7 Energy Storage Stocks to Invest In | Investing | U.S.

With more than $5 billion generated in fiscal 2024 by its battery-focused energy division, however, Panasonic stands among the iconic names

Get a quote

How much is the price difference between energy storage power station

1. The price disparity between energy storage power stations and traditional power grid infrastructures can be substantial, influenced by various factors. 2. Cost structures differ

Get a quote

How much does a household energy storage power station cost?

The procurement of a household energy storage power station typically incurs significant financial outlay. The average price range lies between $7,000 and $15,000,

Get a quote

How much is the total investment in energy storage power

The total investment in energy storage power stations varies significantly based on factors such as technology used, capacity, location, and market conditions.

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

Grid infrastructure investments drive increase in utility spending

Although energy storage remains a relatively small portion of the total budget for distribution infrastructure, spending increased from $97 million in 2022 to $723 million in 2023.

Get a quote

Energy Storage Investments – Publications

Through the first three quarters of 2024, 83 energy storage financing and investment deals were reported completed for a total of $17.6 billion invested [1]. Of these

Get a quote

How much does a self-use energy storage power station cost?

A self-use energy storage power station is a valuable investment not only for potential financial savings through reduced electricity costs but also for achieving energy

Get a quote

How much investment does the energy storage power station

An investment in an energy storage power station involves multiple costs that extend beyond the initial capital. While the upfront expenditure is a considerable factor,

Get a quote

How much does energy storage power station equipment cost?

Investing in energy storage power station equipment necessitates a thorough understanding of numerous cost components, technologies, and trends in the energy market.

Get a quote

How much investment can be recovered from energy storage

Investment recovery from energy storage power stations emerges as a complex yet promising venture. Navigating this terrain requires comprehensive insight into financial,

Get a quote

How much money can energy storage power stations make?

Energy storage power stations can generate significant revenue, driven by multiple factors including demand response opportunities, ancillary services, and peak shaving

Get a quote

How much is the investment in Anlu Energy Storage Power Station?

The investment in Anlu Energy Storage Power Station can vary significantly based on several factors.1. The total investment required typically amounts to an estimated $100

Get a quote

How much does it cost to invest in an energy storage power station

1. The financial requirements to invest in an energy storage power station can vary significantly based on several critical factors.2. On average, initial costs can range from

Get a quote

Global energy storage

Global energy storage capacity outlook 2024, by country or state Leading countries or states ranked by energy storage capacity target worldwide in 2024 (in gigawatts)

Get a quote

Texans approved billions in spending on power plants.

Energy & Environment Texans approved billions in spending on power plants. What comes next? The vote dedicates billions of tax dollars to

Get a quote

Why Energy Storage Power Stations Are Becoming the Hottest

The Fish That Paid the Bill: A Shanghai fisheries company slashed energy costs 40% using storage to power freezers [9] Texas'' Secret Weapon: During 2023''s heatwave,

Get a quote

How much does it cost to invest in a ground source energy storage power

1. The cost of investing in a ground source energy storage power station can significantly vary based on several factors, including project size, location, and technology

Get a quote

How much tax does the energy storage power station earn?

1. Taxation on energy storage power stations varies significantly by jurisdiction, 2. Factors such as infrastructure, investment incentives, and operational costs influence

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

How much investment can be recovered from energy storage power stations

Investment recovery from energy storage power stations emerges as a complex yet promising venture. Navigating this terrain requires comprehensive insight into financial,

Get a quote

How much is the investment in operating an energy storage power station

The investment in operating an energy storage power station is quite variable and influenced by numerous factors. 1. Initial capital expenditures can range from millions to

Get a quote

How much profit does a German hydrogen energy

1. German hydrogen energy storage power stations can yield substantial profits through various mechanisms, particularly due to 1. favorable

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

With more than $5 billion generated in fiscal 2024 by its battery-focused energy division, however, Panasonic stands among the iconic names in energy storage.

Get a quote

How much is the total investment in energy storage power stations

The total investment in energy storage power stations varies significantly based on factors such as technology used, capacity, location, and market conditions.

Get a quote

How much money does an energy storage power station invest in?

A thorough financial analysis of investments in energy storage power stations is paramount. Investors need to assess market demand and energy prices, as these factors will

Get a quote

6 FAQs about [How much money is invested in energy storage power stations ]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How much did energy storage cost in 2022?

Although energy storage remains a relatively small portion of the total budget for distribution infrastructure, spending increased from $97 million in 2022 to $723 million in 2023.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

Why is energy storage important?

Energy storage at the substation or customer site enhances power quality and provides backup power in areas where lines and transformers cannot handle additional capacity, especially as more intermittent renewable resources come online. Other Utilities increased spending by $8.6 billion (30%) on other electricity systems costs from 2003 to 2023.

How much does a utility spend on electricity a year?

Annual spending by major utilities to produce and deliver electricity increased 12% from $287 billion in 2003 to $320 billion in 2023 as measured in real 2023 dollars, according to financial reports to the Federal Energy Regulatory Commission (FERC).

