European Market Outlook for Battery EU solar Storage 2025

By recognising storage systems under EU funding mechanisms and grid planning processes, the EU can unlock their full potential, not only in stabilising energy supply and maximising...

Get a quote

New report: European battery storage grows 15% in 2024, EU energy

Balancing markets must become fully competitive and accessible to storage, through harmonised technical standards and transparent procurement. Europe must enhance

Get a quote

New report: European battery storage grows 15% in 2024, EU

Balancing markets must become fully competitive and accessible to storage, through harmonised technical standards and transparent procurement. Europe must enhance

Get a quote

Europe Battery Energy Storage System Market Size & Industry

Mandatory flexibility procurement rules under the Fit-for-55 package oblige transmission and distribution operators to secure contracted storage capacity for balancing

Get a quote

EU battery storage is ready for its moment in the sun | Ember

Years of strong solar growth and high gas prices have increased electricity price volatility across the EU, strengthening opportunities for battery storage. In turn, batteries can

Get a quote

Europe''s Battery Storage Hits 21.9 GWh Amid Policy Demands

Record battery storage installations across Europe mark a significant achievement, but concerns linger as growth begins to slow. SolarPower Europe''s latest analysis shows an

Get a quote

EU Commission approves €17.7 billion Italian scheme

The Commission adopted in March 2023 a list of recommendations to ensure greater deployment of energy storage, accompanied by a Staff Working

Get a quote

Regulatory progress for energy storage in Europe

Introduction Electricity storage is critical for the future of European power networks. However, for storage to realize its full potential, a robust regulatory

Get a quote

Well-founded market projections and political

This annual report analyzes developments in the European battery storage market and provides in-depth insights into key applications

Get a quote

EU battery storage is ready for its moment in the sun

Years of strong solar growth and high gas prices have increased electricity price volatility across the EU, strengthening opportunities for battery

Get a quote

Energy Storage

This rulemaking identified energy storage end uses and barriers to deployment, considered a variety of possible policies to encourage the cost-effective deployment of energy

Get a quote

It''s high time for an EU Battery Storage Action Plan

Global deployment of battery energy storage systems (BESS) is accelerating at an unprecedented pace – with world installations projected to expand swiftly in the coming years.

Get a quote

Europe Battery Energy Storage System Market Size

Mandatory flexibility procurement rules under the Fit-for-55 package oblige transmission and distribution operators to secure contracted storage

Get a quote

Questions and Answers on Sustainable Batteries Regulation

While the EU scores high in relation to the recycling of portable and lead-acid automotive batteries, much remains to be done as regards lithium-ion batteries used in electric cars,

Get a quote

Europe installed 10GW of energy storage in 2023

Europe has seen its first year when energy storage deployments by power capacity exceeded 10GW in 2023. The eighth annual edition of the European Market Monitor on

Get a quote

The Ultimate Guide to Sourcing Lithium-Ion Batteries:

Introduction Lithium-ion batteries have become essential components across multiple industries, including electric vehicles (EVs),

Get a quote

Ramping up energy storage: lessons for the EU

Content Introduction Why are policies necessary to drive storage development? Storage procurement mandate (California) Discussion Renewable Energy Certificates (South Korea)

Get a quote

Europe''s Battery Storage Hits 21.9 GWh Amid Policy

Record battery storage installations across Europe mark a significant achievement, but concerns linger as growth begins to slow.

Get a quote

Mapping Europe''s Battery Storage Potential for 2025

In this article, we rank EU countries based on their potential for storage investment, focusing on the most relevant indicators for arbitrage and revenue stacking.

Get a quote

New EU regulatory framework for batteries

Introduction The issue of batteries is relevant to many policy areas, from transport, climate action and energy to waste and resources. The development, production and use of batteries are key

Get a quote

EU Battery Passport ''will help reduce

The forthcoming introduction of the European Union (EU) Battery Passport could result in a 2-10% reduction in procurement costs, according to

Get a quote

Energy storage europe procurement

The Commission adopted in March 2023 a list of recommendations to ensure greater deployment of energy storage, accompanied by a staff working document, providing an

Get a quote

Well-founded market projections and political recommendations

This annual report analyzes developments in the European battery storage market and provides in-depth insights into key applications such as large-scale storage systems,

Get a quote

It''s high time for an EU Battery Storage Action Plan

Global deployment of battery energy storage systems (BESS) is accelerating at an unprecedented pace - with world installations projected to expand swiftly in the coming years.

Get a quote

Powering the EU''s future: Strengthening the battery industry

Projections around battery manufacturing in the EU remain highly uncertain. Many reports claim that the EU is on track to meet its future battery needs, yet also highlight significant risks that

Get a quote

EU Battery Passport ''will help reduce

The forthcoming introduction of the European Union (EU) Battery Passport could result in a 2-10% reduction in procurement costs, according to the consortium tasked with its

Get a quote

6 FAQs about [EU Energy Storage Battery Procurement]

Is the European battery storage market ready for 2029?

Despite positive market developments, SolarPower Europe stresses that the European battery storage market needs to grow at an even faster rate to meet the rising demand for grid flexibility. A potential total volume of up to 400 GWh is projected for 2029 – an ambitious but necessary target for the energy transition.

