Africa: Demand up for solar coupled with energy

"The cost of energy storage technology is falling, making solar + storage systems increasingly accessible, especially in developing regions with

Get a quote

Senegal Secures $23M for Niakhar Solar Power Plant

The West African Development Bank (BOAD) has approved a $23 million loan to support the development of the Niakhar solar power plant project in Senegal by Teranga

Get a quote

Eramet Grande Côte and JUWI combine their

Diogo, November 19, 2024 Eramet Grande Côte, Diogo, Senegal, has partnered with JUWI Renewable Energies (), a global renewable energy

Get a quote

Investment in Senegal''s Renewable Energy Sector

Senegal, a West African country, aims to use more solar, wind, and biomass to power the country. This shift is excellent for the planet and opens up opportunities for

Get a quote

How a high cost of capital is holding back energy development in

Both Kenya and Senegal have benefitted from clear government targets and a growing share of renewables in their respective energy mixes. In the past decade, Kenya

Get a quote

Senegal: EPC contract will see May start for solar, BESS project

Work on a solar energy and battery storage project in Senegal, touted to be the biggest in West Africa once it goes live, is set to begin next month after an EPC (Engineering,

Get a quote

Senegal''s Renewables Share; Energy Prices are Some of the

The price drop positions solar and wind as the cheapest energy sources currently available for rural communities who experience a mere 38% electrification rate in Senegal and

Get a quote

Senegal: EPC contract will see May start for solar,

Work on a solar energy and battery storage project in Senegal, touted to be the biggest in West Africa once it goes live, is set to begin next

Get a quote

Investment in Senegal''s Renewable Energy Sector

Senegal, a West African country, aims to use more solar, wind, and biomass to power the country. This shift is excellent for the planet and

Get a quote

Senegal: Senelec contracts Infinity Power for 160MWh battery

The national electric utility of Senegal, Senelec, has signed a 20-year CCA with Infinity Power for a battery energy storage project.

Get a quote

Sections 45Y and 48E Beginning of Construction Notice

Beginning of Construction Requirements for Purposes of the Termination of Clean Electricity Production Credits and Clean Electricity Investment Credits for Applicable Wind and Solar

Get a quote

Taiba N''Diaye Wind Power Station

Taiba N''Diaye Wind Power Station, (French: Parc Eolien Taiba N''Diaye, PETN), is a 158.7 MW (212,800 hp) wind power plant in Senegal. [1] The power station is the largest wind power

Get a quote

Senegal: Energy Development Plan to Decarbonise the

Senegal submitted its first National Determined Contribution (NDC) at the end of 2020 and the country is currently advancing its climate policy to reduce CO2e emissions by 29% by 2030

Get a quote

Renewable Energy Investments in Senegal: Opportunities and

Renewable energy investments in Senegal are primarily concentrated on solar, wind, and biomass projects, with the government targeting a 30% share of renewables in the

Get a quote

Ten Merina Solar Plant, Senegal

This is Meridiam''s second solar power project in Senegal, delivering an additional reliable supply of low-cost and low-carbon electricity. Overall, Ten Merina is a

Get a quote

Senegal solar battery storage costs

Juwi Renewable Energies will build a $33.2 million solar and storage facility in Senegal, featuring a 20 MW solar plant and 11 MWh of battery storage to power the Grande Côte mineral sands

Get a quote

How a high cost of capital is holding back energy

Both Kenya and Senegal have benefitted from clear government targets and a growing share of renewables in their respective energy mixes. In

Get a quote

Senegal wind power generation battery

Explore the advanced solutions in solar photovoltaic power generation and energy storage. Learn how modern technologies are transforming energy systems with sustainable, efficient

Get a quote

Construction and operation of a 30 MWp photovoltaic solar

Contribute to a better coverage of electricity demand and a more secure supply of electricity in Senegal. Contribute to achieving the target of 40% renewable energy in Senegal''s energy mix

Get a quote

Axian Energy bags US $89M for solar-storage park in Senegal

This project will include the construction of two photovoltaic (PV) parks and a 72-MWh battery storage system. The total project cost is estimated at over EUR 105 million.

Get a quote

Utility-scale solar PV and wind in Senegal: Overcoming regional

Access to finance for solar PV and wind projects in Senegal is relatively available, though high payment risk – particularly payment delays that affect projects'' operating cash flows – and

Get a quote

Senegal''s Renewables Share; Energy Prices are

The price drop positions solar and wind as the cheapest energy sources currently available for rural communities who experience a mere 38%

Get a quote

Senegal: Energy Development Plan to Decarbonise the

Senegal has significant solar resources and large wind potential. The costs of renewable energy generation are generally lower with stronger solar radiation and stronger wind speeds.

Get a quote

US wind and solar construction costs rise, natural gas

Implications for the Energy Industry These changes in construction costs for solar, wind, and natural gas projects in the U.S. are significant for the

Get a quote

COSTS AND BENEFITS OF SOLAR IRRIGATION SYSTEMS IN SENEGAL

Lithium battery costs for industrial and commercial energy storage systems Lithium-ion batteries are the dominant energy storage solution in most commercial applications, thanks to their high

Get a quote

6 FAQs about [Senegal wind solar and storage construction costs]

Is a solar energy project in Senegal the biggest in West Africa?

