South Korea Household Energy Storage Battery System Market

The South Korea Household Energy Storage Battery System industry exhibits concentrated regional activity, with key hubs such as Seoul, Incheon, and Busan leading in

Get a quote

South Korea launches $29 billion battery storage

South Korea''s battery makers, including LG Energy Solution and SK On, have been squeezed by waning EV subsidies and shifting demand,

Get a quote

KOREA''S ENERGY STORAGE THE SYNERGY OF PUBLIC

Korea''s battery storage industry has experienced remarkable growth for the accounting for more than 80% of the total lithium-ion battery (hereinafter, Korea''s LiB ESS market size reached

Get a quote

South Korea''s SK On signs energy storage battery supply deal

"The LFP battery production for energy storage systems expects to further strengthen our product lineup and business portfolio and to effectively respond to the

Get a quote

South Korea grid connected battery storage

Kokam has announced 40 megawatt-hoursof solar-connected battery capacity in South Korea as the market shifts to PV-plus-batteries for energy storage growth. The SolarEdge-owned South

Get a quote

A groundbreaking development in South Korea is transforming

A remarkable breakthrough in energy storage technology is taking place in South Korea, where a team of researchers has developed an innovative method that could

Get a quote

South Korea Energy Storage Systems Market Outlook to 2030

The South Korea Energy Storage Systems (ESS) market is driven by rising renewable energy deployment under the 11th Basic Plan, KEPCO''s transmission deferral projects, and strong

Get a quote

Korean Battery Innovators Unveil Breakthroughs

Korean battery giants go on the offensive at InterBattery 2025, unveiling game-changing innovations from SK On, LG Energy Solution, and

Get a quote

A groundbreaking development in South Korea is

A remarkable breakthrough in energy storage technology is taking place in South Korea, where a team of researchers has developed an

Get a quote

South Korea''s SK On signs energy storage battery supply deal

South Korea''s SK On signs energy storage battery supply deal with Flatiron Energy SEOUL, Sept 4 (Reuters) – South Korea''s SK On said on Thursday it has signed a deal with

Get a quote

LG Energy Solution building US factory with 16GWh

Illustration of a solar-plus-storage power plant with LG ES BESS equipment. Image: LG Energy Solution. LG Energy Solution will build a new

Get a quote

Current Status and Prospects of Korea''s Energy Storage

Its accumulated capacity is about two thirds of that of the United States. Considering that Korea''s land mass is only about 1 percent of that of the U.S., the volume of Korea''s ESS installation is

Get a quote

Energy in South Korea

South Korea is a major energy importer, importing nearly all of its oil needs and ranking as the second-largest importer of liquefied natural gas in the world.

Get a quote

Energy storage systems in South Korea

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more

Get a quote

What are the energy storage industries in South Korea?

From lithium-ion technologies to hybrid systems, South Korea''s investment in energy storage presents an intricate yet vibrant chapter in its

Get a quote

SK On secures 7.2 GWh battery storage supply deal in US

6 days ago· The South Korean manufacturer will repurpose a portion of its electric vehicle battery production line at its Georgia plant to produce lithium iron phosphate (LFP) stationary energy

Get a quote

Korean $14.6bn battery lifeline as global EV sales plummet

The Ministry of Trade, Industry and Energy (MOTIE) said on January 15 the KRW21 trillion jumpstart was needed to ensure Korean battery production for EVs and energy

Get a quote

Top five energy storage projects in South Korea

Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database. GlobalData uses proprietary data and

Get a quote

What are the energy storage industries in South Korea?

From lithium-ion technologies to hybrid systems, South Korea''s investment in energy storage presents an intricate yet vibrant chapter in its energy story, promising not only

Get a quote

Battery Innovation System of South Korea

Battery policy or programmes are set by the central government and the Korean President, who is the ultimate authority on research matters. However, industry is strongly involved in the

Get a quote

South Korea''s SK On signs energy storage battery supply deal

It said that it also planned to establish LFP production in South Korea. SK On''s deal echoes a trend among EV battery makers of expanding into energy storage as a hedge against slow EV

Get a quote

SolarEdge opens 2GWh lithium battery cell factory in

Sella 2 factory, Eumseong Innovation City, South Korea. Image: SolarEdge. Smart energy optimisation and management tech company

Get a quote

South Korea''s SK On signs energy storage battery supply deal

South Korea''s SK On said on Thursday it has signed a deal with U.S.-based Flatiron Energy Development to supply lithium iron phosphate (LFP) batteries for energy

Get a quote

South Korea launches $29 billion battery storage initiative

South Korea''s battery makers, including LG Energy Solution and SK On, have been squeezed by waning EV subsidies and shifting demand, prompting a strategic pivot

Get a quote

Advancing grid stability and renewable energy: Policy evolution of

The evolution of policies and regulations supporting battery energy storage system (BESS) development, utilization, and sustainability to enhance resource adequacy was

Get a quote

Guess what you want to know

-

South Korea Energy Storage Battery Power Station

South Korea Energy Storage Battery Power Station

-

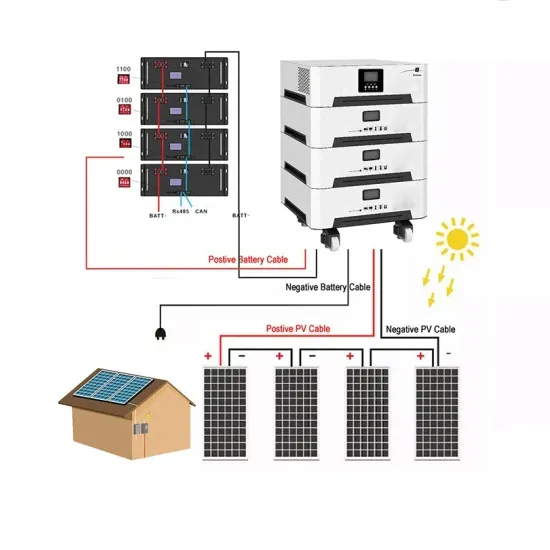

Automated energy storage battery cabinet photovoltaic production

Automated energy storage battery cabinet photovoltaic production

-

Energy Storage Cabinet Battery Production Market

Energy Storage Cabinet Battery Production Market

-

Libya battery energy storage production plant

Libya battery energy storage production plant

-

South African Republic Battery Energy Storage System Project

South African Republic Battery Energy Storage System Project

-

Gabon Battery Energy Storage Production Company

Gabon Battery Energy Storage Production Company

-

15v battery production for energy storage cabinets

15v battery production for energy storage cabinets

-

South Africa s grid-side energy storage lithium battery

South Africa s grid-side energy storage lithium battery

-

Chad energy storage lead-acid battery production

Chad energy storage lead-acid battery production

-

Sodium-ion battery production for energy storage

Sodium-ion battery production for energy storage

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.