Global Energy Storage Market Outlook

Battery costs have fallen dramatically owing to scale and investment of automotive sector Note: Battery price is benchmark price for an LFP energy storage module in the United States Data

Get a quote

CEEC Unveils Record-Breaking 25 GWh Battery Storage Tender, Prices

China Energy Engineering Corporation (CEEC), a major state-owned enterprise, has issued one of the country''s largest energy storage procurement tenders to date, targeting a

Get a quote

Global Energy Storage Growth Upheld by New Markets

The global energy storage market is poised to hit new heights yet again in 2025. Despite policy changes and uncertainty in the world''s two

Get a quote

"Mind blowing:" Battery cell prices plunge in China''s biggest energy

Since then, an auction in China – the country''s biggest for energy storage – suggests that the price decline in battery cells, thanks to intense competition, technology and efficiency

Get a quote

Global Energy Storage Market Records Biggest Jump Yet

The growth in LFP''s market share is made possible by a scale-up in manufacturing capacity led by Chinese battery makers. Battery makers outside China, many of which

Get a quote

Lithium-Ion Battery Pack Prices See Largest Drop

Companies in China faced fierce competition this year. These conditions resulted in falling battery prices and lower battery margins, forcing

Get a quote

"Mind blowing:" Battery cell prices plunge in China''s

Latest battery storage auction prices in China stun analysts with another big price fall that could fast-track green energy switch and uptake of EVs.

Get a quote

BNEF finds 40% year-on-year drop in BESS costs

The research mainly collected pricing information from the world''s biggest battery energy storage system (BESS) markets: China, the US and Europe. The remaining 17% of

Get a quote

Where Does China Rank in Energy Storage Costs? A 2025

Let''s cut to the chase: China currently leads the global race in energy storage cost reduction, with 2024 figures showing lithium iron phosphate (LFP) battery systems hitting a

Get a quote

"Mind blowing:" Battery cell prices plunge in China''s

Since then, an auction in China – the country''s biggest for energy storage – suggests that the price decline in battery cells, thanks to intense competition,

Get a quote

Growth in production will keep lithium carbonate

The average BESS cost for projects marked for delivery by 2028 is US$270/kWh, according to BMI. Image: RWE Battery energy storage system (BESS) project development

Get a quote

What Are The Implications Of $66/kWh Battery Packs In China?

China''s battery packs plummet in price again. Hydrogen prices didn''t decline and BNEF triples its estimates for future costs. The implications are huge.

Get a quote

China-Africa lithium energy storage power spot price list

Explore real-time Lithium Carbonate 99%Min China Spot price data and key metrics crucial for understanding and navigating the Lithium Carbonate 99%Min China Spot market.

Get a quote

Trump''s 1930s-era tariffs bring China battery tariff to 82%

Trump has announced his sweeping ''Liberation Day'' global tariffs, with a new China duty bring the effective tariff on batteries to 82%.

Get a quote

The lithium market: Africa''s moment to shine

Prices surged to $80,000 per tonne in December 2022 but have since fallen to around $55,000, prompting some western miners to reassess their investments, even though

Get a quote

China dominates global trade of battery minerals

In this article, we consider trade of three key minerals needed for batteries—graphite, lithium, and cobalt—among China and key global regions.

Get a quote

Battery energy storage prices spike in Q2 2025 – pv

Tariffs are greatly affecting the battery energy storage market because it''s one of the remaining clean energy sectors that sources materials

Get a quote

China: Price Cuts To Stimulate Demand, Industrial And Commercial Energy

HyperStrong has more advantages in China, with a shipment of about 3.9GWh. 16. Shipment: Large-scale energy storage benefited greatly, and industrial and commercial energy

Get a quote

BNEF finds 40% year-on-year drop in BESS costs

The research mainly collected pricing information from the world''s biggest battery energy storage system (BESS) markets: China, the US and

Get a quote

Lithium-Ion Battery Pack Prices See Largest Drop Since 2017,

On a regional basis, average battery pack prices were lowest in China, at $94/kWh. Packs in the US and Europe were 31% and 48% higher, reflecting the relative

Get a quote

What Are The Implications Of $66/kWh Battery Packs In China?

Bids averaged $66.3/kWh, with 60 bids under $68.4/kWh. The tender, covering supply, system design, installation guidance, 20-year maintenance, and safety features,

Get a quote

Lithium-Ion battery prices drop to USD 115 per kWh in

The global average price of lithium-ion battery packs has fallen by 20% year-on-year to USD 115 (EUR 109) per kWh in 2024, marking the

Get a quote

China Storage Price per kWh: The Evolving Cost Dynamics

Recent data from CNESA reveals that while utility-scale storage system prices dropped to ¥1.05/Wh ($0.145/kWh) in coastal provinces, western regions still grapple with ¥1.35/Wh tariffs

Get a quote

China EV battery prices fall slightly in Jul as material

Demand for power batteries in China was steady overall in July, but battery material costs continued to fall, resulting in a slight downward trend in battery cell prices, TrendForce said.

