Portugal''s 5G Transformation

The Portuguese electronic communications sector has invested 10 billion euros over the past nine years, resulting in the unique distinction of two Portuguese cities being

Get a quote

Telecommunications in Portugal

Portugal has a mid-sized but advanced telecoms market, with a steadily growing broadband subscriber base well served by cable, DSL and the emerging FTTx platforms.

Get a quote

Altice Portugal

Altice Portugal S.A. (formerly known as PT Portugal) is the largest telecommunications service provider in Portugal. Since 2 June 2015 the company has been a wholly owned subsidiary of

Get a quote

Portugal''s Diverse Internet and Telecommunication Services

The main operators, NOS, Vodafone, and MEO, have installed these stations, with NOS leading in the number of 5G base stations, covering 69% of the country''s parishes.

Get a quote

Portugal''s NOS launches 5G Standalone network

The operator says it has more than 4,200 5G base stations, and its coverage extends to more than 93 percent of the Portuguese population.

Get a quote

NOS leads the way in 5G with more than 51% of stations installed

NOS reinforced its leadership in Portugal''s coverage with 5G, having installed, by the end of 2022, 2985 5G stations, according to the report released by the communications

Get a quote

Mission Statement, Vision, & Core Values (2025) of

An Overview of NOS, S.G.P.S., S.A. General Summary of NOS, S.G.P.S., S.A. NOS, S.G.P.S., S.A. is a leading Portuguese telecommunications and

Get a quote

4G and 5G LTE Base Station Market

The global 4G and 5G LTE Base Station market size was valued at approximately USD 37.2 billion in 2023 and is expected to reach around USD 85.6 billion by 2032, growing at a

Get a quote

Portugal''s Diverse Internet and Telecommunication Services

The main operators, NOS, Vodafone, and MEO, have installed these stations, with NOS leading in the number of 5G base stations, covering 69% of the country''s parishes. For further details

Get a quote

Over 10,000 5G stations in Portugal

The three operators are at different stages of expanding their 5G coverage in the country. In the second quarter, Vodafone was the one that installed stations at the fastest rate

Get a quote

5G now present in all Portuguese municipalities and in 70% of

Analysing the data by operator, NOS has installed the most 5G base stations (4,705), followed by Vodafone (3,816) and MEO (1,478). In terms of the number of stations

Get a quote

Portugal''s NOS launches 5G Standalone network

The operator says it has more than 4,200 5G base stations, and its coverage extends to more than 93 percent of the Portuguese population. NOS claims that one in four of

Get a quote

€420 million investment in 5G

NOS has so far invested 420 million euros in 5G, with more than 4,200 base stations, and expects to invest another 110 million euros "in the coming years".

Get a quote

Number of 5G base stations installed in Portugal increased by

NOS remains the operator with the highest number of base stations installed to date, followed by Vodafone and MEO. In terms of change in the number of stations installed

Get a quote

Portugal Telecom Market Size & Share Analysis

Key telecom giants, including Nokia and Vodafone, have established a strong foothold in Portugal. These companies are actively fueling the market''s growth through

Get a quote

Digi''s €500 Million Investment Set to Transform Portugal''s Telecom

Digi, the Romanian telecom operator, has announced a significant investment of €500 million in Portugal, following its acquisition of Nowo. This move is expected to bring

Get a quote

Top 10 countries with the most extensive 5G in 2022

7. Australia Telstra, Australia''s largest telecommunications company, has installed over 2000 5G base stations, covering 41% of the country''s population. To provide 5G services

Get a quote

Telecommunications in Portugal

Portugal has a mid-sized but advanced telecoms market, with a steadily growing broadband subscriber base well served by cable, DSL and the emerging FTTx platforms. Mobile penetration is far above the European Union average, while the development of digital TV services has progressed under cautious regulatory guidance. The progressive liberalisation of the Portuguese market began at the beginning of the 1990s through the creation of the Portuguese Institute for

Get a quote

MEO Portugal: Exploring the Strengths, Services, and Future of a

MEO, a brand under the Portuguese telecommunications giant Altice Portugal, stands as one of the most prominent mobile network operators in the country. It has played a

Get a quote

Top 22 Wireless Infrastructure Companies in the US

Explore the wireless infrastructure companies shaping connectivity, including Cisco Meraki and Cradlepoint, essential for modern telecommunications

Get a quote

6 FAQs about [Which Portuguese Telecommunications Company Has More Base Stations]

How many base stations in Portugal have 5G?

Since the end of the first half of 2022, ANACOM has been reporting quarterly on progress in the implementation of these latest-generation mobile communications networks. At the end of 1st quarter 2024, according to information reported by operators, there were 9,999 base stations in Portugal with 5G technology.

What is the density of 5G base stations in Portugal?

Regarding the density of 5G base stations in Portugal, it was found that at the end of the 2 nd quarter of 2023, the average was approximately one station per 12 km 2, with an increase in density compared to the previous quarter, which shows the growth of the 5G network in Portugal.

Which telecom companies are driving growth in Portugal?

Key telecom giants, including Nokia and Vodafone, have established a strong foothold in Portugal. These companies are actively fueling the market’s growth through consistent and substantial investments in research and development, underlining their commitment to fostering innovation.

Which operator has installed the most 5G base stations?

Analysing the data by operator, NOS has installed the most 5G base stations (4,705), followed by Vodafone (3,816) and MEO (1,478). In terms of the number of stations installed per operator compared to the previous quarter, Vodafone reported an increase of 18% (+583 stations), NOS 11% (+470 stations) and MEO 1% (+19 stations).

Why is Portugal's Telecom market semi consolidated?

