U.S. Grid Energy Storage Factsheet

Electrical Energy Storage (EES) refers to systems that store electricity in a form that can be converted back into electrical energy when needed. 1 Batteries

Get a quote

Storage propels Neoen towards new 10GW target

A faster-than-expected expansion in large batteries has propelled France''s Neoen to Australia''s biggest clean energy player, revealing a target

Get a quote

Saudi 7.8GWh Energy Storage Contract Worth Over $800m

Saudi Arabia recently awarded engineering, procurement, and construction (EPC) contracts for three energy storage systems are estimated to be worth over $800m. A source

Get a quote

Built For Growth: Energy Storage Systems In The Gulf | M...

*The Gulf Arab states'' utility-scale energy storage market is expected to reach 1.5-2.5GW by 2027, compared to 0.1GW of capacity installed by 2021. This will constitute a

Get a quote

Solar Stocks Get Boost From Record Tesla Energy Storage

Solar stocks rose Thursday after Tesla announced record-high energy storage deployments in the fourth quarter. The electric vehicle producer also makes batteries for

Get a quote

EDF''s ''ESP'' foresees US$10b investment for 10GW of energy storage

EDF has set its sights on becoming a European leader in energy storage after announcing plans to invest €8 billion (US$9.96 billion) in deploying 10GW of new projects by

Get a quote

Top Battery Storage Companies to Watch in 2025

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an

Get a quote

EDF Group 10GW storage goal for carbon-free power system by

The investment is on top of the 5GW of storage already operated by the group, which has interests in storage technology applications including batteries and pumped-storage

Get a quote

EDF''s ''ESP'' foresees US$10b investment for 10GW of

EDF has set its sights on becoming a European leader in energy storage after announcing plans to invest €8 billion (US$9.96 billion) in

Get a quote

These are the top five energy technology trends of 2025

3 days ago· China''s investments in renewables, energy storage and batteries, electric vehicles and nuclear, for example, aim to primarily reduce its reliance on oil and gas imports and to

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium and battery technology.

Get a quote

White paper BATTERY ENERGY STORAGE SYSTEMS

The majority of newly installed large-scale electricity storage systems in recent years utilise lithium-ion chemistries for increased grid resiliency and sustainability. The capacity of lithium

Get a quote

Top Battery Storage Companies to Watch in 2025

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an accelerating shift to renewables,

Get a quote

Energy Storage | ACP

The energy storage industry has announced a historic commitment to invest $100 billion in building and buying American-made grid batteries, including capital for new battery

Get a quote

How to invest in grid-scale battery storage companies

Investing in grid-scale battery storage companies offers exposure to a transformative clean energy technology enabling renewable adoption and grid modernization.

Get a quote

12 Best Energy Storage Stocks to Buy in 2025

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth as the demand for renewable energy

Get a quote

US energy storage sector commits to $100B

Plus Power''s 250-MW Sierra Estrella battery storage project in Avondale, Arizona. The U.S. energy storage industry will invest $100 billion

Get a quote

California''s power grid is stronger with batteries | Sacramento Bee

California''s power grid emerged from a nearly three weeklong record-setting heat wave relatively unscathed, and officials are crediting years of investment in renewable energy

Get a quote

U.S. Energy Storage Industry to Invest $100 Billion in

Industry Commits to Investing $100 Billion into Building and Buying American-Made Grid Batteries The U.S. energy storage industry is committed to investing more than $100 billion in American

Get a quote

U.S. Energy Storage Industry to Invest $100 Billion in

Today''s investment commitment aims to advance a manufacturing expansion in the United States that could enable American-made batteries to satisfy 100% of domestic energy storage project

Get a quote

12 Best Energy Storage Stocks to Buy in 2025

5 days ago· Top energy storage stocks across advanced li-ion, flow, solid-state, and green hydrogen—curated for high-growth exposure.

Get a quote

US energy storage industry ready to commit US$100 billion

Clean energy trade body American Clean Power Association (ACP) announced a commitment on behalf of the US energy storage industry to invest US$100 billion in building

Get a quote

California crosses 10 GW battery storage threshold

California is adding massive amounts of battery energy storage and the project pipeline shows no sign of slowing down. Batteries are playing an

Get a quote

Top Energy Storage Stocks 2025: Pure-Play Watchlist

5 days ago· Top energy storage stocks across advanced li-ion, flow, solid-state, and green hydrogen—curated for high-growth exposure.

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

The same is true for solar power and related next-gen battery technology. Energy storage systems are increasingly in demand to increase

Get a quote

10gw energy storage super project investment

By the end of 2023, electrochemical energy storage projects in Arizona are expected to reach 2.2 GW (including projects at the planning stage, under construction and in operation), accounting

Get a quote

6 FAQs about [Invest in 10GW energy storage batteries]

Should you invest in battery storage stocks?

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth. As the demand for renewable energy continues to expand, investing in well-known energy storage companies like Tesla, Panasonic, and LG Chem can be a strategic move.

Are battery storage systems a good investment?