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Guess what you want to know

-

How many energy storage power stations are there in Ireland

How many energy storage power stations are there in Ireland

-

How many types of batteries are there in energy storage power stations

How many types of batteries are there in energy storage power stations

-

How many energy storage power stations are there in the northwest of Malta

How many energy storage power stations are there in the northwest of Malta

-

How many energy storage power stations are there in Denmark

How many energy storage power stations are there in Denmark

-

How many companies are involved in Algeria s energy storage power stations

How many companies are involved in Algeria s energy storage power stations

-

How many energy storage power stations are there in Seychelles

How many energy storage power stations are there in Seychelles

-

How many companies are there in Brazil that produce energy storage power stations

How many companies are there in Brazil that produce energy storage power stations

-

How many energy storage power stations are there in Bangladesh

How many energy storage power stations are there in Bangladesh

-

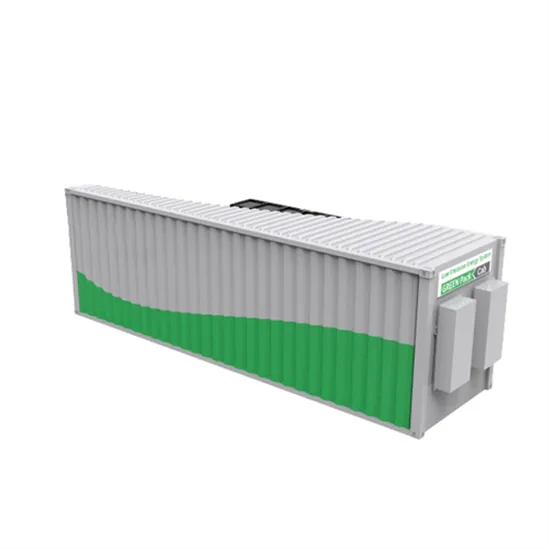

How container energy storage power stations work

How container energy storage power stations work

-

Construction costs of energy storage power stations

Construction costs of energy storage power stations

Industrial & Commercial Energy Storage Market Growth

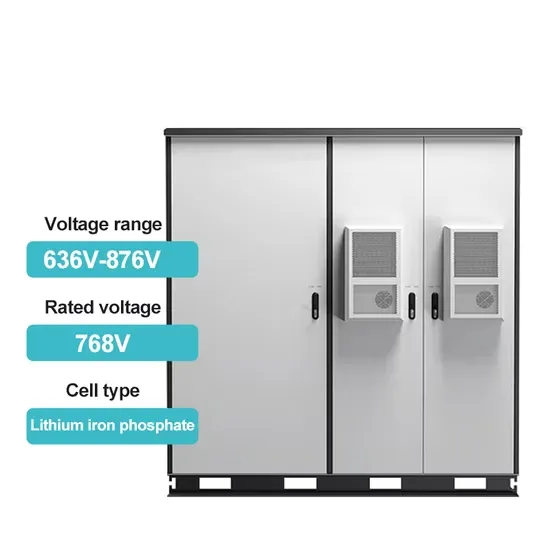

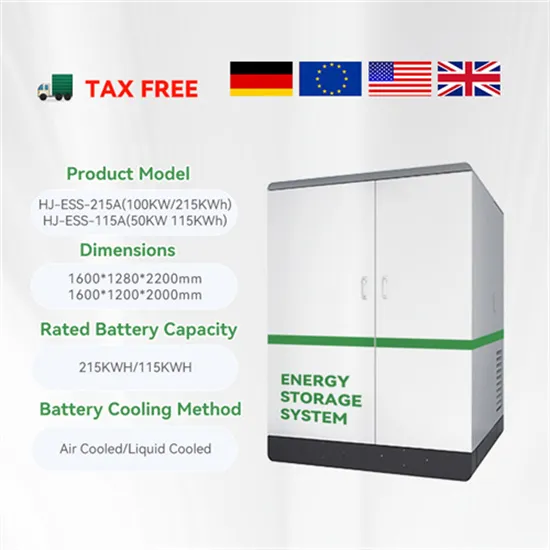

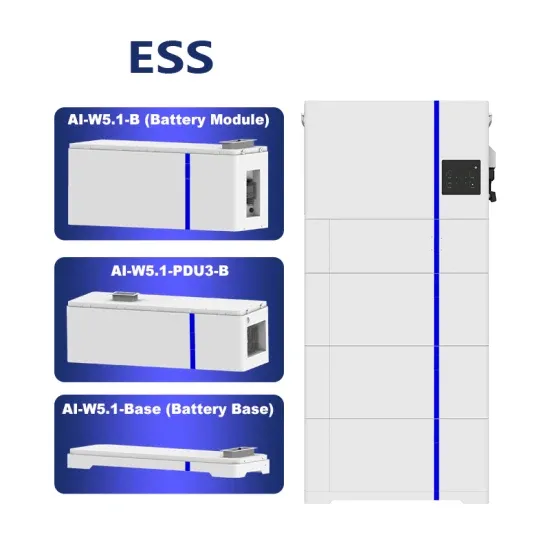

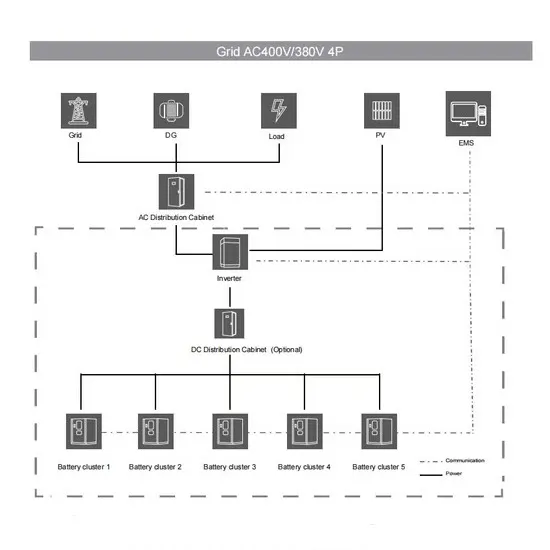

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.