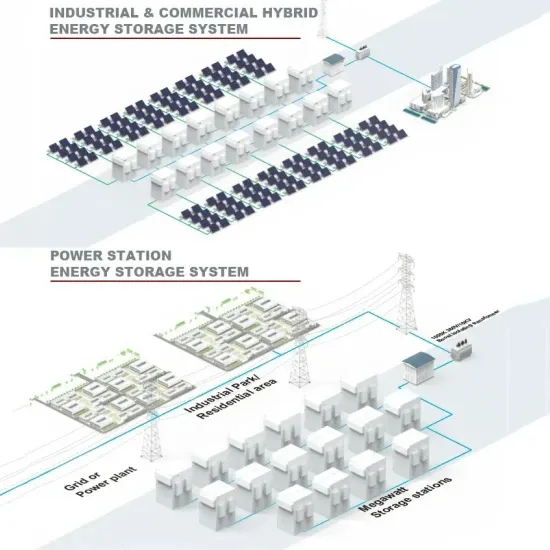

Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for later use. LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical technologies, thermal storage, and chemical storage.

Why is energy storage important?

Energy storage serves important grid functions, including time-shifting energy across hours, days, weeks, or months; regulating grid frequency; and ensuring flexibility to balance supply and demand.

How will energy storage help a net-zero economy by 2050?

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors, energy storage will play a key role in the shift to a net-zero economy by 2050.

Is battery storage a good investment?

Debt financing also plays a strategic role in cashing in on the potential for high returns, with storage projects often securing leverage between 60% and 80% of project costs, contingent on revenue certainty. Despite the strong return prospects, battery storage investments also have notable risks.

Is battery storage a fundamental part of energy infrastructure?

“Battery storage is now viewed as a fundamental part of energy infrastructure, much like LNG terminals and oil tankers,” said Gresham House infrastructure and energy transition investor Lefteris Stakosias. Stakosias said this investment boom reflects a broader shift in the global energy market toward renewables.

Guess what you want to know

-

Is the energy storage cabinet battery worth investing in

Is the energy storage cabinet battery worth investing in

-

The first batch of new energy storage projects in Tartu Estonia

The first batch of new energy storage projects in Tartu Estonia

-

How many energy storage power station projects are there in Egypt

How many energy storage power station projects are there in Egypt

-

Energy storage projects belong to

Energy storage projects belong to

-

The average investment cost of energy storage projects includes

The average investment cost of energy storage projects includes

-

Southeast Asia Industrial and Commercial Energy Storage Projects

Southeast Asia Industrial and Commercial Energy Storage Projects

-

Proposed energy storage projects in Kosovo

Proposed energy storage projects in Kosovo

-

Large-scale clean energy storage projects

Large-scale clean energy storage projects

-

What is the normal energy consumption of energy storage projects

What is the normal energy consumption of energy storage projects

-

Does the hospital also have energy storage projects

Does the hospital also have energy storage projects

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

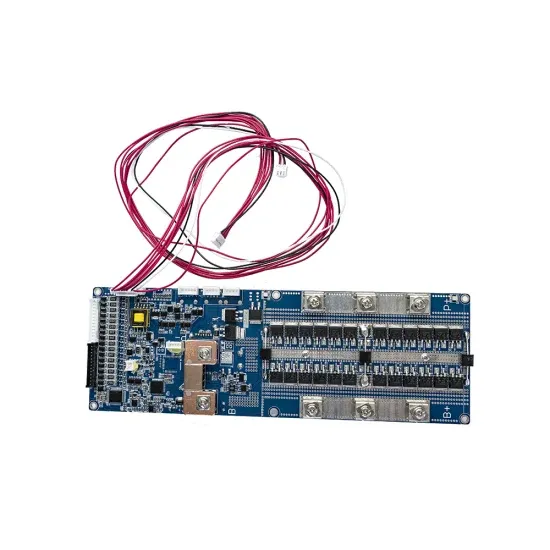

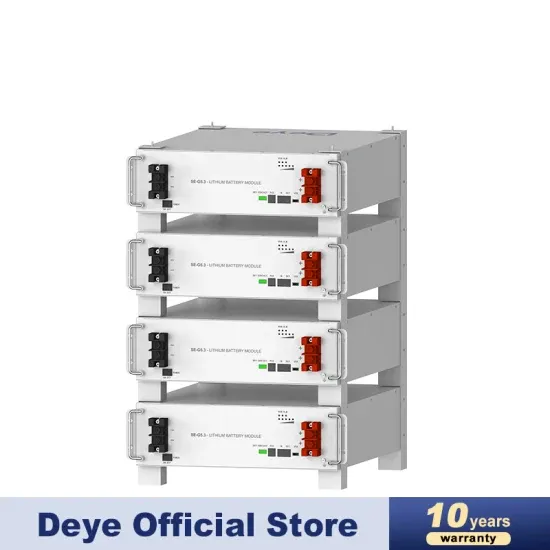

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.