How can European policymakers help the battery storage sector?

ecomendationsHow can European policymakers help the battery storage sectorBattery storage systems are essential for strengthening the EU’s energy security and competitiveness by enhancing flexibility, providing ancillary services to secure the grid, maximising the use of renewable energy, and effectively dealing with energy pr

What percentage of European battery energy storage systems are lithium ion?

By battery type, lithium-ion commanded 92% of the European battery energy storage system market share in 2024; flow batteries are projected to expand at a 16.66% CAGR through 2030.

How many battery energy storage systems were installed in Europe in 2024?

21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing Europe’s total battery fleet to 61.1 GWh. However, the annual growth rate slowed down to 15% in 2024, after three consecutive years of doubling newly added capacity.

Why is battery production important for the EU?

Batteries, widely used in the transport and energy sectors, are central to the global energy system. They will be key to the EU's clean energy transition, industrial future and strategic autonomy. Boosting the industrial base for battery production is therefore a key task for the EU.

Where is the battery storage market in Europe?

*In the European Market Outlook for Battery Storage, the Europe region refers to the EU-27 + the UK + Switzerland. Spain analysis from the report Last year Spain installed less than 250 MWh of batteries (14th biggest market in Europe 2024).

Guess what you want to know

-

Swedish energy storage battery procurement

Swedish energy storage battery procurement

-

EU energy storage lead-acid battery prices

EU energy storage lead-acid battery prices

-

Energy storage battery industry procurement

Energy storage battery industry procurement

-

EU lithium battery energy storage project

EU lithium battery energy storage project

-

US rack-mounted energy storage battery

US rack-mounted energy storage battery

-

Guinea Lithium Battery Energy Storage System Company

Guinea Lithium Battery Energy Storage System Company

-

Energy storage battery growth rate

Energy storage battery growth rate

-

Factory Energy Storage Power Battery

Factory Energy Storage Power Battery

-

Belarus solar energy storage lithium battery

Belarus solar energy storage lithium battery

-

Huijue battery and energy storage cabinet battery

Huijue battery and energy storage cabinet battery

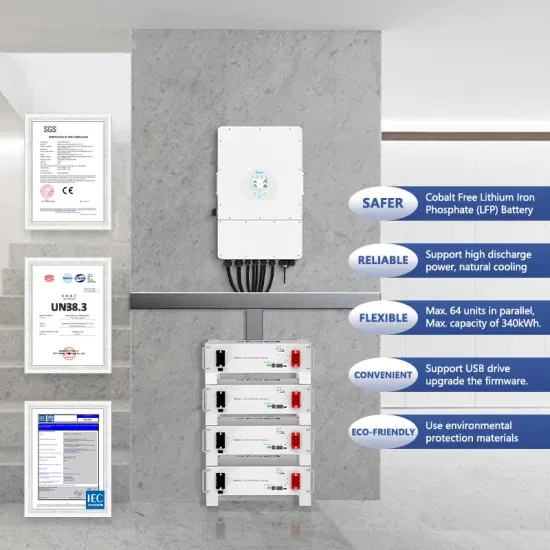

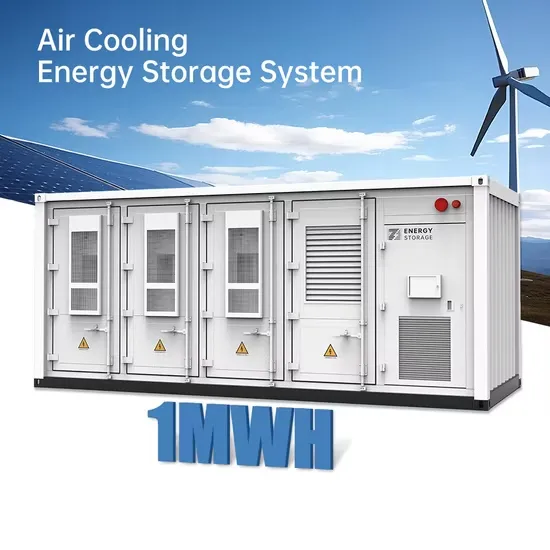

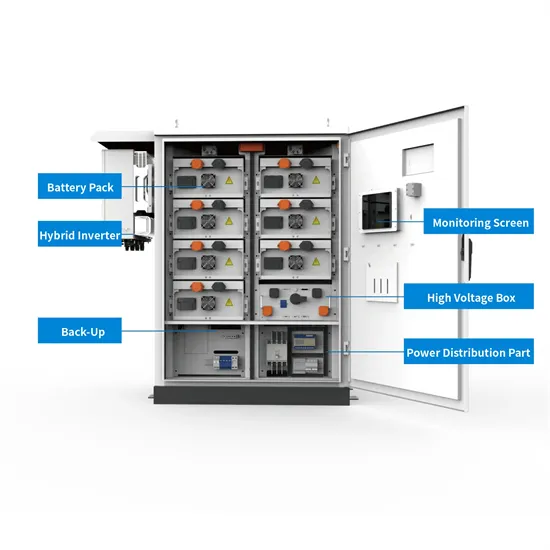

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.