Top 5 Lithium Ore Processing Plant Suppliers in the Middle East

1. Al Masa Mining Solutions When it comes to understanding the Middle East''s mining landscape, few companies can match Al Masa Mining Solutions. Founded in 2005 in Dubai, this family

Get a quote

EMEA (Europe, Middle East and Africa) Lithium Ion Cell and Battery Pack

In this report, the EMEA Lithium Ion Cell and Battery Pack market is valued at USD XX million in 2017 and is expected to reach USD XX million by the end of 2025, growing at a CAGR of XX%

Get a quote

Statevolt''s push for a sustainable battery supply chain

Lars Carlstrom shares insights on Statevolt Emirates'' mission to localise and innovate battery production in the Middle East. Inside Statevolt''s push for a sustainable battery

Get a quote

Top 10 Lithium-Ion Battery Crushing and Separation Equipment

When it comes to high-capacity lithium-ion battery recycling, EcoCycle Middle East leads the pack. Founded in 2018 with headquarters in Dubai, this homegrown company has quickly

Get a quote

Madenat Al Nokhba all set to revolutionise lithium-ion

"The processing unit comes with advanced robotics and automation to safely disassemble lithium-ion batteries, ensuring minimal risk

Get a quote

Lithium Scrap Recycling Machine in Middle East | Recycling

The demand for Lithium Scrap Recycling Machine in Middle East has significantly increased due to the widespread use of lithium-ion batteries in industries such as electronics, electric

Get a quote

From oil to lithium: How Saudi Arabia is building a battery supply

The deals could make Saudi Arabia''s lithium ion supply chain the most developed in the Middle East, which right now has virtually no battery material capacity.

Get a quote

Top 5 Lithium Tailings Extraction Plant Suppliers in the Middle East

The Middle East''s lithium tailings extraction market is booming, and with the right equipment, your mining operation can turn waste into wealth while contributing to a more

Get a quote

The Future of Battery Market in the Middle East & Africa

This report explores the key dynamics shaping the battery market across the region: from the rise of lithium-ion and solid-state technologies to growing applications in energy storage, electric

Get a quote

Top 5 Lithium Ore Processing Plant Suppliers in the Middle East

Today, we''re taking a deep dive into the top 5 lithium ore processing plant suppliers in the Middle East, exploring their expertise, standout projects, and why they''re trusted by miners and

Get a quote

About LOHUM : Leading Lithium Ion Battery Material Company

LOHUM : The world''s sustainable Lithium Ion battery material company, recycling, repurposing & refining to shape a greener, cleaner future for energy storage.

Get a quote

From Oil to Lithium: How Saudi Arabia is Building a Battery

In 2021, Saudi Arabia became the first Middle Eastern country to establish pipeline capacity in lithium processing by signing an agreement with EV Metals Groups to build a

Get a quote

Madenat Al Nokhba all set to revolutionise lithium-ion battery

"The processing unit comes with advanced robotics and automation to safely disassemble lithium-ion batteries, ensuring minimal risk to human workers and maximum

Get a quote

From oil to lithium: How Saudi Arabia is building a

The deals could make Saudi Arabia''s lithium ion supply chain the most developed in the Middle East, which right now has virtually no battery material capacity.

Get a quote

Top 10 Lithium Tailings Extraction Plant Suppliers in the Middle East

That''s where lithium tailings extraction plants come in, turning waste into wealth while reducing environmental impact. In the Middle East, with its growing focus on sustainable

Get a quote

Middle East and Africa Battery Packaging Market Size and

New battery manufacturing facilities in Middle East And Africa are driving parallel growth in battery packaging operations. Co-location of packaging units ensures better

Get a quote

Top 5 Lithium-ion Battery Crushing and Separation Equipment

Founded in 2018 by a team of UAE-based engineers, this supplier specializes in li-ion battery breaking and separating equipment that''s designed for the Middle East''s unique

Get a quote

EV Battery Recycling Methods for the Middle East | EcoMENA

With the rise of EVs comes the serious challenge of managing used batteries. This article explores EV battery recycling in the Middle East, including recycling methods,

Get a quote

How Saudi Arabia is leveraging Lithium-Sulfur

The development of domestic lithium processing facilities and sulfur-based battery technologies positions Saudi Arabia to become a key

Get a quote

Middle East Primary Lithium Battery Market | Size, Share, Trends

This latest report helps you to gain a quick and comprehensive understanding of the Middle East Primary Lithium Battery Market. Download FREE sample report now!

Get a quote

The lithium rush: How the UAE and Saudi Arabia are racing to

"Saudi Arabia and the UAE are investing in lithium processing facilities and forming strategic partnerships to secure a stable lithium supply for local battery production.

