Chile makes progress on energy storage with 20

The technological diversity of energy storage projects in Chile is remarkable. From battery storage systems to innovative projects with gases such as CO2,

Get a quote

Chile Energy Storage

Chile will need new renewable energy storage systems to replace its current backup capacity of coal-fired plants and natural gas-powered combined cycle turbines and

Get a quote

Energy Laws and Regulations 2025 – Chile

This chapter discusses oil, gas and electricity regulations, current energy mix, energy situation changes, government policy developments, and

Get a quote

Chile: BESS as an answer to solar curtailment, grid constraints

However, in recent years, Chile has been facing some serious issues: curtailment and marginal costs nearing zero. With solar project owners needing to find a solution to make

Get a quote

Chile

Since the cost of energy is one of the highest in Latin America, energy efficient equipment is required for Chile to reduce production costs and remain competitive in the international

Get a quote

Large scale battery storage on the rise in Chile

Three utility scale battery energy storage projects co-located with solar plants were announced last week in Chile. Enel is building a 67 MW/134

Get a quote

Wärtsilä''s battery energy storage system with Colbun, Chile

Wärtsilä''s energy storage system in Chile provides stability and flexibility for one of the largest power generation companies in the country.

Get a quote

Chile Focuses on Solar and Storage as Generation

Chile is rapidly moving to build more power generation capacity, with much of that effort focused on renewable energy resources and battery energy

Get a quote

How Energy Storage is Powering Chile''s Sustainable Future

Through the deployment of cutting edge battery storage technology, Fluence is not only addressing the technical challenges of Chile''s energy transition but also contributing to the

Get a quote

Chile Energy Storage: Powering the Future with Innovation

Chile''s energy storage strategy reads like a thriller novel. The Atacama Desert – drier than a British comedy – now hosts South America''s largest solar-storage hybrid plant.

Get a quote

Energy storage is a challenge and an opportunity for

Chile''s first battery energy storage projects were commissioned in 2009, and all but two of its 16 administrative regions have facilities in

Get a quote

CIP building 1.1 GWh standalone battery storage project in Chile

Founded in 2012, CIP focuses on investment in energy storage, transmission, and distribution; wind, solar, biomass, and advanced bioenergy; energy from waste; and power-to

Get a quote

XYZ Storage Completes Equipment Installation for Chile''s First

The project construction started in October 2024 and equipment installation was completed in 70 days. The project represents significant progress for China''s first 100MW-scale energy storage

Get a quote

Engie to build large battery storage unit at former coal plant in Chile

A similarly-sized 638MWh BESS the company brought online in Chile last month. Image: Engie Chile. Global utility and IPP Engie will build a 116MW/660MWh battery energy

Get a quote

Chile Energy Storage Industry Holds Promise | EMIS

Chile is exploring a variety of solutions to keep abreast of the changing energy demand landscape ranging from BESS to innovative projects using CO2. In March 2024,

Get a quote

Battery Energy Storage Systems (BESS) in Chile

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged

Get a quote

2024 REPORT: Battery Storage Landscape in LAC

Despite Chile''s pipeline of nearly 8 GW in battery energy storage systems (BESS), a potential flattening of its duck curve and increased

Get a quote

Chile launches an energy storage project which is the largest one

On 17 April, France''s Engie Group launched the BESS Coya Porject in María Elena, Antofagasta Region, Chile, which is currently the largest energy storage system in Latin

Get a quote

Solar power in Chile

Solar power in Chile is an increasingly important source of energy. Total installed photovoltaic (PV) capacity in Chile reached 11.05 GW in 2023. [1] In 2024, Solar energy provided 19.92

Get a quote

3.5GWh, BYD Energy Storage Signs Largest Energy Storage

Recently, BYD Energy Storage signed an energy storage order agreement with Grenergy, a world-renowned renewable energy company, for the supply of 3.5GWh energy

Get a quote

Chile Focuses on Solar and Storage as Generation Capacity

Chile is rapidly moving to build more power generation capacity, with much of that effort focused on renewable energy resources and battery energy storage systems (BESS).

Get a quote

Chile makes progress on energy storage with 20+ approved projects

The technological diversity of energy storage projects in Chile is remarkable. From battery storage systems to innovative projects with gases such as CO2, the country is exploring different

Get a quote

Energy storage is a challenge and an opportunity for Chile

Chile''s first battery energy storage projects were commissioned in 2009, and all but two of its 16 administrative regions have facilities in operation, under construction or in the

Get a quote

The blooming of Chilean energy storage

Energy storage players have turned their attention to the country as the government has started awarding more support. In this article, we look at what''s happening in Chile and whether it will

Get a quote

Chile: BESS as an answer to solar curtailment, grid

However, in recent years, Chile has been facing some serious issues: curtailment and marginal costs nearing zero. With solar project owners

Get a quote

METLEN Powers Chile: Solar Power and Energy

Expansion of solar power and energy storage capacity can support Chile''s energy transition for a sustainable energy future. This growth

Get a quote

6 FAQs about [What is energy storage equipment in Chile ]

Is Chile ready for a standalone energy storage project?

This project alone nears the capacity (13GWh) the Chilean Ministry of Energy sought in a public land bidding auction for standalone energy storage projects in May of 2024. Chile has been one of the countries at the forefront of the renewable energy transition in Latin America, first with solar PV and now with BESS.

