Solar energy

Solar photovoltaic (PV) uses electronic devices, also called solar cells, to convert sunlight directly into electricity. It is one of the fastest-growing renewable energy technologies and is playing an

Get a quote

How about investing in photovoltaic energy storage power stations

The viability of investing in photovoltaic energy storage power stations is bolstered by various factors, including 1. escalating global energy demand, 2. decreasing costs of

Get a quote

Global Renewable Energy Investment Still Reaches New Record

London, August 26, 2025 – Global investment in new renewable energy projects hit a record $386 billion in the first half of 2025, up 10% from the previous year. However, asset finance for utility

Get a quote

World Energy Investment 2024

Rising investments in clean energy push overall energy investment above USD 3 trillion for the first time Global energy investment is set to exceed USD 3 trillion for the first time in 2024, with

Get a quote

Cost–benefit analysis of photovoltaic-storage investment in

With the promotion of renewable energy utilization and the trend of a low-carbon society, the real-life application of photovoltaic (PV) combined with battery energy storage

Get a quote

Federal Solar Tax Credits for Businesses

Disclaimer This resource from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) provides an overview of the federal investment and production tax credits for

Get a quote

Navigating One Big Beautiful Bill and tariffs in U.S. solar PV and storage

The U.S. solar PV and storage sectors are entering a phase of major policy and market realignment. The One Big Beautiful Bill (OBBB), together with proposed tariffs on

Get a quote

Türkiye to invest $10B in energy storage to boost wind

Timeline: Energy storage investments will gain speed by the first quarter of 2025, with systems operational by early 2026. Objective: Store

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays. The landmark tax-and-spending

Get a quote

NSW invests $1 billion to boost energy storage and infrastructure

The New South Wales government will channel up to $1 billion into large-scale and community batteries, pumped hydro, and virtual power plants as it seeks to ramp up

Get a quote

Navigating One Big Beautiful Bill and tariffs in U.S. solar PV and

The U.S. solar PV and storage sectors are entering a phase of major policy and market realignment. The One Big Beautiful Bill (OBBB), together with proposed tariffs on

Get a quote

Which funds hold photovoltaic and energy storage | NenPower

A multitude of investment vehicles, such as mutual funds, ETFs, and private equity funds, focus on stakeholders involved in photovoltaic energy and energy storage solutions.

Get a quote

2025 Photovoltaic Energy Storage Investment: Why Your Wallet

The 2025 photovoltaic energy storage investment wave isn''t just for tech geeks—it''s for anyone who likes saving money and the planet. Imagine telling your grandkids you helped

Get a quote

Future of Photovoltaic

Deployment, investment, technology, grid integration and socio-economic aspects Reducing carbon dioxide (CO 2) emissions is at the heart of the world''s accelerating shift from

Get a quote

Optimal investment strategy in photovoltaics and energy storage

Abstract: In order to attain higher degrees of energy efficiency and lower energy consumption costs, buildings stakeholders are installing local photovoltaic (PV) renewable generation and

Get a quote

Financial Investment Valuation Models for Photovoltaic and Energy

Using the Web of Science (WoS) and Scopus databases, a scientometric analysis was carried out to understand the methods that have been used in the financial appraisal of

Get a quote

Solar PV Energy Storage Investment: Why It''s the Future (and

Enter solar PV energy storage systems —the unsung heroes that store sunshine for a rainy day (literally). With the global energy storage market booming at $33 billion annually

Get a quote

advance investments in PV and Energy Storage

systems is crucial for en-hancing the reliability and efficiency of PV technologies. Advanced storage solutions, such as solid-state batteries, hydrogen-based systems, and thermal

Get a quote

IRENA: Grid infrastructure and energy storage key to energy

The deployment of grid infrastructure and energy storage is a key element to avoid delaying global energy transition, according to IRENA.

Get a quote

Sumitomo Corporation of Americas Diversifies into Distributed Energy

Sumitomo Corporation, through Sumitomo Corporation of Americas (hereinafter collectively referred to as, "Sumitomo Corporation Group") announced today a tax equity

Get a quote

Cost–benefit analysis of photovoltaic-storage investment in

Request PDF | Cost–benefit analysis of photovoltaic-storage investment in integrated energy systems | With the promotion of renewable energy utilization and the trend

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays. The landmark tax-and-spending legislation signed into law by President

Get a quote

Solar Energy Storage: Technologies, Costs & ROI Explained

1 day ago· Learn how energy storage in solar plants works, compare technologies, and discover key cost and ROI metrics to guide investment decisions.

Get a quote

Investment Returns of Solar + Storage Systems: Key Factors and

Driven by falling costs, policy incentives, and rising electricity prices, solar+storage projects now offer compelling returns for residential, commercial, and utility-scale investors.

Get a quote

Photovoltaic energy storage investment and operation

The benefit boundary of distributed PV investment is given in (Ming et al., 2018). Subsidy subsidence and unit installed cost will have a greater impact on distributed energy The

Get a quote

Financial Investment Valuation Models for Photovoltaic and

The share of non-conventional renewable energies within the global energy matrix has been growing and, for the first time, exceeded 10% in 2021 [2], and since the end of this year (due to

Get a quote

6 FAQs about [Photovoltaic investment and energy storage investment]

Why should you invest in a PV-Bess integrated energy system?