With advancements in technology and decreasing costs, battery storage systems are becoming more accessible and efficient, allowing for greater integration of renewable energy sources into the grid and reducing reliance on fossil fuels. Identifying top energy storage stocks in an industry with many players can be challenging.

Why should you invest in invinity batteries?

For investors, Invinity offers pure-play exposure to vanadium flow batteries—a durable, fully recyclable complement to lithium-ion. Electric vehicle (EV) adoption is one of the main drivers of energy storage technology. Solid-state batteries promise the holy trinity: higher energy density, faster charging, and inherent safety.

Should battery energy storage be integrated with renewables?

Battery energy storage, particularly when integrated with renewables, offers a faster and more flexible deployment solution compared to traditional power generation methods.

What is the broader sector that battery storage stocks belong to?

Battery storage stocks are a subset of the broader energy sector. These stocks are shares in companies that specialize in energy storage solutions through the use of batteries.

What is the future of battery storage?

The future of battery storage is promising, as it has the potential to revolutionize the way we generate and consume energy. Battery storage is the use of rechargeable batteries to store electrical energy.

Guess what you want to know

-

What are the energy storage batteries from major manufacturers

What are the energy storage batteries from major manufacturers

-

Which company produces energy storage batteries

Which company produces energy storage batteries

-

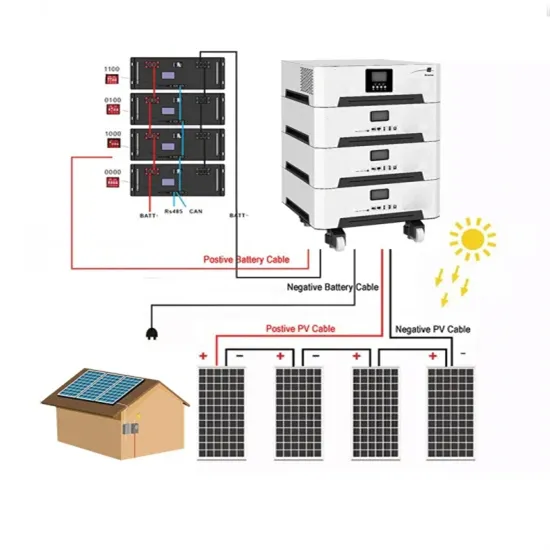

Photovoltaic energy storage supporting lithium batteries

Photovoltaic energy storage supporting lithium batteries

-

Wholesale prices of lithium batteries for energy storage in Guinea-Bissau

Wholesale prices of lithium batteries for energy storage in Guinea-Bissau

-

Nano-ion batteries are more suitable for energy storage

Nano-ion batteries are more suitable for energy storage

-

Professional production of energy storage batteries

Professional production of energy storage batteries

-

Should the energy storage batteries be connected in series or in parallel

Should the energy storage batteries be connected in series or in parallel

-

Lithium-ion batteries for wind power generation and energy storage

Lithium-ion batteries for wind power generation and energy storage

-

What kind of energy storage batteries does Huawei use

What kind of energy storage batteries does Huawei use

-

Multiple voltage energy storage batteries

Multiple voltage energy storage batteries

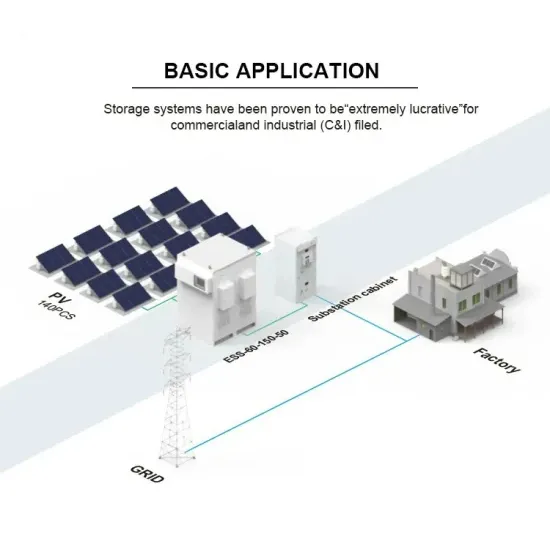

Industrial & Commercial Energy Storage Market Growth

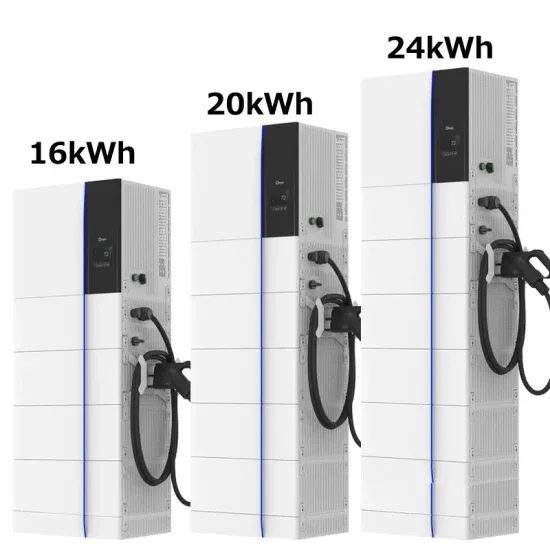

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.