How many energy storage projects are in Chile?

Currently, 36 of the 129 large-scale projects Latin America projects with an energy storage component under development are in Chile, including 32 out of 71 of the region’s early works projects. The storage technologies either in use or being considered include:

Why is energy storage important in Chile?

Image: Grenergy Grid constraints have prevented Chile from maximising the potential of its world-class solar resources. Energy storage has, therefore, become a necessity to ensure the financial viability of PV projects, writes Jonathan Tourino Jacobo.

Where are Chile's battery energy storage facilities located?

Chile’s first battery energy storage projects were commissioned in 2009, and all but two of its 16 administrative regions have facilities in operation, under construction or in the planning stage. The greatest installed capacity is found in the northern regions of Antofagasta and Tarapacá, the country’s solar powerhouses.

Are battery energy storage systems a viable alternative for Chilean power producers?

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged as a profitable alternative for Chilean power producers.

How can Chile keep up with the changing energy demand landscape?

Chile is exploring a variety of solutions to keep abreast of the changing energy demand landscape ranging from BESS to innovative projects using CO2. In March 2024, BESS Coya, the largest battery-based energy storage system in Latin America, started operations.

Guess what you want to know

-

What does industrial and commercial energy storage equipment include

What does industrial and commercial energy storage equipment include

-

What are the equipment of electric energy storage vehicles

What are the equipment of electric energy storage vehicles

-

What does 8mwh energy storage equipment refer to

What does 8mwh energy storage equipment refer to

-

What is solar energy storage container equipment

What is solar energy storage container equipment

-

What types of energy storage equipment configurations are there

What types of energy storage equipment configurations are there

-

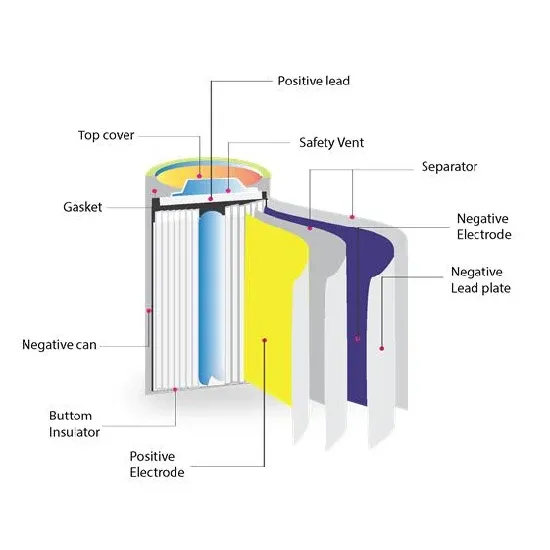

What are the components of energy storage equipment

What are the components of energy storage equipment

-

What are the production equipment for energy storage cabinets in the United States

What are the production equipment for energy storage cabinets in the United States

-

What equipment is needed to manufacture energy storage containers

What equipment is needed to manufacture energy storage containers

-

What are the manufacturers of emergency communication base station energy storage system equipment

What are the manufacturers of emergency communication base station energy storage system equipment

-

What are the energy storage cabinet equipment included in

What are the energy storage cabinet equipment included in

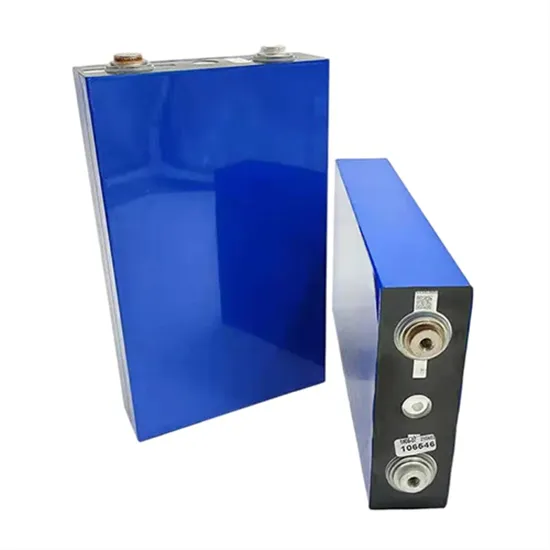

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

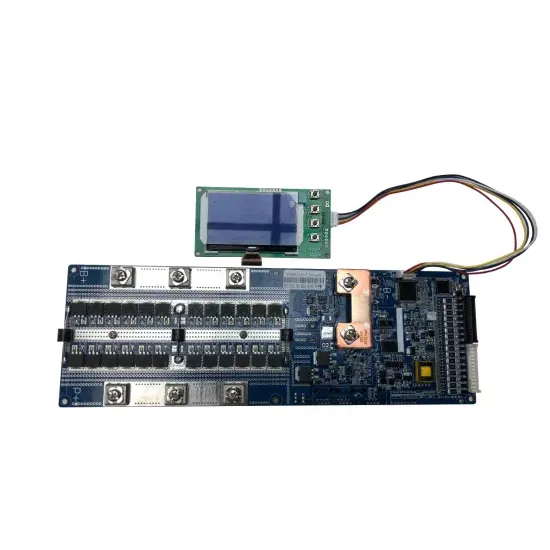

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.