Get a quote

CEEC Unveils Record-Breaking 25 GWh Battery Storage Tender,

China Energy Engineering Corporation (CEEC), a major state-owned enterprise, has issued one of the country''s largest energy storage procurement tenders to date, targeting a

Get a quote

5 FAQs about [China-Africa lithium battery energy storage price]

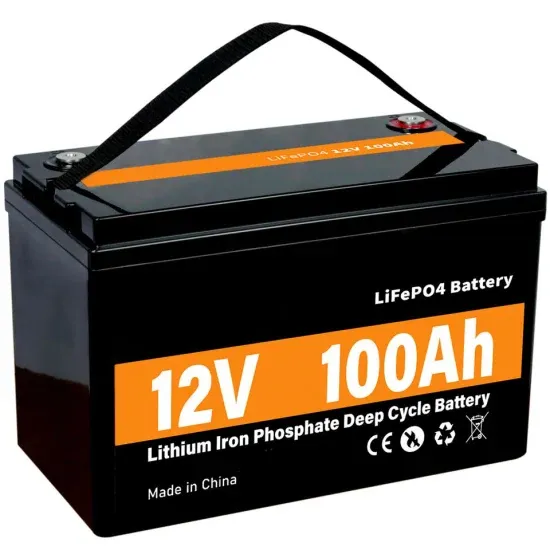

How much does a battery cost in China?

On a regional basis, average battery pack prices were lowest in China, at $94/kWh. Packs in the US and Europe were 31% and 48% higher, reflecting the relative immaturity of these markets, as well as higher production costs and lower volumes.

Why are battery prices so low in China?

Companies in China faced fierce competition this year. These conditions resulted in falling battery prices and lower battery margins, forcing many battery manufacturers to enter new markets, including energy storage, while also eyeing overseas markets willing to pay more for batteries. The industry has also benefitted from low raw material prices.

How much does a battery electric car cost in China?

Prices for battery electric vehicles (BEVs) came in at $97/kWh, crossing below the $100/kWh threshold for the first time. While EVs have reached price parity in China, they are still more expensive than comparable combustion cars in many markets.

How much lithium is mined in China?

China domestically produced approximately 18% (33,000 short tons) of the world’s mined lithium in 2023, and Chinese companies control 25% of the world’s lithium mining capacity.

Does China have a lithium project in Argentina?

According to the National Geospatial-Intelligence Agency’s Tearline Project, Chinese companies have significant investments in multiple mining and extraction projects in Argentina, giving China access to the lithium triangle, an area in Argentina, Bolivia, and Chile that contains 50% of the world’s lithium.