Work on a solar energy and battery storage project in Senegal, touted to be the biggest in West Africa once it goes live, is set to begin next month after an EPC (Engineering, Procurement and Construction) contract for its development was recently signed. The Kolda project will encompass a 60MWp PV solar plant coupled with a 90MWh storage system.

How much energy does Senegal's new wind farm provide?

Commissioned in December 2019, the initial phase of the project is already pumping 55 megawatts (MW) of renewable energy into the national grid, lighting up homes and businesses across the country. When fully completed by 2021, the wind farm will provide 158 MW of electricity to Senegal’s grid, or 15 percent of the country’s generation capacity.

Is Senegal achieving universal energy access?

With a national electricity access rate of 84%, Senegal is making progress towards universal energy access, yet more than 30% of rural communities remain disconnected from the grid.

What is Senegal's energy strategy?

“Senegal’s energy strategy prioritises mobilising $2 billion in private investments. Recognising that achieving universal access cannot rely solely on public resources, the approach leverages private sector innovation and efficiency to meet ambitious targets,” said the World Bank.

When will a solar power plant be built in Senegal?

“This agreement paves the way for the construction to begin in May 2025, with the deployment of a 60MWp photovoltaic plant coupled with a 90MWh storage system.” Voltalia is to supply the PV infrastructure for the solar power plant, which will operate on Senegal’s national grid managed by SENELEC.

Does Senegal have a stable electricity supply?

In January the World Bank, in a feature on the transformative impact of a stable electricity supply since the beginning of 2025 in Ndorong Serere – a village located 100km from Senegal’s capital city Dakar – said the country’s commitment to universal electricity access is supported by innovative financing and strategic partnerships.

Guess what you want to know

-

Wind solar and storage construction costs in Tanzania

Wind solar and storage construction costs in Tanzania

-

Suriname Wind Solar and Storage Project Costs

Suriname Wind Solar and Storage Project Costs

-

Wind and solar energy storage construction equipment company

Wind and solar energy storage construction equipment company

-

Gambia wind solar and energy storage project construction

Gambia wind solar and energy storage project construction

-

Wind solar and energy storage costs

Wind solar and energy storage costs

-

Construction of wind solar and energy storage projects in St Kitts and Nevis

Construction of wind solar and energy storage projects in St Kitts and Nevis

-

Latvia wind solar and energy storage project construction

Latvia wind solar and energy storage project construction

-

Construction cost of wind and solar hybrid communication base stations in Togo

Construction cost of wind and solar hybrid communication base stations in Togo

-

Southern Europe Wind Solar and Storage Energy Base

Southern Europe Wind Solar and Storage Energy Base

-

Nigeria wind and solar energy storage power generation

Nigeria wind and solar energy storage power generation

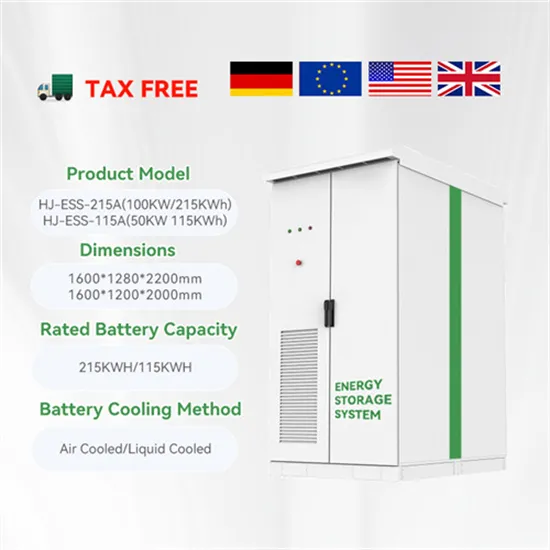

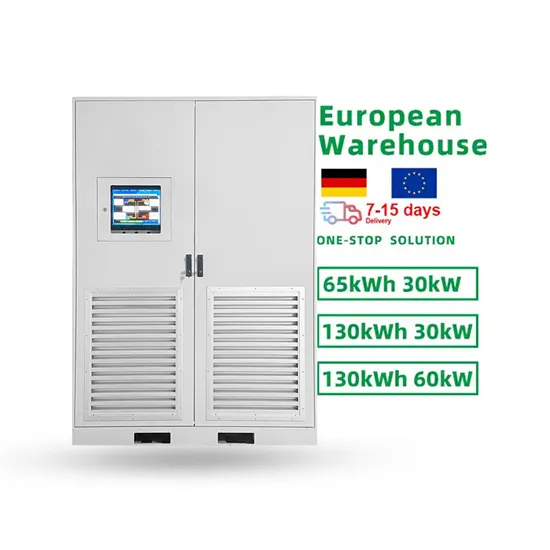

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.