Get a quote

Evaluating economic and environmental viability of

Evaluating economic and environmental viability of recycling lithium-ion battery for electric vehicles in the middle east: a case study in the

Get a quote

Top 5 Air Pollution Control System Suppliers for Lithium Battery

The Middle East is rapidly emerging as a key player in the global lithium battery recycling industry. With electric vehicles (EVs) hitting the roads in record numbers—Saudi Arabia alone aims for

Get a quote

The lithium rush: How the UAE and Saudi Arabia are racing to

Kezad Group and Titan Lithium, a UAE-based company, are also planning a $1.4 billion lithium processing plant in Abu Dhabi to support the region''s EV industry.

Get a quote

Guess what you want to know

-

Middle East lithium battery pack supplier company

Middle East lithium battery pack supplier company

-

Philippines lithium battery pack processing and wholesale

Philippines lithium battery pack processing and wholesale

-

Dominic lithium battery pack processing

Dominic lithium battery pack processing

-

Middle East lithium battery bms structure company

Middle East lithium battery bms structure company

-

Mongolia lithium battery pack processing

Mongolia lithium battery pack processing

-

Cape Verde titanate pack lithium battery

Cape Verde titanate pack lithium battery

-

High-voltage lithium battery pack life

High-voltage lithium battery pack life

-

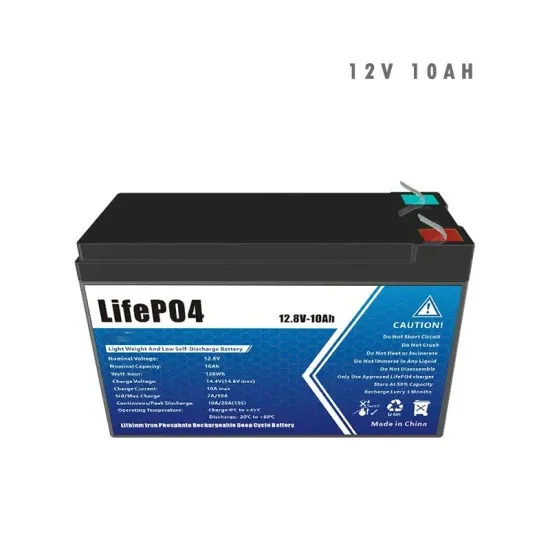

Turkey lithium iron phosphate battery pack

Turkey lithium iron phosphate battery pack

-

Micronesia lithium battery pack supplier customization

Micronesia lithium battery pack supplier customization

-

Battery pack single string lithium battery charging at home

Battery pack single string lithium battery charging at home

Industrial & Commercial Energy Storage Market Growth

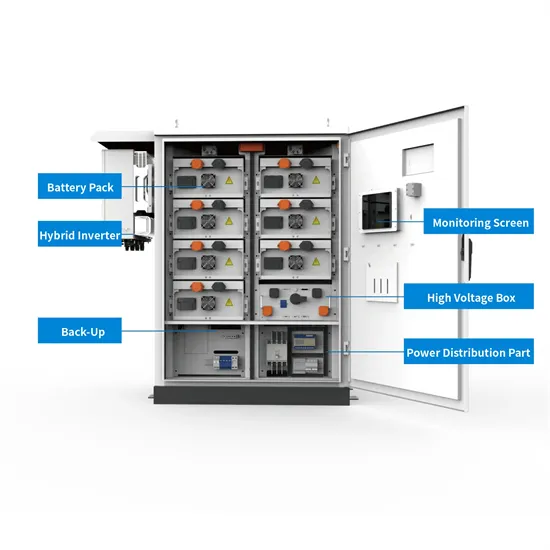

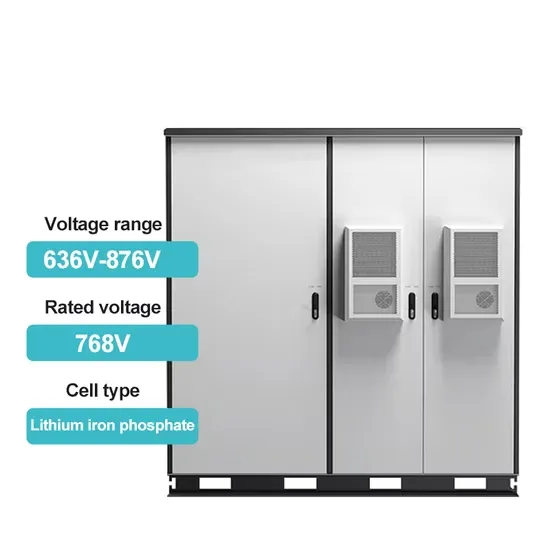

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.