Guess what you want to know

-

Ecuador energy storage lithium battery BMS price

Ecuador energy storage lithium battery BMS price

-

Kyrgyzstan lithium titanate battery energy storage container selling price

Kyrgyzstan lithium titanate battery energy storage container selling price

-

New Zealand lithium titanate battery energy storage container price

New Zealand lithium titanate battery energy storage container price

-

Energy storage cabinet lithium battery communication base station price

Energy storage cabinet lithium battery communication base station price

-

Current price of energy storage lithium battery

Current price of energy storage lithium battery

-

Canadian energy storage lithium battery wholesale price

Canadian energy storage lithium battery wholesale price

-

Average price of energy storage lithium battery pack

Average price of energy storage lithium battery pack

-

Cost price of lithium battery energy storage cabinets in Somalia

Cost price of lithium battery energy storage cabinets in Somalia

-

Price of household photovoltaic energy storage lithium battery station cabinet

Price of household photovoltaic energy storage lithium battery station cabinet

-

How much is the price of lithium battery energy storage cabinet in Iraq

How much is the price of lithium battery energy storage cabinet in Iraq

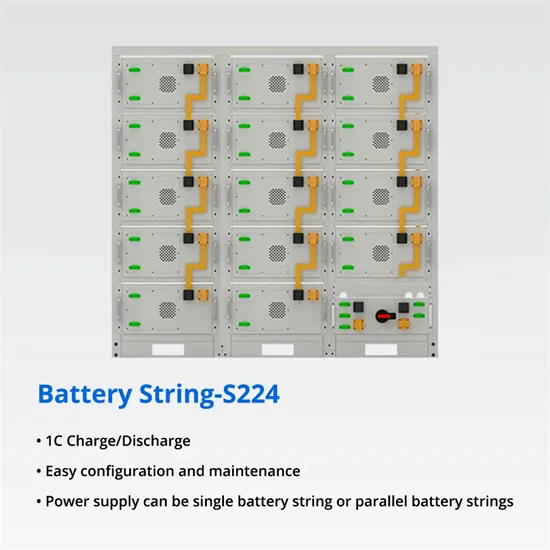

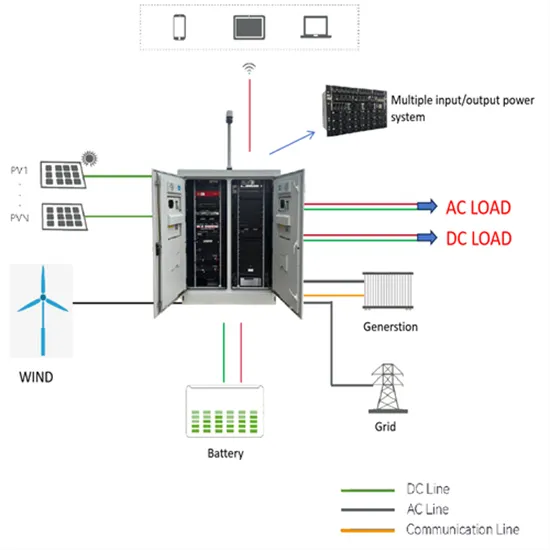

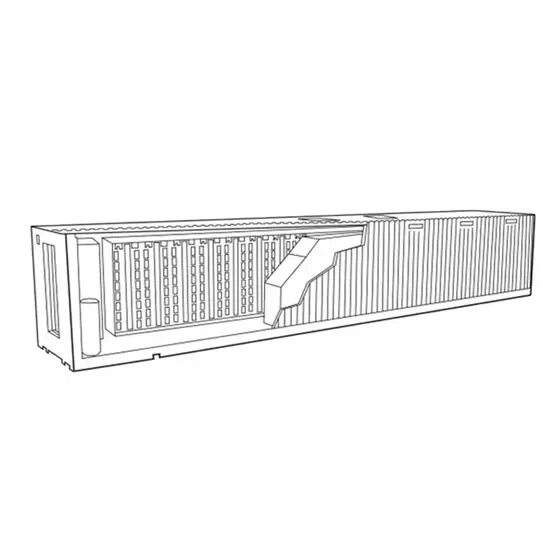

Industrial & Commercial Energy Storage Market Growth

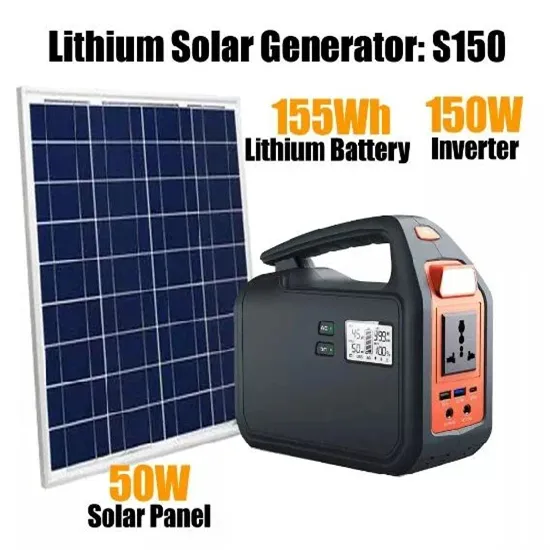

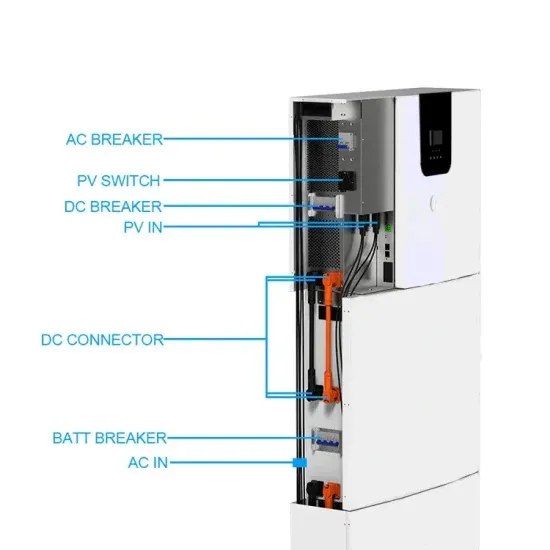

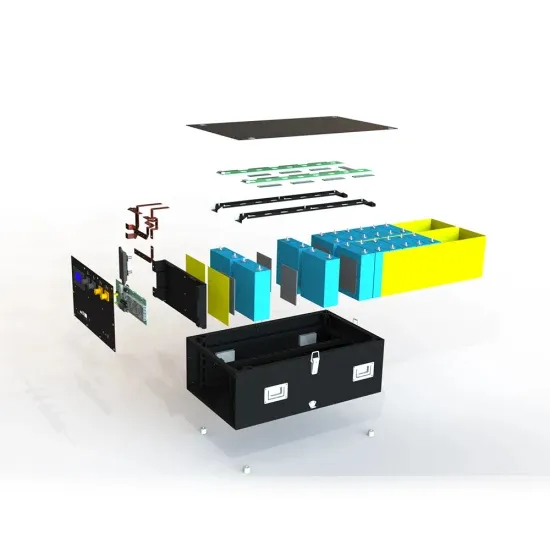

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.