Portugal's telecom market is semi-consolidated due to the ongoing partnerships and recent advancements in the market. Some major players in the market include Vodafone Group PLC, Nokia Corporation, and Altice Portugal, among others. January 2024: Nokia partnered with NOS, a Portuguese operator, chosen for its 5G standalone core.

How is the Portugal Telecom market segmented?

The Portugal Telecom Market is Segmented by Services, Which Have Been Further Classified Into Voice Services (Wired and Wireless), Data and Messaging Services, and OTT and PayTV. The Market Size and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Guess what you want to know

-

Which telecommunications company in Africa has the most base stations

Which telecommunications company in Africa has the most base stations

-

Which Guyana Telecommunications Company has more base stations

Which Guyana Telecommunications Company has more base stations

-

Which communication company has more 5G base stations

Which communication company has more 5G base stations

-

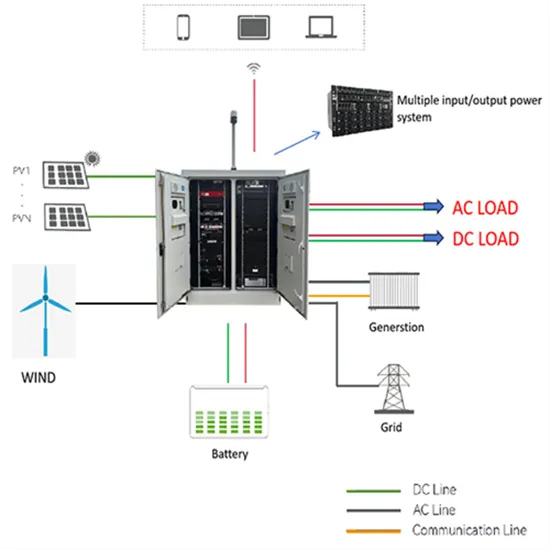

Which wind power plant is better for communication base stations

Which wind power plant is better for communication base stations

-

Which one has more liquid flow batteries for Bolivian communication base stations

Which one has more liquid flow batteries for Bolivian communication base stations

-

Which companies have electricity base stations in Sudan

Which companies have electricity base stations in Sudan

-

A company in the Cook Islands that makes inverters for communication base stations

A company in the Cook Islands that makes inverters for communication base stations

-

Which company is the green base station company

Which company is the green base station company

-

Guinea-Bissau telecommunications operator installs 5G base stations

Guinea-Bissau telecommunications operator installs 5G base stations

-

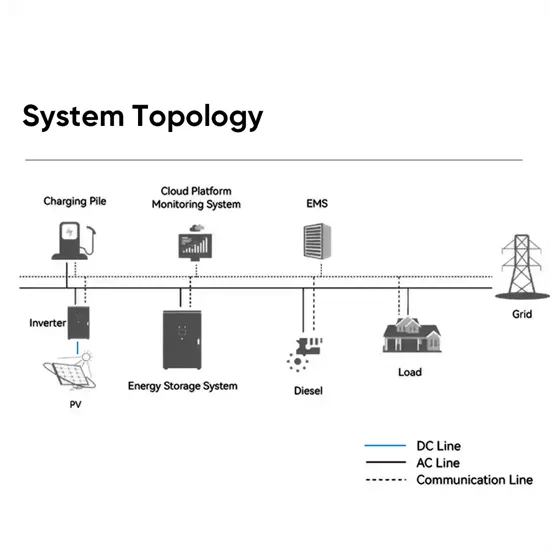

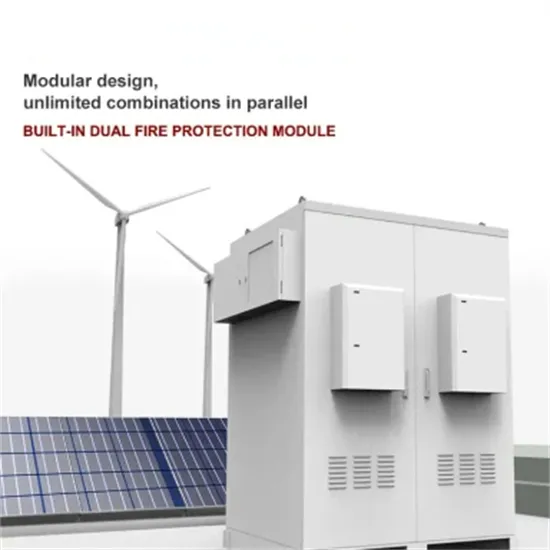

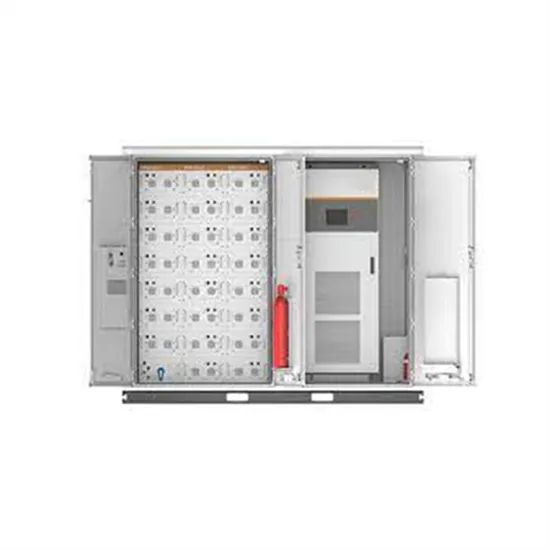

Which company s photovoltaic communication base station energy storage system

Which company s photovoltaic communication base station energy storage system

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.