With the promotion of renewable energy utilization and the trend of a low-carbon society, the real-life application of photovoltaic (PV) combined with battery energy storage systems (BESS) has thrived recently. Cost–benefit has always been regarded as one of the vital factors for motivating PV-BESS integrated energy systems investment.

Is PV-Bess a good investment compared to a pure utility grid?

The cost–benefit analysis reveals the cost superiority of PV-BESS investment compared with the pure utility grid supply. In addition, the operation simulation of the PV-BESS integrated energy system is carried out showing that how the energy arbitrage is realized.

Why is cost–benefit important in PV-Bess integrated energy systems?

Cost–benefit has always been regarded as one of the vital factors for motivating PV-BESS integrated energy systems investment. Therefore, given the integrity of the project lifetime, an optimization model for evaluating sizing, operation simulation, and cost–benefit into the PV-BESS integrated energy systems is proposed.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

What is the cost-benefit analysis for PV-Bess project?

From the investors’ point of view, the cost–benefit analysis for the PV-BESS project is accomplished in consideration of the whole project lifecycle, proving the cost superiority of PV and BESS investment. At last, sensitivity analysis of PV and BESS optimal allocation is conducted to ideally balance the PV and BESS sizes for investment.

How long does it take to recover a PV-Bess investment?

Meanwhile, the cumulative cash flow shows that in the year of 3, the PV + BESS investment is paid back, which indicates it would only take 3 years to recover the difference in investment costs between the PV-BESS optimal planning and the utility grid supply strategy. Table 2. Planning results and comparison. Fig. 3.

Guess what you want to know

-

Bolivia photovoltaic power generation and energy storage investment and construction

Bolivia photovoltaic power generation and energy storage investment and construction

-

Portugal s photovoltaic energy storage investment

Portugal s photovoltaic energy storage investment

-

Sao Tome and Principe photovoltaic power station energy storage investment

Sao Tome and Principe photovoltaic power station energy storage investment

-

Photovoltaic energy storage integrated investment

Photovoltaic energy storage integrated investment

-

Photovoltaic investment and energy storage investment

Photovoltaic investment and energy storage investment

-

Mauritius photovoltaic energy storage project investment

Mauritius photovoltaic energy storage project investment

-

Photovoltaic energy storage distance

Photovoltaic energy storage distance

-

New Zealand container photovoltaic energy storage lithium battery foreign trade

New Zealand container photovoltaic energy storage lithium battery foreign trade

-

How many photovoltaic energy storage plants are there in Latvia

How many photovoltaic energy storage plants are there in Latvia

-

How many batteries are needed for 20kw photovoltaic energy storage

How many batteries are needed for 20kw photovoltaic energy storage

Industrial & Commercial Energy Storage Market Growth

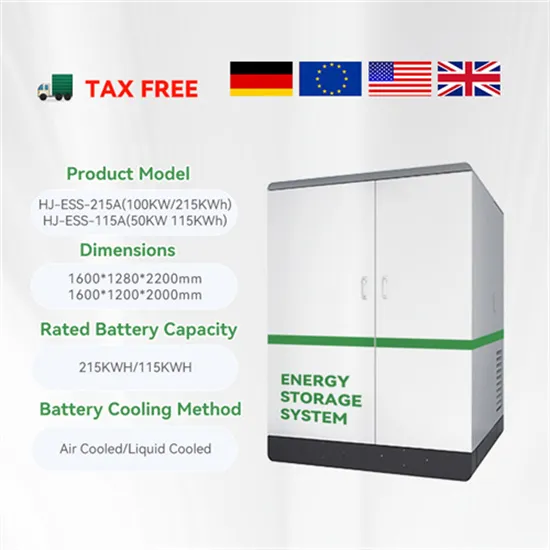

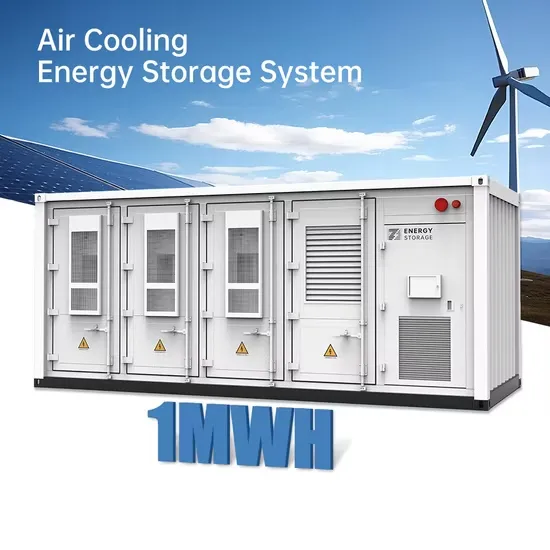

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.